Tech 5: Tesla Pulls Plug on Dojo, Chipmakers Largely Exempt from Trump's Tariffs

Elsewhere in the tech space, Firefly Aerospace made its debut and Palantir reported its latest quarterly earnings.

This week saw tech stocks push the Nasdaq Composite (INDEXNASDAQ:.IXIC) to its best week since June.

However, on Monday (August 4), multiple news outlets reported that various Wall Street firms were warning of a near-term drop in the S&P 500 (INDEXSP:.INX) after its strong rally. In a note to clients, Mike Wilson of Morgan Stanley (NYSE:MS) forecasts that tariffs, which went into effect this week, will lead to a 10 percent correction.

“Over the last couple of weeks, we have noted that investors should expect a modest pullback in the third quarter,” Wilson wrote. Julian Emanuel of Evercore (NYSE:EVR) anticipates a 15 percent drop. Additionally, Parag Thatte's team at Deutsche Bank (NYSE:DB) points to an overdue drawdown following three months of equity expansion.

Markets appear to have disregarded the warnings, as economic data released this week has revived expectations for interest rate cuts. Stephen Miran, US President Donald Trump’s interim selection for Adriana Kugler’s position as chair of the Council of Economic Advisers, has further fueled these expectations. According to CME Group's (NASDAQ:CME) Fedwatch tool, traders now anticipate a nearly 90 percent probability of a rate cut next month.

Furthermore, exemptions to the Trump administration's tariffs for companies investing in US manufacturing capacity led to a midweek rally in tech stocks that persisted through to Friday (August 8).

1. OpenAI's busy week

On Wednesday (August 6), OpenAI unveiled the long-awaited GPT-5 version of ChatGPT, which CEO Sam Altman described as a “significant step” along the path to artificial general intelligence (AGI).

Altman declared that GPT-5 gives users PhD-level expert assistance on any subject, with fewer hallucinations, as well as superior coding abilities that could lead to an era of “software on demand."

“Something like GPT-5 would be pretty much unimaginable in any other time in history,” he said during a pre-briefing with journalists on Wednesday. While GPT-5 exhibits signs of broad intelligence, Altman clarified that it lacks a key characteristic of AGI: the ability to learn and improve autonomously.

Concurrently, OpenAI for Government announced it is partnering with the US General Services Administration to offer ChatGPT Enterprise to the federal executive branch workforce for US$1 per agency for the next year.

In a statement to Wired, Altman said the agreement was part of Trump’s Artificial Intelligence (AI) Action Plan, which is geared at leveraging AI to better serve the American people.

Additionally, the company reportedly engaged in early discussions this week for a secondary stock sale that would increase its valuation to US$500 billion. During an interview with Schwab Network, Ben Emons, chief investment officer and founder of FedWatch Advisors, said OpenAI’s valuation could hit US$1 trillion.

A recent report by the Information found that OpenAI has hit an annualized run rate of US$12 billion, roughly double the US$6 billion recorded in revenue in the first half of 2025.

OpenAI also introduced a pair of freely available models this week, which Amazon (NASDAQ:AMZN) will offer to cloud-computing clients.

2. Stocks react to chip tariff exemptions

Trump announced plans to impose a nearly 100 percent tariff on semiconductor chips on Wednesday, but carved out an exemption for companies investing in US manufacturing capacity.

After a meeting at the White House, Apple (NASDAQ:AAPL) CEO Tim Cook pledged an additional US$100 billion investment in US manufacturing capacity, bringing its total commitment to US$600 billion over the next four years.

However, final assembly is expected to remain overseas “for a while,” according to Cook, and the announcement did not include any mention of future iPhone assembly in the US.

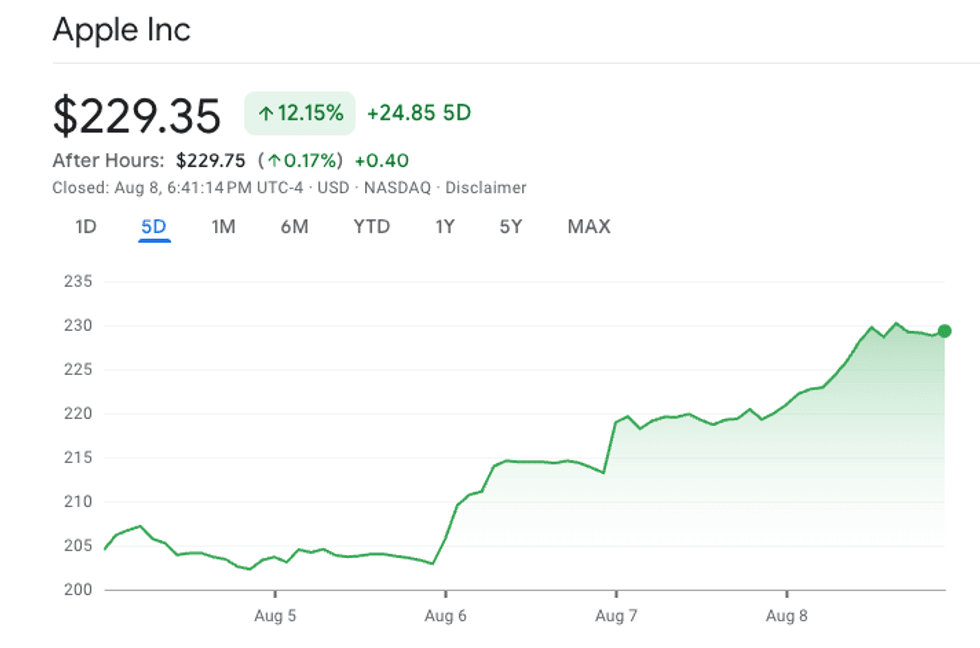

Apple performance, August 5 to 8, 2025.

