Silver Price Update: Q2 2024 in Review

The silver price soared at the end of Q1 and broke through the US$32 mark in Q2. Learn what's driving silver's gains and what could come next.

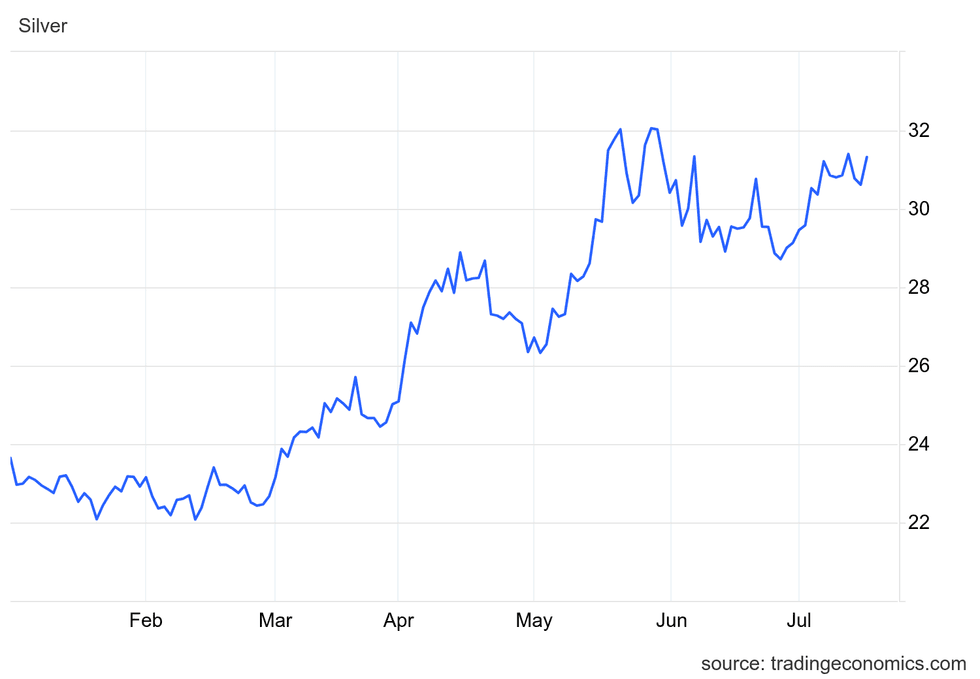

The silver price saw significant gains through the first half of 2024, hitting levels not seen in over a decade.

After starting the year trading in the US$22 per ounce range, the price of silver saw little change until March, when the white metal began to gain momentum following a US Federal Reserve meeting.

While the Fed left interest rates steady at that time, dovish language provided critical support for silver as investors pushed the price above US$25. Silver continued its upward trend through April and into May, when it climbed above US$32 for the first time since November 2012 and set a year-to-date high of US$32.07 on May 27.

Silver price breaks important US$30 level

A number of factors have been driving the price of silver upward in 2024.

Even though rate cuts from the Fed have yet to materialize, softening interest rates and slowing economic growth have led to greater speculation that at least one reduction will come in the second half of the year.

Silver was initially followed gold higher in the March to May period. However, the gains in silver have outpaced gold nearly two to one in 2024. To date, silver has risen nearly 30 percent, while gold has only gained 15 percent.

Silver price, January 1, 2024, to July 16, 2024.

Chart via Trading Economics.

The pace of these gains has led to improving sentiment among investors. As of April, managed money positions in silver had climbed to their highest level since May 2022, and exchange-traded product holdings rose to their highest since July 2023, as outlined in the Silver Institute’s 2024 World Silver Survey presentation and report.

In an email to the Investing News Network (INN), Silver Institute President and CEO Michael DiRienzo said that the close link between silver and gold has led some investors to use it as a leverage play to gain exposure to gold.

“In addition, silver’s low unit cost and lower entry level have also made it more attractive to retail investors with a limited investment budget,” DiRienzo explained.

This was a point echoed by IndependentSpeculator.com CEO Lobo Tiggre in an interview with INN that took place on July 9. He suggested that even though silver has acted more like an industrial metal over the last several years, 2024 has seen investors once again looking at it for its value as a precious metal.

“That market dynamic has changed, and it’s moving more strongly with gold again as a monetary metal should … I think it's fantastic news for silver — and long-suffering silver bulls out there,” he said.

Industrial silver demand continues climbing in India, China

Improved sentiment has coincided with heightened industrial demand, particularly in the Indian market. Overall, silver demand is projected to grow by 2 percent in 2024, with the Silver Institute forecasting that industrial demand will increase by 9 percent — photovoltaics alone are expected to see a 20 percent gain.

As mentioned, India in particular has upped its silver purchases in 2024. Its imports came to a record 2,295 metric tons of silver in February, nearly outstripping an entire month of global mine supply. Though purchases have waned as prices have risen, the first four months of the year saw India import more silver than it did for all of 2023.

