Uranium Outlook 2022: Prices Have Broken Out, How High Will They Go?

2021 was an eventful year for uranium, but what’s the uranium outlook for 2022? Experts weigh in on supply cuts, rising demand and more.

Click here to read the previous uranium outlook.

2021 was another breakout year for uranium prices.

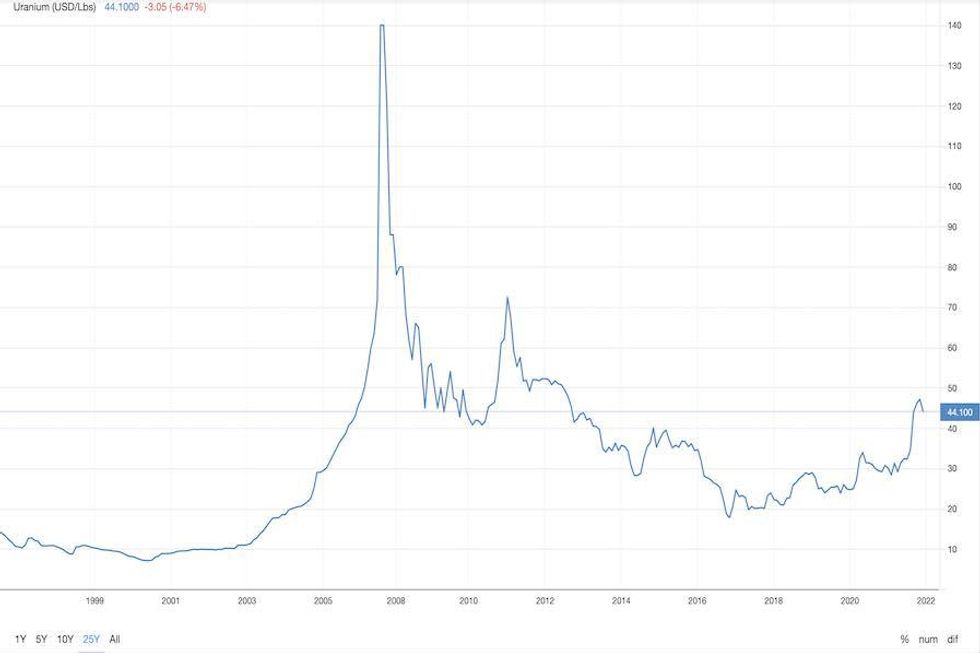

Following 2020’s growth, prices for the energy fuel climbed 45 percent, rising from US$29.63 per pound in January to US$50.63 in September, a nine year high and a critical threshold for explorers, developers and producers.

Although prices were unable to maintain that level, values have been able to remain above US$40 in the months since then. As one of the few commodities to register two solid years of gains amid the pandemic, many analysts are of the belief that higher uranium prices are here to stay.

This idea has been bolstered by rising demand for clean energy, specifically the need for carbon-free electricity.

“Globally, nuclear continues to account for 10 percent of total electricity and is the second largest source of carbon-free power,” said John Kotek, vice president of policy development and public affairs at the Nuclear Energy Institute. “While that number won’t change much in the near term given the number of nuclear reactors under construction today, the interest we’re seeing in new nuclear construction coupled with the increasing drive to decarbonize gives us confidence that share will grow over time.”

Kotek also noted that recent analysis by the International Atomic Energy Agency, the Organization for Economic Co-operation and Development, the International Energy Agency and others reinforces the expectation that world nuclear generation capacity will increase significantly by 2050.

This growth will be facilitated by new reactors coming online and joining the current global fleet of 445 reactors.

“There is a clear need for new generating capacity around the world, both to replace old fossil fuel units, especially coal-fired ones, which emit a lot of carbon dioxide, and to meet increased demand for electricity in many countries,” a 2021 report released by the World Nuclear Association states. “In 2018, 64 percent of electricity was generated from the burning of fossil fuels.”

There are now 50 new nuclear reactors under construction, with the majority being erected in China.

However, with current supply unable to meet demand, there have been talks of countries stockpiling uranium for domestic use. This topic was raised during Donald Trump's presidency, when the former head of state proposed a domestic stockpile to fuel the country’s nuclear reactors and military applications.

What other factors are important to the uranium outlook today? The Investing News Network (INN) spoke with expert market watchers to get their thoughts about the year ahead. Here's what they had to say.

Uranium outlook 2022: Will a 2007-style rally happen again?

Constrained supply in a sector that was already battling headwinds before the pandemic will likely lead to more uranium price upside in 2022. Whether values follow a path similar to 2007, when a confluence of issues catapulted the commodity to an all-time high, remains to be seen.

At that time, U3O8 underwent a massive surge from US$45 to US$139 in just 12 months. The spot price for the energy fuel currently stands at US$44.10.