Chart via Google Finance.

The pledge led to a significant market reaction, with Apple shares climbing over 4 percent, leading gains on Wall Street.

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) also saw strong gains after it was reported that National Development Council Chief Liu Chin-ching told parliament that the company will be exempt since it has factories in the US, referring to fabrication plants currently under construction in Arizona.

However, he added that some of Taiwan’s chipmakers will be affected.

Likewise, South Korean trade officials stated that Samsung Electronics (KRX:005930) and SK Hynix (KRX:000660) will both avoid the tariffs due to their investments in US manufacturing facilities. Samsung has two chip fabrication plants in Texas, while SK Hynix is building a new advanced chip packaging and R&D facility in Indiana.

3. Firefly Aerospace makes explosive Nasdaq debut

Firefly Aerospace (NASDAQ:FLY) made a strong debut on the Nasdaq Global Market on Thursday (August 7).

The stock opened at US$70 per share, a significant jump from its initial public offering price of US$45.

After first targeting between US$35 and US$39 per share, the company raised the price from US$41 to US$43 on Tuesday (August 5). Firefly was valued at over US$2 billion after a Series D funding round in November 2024.

Its opening price represented a further increase. After briefly topping US$73.80, the company closed its first day on the market at US$60.35, raising US$868.3 million and achieving a valuation of approximately US$8.5 billion.

The company experienced a moderate pullback on Friday, opening at US$54.85 before briefly touching US$57.07; it then closed the week at US$50.17.

4. Tesla desbands Dojo team

Tesla (NASDAQ:TSLA) CEO Elon Musk confirmed reports that the company is disbanding its Dojo supercomputer team, posting to X on Thursday evening:

“It doesn’t make sense for Tesla to divide its resources and scale two quite different AI chip designs.

“The Tesla AI5, AI6 and subsequent chips will be excellent for inference and at least pretty good for training. All effort is focused on that.”

Tesla intended for Dojo to facilitate the training of its Autopilot and Full Self-Driving systems.

Sources for Bloomberg, which first reported the story, said Tesla will rely on partners like NVIDIA (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD) and Samsung for chip manufacturing.

This move contradicts Musk’s commitments to “double down on Dojo” during his company’s second quarter earnings call on July 23. The development follows a letter sent to shareholders by two Tesla directors on Monday explaining the board's decision to grant Musk a US$23.7 billion stock award.

Robyn Denholm, chair of Tesla's board of directors, and Kathleen Wilson-Thompson, a director, said the decision was driven by Tesla's transition from electric vehicles to AI and robotics.

The letter emphasizes the critical need to motivate Musk, stating that his involvement is essential for attracting and retaining talent at Tesla, especially as competition for AI talent intensifies.

5. Palantir reports solid growth in Q2

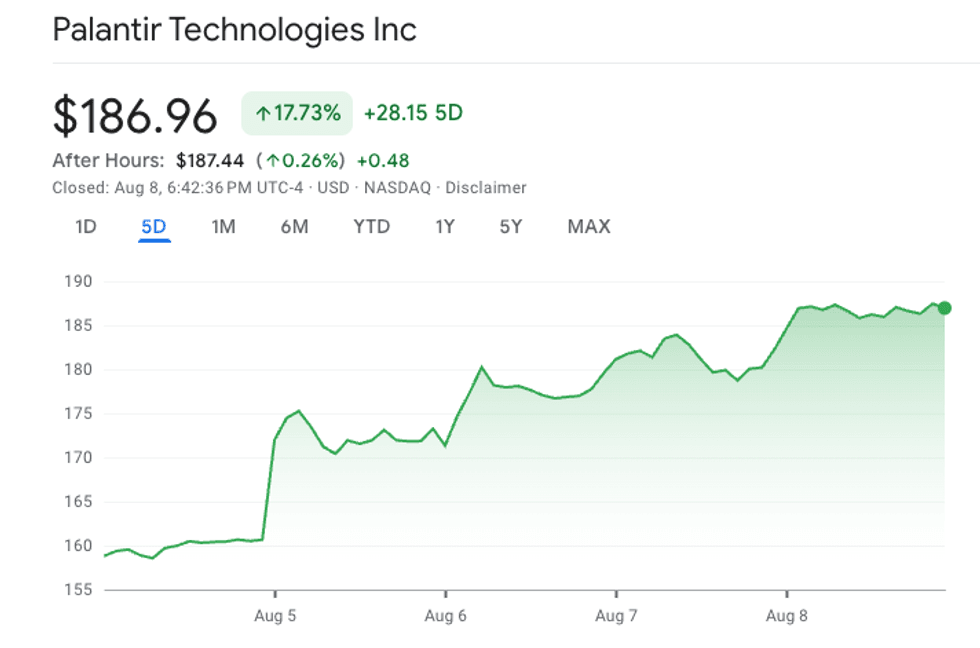

Major software company Palantir Technologies (NASDAQ:PLTR) reported its Q2 earnings on Monday, revealing revenue growth of 48 percent to US$1.003 billion. Shares of the company opened over 7 percent higher on Tuesday and continued to rise, finishing the week up nearly 18 percent.

Palantir Technologies performance, August 5 to 8, 2025.

Chart via Google Finance.

“This was a phenomenal quarter. We continue to see the astonishing impact of AI leverage," said Alex C. Karp, co-founder and CEO of Palantir, in a press release. “We are guiding to the highest sequential quarterly revenue growth in our company’s history, representing 50 percent year-over-year growth.”

Free cashflow rose by 282 percent to US$568.7 million. The company is projecting further revenue growth of around 49 percent in the third quarter. Its share price is up over 145 percent year-to-date after starting the year at US$76.20. As of Friday’s closing bell, shares of Palantir were trading for US$186.96.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.