Platinum Outlook 2022: Rising Demand to Offset Supply Surplus

With 2021 over, many investors are looking ahead to what will happen to platinum next year. Read on for our 2022 platinum outlook.

Click here to read the previous platinum outlook.

The platinum price struggled to make any significant gains in 2021, spending the majority of the 12 month period below US$1,200 per ounce. By year’s end, the versatile metal had shed 9.24 percent.

The metal’s inability to sustain gains was partially due to residual COVID-19-related disruptions and supply chain hiccups, primarily because of the automotive semiconductor shortage during the first half of the year.

In the second half of 2021, a drop in investment demand stemming from platinum exchange-traded fund (ETF) outflows and increasing refined supply weighed on price growth.

The platinum space did see positivity through a 20 percent increase in industrial demand during Q3, with experts anticipating a 26 percent increase for the entire year.

“The global economy continues to recover, with the (International Monetary Fund) projecting a growth rate of 5.9 percent in 2021, with platinum poised to benefit as a result. Residual pandemic effects, such as the semiconductor shortages, will continue to inhibit platinum demand in 2021 and 2022, both of which would otherwise be far higher,” Paul Wilson, CEO of the World Platinum Investment Council (WPIC), said in a November press release.

Wilson went on to note, “2022 will be a crucial year in which the dust from 2020 settles and the remaining portion of the semi-processed material built up in 2020 is released. The speed at which demand inhibitors get resolved will have a major impact on the platinum market balance and we could see a fascinating outcome in 2023.”

Platinum trends 2021: Mined supply surplus weighs on price

As 2021 progressed, the platinum price steadily slipped lower as mined supply increased some 19 percent year-over-year and demand retracted 5 percent.

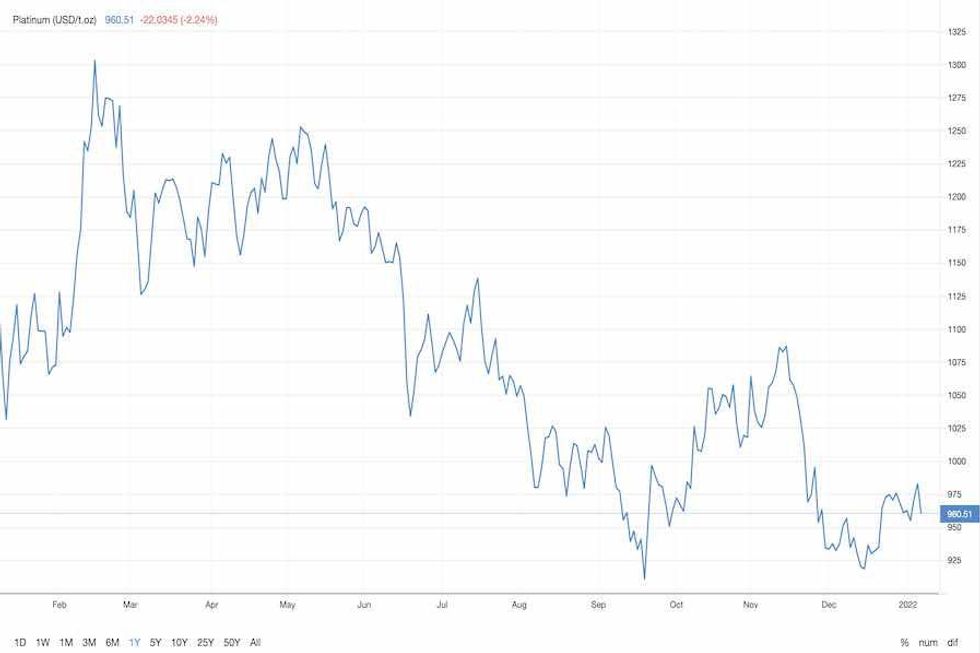

2021 platinum price performance.

Chart via Trading Economics.

The uptick in supply arose from a recovery following pandemic-related disruptions in 2020, as well as the refinement of Anglo American Platinum’s (LSE:AAL,OTC Pink:AGPPF) stockpiled ore, which built up following the company’s converter plant curtailment in early 2020.

“Processing of the 560,000 ounces (koz) of semi-finished material, built up during last year’s Anglo-American Platinum converter plant (ACP) shutdowns, accelerated during Q3 '21 and boosted refined supply by around 140 koz,” the WPIC's review of the third quarter states. “This resulted in total mine supply in the quarter increasing 13 percent (+185 koz) year-on-year to 1,569 koz.”

Some of the rising surplus was offset by a 9 percent drop in global recycling for the same period.