The conditions from 2007 don’t apply this time around, and Lobo Tiggre, founder and CEO of IndependentSpeculator.com, noted that a different set of factors will be important to watch next year.

“There was no Kazatomprom holding super-cheap supply back voluntarily back then," Tiggre told INN. "And Cameco’s (TSX:CCO,NYSE:CCJ) production was down because its key mine, Cigar Lake, was flooded. Not so this time. And there weren’t companies and funds sitting on enough pounds to fuel entire countries back then either.”

Those funds include the Sprott Physical Uranium Trust (TSX:U.UN), which has purchased more than US$1 billion worth of uranium since debuting partway through 2021, and ANU Energy OEIC, a physical uranium fund launched in October by Kazakhstan's Kazatomprom (LSE:KAP).

Tiggre explained that the Sprott trust could serve as either a price catalyst or a headwind. “(It) could reignite the fire, but the real catalyst this market needs — and should soon see — is utilities coming to the table to sign long-term supply contracts with miners,” he said. “Until that happens, it’s all noise and thunder. When it happens, an industry that’s currently insolvent turns positive again and should be able to deliver for shareholders.”

On the flip side, Tiggre warned that the Sprott-initiated spot price rally may be unsustainable.

“The (Sprott trust) phenomenon may have sent spot prices up higher than they 'should' be until those long-term contracts put a real floor under this market,” he said. "That makes the spot market vulnerable to correction — especially if funds that bought in the US$20s and US$30s decide to become sellers in the US$40s.”

He also pointed out, “And, as always, there is always a chance a major nuclear accident will torpedo the entire sector. Bulls who are convinced uranium will go to triple digits should never forget this.” Prior to the 2011 Fukushima nuclear disaster, U3O8 prices had touched US$70 before steadily falling to 2016’s low of US$17.95.

As Tiggre noted, utilities coming to market is a major move that the sector is anticipating, because the primary end use of U3O8 is the fueling of nuclear reactors.

For his part, Gerardo Del Real of Digest Publishing believes utilities companies will begin purchasing once the price ticks higher. Of course, investors who want to ride the uranium wave will want to get in before that happens.

“They'll come to market when the price goes higher, because that's what the utilities do,” he said. “It's always amazing to me that the 'buy low, sell high' equation is one of the simplest equations in history. Yet it's so hard for people to get that part right. Because nobody wants to buy at the lowest because it's not attractive, it's not fun.”

He continued, “But man, is it profitable to buy at the low, hold and just wait for it to turn, especially if you're getting in on some of the better names and understand the leverage that comes with being early.”

Uranium outlook 2022: Energy correlation key to value

While gold is tied to monetary policy and the US dollar, uranium also has correlations, primarily to energy.

“Uranium marches to the beat of a very different drummer,” Tiggre said. “It will often suffer or enjoy knee-jerk reactions to news markets see as good or bad for energy, but this is usually a short-lived mistake. Consumers spending less on gas is a very different thing from utilities deciding to pull the plug on base-load energy.”

Frank Holmes, CEO and chief investment officer at US Global Investors (NASDAQ:GROW), believes the uranium market is heavily correlated to oil and gas, and is wary of the discourse around clean and green energy, especially from countries that are heavy users of coal and fossil fuels.

“What happens is a lot of these social, politically correct policy makers do not look at the law of unexpected consequences. They don't look at the collateral damage, they only see that it's going to be their utopia, but without cost,” Holmes said. “There's no free lunch on the periodic table.”

Undoubtedly, the movements of the energy sector will influence the uranium space; however, for Del Real uranium's correlation to the nuclear fuel market and utilities companies will be the key driver.

“When I look at the fact that there are 52 nuclear reactors that are under construction, (and) 120 additional ones already having their plants completed, and I look at more than 300 others that are being contemplated,” he said. "And then you consider that the utilities, which are the largest consumer of uranium, haven't even stepped off the sidelines ... I am extremely bullish on the uranium price and its ability to go higher in 2022."

Del Real also sees investment demand being a significant influence on future prices, and suggested investors look at uranium as an asset class similar to gold.

“We often get stuck in being gold bugs, or just uranium bugs, or just US dollar bugs. And, you know, there's so many different ways that you can balance out a portfolio,” he said.

“Personally, I have copper names, I have uranium names, I have gold names, physical gold and lithium names. I would just caution people to not be so married to one idea, right? We can do a couple of things at a time. And we can do those things well, if we're just paying attention.”

Uranium outlook 2022: Price expectations next year

As one of the few commodities to register two consecutive years of gains during the pandemic, uranium is poised to rise even more in 2022 — but by how much?

“I think it'll overshoot to that US$200 level, and then you're going to get one of those 50 percent retractions where it comes back to that US$100 to US$110 level,” Del Real said.

He went on to explain that the higher price point will incentivize new production to come online, which could meet the expected demand. “And then at that level, the projects that are better — sustainable and scalable — will rise to the top, and those are going to be the winners in the market,” Del Real said.

