VRIC 2025: Experts Tout Hard Assets, Energy as Sure Bets Amid Uncertainty

Experts discussed geopolitical tensions, Trump tariffs and the outlook for gold and other commodities at this year's Vancouver Resource Investment Conference.

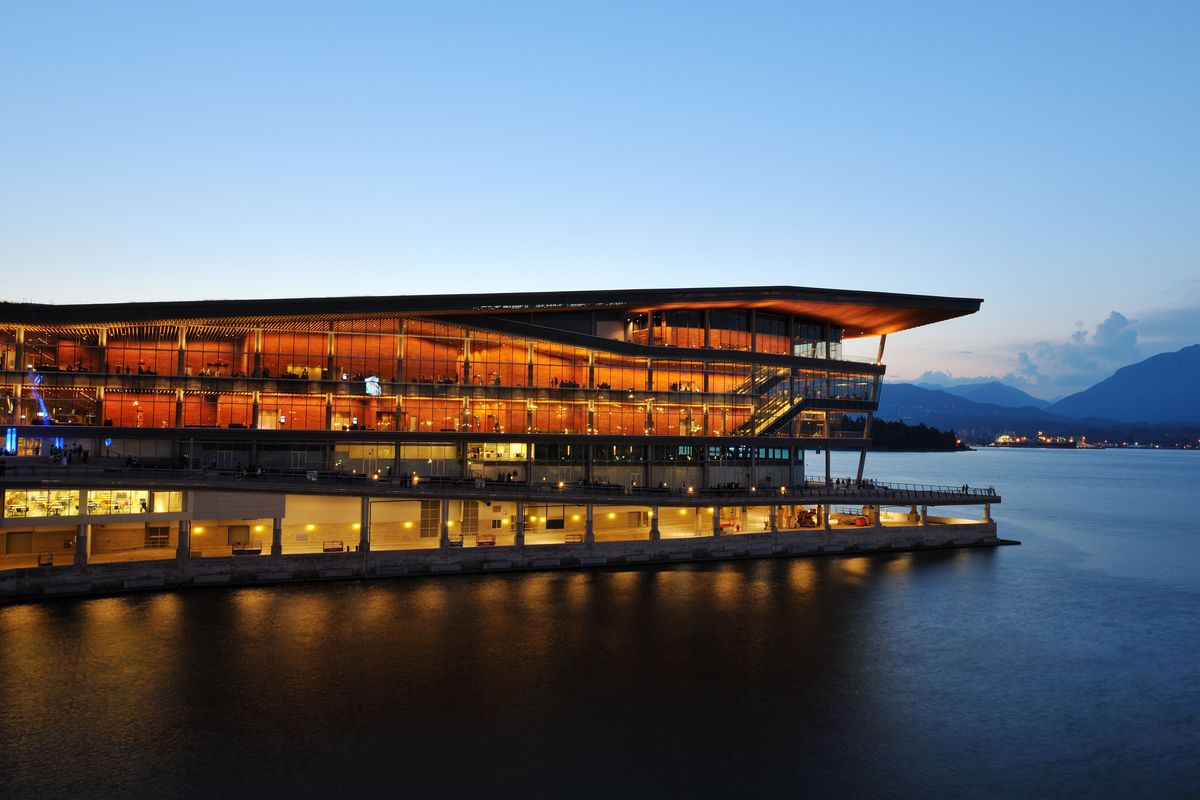

The annual Vancouver Resource Investment Conference (VRIC) took place at the Vancouver Convention Center from January 19 to 20, bringing together an illustrious list of speakers, panelists and guests.

Get a taste of the event with key insights shared during the two day show.

VRIC day 1: Trump trade and gold outlook

In addition to resource investing, VRIC had a strong focus on geopolitics.

During his opening remarks, Jay Martin, CEO of Cambridge House, underscored Canada's vast resource potential, while also highlighting that the country isn't capitalizing on its mineral abundance.

This is evidenced by Canada’s weak economy — the slowest of all the G7 nations.

Canada is at a tipping point, Jay Martin said in his opening remarks at #VRIC2025. The country has forgotten its competitive advantage in the resource industry, but has all the right ingredients to return to its core strength.

