Tech 5: US Government Strikes Big Tech Deal, Perplexity Plots Expansion

Elsewhere in the tech space, CoreWeave reported earnings for Q2, and Apple announced plans to expand its product line.

Tech stocks led Wall Street to a second consecutive week of gains as a series of data releases reignited optimism about a September interest rate cut from the US Federal Reserve.

A strong consumer price index report was the catalyst, renewing anticipation that the Fed will lower rates when it meets next month. While Thursday's (August 14) less optimistic producer price index report caused a momentary pause, the tech sector's resilience — or defiance — mitigated losses and kept momentum alive.

Here's a look at the key moments that shaped the tech sector this week.

1. US government strikes controversial Big Tech deal

On Monday (August 11), the Washington Post reported on a deal between the US government and tech giants NVIDIA (NASDAQ:NVDA) and Advanced Micro Devices (AMD) (NASDAQ:AMD). It stipulates that the tech companies must surrender 15 percent of revenue from Chinese sales of NVIDIA's H20 chips and AMD's MI308 chips.

Anonymous sources told the news outlet that this condition was imposed as a prerequisite for granting the companies export licenses to sell their products in China. The move that has prompted legal concerns among trade experts who say the fee could be construed as an unconstitutional trade tax.

“To call this unusual or unprecedented would be a staggering understatement,” Stephen Olson, a former US trade negotiator, told Bloomberg. “What we are seeing is in effect the monetization of US trade policy in which US companies must pay the US government for permission to export.”

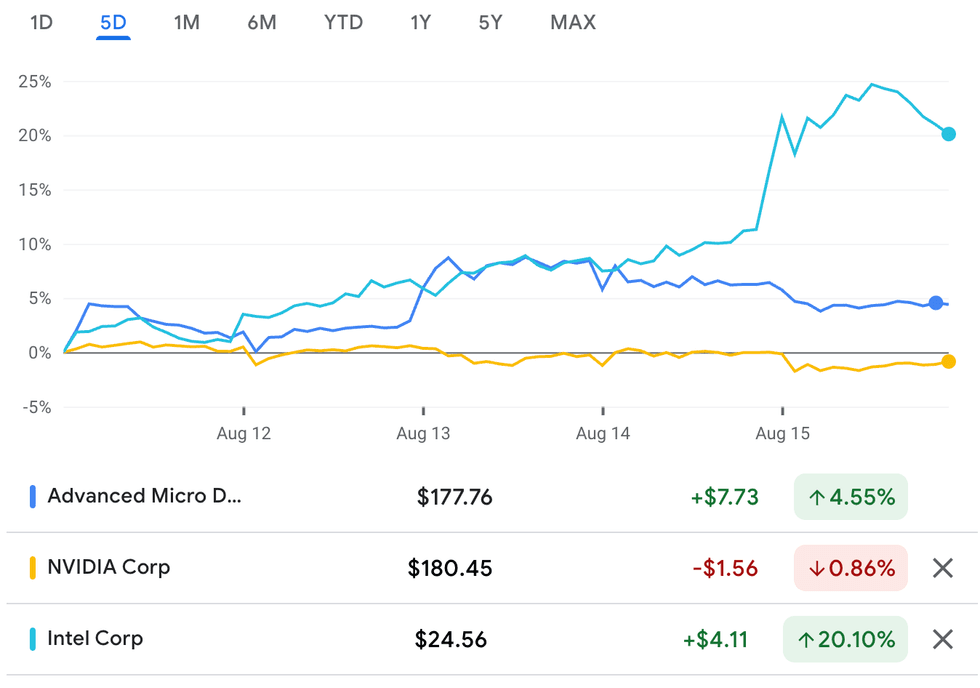

AMD, NVIDIA and Intel performance, August 12 to 15, 2025.

Chart via Google Finance.

Meanwhile, shares of Intel (NASDAQ:INTC) rose as much as 4.6 percent on Tuesday (August 12) following a "candid and constructive" meeting between CEO Lip-Bu Tan and US President Donald Trump on Monday.

