Copper Price Update: Q3 2022 in Review

Here’s an overview of the main factors that impacted the copper market in Q3 2022, and what’s ahead for the rest of the year.

Click here to read the latest copper price update.

After declining sharply in Q2, copper prices remained above the US$7,000 per metric ton (MT) mark in the third quarter.

Overall market volatility paired with weaker demand in China have been putting pressure on copper since April.

With Q4 already in motion, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for copper supply, demand and prices.

Copper price update: Q3 overview

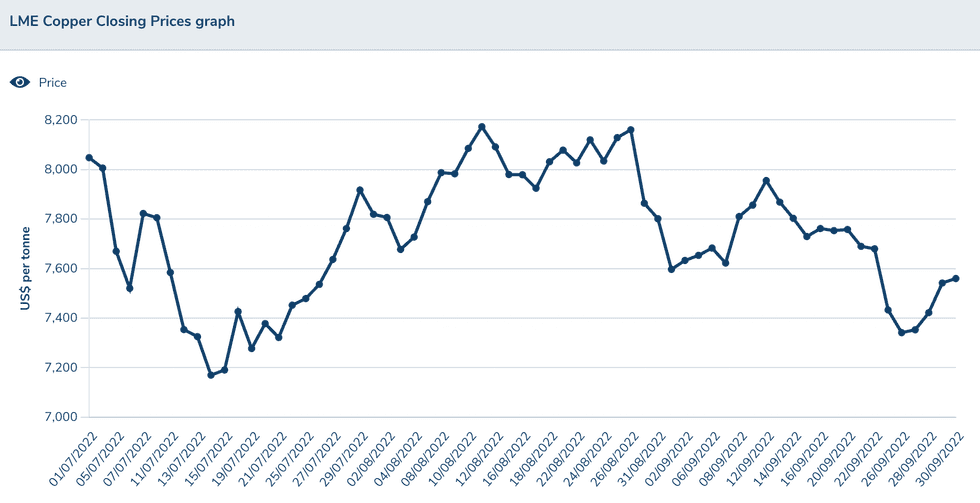

Copper kicked off the third quarter of the year trading above US$8,000, coming off a weak second quarter of the year that saw the base metal decline more than 20 percent.

Copper's price performance in Q3.

Chart via the London Metal Exchange.

The highest point of the quarter came at the start of July, when copper was changing hands for U$8,048. Prices performed with volatility throughout the period, but managed to stay above US$7,000. Copper's lowest point for the third quarter was touched on July 14, when the red metal sank to US$7,170.

Speaking with INN about the major trends seen in the copper space in the third quarter, Karen Norton of Refinitiv said she anticipated further price weakness. That was mainly due to broadly pessimistic demand expectations that dominated the sector amid growing recession fears and measures taken to tackle rampant inflation.

“Despite this, prices found a floor just below US$7,000 early in the period, managing to stabilize to some extent as supply growth also remained lackluster to offset,” she said. “Market watchers may also be wary of sharply lower prices acting as a disincentive for new projects at a time when they should be committed if the energy transition is to keep anywhere close to the stated timelines.”

As the world moves away from fossil fuels, the use of copper to electrify the world will become essential. Most analysts agree that the base metal is bound to be a winner of the green energy transition. Wood Mackenzie data shows that in 10 years’ time, 7.6 million to 11.3 million MT of new mine capacity will be required to fill the supply gap.

All in all, prices ended the three month period down, trading at US$7,560 — a decline of more than 6 percent for the quarter.

Copper price update: Supply and demand dynamics

Copper is widely used in building construction, electrical grids, electronic products, transportation equipment and home appliances. But demand has been under pressure from macroeconomic factors, as well as developments in China.

“The short-term demand outlook remains weak amid recession fears and weakening global manufacturing activity,” Ewa Manthey of ING said in an article on the sector published at the beginning of October.

Commenting on what he is expecting for copper demand in the fourth quarter, Robert Edwards of CRU Group told INN he is still concerned about Chinese residential real estate as a demand driver. The Asian country is the world's top copper consumer.

“But copper demand is benefiting from end uses related to the green energy transition, such as electric vehicles and renewables, along with exports of wire and cable and some copper semi-fabricated products,” he said.

Similarly, Norton doesn’t believe that there will be a significant pick-up in China's demand in the final quarter.

“The new energy sector is a bright spot, but accounts for a much smaller proportion of demand than the real estate sector, which remains weak and an area of continued concern,” she said.

Moreover, when opening the Communist Party Congress in mid-October, Chinese President Xi Jinping reiterated the country's COVID-19 stance, going against market expectations of an easing in such curbs.

For Refinitiv, 2022 looks set to be a year of subdued growth at best, with growth prospects for next year also looking precarious, particularly in Europe. “The energy crisis is threatening to push back the energy transition, which inevitably would be expected to have a knock-on effect for demand for key metals such as copper,” Norton said.

However, European demand has held up better for copper than for some other metals. “(That’s) possibly because of energy infrastructure-related use, but clearly the end of the year and 2023 H1 is going to be a challenge,” CRU's Edwards said.

Looking over to the supply side of the story, disruptions in major copper-producing countries have been under the spotlight in recent months. “South America — Chile and Peru — remain the primary supply risk going into 2023, plus the inevitable uncertainty around the startup of some large-scale projects,” Edwards said.

Mine workers at Chile’s Escondida and Antofagasta threatened to strike over safety labor conditions, while in Peru protests disrupted work at various mines, including Glencore’s (LSE:GLEN,OTC Pink:GLCNF) Antapaccay, MMG’s (OTC Pink:MMLTF,HKEX:1208) Las Bambas and Hudbay Minerals’ (TSX:HBM,NYSE:HBM) Constancia.

“Despite the ongoing supply disruptions, concerns over macro headwinds and recession fears are dominating copper’s sentiment and prices for now,” ING's Manthey said.

Supply growth has been hamstrung this year in both Chile and Peru, the world’s two top copper-mining nations.

“Further disruptions cannot be ruled out in Peru, especially if there are further local community protests,” Norton said. “Also, among the handful of projects that are ramping up, some may take longer than foreseen.”

Copper price update: What’s ahead?

As the fourth quarter of the year begins, investors should keep an eye on stocks in exchanges.

“Exchange stocks can sometimes take a back seat as increases in one region are offset by declines in another,” Norton said.

“But the sharp increase in Shanghai inventories this week and the uptrend in London Metal Exchange inventories since mid-September are likely to have put market players on alert.”

In terms of prices, if China introduces more stimulus measures that start to pay off quickly, and demand also gathers momentum with relaxation of the latest COVID-19 measures, then prices could see an improvement, Norton said.

“But we see greater potential for prices to come under fresh and concerted downward pressure in late 2022, on the assumption that worries about global economic prospects next year cannot be fully assuaged,” she added.

Meanwhile, CRU is expecting copper prices moving towards US$8,000 rather than the low US$7,000s.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Copper Supply to Catch Breath in 2022 Before Heading for ... ›

- Copper Outlook 2022: Prices Likely to Remain High, Modest Surplus ... ›

- Top 5 Copper Stocks on the TSX in 2022 | INN ›

- When Will Copper Go Up? | INN ›

- Top 3 Copper Stocks on the TSX (Updated August 2022) ›

- Top 3 Copper Stocks on the TSX (Updated October 2022) ›