Investor Insight

Silver Dollar Resources is repositioning its flagship La Joya silver-gold-copper project to unlock high-grade underground potential in Mexico’s prolific Durango-Zacatecas silver belt. Strengthened by the all-share sale of its Ranger-Page project to Bunker Hill Mining, the company offers investors leveraged exposure to near-term silver (zinc-lead) production in Idaho’s Silver Valley, while remaining fully funded to advance exploration across its core portfolio through 2026.

Overview

Silver Dollar Resources (CSE:SLV,OTCQX:SLVDF,FSE:4YW) is a precious metals exploration company focused on advancing high-grade silver and gold opportunities in Mexico. The company’s primary asset is the La Joya silver-gold-copper project, located in the southern portion of the Durango-Zacatecas silver belt, one of the world’s most productive silver regions.

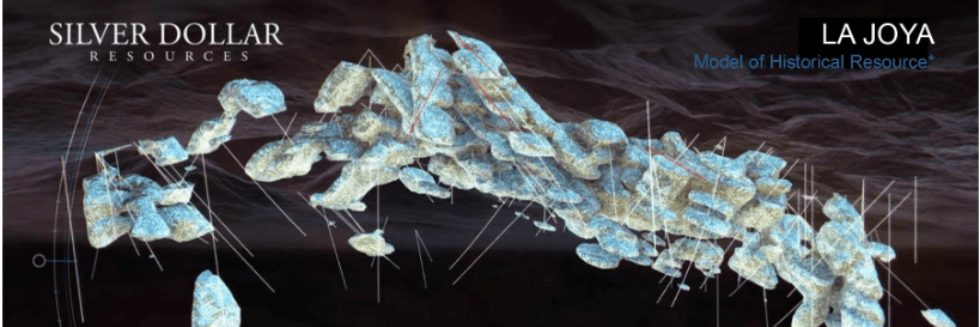

La Joya has been the subject of extensive historical exploration, including more than 51,600 meters of drilling across 182 drill holes. This work outlined multiple mineralized zones, including the Main Mineralized Trend, Santo Niño and Coloradito. Silver Dollar is re-evaluating the project with an underground-focused exploration model, supported by structural analysis, underground sampling and reassessment of historic drill core to identify higher-grade targets at depth.

The company also owns the Nora silver-gold project in Durango, Mexico, which hosts the historic Candy mine and epithermal vein system that has returned high-grade surface sampling results. In addition, Silver Dollar holds an equity position in Bunker Hill Mining following the sale of the Ranger-Page project, providing equity exposure to the planned production restart in Idaho’s Silver Valley in the first 2026.

Silver Dollar is supported by an experienced management and technical team with expertise in underground exploration, epithermal systems and project evaluation. With a strong treasury, active exploration programs and multiple upcoming catalysts, the company is positioned to deliver exploration progress through 2026.

Company Highlights

- 100 percent owned La Joya project, an advanced-stage silver-gold-copper system in Mexico’s Durango-Zacatecas silver belt

- La Joya was originally proposed as an open pit in 2013 based on US$24 silver, US$1,200 gold and US$3 copper

- Strategic shift toward evaluating La Joya’s high-grade underground potential supported by new 3D geological modeling, underground sampling, and drill target development

- Completed sale of the Ranger-Page project to Bunker Hill Mining, providing equity exposure to a near-term US silver producer

- Fully funded to carry out planned exploration programs through 2026

- Largest shareholder is mining investor Eric Sprott, with approximately 17.5 percent ownership

- Multiple exploration catalysts planned, including drilling at La Joya in early 2026

Key Projects

La Joya Silver-Gold-Copper Project

The La Joya project is Silver Dollar’s 100 percent owned flagship asset. It is located within the Durango-Zacatecas silver belt, which hosts numerous past-producing and operating mines, including assets operated by First Majestic Silver, Grupo México, Industrias Peñoles and Pan American Silver.

Historical exploration at La Joya outlined multiple zones of mineralization, including the Main Mineralized Trend, Santo Niño and Coloradito, with mineralization occurring as skarn, replacement and vein-style systems. Previous work was largely oriented toward evaluating open-pit potential.

