Tech Weekly: Stocks Sink as Iran War Continues, Stoking Inflationary Fears

Explore this week’s top tech news and market movers, plus key catalysts to watch next week.

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market.

We also break down next week's catalysts to watch to help you prepare for the week ahead.

In this article:

This week's tech sector performance

The tech-heavy Nasdaq Composite (INDEXNASDAQ:.IXIC) navigated a volatile week.

Early week caution gave way to a rebound by Monday’s close (March 2), with the Nasdaq eking out a small gain led by defense and tech stocks. On Tuesday (March 3), the Trump administration’s plans to secure the Strait of Hormuz shipping lanes helped pare losses, with major indexes closing down but less severely.

US services PMI on Wednesday (March 4) showed the fastest expansion since mid-2022, supporting gains; however, the Nasdaq rose only slightly, with gains capped by lingering oil price worries.

Markets plunged on Thursday (March 5) after an Iranian missile strike on an oil tanker in the Persian Gulf intensified concerns of conflict longevity and supply constraints. The price of oil surged to its biggest weekly gain since 2022, with analysts forecasting further increases if the Strait of Hormuz stays disrupted beyond 3 - 4 weeks.

Also on Thursday, reports surfaced that the administration was considering new rules requiring US approval for AI chips shipped abroad, which hit Nasdaq heavyweights NVIDIA (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD). This revelation followed earlier reports that officials were considering limiting purchases of Nvidia’s H200 chips and AMD's MI325 chips, which have similar capabilities, to Chinese companies, capping them at 75,000 chips per firm.

Friday’s (March 6) jobs report for February boosted rate-cut odds but fueled recession fears. The report showed nonfarm payrolls dropped by 92,000, a stark contrast to the forecasted 50,000 to 60,000 added jobs. Additionally, unemployment increased to 4.4 percent, signaling that the labor market is cooling faster than expected.

These macroeconomic pressures and geopolitical uncertainty exerted a palpable weight on financial markets, heavily impacting volatility-sensitive tech stocks.

3 tech stocks moving markets this week

1. Intuit (NASDAQ:INTU)

Intuit had a strong week, finishing up 25.08 percent as investors rotated into defensive fintech and software amid weakness in the capital-intensive and cyclical semiconductor sector.

Zacks Investment Research explained Intuit’s stock rise as a gain driven by analyst upgrades and price target hikes. Piper Sandler raised its price target on Intuit to US$780 and maintained an Overweight rating. Susquehanna also raised its target to US$850 and kept a Positive rating. Meanwhile, TD Cowen cut its target to US$633 but reiterated Buy.

Analysts cited Intuit’s strong AI-driven results from last week’s Q2 earnings and highlighted growth in the company’s GBS Online Ecosystem, Desktop Ecosystem and Credit Karma.

2. Palantir Technologies (NASDAQ:PLTR)

Palantir gained alongside other defense stocks as Mideast tensions boosted demand for defense AI. Shares rose more than five percent on Monday, while analysts at Wedbush named it a top pick on Thursday with a US$75 price target. Palantir gained 17.22 percent for the week.

2. AppLovin (NASDAQ:APP)

AppLovin ranked third for this week’s gainers, closing 16.29 percent higher on Arete’s upgrade to neutral from sell, with an adjusted price target down to US$340 From US$458. Speculation about AppLovin potentially launching a competing app to rival TikTok may have further contributed to the gains.

