Copper Price Update: Q2 2022 in Review

Here’s an overview of the main factors that impacted the copper market in Q2 2022, and what’s ahead for the rest of the year.

Click here to read the latest copper price update.

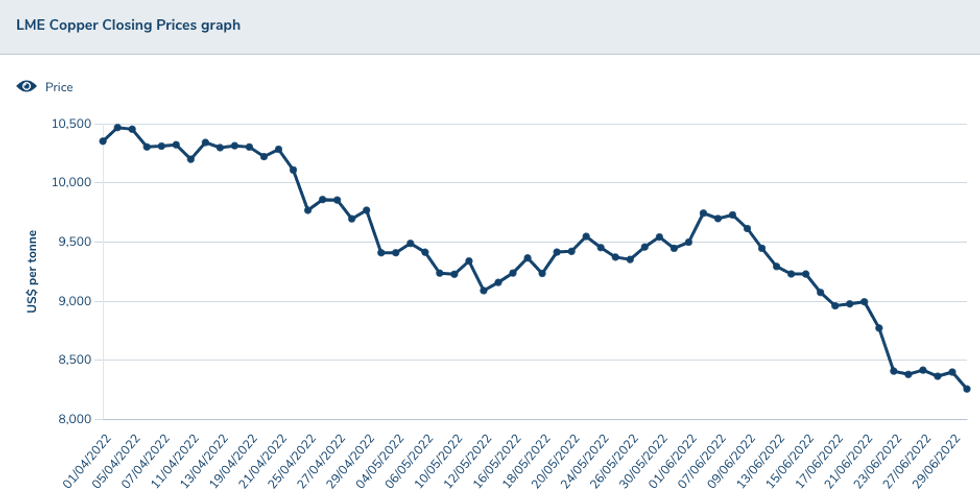

Following a first quarter that saw prices surpass the US$10,500 per metric ton (MT) threshold, copper prices declined sharply in the second quarter.

Overall market volatility paired with weaker demand in China have been putting pressure on copper since April.

With Q3 already in motion, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for copper supply, demand and prices.

Copper price update: Q2 overview

Copper kicked off the second quarter of the year trading at US$10,353.50, coming off a strong first three months of the year that saw the base metal increase 7 percent.

Copper's price performance in Q2 2022.

Chart via the London Metal Exchange.

The highest point of the quarter came early in April, when copper was changing hands for U$10,469. But after that, the trend was only downward, with prices losing more than US$2,000 by the end of the three month period.

Speaking with INN about copper’s performance in Q2, Karen Norton of Refinitiv said the price correction that has continued into Q3 has been sharper than anticipated.

“Inventories are low and the price collapse has been exacerbated by speculative activity,” she said. “Even so, the zero-COVID policy in China and subsequent disappointing recovery to date, along with growing fears for a global recession, are combining to undermine sentiment.”

Similarly, Robert Edwards of CRU Group said he was not expecting such a sharp correction in prices, as the copper market's micro-indicators are still relatively positive.

“There were low exchange inventories (and) US/European demand remaining relatively robust; China physical market was weak, but not as bad as macro data was suggesting,” he said.

All in all, prices declined over 20 percent over the quarter and ended the period at US$8,258.

Copper price update: Supply and demand dynamics

Despite weaker Chinese demand in Q2, analysts remain relatively optimistic about the coming months.

“(The Chinese) government has limited space to ease monetary policy further, but fiscal policy is being used (spending and tax cuts) … infrastructure should be the first sector to benefit,” Edwards said.

Copper is widely used in building construction, electrical grids, electronic products, transportation equipment and home appliances. For CRU, the rest of the world excluding China should see some slowing in growth, in particular in Europe and the US during the fourth quarter of the year.

The next few months are likely to see accelerating demand in China as lockdown measures are eased, Dan Smith of Commodity Markets Analytics told INN.

“But this will be offset by weakness and slow growth in the OECD area,” he added, referring to countries in the Organization for Economic Cooperation and Development.

Though it is not a given, Norton would also expect Chinese copper demand to improve substantially as the year wears on, helped by government stimulus measures and as the economy recovers from COVID-related lockdowns.

“This will at least partially mitigate weakness in some other major consuming regions in the period and should act as a brake on prices,” she said.