The meeting came after Trump called for Tan's removal last week.

According to a separate Bloomberg article, the US government is considering taking a stake in the chipmaker to help it establish a planned factory hub in Ohio; the company once promised it would be the world’s largest chipmaking facility. Tan has not confirmed or denied the report, but discussions are said to be ongoing. Sources told Bloomberg the government is considering using funds from the Biden administration’s Chips Act to fund the stake.

2. Amazon to expand grocery delivery services

Amazon (NASDAQ:AMZN) shares rose as much as 1.3 percent on Wednesday (August 13) after the commerce company announced plans to significantly expand its grocery services.

On Wednesday, the company said its same-day delivery service will now include fresh groceries, including produce, meat and dairy, in over 1,000 cities, with plans to expand into more than 2,300 by the end of the year.

The service is included in Amazon Prime memberships for orders over US$25. Smaller orders and orders from non-members will require fees of US$2.99 and US$12.99, respectively.

3. CoreWeave shares drop after mixed earnings report

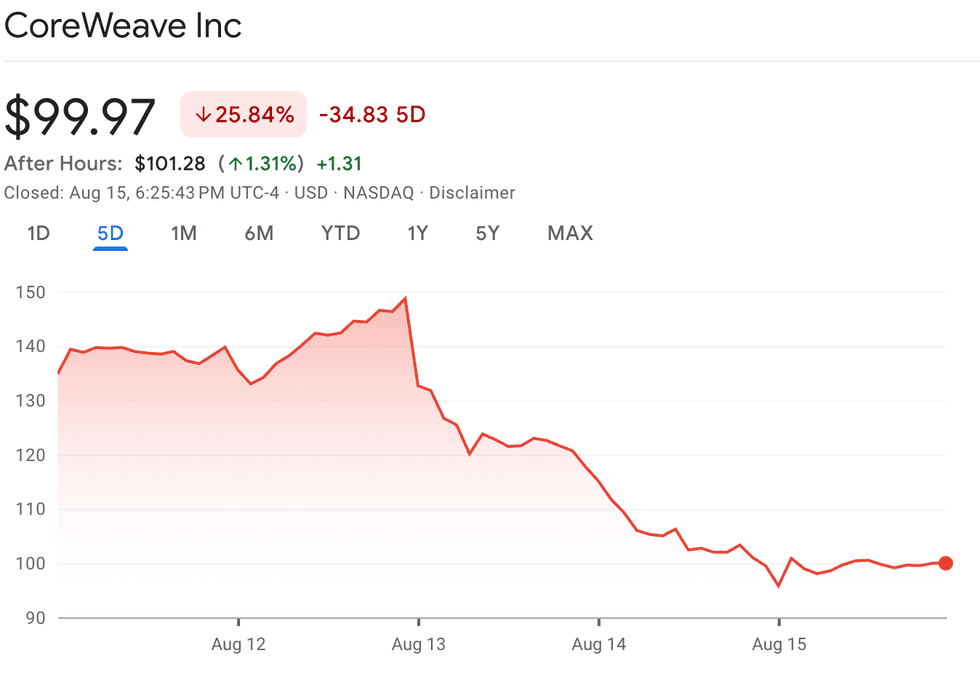

Artificial intelligence (AI) data center operator CoreWeave (NASDAQ:CRWV) reported mixed Q2 results on Tuesday, with revenue more than doubling year-on-year to US$1.2 billion, beating estimates of US$1.08 billion, and a revenue backlog of US$30.1 billion. However, the growth came at a high cost. The company reported a record US$2.9 billion in capital expenditures for the quarter, and operating expenses jumped by 276 percent to US$1.19 billion.

CoreWeave performance, August 12 to 15, 2025.

Chart via Google Finance.

The company also reported losses of US$291 million, larger than the US$190.6 million analysts had estimated.

Shares of CoreWeave opened more than 10 percent lower on Wednesday and declined throughout the week, closing at US$99.97 on Friday (August 15) compared to Monday’s opening price of US$134.80.