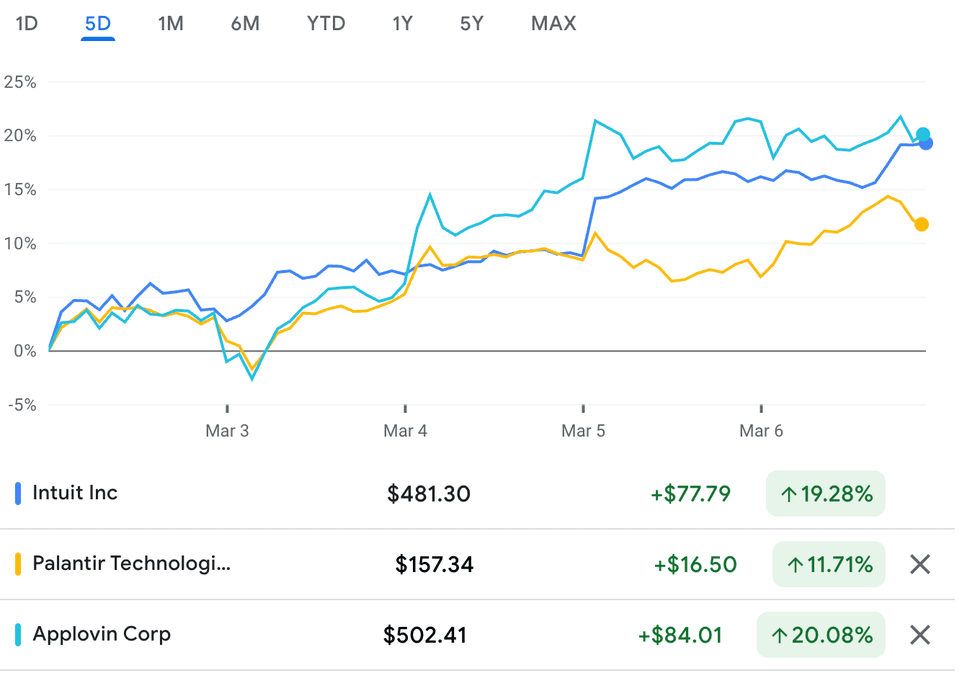

Intuit, Palantir Technologies and AppLoving stock performance, March 2 to 6, 2026.

Chart via Google Finance.

Top tech news of the week

- Broadcom (NASDAQ:AVGO) jumped on Thursday morning after reporting quarterly financial figures that were slightly above estimates, as well as strong current-quarter guidance after hours on Wednesday. The company’s revenue reached US$14.9 billion, up 34 percent YoY, with AI revenue reaching US$4.1 billion. EPS came to US$1.72, beating estimates of US$1.65. The company’s Q2 guidance forecasted revenue between US$15.25 billion and US$15.65 billion.

- Marvell Technology (NASDAQ:MRVL) rose on post-earnings momentum from its FY26 results reported Thursday. The company reported US$8.195 billion in revenue, a 42 percent gain YoY. EPS came in at US$2.84, 81 percent higher, while Q4 AI networking revenue hit US$2.2 billion amid data center strength. FY27 guidance was strong, with 30 percent overall growth and US$2.2 billion in forecasted revenue for Q1, beating estimates.

- Apple (NASDAQ:AAPL) made a string of announcements this week during its “March Madness” product reveal, unveiling low-priced devices including a US$599 iPhone 17e, equipped with the A19 chip, as well as a new US$599 MacBook Neo powered by the A18 Pro chip. Premium options were also revealed, such as the new MacBook Pro with M5 Pro and M5 Max chipsets and M5-updated MacBook Air and Pro models.

- In the prediction market space, Kalshi announced Monday it has struck a deal with Associated Press to license election data, beginning with the midterms. Also on Monday, DraftKings announced plans for a new “Super App” merging its sportsbook, iGaming, and Predictions platform; on Friday, the company detailed ESPN account linking for personalized March Madness betting. Meanwhile, a proposed rule change filed with the US Securities and Exchange Commission on Monday revealed the Nasdaq’s intention to introduce outcome-related options on the Nasdaq-100 (INDEXNASDAQ:NDX) and the Nasdaq 100 Micro Index.

- As proposals for AI data centers continue to drive a surging need for power, energy company AES said it is being taken private in a US$33.4 billion deal led by BlackRock's (NYSE:BLK) Global Infrastructure Partners and EQT Partners, marking the second-largest private equity-backed power deal ever recorded.

- Shares of Lumentum Holdings and Coherent jumped on Monday after NVIDIA said it would invest US$2 billion in each company to accelerate the development of advanced optics and laser technologies for AI data centers.

- At this week’s Morgan Stanley (NYSE:MS) tech conference, Nvidia CEO Jensen Huang confirmed that his companys US$30 billion investment in OpenAI is “likely its last major commitment there” and that the original US$100 billion pledged in September 2025 is “not in the cards” due to OpenAI's impending IPO.

- OpenAI has launched GPT-5.4, an AI model targeting the enterprise market. The release includes advanced reasoning capabilities and the ability to autonomously operate computers, alongside new integrations like ChatGPT for Excel and Google Sheets.

- Oracle (NYSE:ORCL) is reportedly planning to eliminate thousands of jobs, possibly as soon as this month, according to people familiar with the situation, who said the cuts would partially target roles that the company anticipates needing less of due to AI.

Tech ETF performance

Tech exchange-traded funds (ETFs) track baskets of major tech stocks, meaning their performance helps investors gauge the overall performance of the niches they cover.

This week, the iShares Semiconductor ETF (NASDAQ:SOXX) declined by 5.91 percent, while the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) lost five percent.

The VanEck Semiconductor ETF (NASDAQ:SMH) also decreased by 4.21 percent.

Tech news to watch next week

Investors face a pivotal week ahead, headlined by Monday’s (March 9) release of the NY Fed’s one-year inflation expectations and the highly anticipated February CPI report on Wednesday (March 11), which could provide a key signal for the Fed’s next move.

Later in the week, Thursday’s (March 12) jobless claims will be under the microscope to see if February’s labor trends hold steady. On the corporate side, it’s a big week for software and cloud infrastructure, with Oracle, Hewlett Packard Enterprise, and Constellation Software reporting Monday, followed by Adobe (NASDAQ:ADBE) on Thursday.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.