Trump's Copper Tariffs: Market Impact and How to Invest

Tariffs have been applied to a limited number of copper imports to the US, with further levies to be phased in between 2027 and 2028. What's the impact for investors?

Tariffs have been central to Donald Trump’s presidency even before he assumed office at the start of 2025.

From his perspective, levies on nearly all US imports are meant to balance a trade deficit with major partners, including Canada, Mexico, the EU and the UK, while stimulating domestic production in key sectors.

Trump has put forward other reasons for tariffs as well, saying he wants to stem the flow of illegal drugs and immigration, and mentioning broader national security concerns. How effective tariffs would be at controlling these issues is unclear, but they have sown uncertainty and chaos through global financial markets.

In the copper sector, tariff turmoil has created price volatility and left investors wondering how to position.

Trump's copper tariffs cause price turmoil

On February 25, not long after taking office for the second time, Trump initiated an investigation into copper's national security implications under Section 232 of the Trade Expansion Act of 1962.

Further details came months later, when the president provided an update on on July 8.

“I believe the tariff on copper, we're going to make 50 percent,” Trump said during a White House cabinet meeting.

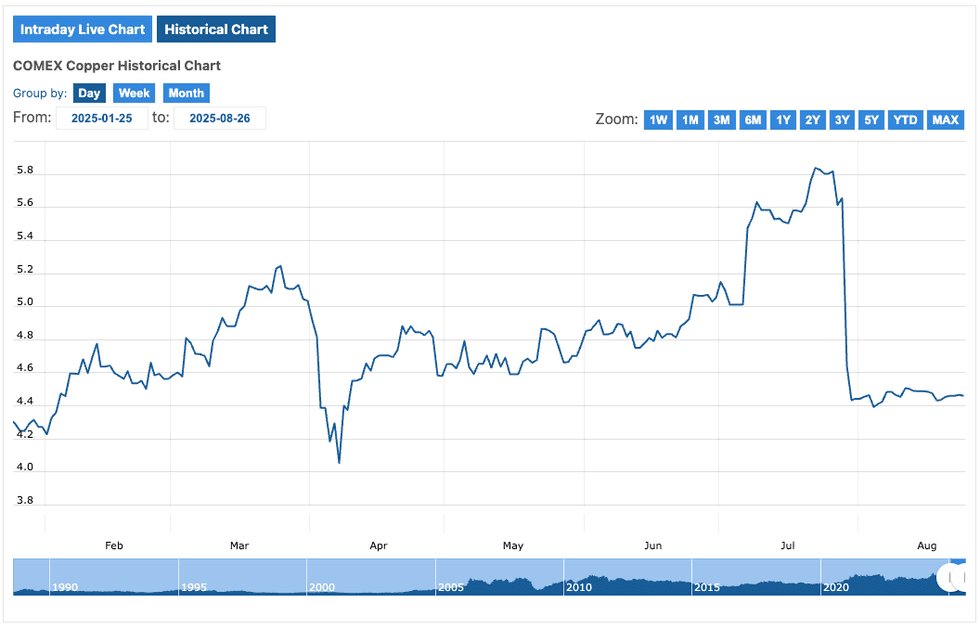

His comments came without an official announcement, although Secretary of Commerce Howard Lutnick said the tariff could take effect by late July or early August. This lack of clarity caused copper prices on the Comex to surge as traders worked to bring the metal into the US ahead of potential levies.

Copper price, January 1, 2025, to August 25, 2025.

Chart via Comex Live.

Ultimately, the Trump administration said on July 30 that copper tariffs would only be applied to unrefined copper, semi-finished and copper-intensive derivatives like pipe fittings, cables, connectors and electrical components.

Refined copper will be phased in at 15 percent in 2027 and 30 percent in 2028.

The move essentially pulled the rug out from prices and caused Comex copper to plummet nearly 25 percent.

Will copper tariffs boost US production?

Copper is increasingly being viewed as a critical mineral, and there are clear reasons why the US would want to increase production of the metal. But what do Trump's tariffs really mean for supply?

Taking a look at how US steel and aluminum tariffs played out in 2018, during Trump's first presidency, could provide insight. A March article published by Reuters analyzes the overall impact of those tariffs.

Prices started to rise in the lead up to the expected tariff deadline, similar to what happened with copper this time around, as importers began stockpiling products ahead of fee implementation. Steel prices rose 5 percent within a month of the tariffs being applied, while aluminum prices rose 10 percent. While they began to fall after just a few months, there was still a significant gap between prices for these products in the US and the rest of the world.

There were also more pronounced fluctuations between US and world prices as COVID-19 pandemic supply chain disruptions further impacted the steel and aluminum sectors.

While the steel and aluminum tariffs did stimulate domestic production of these materials, they ultimately weren't enough to overcome the price differential, as increased US output also faced headwinds.

The US is facing these same challenges with copper production. According to the US Geological Survey, in 2024 the US produced 1.1 million metric tons of unrefined copper and 850,000 metric tons of refined products. The US also exported 320,000 metric tons of concentrates and 60,000 metric tons of refined copper.