— Resource Investing (@INN_Resource) January 19, 2025

"I feel that Canada has an opportunity right now,"… pic.twitter.com/kCVvHSAdm4

Following his opening address, Martin welcomed Dr. Pippa Malmgren, Col. Douglas Macgregor and Dr. Pascal Lottaz to the stage to discuss the global geopolitical outlook.

All three panelists remarked on the broad-based uncertainty in the world, and Macgregor urged the audience to look to tangible assets for security in this environment.

During the #VRIC Global Geopolitical Outlook panel, Col. Douglas Macgregor emphasized that hard assets are critical, whether you grow them or dig them up from the ground. @DougAMacgregor #INNatVRIC #VRIC2025 #mining pic.twitter.com/y6dY9ZuSwd

— Resource Investing (@INN_Resource) January 19, 2025

This sentiment was reiterated by Frank Giustra, CEO of Fiore Group, during the gold outlook panel.

Giustra explained that gold will benefit from US volatility and political instability.

"At some point sooner or later there will be a crisis in the US and gold will go through the roof," Frank Giustra told the #VRIC audience during the 2025 Gold Forecast panel. @Frank_Giustra #INNatVRIC #VRIC2025 #goldprice pic.twitter.com/2tHFvR4oB6

— Resource Investing (@INN_Resource) January 19, 2025

During his presentation, "Trump Trade 2025," Lobo Tiggre, CEO of IndependentSpeculator.com, also pointed to the heightened volatility markets will see under the Trump administration.

"The Trump Trade of 2025 is high volatility," Lobo Tiggre said during his Trump Trade 2025 presentation at #VRIC. He recommended #gold for stability and gave advice to investors on how to take advantage of the volatility this year. @duediligenceguy #INNatVRIC #VRIC2025 pic.twitter.com/h4VkBimHMB

— Resource Investing (@INN_Resource) January 19, 2025

"The most obvious, number one thing to do, is buy gold,” Tiggre told the audience. "And I'm willing to say that with gold near nominal all-time highs, because I don't see buying gold as a speculation on higher prices ... It's because it's savings, it's insurance — it is real wealth that you can hold in your hand and use in case of extreme need."

Later in the day, Martin sat down with Amir Adnani, president, CEO, director and founder of Uranium Energy (NYSEAMERICAN:UEC) to discuss the growing demand for nuclear energy.

Adnani highlighted the tech sector's increasing need for energy to power data centers. He pointed to the major tech and power deals that happened in 2024, notably Microsoft's (NASDAQ:MSFT) nuclear power purchase agreement with Constellation Energy (NASDAQ:CEG). The deal will see Constellation restart Three Mile Island Unit 1.

"When Trump says 'drill, baby, drill,' what he really means is 'energy, energy, energy' — and that could not be better captured in the trends we're seeing with technology companies,” said Adnani.

Amir Adnani explained why tech companies focused on energy-intensive AI technologies are looking to secure nuclear energy deals at #VRIC.

— Resource Investing (@INN_Resource) January 20, 2025

"One pound of uranium is the energy equivalent of 3,000 barrels of oil," @AmirAdnani told @JayMartinBC. #AI #VRIC2025 #INNatVRIC pic.twitter.com/0kV7vQTDRh

VRIC day 2: Stock picks and hot takes

VRIC's second day also featured a wide array of speakers offering valuable insight into commodities markets.

Kicking off the morning, David Lin of the David Lin Report spoke with Robert Kiyosaki, public speaker and author of “Rich Dad, Poor Dad." During the chat, Kiyosaki showed off the board game he and his wife created in 1996, Cashflow. The well-known financial speaker revealed that he initially wrote "Rich Dad, Poor Dad" in order to sell the board game.

Like the previous day’s speakers, Kiyosaki warned of dollar devaluation and urged investors to look to “hard assets.”

He also offered price forecasts for both gold and Bitcoin.

At #VRIC Robert Kiyosaki, author of the book Rich Dad, Poor Dad, told the audience he forecasts gold will reach US$15,000 this year, and also shared a guess of US$250,000 for Bitcoin in 2025. @theRealKiyosaki #VRIC2025 #INNatVRIC pic.twitter.com/x6DG2BwF4F

— Resource Investing (@INN_Resource) January 20, 2025

Concern about the impact potential US tariffs could have on Canada was also an ongoing theme during the second day of the conference, which coincided with Donald Trump's inauguration.