Platinum’s 2021 price performance was also impeded by its correlation to gold as the yellow metal battled headwinds caused by looming interest rate hikes and changing monetary policy.

“A bigger surplus in the platinum market this year (2021) also offers little comfort, itself the result of a recovery in South African mine output along with weaker than expected growth in autocatalyst demand, due to chip shortages and other supply chain disruptions,” Metals Focus states in a market report.

“Interestingly, even with these headwinds, platinum prices have found good support in the US$900s," it continues. "This likely reflects investors’ interest in platinum’s future demand fundamentals, notably substitution of palladium with platinum in autocatalysts and the use of platinum in the hydrogen economy.”

The firm's comprehensive precious metals sector overview goes on to note that while still modest at the moment, growth in the automotive and hydrogen spaces has been supportive to investment.

Platinum outlook 2022: Automotive demand a key factor

In addition to being a precious metal, one of platinum’s primary end uses is in the automotive sector as a component in catalytic converters, where it is prized for its ability to reduce toxic vehicle emissions.

2022 is anticipated to bring continued growth in automotive demand following an approximate 14 percent increase in 2021; this came despite a global semiconductor shortage, which hampered production.

Platinum demand from this space is forecast to grow another 19 percent in 2022 to 3.2 million ounces. Growth in this segment could be further compounded by Chinese platinum imports, which have been steadily rising.

The uptick has prompted some analysts to speculate that the country could be building a strategic stockpile for the auto sector as emissions standards increase in the country.

“One of the unexplained phenomena of recent times has been China’s net platinum imports consistently exceeding the country’s identifiable demand, a trend which has only accelerated in recent quarters, and which remains unexplained,” the WPIC's Q3 report notes.

Trevor Raymond, director of research at the WPIC, explained to the Investing News Network (INN) that there seems to be a contradiction in the market’s supply and demand fundamentals.

“We think the significant imports of platinum into China — almost double identified demand — are really part of what's going on,” he said during a November interview. "Platinum seems to be less widely available than you would imagine in the face of this massive surplus. We think higher platinum loadings, particularly heavy-duty vehicles in China, and certainly higher rates of platinum substitution for palladium, could explain part of that disconnect.”

Another explanation could be that the country may have earmarked the stored metal to build inventory at an attractive price for the hydrogen fuel space.

While the discrepancy has built uncertainty into the 2022 forecast, Steven Burke, an economist at FocusEconomics, believes it will be less impactful on the supply and demand picture long term.

“Any potential stockpiling from China will likely have a limited impact on supply levels,” he told INN, noting that platinum production surged in 2021 and is expected to have surpassed 2019's pre-pandemic levels.

“This strong jump in production is expected to outpace demand levels for (2021) and in 2022, and the platinum market should remain in surplus until at least 2024,” Burke said in December. “Any stockpiling of the metal would likely speed up the narrowing of the surplus, but prices are only expected to rise modestly in the coming years.”

For Wilma Swarts, director of platinum-group metals (PGMs) at Metals Focus, a rise in Chinese consumption is likely to have little bearing on a market that is already in surplus.

“I don’t believe there is a direct correlation between speculative demand and supply. Essentially supply is more a factor of the basket price and fundamental demand rather than speculative demand,” Swarts said.

“The speculative demand will have an impact on the price, which perhaps could indirectly impact supply. China has over the years been known to take strategic positions, which has not had any material direct impact on supply in my view," added the expert in conversation with INN.

Platinum outlook 2022: Mixed investment demand expected

Many platinum segments recovered in 2021, but investment demand remained varied, with physical demand rising on bar and coin buying, while exchange-traded products performed well during H1, then saw outflows in H2.

“ETF holdings of platinum as an investment vehicle dropped off notably in the third quarter of this year, while investment demand for physical platinum such as coins and bars surged,” Burke of FocusEconomics said. “This was likely the result of developments in the macroeconomic outlook.”

Widespread market volatility may have prompted some investors to change course, while others left ETFs to invest in South African mining equities, a factor that could aid in price growth.

“Investment into miners would support further aboveground stock, which would likely encourage greater use of the metal from the industrial sector, and consequently support demand levels ahead,” Burke added.

The rotation out of platinum ETFs into PGMs equities is an occurrence that happens periodically, according to the WPIC’s Raymond, and is likely driven by South African pension funds, which are key investors in the space.

He explained that the rationale for the Q3 2021 rotation was high rhodium and palladium prices, which led those mining companies to make huge earnings and pay “really good dividends.”