Silver Dollar is advancing a reinterpretation of La Joya as a potential high-grade underground system. Recent work includes:

- Underground sampling from historic workings, returning values of up to 2,753 grams per metric ton (g/t) silver equivalent

- Identification of the Central Dyke zone over approximately 770 meters, including a sample returning 3,513 g/t (~124 oz/ton) silver

- Discovery of the Brazo zone, located approximately 1 kilometer west of the Main Mineralized Trend, with Phase II drilling returning up to 451 g/t silver over 5 meters

- The Brazo Zone provides evidence of deeper, high-grade mineralization at La Joya

- Development of new 3D geological models is in progress incorporating the large database of structural, geochemical and fault-kinematic analysis

Silver Dollar plans to advance a new phase of drilling at La Joya in the first quarter of 2026, with a focus on testing high-grade underground targets identified through recent modeling and sampling.

Nora Silver-Gold Project

The Nora project is located in Durango, Mexico, within the same regional silver trend as several major operations. The property hosts an epithermal vein system known as the Candy vein.

Geological mapping and surface sampling have returned high-grade gold, silver and base metal values, including samples grading up to 29.61 g/t gold and 2,215 g/t silver, along with locally elevated copper, lead and zinc values.

In 2025, Silver Dollar identified the North Canyon zone, located approximately 1.5 kilometers north of the historic Candy mine. Channel sampling returned 162 g/t silver equivalent over 12.48 meters within a broad oxidation zone. Ongoing mapping and trenching are being used to define drill targets for potential drill testing in the first quarter of 2026.

Ranger-Page Project (Sold)

Silver Dollar acquired the Ranger-Page silver-lead-zinc project in Idaho’s Silver Valley in August 2024 and agreed to sell the asset to neighbor Bunker Hill Mining in October 2025 for C$3.5 million, payable by the issuance of 23,333,334 Bunker Hill shares at a deemed price of C$0.15 per share. The sale closed in December and the value of those Bunker Hill shares at the time of closing was approximately $5.8 million.

The Ranger-Page project is geologically contiguous with the Bunker Hill mine system. The transaction provides Silver Dollar with equity exposure to Bunker Hill’s planned production restart in the first half of 2026. Teck Resources owns ~32 percent of Bunker Hill and has life-of-mine off-take agreement for 100 percent of the zinc and lead production. Silver Dollar expects Bunker Hill to receive increased analyst coverage and a higher valuation next year as production commences.

Red Lake Area Properties

Silver Dollar also holds two 100 percent owned gold grassroots exploration properties in Ontario’s Red Lake mining division: Pakwash Lake and Longlegged Lake. Early-stage work has included airborne magnetic surveys, geological mapping and surface sampling, identifying structural and geophysical targets associated with the Pakwash Lake Fault Zone.

While not a primary focus, the properties provide optionality in a well-established gold district with major Kinross Gold discovery drilling on the Dixie Halo property that adjoins both properties to the north.

Management Team

Gregory Lytle — President, CEO and Director

Gregory Lytle has more than 20 years of experience advising mineral exploration companies on corporate strategy, capital markets and communications. Prior to becoming CEO in 2025, Lytle served as a consultant to Silver Dollar and has facilitated more than $100 million in financings for mining-sector clients.

J.J. (Jeff) Smulders — CFO, Corporate Secretary and Director

Jeff Smulders has more than 45 years of experience in accounting, taxation and financial management. He has provided financial consulting services to public and private companies for more than 25 years.

Bruce MacLachlan — Independent Director

Bruce MacLachlan is an exploration professional with more than four decades of experience across grassroots and advanced-stage projects. He has worked with companies including Noranda, Hemlo Gold, Battle Mountain and Noront.

Guillermo Lozano-Chávez — Independent Director

Guillermo Lozano-Chávez is a geologist with more than 40 years of experience in exploration and mine management across the Americas. He previously served as vice president of exploration at First Majestic Silver.

Dale Moore — Exploration Manager and Qualified Person

Dale Moore is an underground-focused geologist with more than a decade of experience in Idaho’s Coeur d’Alene Mining District. His work includes major deposits such as Lucky Friday and the Galena Complex, and he leads technical work at La Joya.

Mark Malfair — Country Manager, Mexico

Mark Malfair is a bilingual geologist with more than 25 years of experience in exploration and project management in Mexico, including previous work at Chesapeake Gold’s Metates project.