DiRienzo said that while the primary silver demand in India continues to be from the production of jewelry, the precious metal has also benefited from “firmer electrical & electronics demand, thanks to the continued strength in India’s real estate market and rising investment in local infrastructure construction.”

Additionally, he noted that Indian manufacturing of solar cells received additional support as companies reduced their reliance on Chinese manufacturing and diversified their supply lines for solar panels.

India has been the biggest driver in the photovoltaics category as the country continues building up its domestic solar supply chain through efforts such as its Approved List of Models and Manufacturers, which consists wholly of domestic companies. After a pause due to supply concerns last year, the nation's government reinstated the mandate as of April 1 of this year — as a result, government-funded and subsidized solar projects in India must source their solar photovoltaic modules from one of the companies included on the list.

Even so, China remains the global leader in photovoltaics production. And with new N-Type TopCon panels — which require 50 percent more silver — set to become the industry standard, industrial demand is set to rise even further.

Last year, a flagging Chinese economy not only put base metals under pressure, but dragged on silver as well. According to DiRienzo, fiscal stimulus measures implemented by the Chinese government have provided crucial support.

“Expectations on further fiscal stimulus for the Chinese economy led to a sharp rebound in base metal prices during 2024-to-date, which has benefited silver,” he said.

New silver mine supply won't outweigh deficit

While both retail and industrial demand is growing, it’s not just demand driving prices.

Silver is also facing a severe supply crisis as a deficit that began to emerge in 2021 continues to widen, with the Silver Institute forecasting that the deficit will reach 215 million ounces by the end of 2024.

According to the Silver Institute, Mexico and Argentina had steep output declines in 2023, with production falling by 10.9 million ounces and 4.9 million ounces, respectively. The Silver Institute predicts that global production will fall further in 2024 to 823.5 million ounces due to the closure of several mines in Peru.

While it isn’t expected to eclipse these declines, new silver supply is coming online from various sources this year.

The Silver Institute forecasts an increase from Mexico this year now that Newmont’s (TSX:NGT,NYSE:NEM) Peñasquito mine is back at full operating capacity following a strike in 2023. Additionally, Endeavour Silver (TSX:EDR,NYSE:EXK) announced in April that its Terronera project was more than 50 percent complete and on schedule to begin production at the end of 2024. The mine will add 4 million ounces of silver supply to global markets annually.

The US is also increasing its silver output this year. Hecla Mining Company's (NYSE:HL) Lucky Friday mine in Idaho returned to full production in March, while the expansion at Coeur Mining’s (NYSE:CDE) Rochester silver-gold mine in Nevada entered commercial operation at the end of the first quarter. Once fully ramped up, it will be the largest domestic source of silver in the US, processing 32 million metric tons of ore per year.

Aya Gold and Silver (TSX:AYA,OTCQX:AYASF) provided an update on progress at its Zgounder mine expansion in Morocco on July 9, announcing it had made the first silver pour. The company said it remains on schedule for commercial production to begin in Q4. Once fully ramped up, the expanded mine is expected to produce 6.8 million ounces of silver per year, a significant increase from its 2023 output of 1.97 million ounces.

Despite these new and expanded mining operations bringing significant new silver supply to the market, it’s still a far cry from meeting the more than 200 million ounce deficit.

How high can the silver price rise in 2024?

While gold tends to garner more of the media attention, silver has already been a stronger performer in 2024. Since its move began this year, a variety of experts have suggested the white metal has further to go.

In an interview with INN on July 3, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, suggested that silver is at a multi-year consolidation. He thinks a run over the next few months to US$36 per ounce is a possibility.

Peter Krauth, editor of Silver Stock Investor, told INN on May 24 that silver might experience a slight pullback over the next couple of months, but would likely establish a new floor at US$30. This came to pass as silver traded in the US$29 range in June before stabilizing above US$30 through the first half of July.

“We still have the gold-to-silver ratio somewhere around 75; it's averaged about 55 or 60 over the last few decades, so just on that basis if gold were to stay put, silver has a lot higher to go,” Krauth said.

“Typically when you get the ratio running down, both metals do well, but silver continues to do even better … so look for this to be a really tremendous run over the next months and years," he added.

While this might not be good news for manufacturers that require silver and consumers who buy their products, it's positive news for existing silver investors and new market participants who are looking for opportunities for a safe-haven investment that doesn’t come with the high entry point of gold.

There are also opportunities in silver stocks, which have been undervalued in recent years — in fact, many silver stocks have already seen significant gains this year. For example, silver producer Endeavour Silver and advanced development-stage companies GR Silver Mining (TSXV:GRSL,OTCQB:GRSLF) and Defiance Silver (TSXV:DEF,OTCQX:DNCVF) have all gained more than 100 percent from the start of the year through July 9.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Affiliate Disclosure: The Investing News Network may earn commission from qualifying purchases or actions made through the links or advertisements on this page.