“The expectation was that because they were doing so well, they will probably start building new mines,” said Raymond, who noted those types of announcements have yet to be made.

When asked how the rotation impacts supply, Swarts also pointed to positive attitudes around growing supply.

“Due to higher commodity prices, mining companies have done well and are able to pay dividends, which have attracted investors who currently believe that the dividend yields could be greater than the return they can gain from the underlying commodity,” she said. “Share price appreciation is generally supportive to miners expanding or growing their business, which will support supply.”

Additionally, she pointed out what it may mean for balance in the market. “In theory, rotation away from ETFs will increase the market surplus and aboveground stock. An oversupplied market will depress prices, which in turn will influence the basket price, and as a result could see mining companies look to increase supply. However, in practice it is not that easy to flex mine production due to the time scales involved in project development.”

Total ETF outflows for 2021 are expected to top 40,000 ounces; however, the 2022 forecast calls for ETF holdings to rise by 50,000 ounces.

Platinum outlook 2022: Price forecast moving forward

Platinum prices finished 2021 holding in the US$960 range before moving as high as US$1,005 in the first days of the new year. Values for the metal subsequently contracted to the US$955 level.

With that said, market trends point to growth across most segments in 2022, including investment, industrial, automotive and jewelry. This broad growth will be offset by another year of surplus material, but consultancy firm Metals Focus is forecasting price momentum in 2022.

“With positive sentiment towards platinum’s future use and stock replenishments by the supply chain, this surplus should be comfortably absorbed by investors,” the firm's Investment Focus report states. “This explains why we expect platinum prices to post a gradual recovery over the course of 2022, in the process outperforming gold.”

The average price for platinum is projected to rise to US$1,150 in the fourth quarter of 2022.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- How to Invest in Platinum | INN ›

- 4 Platinum Uses for Investors to Know | INN ›

- Palladium Outlook 2022: Auto Demand will Determine Price Movement | INN ›

- Platinum Forecast | INN ›

- Thom Calandra: Look to Precious Metals as Inflation Gets Pervasive | INN ›

- Shree Kargutkar: Gold and Silver Price Drivers, Major Opportunity in Stocks | INN ›

- Shree Kargutkar: Gold and Silver Price Drivers, Major Opportunity in Stocks | INN ›

- From Gold to Uranium: How High Inflation is Affecting Prices and Companies ›

- Steve St. Angelo: Energy Cliff to Spur Next Move Higher for Gold and Silver | INN ›

- 5 Top Countries for Palladium and Platinum Production | INN ›

- Will Rhind: Gold's "Fear Factor" is Back; Russia/Ukraine and Platinum, Palladium | INN ›

- PGMs Prices Soar Amid Potential Supply Challenges Out of Russia | INN ›

- Randy Smallwood: Reasons to Own Gold Stacking Up, Silver Still a Favorite | INN ›

- David Erfle: Technical Bottom in for Gold Stocks, Where to Find Opportunity | INN ›

- Top Stories This Week: Gold Reacts to Fed Hike, Big Lithium Miners Share Results | INN ›

- Rick Rule: Gold, Oil and Gas, Coal, Water — Commodities for Now and Later | INN ›

- Experts Talk Market Volatility, Fed's Next Move, Gold Price at VRIC | INN ›

- Mickey Fulp: I'm Bullish on Physical Gold and Farmland | INN ›

- Gary Wagner: Gold Will Hit a Another Record, but Rally Close to Final Leg ›

- War, Decarbonization Could Catalyze Platinum as Palladium Stays Elevated ›

- US$6.7 Billion Deal Hits Gold Sector, Price at Highest in a Month | INN ›

- Byron King: Plenty of Picks in Beaten-up Gold Sector, Energy Also Compelling ›

- Adrian Day: Recession, Stagflation, Crash? What it Means for Gold ›

- Will Rhind: Upside Favors Gold; Strong US Dollar Checking Gains for Now ›

- Have Challenging Economic Times Made Mining Finance More Difficult? ›

- Rule Symposium 2022: Fed Can’t Fight Inflation and Recession at Same Time ›

- Gold Price Bounces Back, Experts Talk Recession Question ›

- David Garofalo: Gold Due for Dramatic Move as Unprecedented Inflation Looms ›

- Adrian Day: Gold Miners Facing Inflation Woes, Watch this Pressure Point ›

- Experts: Gold is the Answer to Today’s Troubling Questions ›

- Andy Schectman: How a Great Reset Happens and What it Means for Gold ›

- Inflation High, Markets Volatile — Experts Talk Strategies for Tough Times ›

- Platinum Price Update: H1 2020 in Review | INN ›