4. Perplexity bids on Chrome, prepares for fresh funding round

AI startup Perplexity made a US$34.5 billion bid for Google's (NASDAQ:GOOGL) web browser, Chrome, in a move to secure its future in the AI search market. Perplexity told the Wall Street Journal that the unsolicited offer would be funded with the help of outside investors. The company's advance comes as Google faces a potential divestiture following an antitrust trial that found it had illegally monopolized online search and search advertising.

OpenAI has also expressed interest in acquiring Chrome.

On Thursday, Business Insider reported that Perplexity is preparing for another round of funding, which would mark its sixth fundraiser in 18 months. The company is reportedly seeking a post-money valuation of US$20 billion. This comes barely one month after the startup achieved a US$18 billion valuation.

The rapid succession of these events underscores the intense, high-stakes competition among AI startups to secure foundational assets and challenge established tech giants.

Canadian AI startup Cohere secured US$500 million in fresh funding on Thursday from a group of investors that included NVIDIA and AMD, bringing its valuation to US$6.8 billion. The company also onboarded former executives from Uber Technologies (NYSE:UBER) and Meta Platforms (NASDAQ:META).

5. Apple plans product expansion

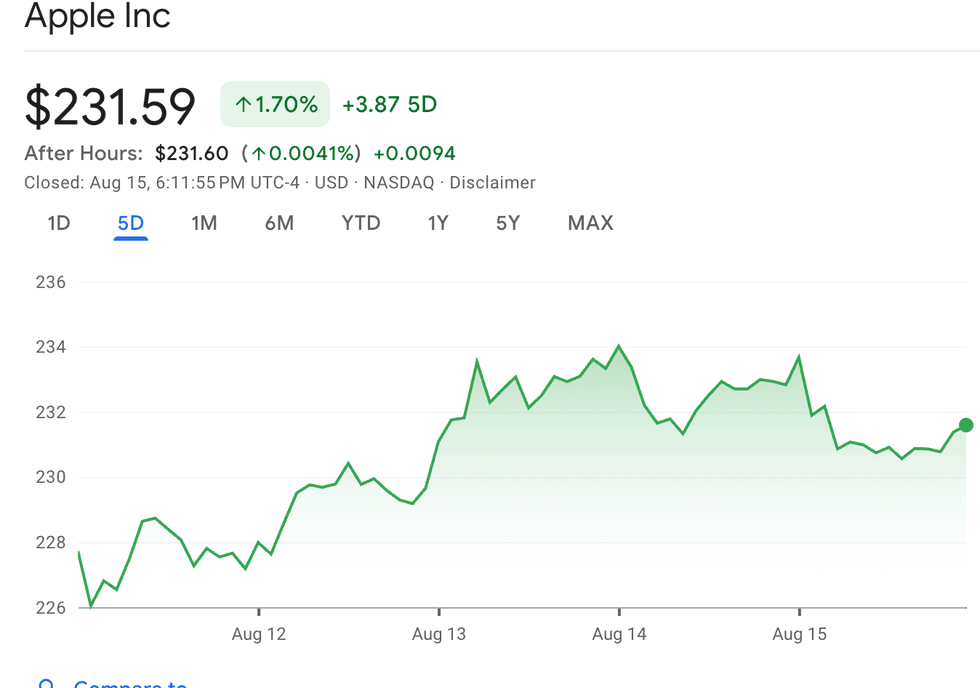

Apple (NASDAQ:AAPL) shares climbed as high as 1.7 percent on Wednesday after Bloomberg reported on the company’s planned expansion into robotics, home security and smart displays.

The new products are aimed at strengthening Apple's product ecosystem, which has paled in comparison to offerings from tech rivals like Amazon and Meta.

Apple performance, August 12 to 15, 2025.

Chart via Google Finance.

Some of the new devices slated for future release include a tabletop virtual companion robot, a long-planned advanced Siri model with a visual personality, a smart speaker with display capabilities and home security cameras.

Apple finished the week at US$231.59, a 1.7 percent gain from Monday.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.