Geopolitics, Power and Resources Collide as Global Order Frays

Feb 10, 2026 02:00PM PST

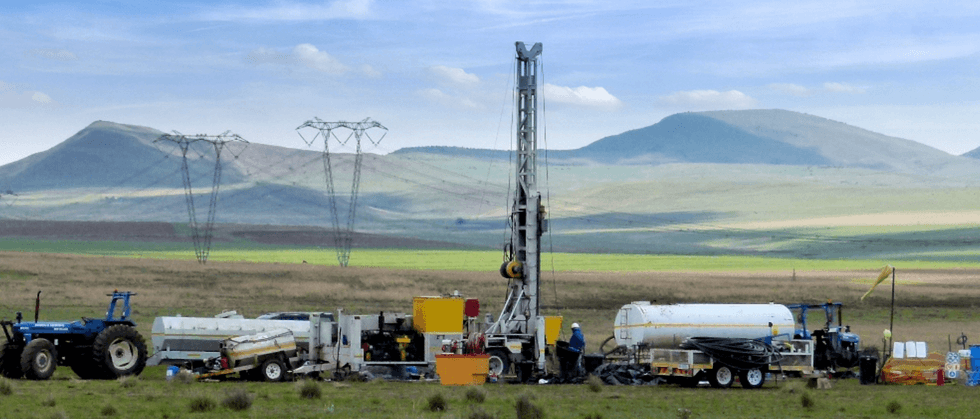

As geopolitical tensions rise and the postwar order shows signs of strain, resource investors are being forced to reckon with a new reality: metals, minerals and mining projects are increasingly entangled with global power politics.