Looking over at copper supply, output is growing more slowly than expected at the start of the year due to ongoing political tensions in top-producing countries such as Chile and Peru.

“This is helping to bring down spot treatment charges, showing that the raw materials market for copper concentrate is getting tighter, which is a significant bullish factor helping to underpin prices,” Smith said.

As it stands, copper mine production could be a bit lower than Refinitiv’s projections at the start of the year, dogged in part by temporary mine suspensions in Peru and declines at some large Chilean mines.

“A handful of new projects and expansions are making a positive contribution, though, including the successful and speedy ramp up of Kamoa-Kakula and the recent start up of Quellaveco; production should still end up posting above trend growth over the year,” Norton said. “Nevertheless, this does come on top of three years of limited growth.”

But looking further ahead, the lack of commitment to new mine projects remains a concern.

According to the International Copper Study Group, production in Chile, home to the world’s largest copper mine, Escondida, was down by 6.4 percent in the first five months of 2022.

Chile is the world’s largest copper producer, putting out 5.6 million MT of copper in 2021 and with reserves of 200 million MT. The value of copper exports jumped more than 40 percent in 2021, according to Chile’s central bank, with copper shipments reaching US$53.42 billion last year.

But the industry is starting to get worried after the country’s recent move to introduce a tax reform bill that would increase copper-mining royalties on companies that produce more than 50,000 MT a year. The bill would also raise taxes on high-income earners to fund the government's proposed social programs and reforms.

Chilean supply is critical to the copper industry, as it is home to top producers including Codelco, BHP (ASX:BHP,NYSE:BHP,LSE:BHP) and Antofagasta (LSE:ANTO,OTC Pink:ANFGF).

“There is concern that given the impact on costs of such measures, some projects will be disincentivized and producers likely to seek alternative locations,” Norton said. “However, Chile is still deemed a more stable environment for miners than some of the potential alternatives, and the more diversified major miners are likely to be able to absorb the impact more easily than those focused mainly on copper."

In contrast, Smith said investors are being put off by the lack of stability in Chile, which was previously seen as a safe haven in a challenging region. “As a result, mine development is being hampered,” he said. “Overall, this means that copper prices need to be higher to justify the extra costs being imposed on the industry and the greater uncertainty that investors need to account for.”

When asked about his overall forecast for the market, all in all Smith sees both supply and demand growth being subdued in the months ahead, resulting in a broadly balanced market.

“On-warrant London Metal Exchange inventory levels remain very low, though, so any unexpected demand strength would quickly drive the market into deficit, and prices would spike higher on the back of this,” Smith said.

Meanwhile, for Norton, the net impact of weaker-than-anticipated demand this year looks set to be offset by a supply picture that is also coming up slightly short of expectations.

“This will leave the market in what is still a relatively modest surplus against the backdrop of low inventories,” Norton said. “The prospect of a larger surplus next year though in a recessionary environment would likely weigh on sentiment.”

Copper price update: What’s ahead?

As the third quarter of the year continues to unfold, investors might be wondering what is ahead for prices.

For Norton, prices may fall further, with thin trading conditions over the seasonally quieter period exaggerating moves against the backdrop of broadly pessimistic demand expectations.

“The anticipated recovery in China, the world’s biggest consumer, should help to mitigate in coming months, although the doom and gloom surrounding the country’s real estate sector remains a concern,” she said.

In the short term, Smith also said it is likely for prices to fall further.

“Inflation remains a significant problem, and the European manufacturing sector will struggle to cope with energy shortages due to the challenges around Russia,” he said.

Prices are a key factor to watch as the year progresses, because if they fall substantially from current weaker levels, this could lead to cutbacks and, critically, project deferrals.

“That (scenario) will call into question even further the ability of the copper pipeline to satisfy the demand growth trajectory required for the energy transition,” Norton said. “Some projects have the potential to surprise in the speed of their development, but the substantial projects potentially on the drawing board are largely concentrated in the hands of major companies and are likely to have long lead times.”

Another key catalyst to continue to pay attention to is inflation pressures in the US.

“Any sign that inflation is coming down quickly would potentially be a bullish trigger for copper, and financial markets more generally,” Smith said. “Russia remains a key swing factor, of course, and this is likely to remain a significant headwind for copper.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.