During a panel entitled “North America 2025: Inflation, Trump and a Stock Market Bubble?” David Rosenberg, founder and president of Rosenberg Research, noted that cross-border tariffs would likely boost inflation in both countries.

There is no appetite in the US for inflation, so if Donald Trump's policies lead to inflation, his legacy "will go down in flames," David Rosenberg told the audience at #VRIC. @EconguyRosie #VRIC2025 #INNatVRIC pic.twitter.com/1i5DvNRxpS

— Resource Investing (@INN_Resource) January 20, 2025

Before the mid-day break, legendary investor and speculator Rick Rule took to the stage for a presentation called “Exhibitors at This Conference, That I Own; Why, and What Could Go Wrong.” The proprietor of Rule Investment Media listed nearly two dozen companies that he has money in, going in alphabetical order.

In a jam packed room at #VRIC Rick Rule took to the stage to give a quick overview of the stocks he owns that are in attendance at the conference. For those who missed it, find the ticker symbols for his full list below. @RealRickRule #VRIC2025 #INNatVRIC$ALS.TO $AHR.V $ARG.TO… pic.twitter.com/0A27SzSt3U

— Resource Investing (@INN_Resource) January 20, 2025

The companies Rule listed include:

- Altius Minerals (TSX:ALS,OTCQX:ATUSF)

- Amarc Resources (TSXV:AHR,OTCQB:AXREF)

- Dolly Varden Silver (TSXV:DV,OTCQX:DOLLF)

- Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX)

- Fireweed Metals (TSXV:FWZ,OTCQX:FWEDF)

- Fortuna Silver Mines (TSX:FVI,NYSE:FSM)

- GoGold Resources (TSX:GGD,OTCQX:GLGDF)

- IsoEnergy (TSX:ISO,OTCQX:ISENF)

- Snowline Gold (TSXV:SGD,OTCQB:SNWGF)

- Uranium Energy

- Vizsla Silver (TSX:VZLA,NYSEAMERICAN:VZLA)

Later in the day, economic geologist Brent Cook, founder of Exploration Insights, took to the stage to offer insights on how investors can use drill results to inform their investment decisions.

"It's imperative that geologists and management understand what success looks like, and that's what I talked about right from the beginning. What the economics are you need for deposit, what the deposit looks like and then calculate what you need to be seen in the results as they come through. More often than not, you'll find the fatal flaw,” said Cook.

Geologist Brent Cook advised investors evaluating resource stocks to check the company's exploration results for consistency of grades, which he said is more important than high grades over short intervals.

— Resource Investing (@INN_Resource) January 20, 2025

Another tip he gave is to check mineral resource estimates for the "CV"… pic.twitter.com/VFUblye5xD

Cook later joined Jamie Keech, executive chairman and co-founder of Vida Carbon, to talk about mining stocks.

Jamie Keech told investors they shouldn't fall in love with a resource company in a #VRIC talk with Brent Cook and Trevor Hall.

— Resource Investing (@INN_Resource) January 20, 2025

"Mining companies are not real businesses. They are levered bets on commodity prices. They're the kind of stocks you should buy at cyclical bottoms… pic.twitter.com/GILMYcUL7K

As the final day of the conference drew to a close, newsletter writer Jeff Clark, editor of Paydirt Prospector, joined several other experts to provide a silver market outlook. During the panel, Clark reminded attendees that the majority of the precious metals catalysts since the 1970s have been unforeseeable.

"Half of all the catalysts for gold and silver since the 1970s have been Black Swan events," Jeff Clark said about precious metal market sentiment during the #VRIC 2025 Silver Forecast panel. @TheGoldAdvisor #VRIC2025 #INNatVRIC pic.twitter.com/1cm3fCeYHi

— Resource Investing (@INN_Resource) January 21, 2025

Stay tuned for more coverage of VRIC, including video interviews with many of the experts mentioned above.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Affiliate Disclosure: The Investing News Network may earn commission from qualifying purchases or actions made through the links or advertisements on this page.

- VRIC 2025 Preview — Jay Martin Talks Resource Wars, Geopolitics and How to Invest ›

- Black Swans, White Swans and Trump’s Clash with the Fed ›

- How Will Trump’s Permitting Plans Impact the US Mining Sector? ›

- Is Trump a Threat to US Electric Vehicle and Battery Supply Chain Growth? ›