What happened in the silver market in Q3? Our silver price update covers supply, demand and other key factors impacting the metal.

Click here to read the latest silver price update.

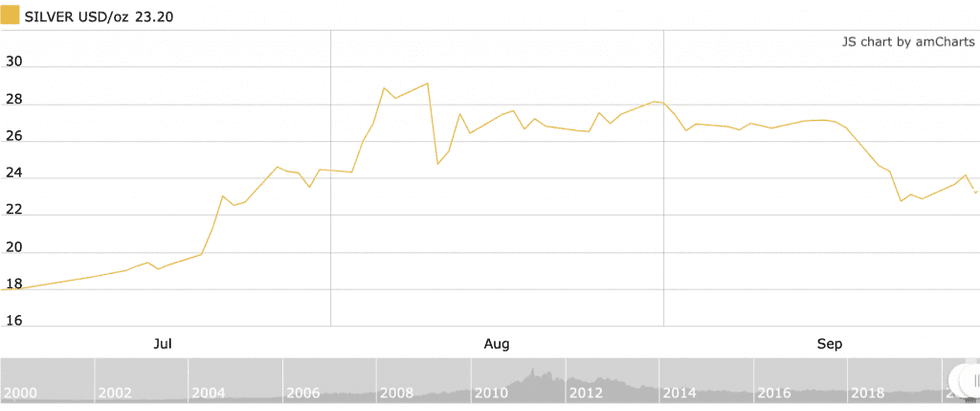

Silver put in its best performance of 2020 in Q3, adding more than 60 percent to its value by mid-August. Surging to a seven year high, the metal neared US$30 per ounce.

The price move created a value opportunity for investors. Pushed higher by precious metals demand, industrial declines had less of an impact on silver’s ascent than initially expected. Meanwhile, heightened exchange-traded fund buying also factored into the metal’s push to US$29.14.

However, silver’s strong momentum didn’t last — by the end of September, the white metal had shed 27 percent of its Q3 gains to hold in the US$24 range.

Silver’s upward momentum in Q3 came after a slow start to the year. The white metal began 2020 at US$18.02 and faced incredible headwinds late in Q1 as the markets fell sharply in response to domino-ing global COVID-19 lockdowns, which stunted supply chains and paralyzed international manufacturing.

Silver price during Q3 2020. Chart via Kitco.

Dipping to an 11 year low of US$12.59, the road to recovery was quick as investors looked to jump into the market, while also looking for alternative currency metal investments.

By July, silver had climbed back to its January value — US$18.02 — and was positioned to rise rapidly.

“We have a perfect storm to send both gold and silver higher,” Chris Marchese, senior analyst at GoldSeek told the Investing News Network midway through the year.

He continued, “I think the second of half of 2020 is going to be great. There’s a lot of catalysts (that are) good for the precious metals, bad for mankind. A lot more money printing (and) let’s see who wins the election — I don’t think it’ll be Trump.”

Watch the video above to hear more from Marchese about the precious metals market.

Concerns about a more prolonged economic recovery motivated both silver and gold throughout July as coronavirus infection stats rose. The yellow metal pushed up to to US$1,976 per ounce, while sister metal silver was holding at US$24.47.

During the Sprott Natural Resource Symposium in late July, mining entrepreneur Ross Beaty made the case for a rising silver price in the second half of 2020, saying the metal’s duality could be a key catalyst.

“The thing about silver is you’ve got to understand not just the conditions in the precious metals market … but you’ve also got to understand what’s going on in the industrial market, because silver has all these industrial uses,” said the chairman and founder of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS).

He went on to point out that silver could outperform gold as it has done in the past if currency, safe haven and industrial demand pick up simultaneously.

Silver price update: Gold/silver ratio falls, prices rise

As mentioned, silver rose sharply to US$29.14 in the first week of August, hitting a seven year high. The move forced the gold/silver ratio lower, and it reached 69:1 on August 7. The dramatic dip stood in stark contrast to the all-time high of 126:1 that the ratio reached in March.

