Silver Price Surges Past US$100, Hitting Triple-Digit Territory

The silver price hit yet another a new record, pushing past US$100 per ounce.

The silver price hit a new all-time high on Monday (January 26), rising as high as US$116.67 per ounce as gold broke US$5,000 and brought its sister metal along for the ride.

Silver is continuing a breakout that began earlier this month on a mixed bag of economic uncertainty, rising geopolitical tensions in Venezuela and Iran and underlying industrial demand strength in the face of a multi-year supply deficit.

Adding fuel to the fire last week were US President Donald Trump's comments about Greenland.

On January 17, Trump said on his social media platform Truth Social he would place tariffs on Denmark and seven other European countries until a deal was reached for the US to purchase Greenland.

The statement raised hackles in Europe, and Trump ultimately removed the tariff threat, saying the US will not use force to take control of Greenland. However, the president also said he's reached a deal framework with NATO regarding Greenland's future; details about the deal have not been released at this time.

Tensions between Trump and US Federal Reserve are also providing support for silver, which like gold acts as a safe haven in times of turmoil. On January 9, the US Department of Justice served the Fed with grand jury subpoenas, threatening a criminal indictment over Chair Jerome Powell's testimony to the Senate Banking Committee this past June.

Trump denied knowledge of the investigation, but the move has still reignited concerns about Fed independence, with Powell linking it to the Fed's refusal to lower interest rates as quickly as Trump would like.

Powell's term as Fed chair ends in May, but two years still remain on his term as a governor of the board.

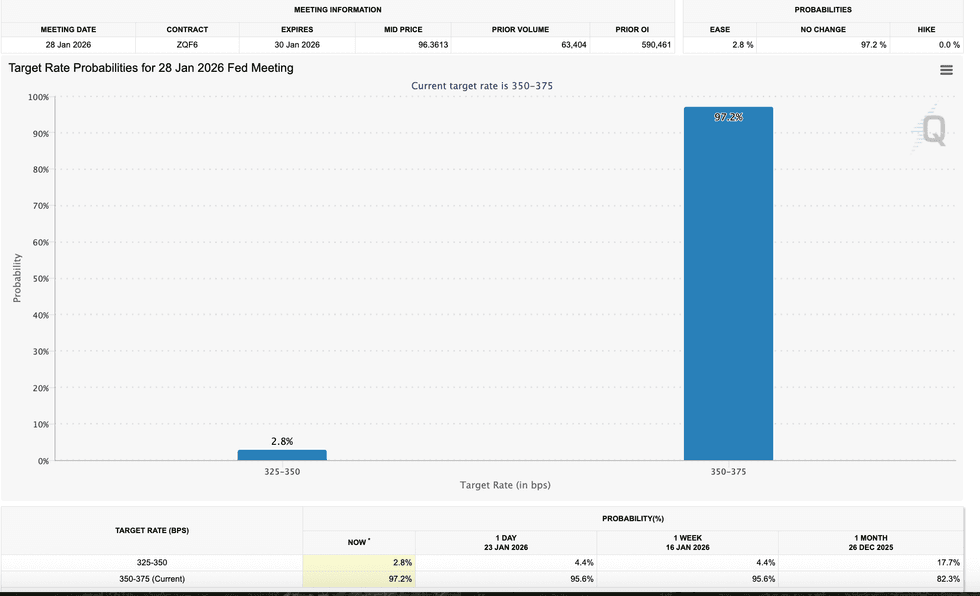

Target rate probabilities for January 2026 Fed meeting.

Chart via CME Group.

The Fed's next rate announcement is set for January 28, and CME Group's (NASDAQ:CME) FedWatch tool shows strong expectations for a hold. That's despite core consumer price index (CPI) data showing that inflation rose by a lower-than-expected 0.2 percent for December. On an annual basis, core CPI was up 2.6 percent.

Trump has frequently criticized Powell for not lowering rates quickly enough, and Powell's replacement, who has not yet been announced, is widely expected to be more in line with Trump's views.

“We see increased interference with the Fed as a key bullish wildcard for the precious metals in 2026,” Carsten Menke, head of next-generation research at Julius Baer Group, told Bloomberg. He noted that because silver is a smaller market than gold, it typically reacts “more strongly to such concerns.”

Silver price chart, January 18 to 26, 2026.

Chart via the Investing News Network.

Silver and its sister metal gold tend to fare better when rates are lower, meaning rate cut expectations coupled with the investigation of Powell and the Fed have helped to stoke prices for the precious metals.

While silver is known for lagging behind gold before outperforming, it's now ahead in terms of percentage gains — silver is up about 279 percent year-on-year, while gold has risen around 85 percent.

The yellow metal also hit a new all-time high on Friday, peaking at US$5,110.23 per ounce.

In addition to rate-related factors, silver's breakout this year has been driven by various other elements.

As a precious metal, it's influenced by many of the same factors as gold, but its October price jump, which took it past the US$50 level, was also driven by a lack of liquidity in the London market.

While that issue appears to have resolved, silver remains in a multi-year supply deficit. Tariff concerns and silver's new status as a critical mineral in the US have also provided support.

In addition to its appeal as a precious metal, silver's industrial side shouldn't be forgotten — according to the Silver Institute, the white metal's "global silver industrial demand is poised to grow further as demand from vital technology sectors accelerates over the next five years. Sectors such as solar energy, automotive electric vehicles and their infrastructure, and data centers and artificial intelligence will drive industrial demand higher through 2030."

What's next for the silver price?

The US$100 milestone is a major psychological level for silver, making it tricky to predict what's next.

Steve Penny, founder of SilverChartist.com, said he's studying the 1970s precious metals bull market to understand what could be next for silver — specifically, he sees either a 1974 moment or a 1979 moment ahead.

Penny explained that in 1974, silver went from about US$1.20 to US$6.50 in 27 months, but after that big move it experienced a blow-off intermediate top. Silver then consolidated for five years before its major 1979 run.

"I lean towards this being a 1974 moment, with some caveats. I think we're headed towards an intermediate peak here. That doesn't mean you can't go higher — (it) might go up to US$150. Not necessarily predicting that, but it's possible with this kind of momentum," he said. "But the difference between now and 1974 is I don't expect a five year consolidation period. I think it will be much shorter, limited to probably a few months, maybe a few quarters."

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.