Tiggre of IndependentSpeculator.com gave a more conservative price forecast.

“My expectation is for the spot price to continue making big moves, two steps forward, one step back, until it hits at least US$60, but probably US$70,” he said.

“After that, it may or may not spike, but long term, I expect it to settle in this range (adjusting for inflation). And that will be just fine for the better exploration, development and mining companies.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- What Was the Highest Price for Uranium? | INN ›

- Uranium Trends 2021: Energy Metal Amongst Top Performers | INN ›

- When Will Uranium Prices Go Up? | INN ›

- Are Thorium Reactors the Future of Nuclear Energy? | INN ›

- Uranium Outlook | INN ›

- How to Invest in Uranium | INN ›

- Largest Uranium-producing Countries | INN ›

- U3O8 Price Update: Q3 2021 in Review | INN ›

- Energy Investing | INN ›

- Athabasca Basin Uranium Companies | INN ›

- From Gold to Uranium: How High Inflation is Affecting Prices and Companies ›

- Top Uranium Stocks on the TSX and TSXV | INN ›

- David Talbot: Uranium Supply, Demand and Prices — What to Watch in 2022 | INN ›

- Top Uranium Countries by Reserves | INN ›

- Lobo Tiggre: Gold, Silver and Uranium — What to Watch as "New Iron Curtain" Descends | INN ›

- Uranium Reserves: Top 5 Countries (Updated 2022) | INN ›

- Top 5 Uranium Stocks on the TSX and TSXV (Updated February 2022) | INN ›

- Top 5 Uranium Stocks on the TSX and TSXV (Updated February 2022) ›

- U3O8 Price Update: Q3 2021 in Review | INN ›

- U3O8 Price Update: Q3 2021 in Review | INN ›

- 5 Largest Uranium Companies by Market Cap | INN ›

- Justin Huhn: Uranium Moves Still to Come, Big Money Waiting to Position | INN ›

- Investors Eyeing Uranium on Back of New Products, Conflict and More | INN ›

- Uranium Stockpiling: The Rise of Nationalism or an Energy Security Effort? | INN ›

- The Impact of Geopolitics on the Nuclear Fuel Sector | INN ›

- Nick Hodge: Gold Waiting for Fed Pivot, Uranium Bull Case Still in Play ›

- Top 5 Uranium Stocks on the TSX and TSXV in 2022 ›

- Lobo Tiggre: Uranium is My Highest-Confidence Thesis for 2022 ›

- Lobo Tiggre: Uranium is My Highest-Confidence Thesis for 2022 ›

- Gwen Preston: Uranium Market "Very Bullish," Which Stocks Have Potential? ›

- How to Invest in Uranium ›

- VIDEO — Energy Fuels: Nuclear Power is Making a Comeback, Higher Uranium Prices Needed | INN ›

- Uranium Stocks: 5 Biggest Companies in 2022 ›

- 5 Top Weekly TSX Performers: Uranium Stocks Move Up ›

- Top 5 Uranium Stocks on the TSX and TSXV (Updated March 2022) ›

- U3O8 Price Update: Q1 2022 in Review ›

- Gerardo Del Real: Gold Price Breakout Catalyst, Uranium and Lithium Stocks to Watch ›

- Lobo Tiggre: My Shopping List is Ready and Uranium Stocks are at the Top ›

- Rick Rule: Glad to See Gold on Sale, "Solidly Bullish" on Uranium ›

- Gold Near US$1,800, UEC and Denison Fight for UEX ›

- Fed Minutes Spark Speculation, UEX Bidding War Wraps Up ›

- Japan News Boosts Uranium, Powell Takes Hawkish Stance ›

- 5 Top Weekly TSX Performers: Uranium Stocks Take Off ›

- Justin Huhn: Uranium Set for Strong Q4 After Summer Doldrums ›

- Peter Grandich: There's No Such Thing as a Sure Thing — but Uranium is Close ›

- Gold Price Dips Below US$1,700; Musk, Cramer Talk Uranium ›

- John Ciampaglia: Uranium Thesis Gaining Global Traction ›

- Better Fundamentals Make This Uranium Bull Market Different ›

- Ben Finegold: What Will Kick Uranium Cycle to Next Stage ›

- Lobo Tiggre: Uranium Catalysts, Europe's Energy Crisis and Nickel Reality Check ›

- U3O8 Price Update: Q2 2022 in Review ›

- Baselode Energy’s Uranium Discovery has High Potential for Low-cost, Open-pit Mining, CEO Says ›

- Nick Hodge: Uranium Backdrop Never More Bullish ›

- Adam Rozencwajg: Oil, Gas, Uranium — "Unbelievable" Opportunities ›

- Top 3 Uranium Stocks on the TSX and TSXV (Updated September 2022) ›