Listen to David Morgan of the Morgan Report discuss where the silver price could go.

Silver’s appeal as a leveraged play against gold worked in its favor during Q3. Inflows to exchange-traded products neared record levels in August, when 105.2 billion ounces were reported in global holdings.

Physical silver demand has also picked up this year as a store of value in addition to physical gold.

“Globally, silver bullion coin demand is up strongly, with a 65 percent increase in demand over the first three quarters,” notes a report from the Silver Institute. “This was due to strong sales in the two key bullion coin markets, the U.S. and Germany, with both seeing substantial double-digit gains over the first nine months.” The US and Germany also led in bar demand, which has surged higher in 2020.

Safe haven demand continued to buoy silver, although the metal had slipped off its high to the US$28 range by the beginning of September.

Over the next 30 days, pressure from weakened industrial demand and a decline in global jewelry sales provided headwinds for the white metal.

While it’s still too early to say whether silver will outperform gold in 2020, the white metal did outshine its yellow sister in Q3. Silver added 34 percent to its value for the three month period, and during its quarterly peak it had added more than 60 percent year-to-date.

Conversely, the third quarter of 2020 saw gold add 6.9 percent to its value in total, and 16 percent when it reached an all-time high of US$2,063.

Silver price update: Uncertainty and an election

As noted, the pandemic has created much uncertainty in the market, and it is still infusing volatility as second waves begin to descend and some countries enter another round of lockdowns. There is also the pending US election, which is likely to impact markets and the resource space greatly.

Michael DiRienzo, director of the Silver Institute, thinks there will be another stimulus package for Americans, but it likely won’t come until after the November vote. In his opinion, that will make the weeks following the election interesting.

“Both candidates are talking about a huge stimulus bill wrapped into an infrastructure bill at the beginning of their term, so if Joe Biden was elected, that would be on January 20. And I don’t think Mr. Trump would want to start doing that before the new Congress was sworn in, also early in January.”

Regardless of who the winner is, the head of the Silver Institute sees silver as the real winner, as each candidate’s platform would use silver as a component of either technological advancement or green energy growth.

“Biden has already indicated he wants a massive clean energy infrastructure plan, which can only assume solar power would be a major component. So that would bode very well for silver,” he explained.

“President Trump wants to focus more on an infrastructure plan. So that requires building up 5G networks, construction and so forth, which will use and chew up a lot of silver as well.”

While he pointed out that those ideas are speculative right now, ultimately circumstances have the potential to work in silver’s favor, especially in a year where estimated global industrial fabrication demand will have declined by 10 percent.

Silver price update: Where will the price go?

Continued pressure from fractured supply chains and weakened industrial demand are projected to benefit silver investment demand for the remainder of the year.

“Dramatic monetary easing policies and fiscal stimulus measures seen in several key markets, and potentially again in the US before the end of 2020, could boost inflationary expectations and weigh on the US dollar, continuing to raise the appeal of safe haven assets, including precious metals,” highlights the Silver Institute release.

As it continues to hold at the US$24 level, the case for silver moving higher into 2021 is compelling as many investors look to hedge against inflation with more than just gold.

As Independent Speculator Lobo Tiggre pointed out, the white metal has performed exceedingly well amid the challenges of 2020.

“We have to remind people that silver is not just poor man’s gold. It has tracked with gold better than I expected through this time of economic turmoil,” he said, adding that there is no credence to the idea that silver is no longer a currency metal and only functions as an industrial commodity.

“It does clearly have its industrial side and got whacked harder than gold in March during the meltdown — that’s true. But silver is still tracking gold, and many days where markets have been down and industrial commodities have been down, silver has held up with gold.”

Tiggre sees the trajectory of both metals continuing to be positive going forward. “I’m very comfortable with gold and silver,” he said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.