However, US demand requires 1.8 million metric tons of refined product annually, more than double US capacity — that's a key reason why refined products were exempted from tariffs.

In an email to the Investing News Network, Lauren Saidel-Baker, CFA, and economist with ITR Economics, spoke about the challenges that copper tariffs could pose to the US economy:

“The US does not have the capacity to produce all the copper that we consume. While there have been investments in new mining capacity, these facilities will take years to come online, leaving US businesses reliant on copper imports for at least the near term."

Although copper is classified as a critical mineral in the US, expanding existing operations will take years, and the time from discovery to opening a new mine could still take more than a decade.

One project nearing completion is Taseko Mines' (TSX:TKO,NYSEAMERICAN:TGB) Florence property in Arizona. The company acquired the asset in 2014, but a March 2023 technical report shows exploration dates back to the 1970s. After environmental assessments, permitting and the building of a test facility between 2017 and 2020, Taseko started full-scale construction of the mine in 2024, with the expectation that operations will begin in late 2025.

Likewise, new smelting operations will not come online until after the first phase of tariffs on refined copper are added in 2027. The newest smelter in the US is Aurubis' (OTC Pink:AIAGF) Richmond facility in Augustus, Georgia. The facility was designed to domesticate some of the more than 900,000 metric tons of scrap copper exported from the US to smelting facilities overseas each year. Construction took four years and US$800 million.

Once operational, the plant will produce 70,000 metric tons of refined copper annually, which is less than 10 percent of annual copper imports to the US.

Copper tariffs could weigh on other industries

Time isn't the only factor hindering the expansion of US copper production.

Mining is an energy-intensive business, and as demand for electricity grows, copper smelters may have to compete with other entities, similar to what happened in the steel and aluminum sector in 2019.

An April McKinsey report suggests that US power demand will grow at a CAGR of 3.5 percent, increasing from around 4,000 terawatt hours (TWh) in 2025 to about 5,000 TWh in 2030 and 7,000 TWh by 2040.

The report states that this increased demand could lead to bottlenecks as providers are faced with supply chain issues and shortages of dispatchable power as new projects face delays due to labor shortages and multi-year lead times for necessary equipment. It also notes that retail electricity bills have increased 6 percent per year since 2020.

The alternative for the copper sector would be to incur further capital costs by investing in off-grid capacity — this might also be affected by tariffs, as has been seen with photovoltaic imports.

The Reuters report evaluating steel and aluminum tariffs notes that the fees were ultimately lifted in 2019 due to the high cost of electricity and limited demand. The downstream effects meant that the manufacturing, construction and transportation industries faced higher costs, reducing growth in those sectors.

Likewise, a small uptick of about 8,000 jobs in the steel and aluminum sectors was outweighed by losses in other industries as companies sought to offset higher costs through efficiency gains.

One study concluded that the tariffs resulted in the loss of 75,000 manufacturing jobs.

Although the bulk of copper tariffs will be phased in starting in 2027 and 2028, that may not provide enough lead time to build new operations and ensure they have the inputs they need to carry out business.

If applied incorrectly, tariffs could have significant consequences for industries that rely on the red metal, including tech and construction, while also impacting overall economic growth.

“Tariffs will increase the cost to US importers and consumers of copper and related products, and will put downside pressure on potential growth,” Saidel-Baker said.

What should investors know about copper tariffs?

For investors interested in copper, the long-term picture is key.

Although Trump's scaled-back tariff announcement caused a price pullback, demand for copper is expected to significantly outweigh supply in the coming years, with experts calling for consumption from the tech industry and energy transition to add to growing requirements from urbanization in the Global South.

Whether tariffs will provide a competitive advantage for copper companies already producing and serving the US market remains to be seen, but some market watchers see potential for that to happen.

For example, Morgan Stanley (NYSE:MS) upgraded its price target for Freeport-McMoRan (NYSE:FCX) to US$48 on August 11. In its reasoning, Morgan Stanley said that the market is not currently appreciating the benefits Freeport will gain from the tariffs, also noting that it will be able to raise pricing for 2026 copper rod contracts, a semi-finished product, which accounts for the majority of the company’s North American sales volume.

Robert Friedland, founder and co-chair of Ivanhoe Mines (TSX:IVN,OTCQX:IVPAF), has come out in support of the tariffs, suggesting that they will help to rebuild the US copper industry. His reasoning is based on the national security issues inherent to having a single country dominate nearly 50 percent of the market of such a critical mineral.

Tariffs apply a new layer of uncertainty to an already challenging copper supply scenario. If tariffs are phased in gradually and industry is given the proper amount of time and investment, it could lead to a resurgence in US copper production and be a boon for those projects already in development; if not, then it could be a replay of 2018.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Lobo Tiggre: Copper's Trump Tariffs — Plus Gold Price, Uranium Opportunity ›

- Copper Soars to All-time High as Trump Unveils 50 Percent Tariff on Imports ›

- Copper Prices Surpass US$10,000 as US Tariff Fears Shake Global Markets ›

- Trump's Copper Tariff Investigation Triggers Global Market Response ›