5 Best-performing Canadian Uranium Stocks

Guide to Uranium Mining in Canada

Investor Insight

With a focused and cost-efficient exploration strategy, North Shore Uranium is building a dual-jurisdiction uranium portfolio in two of North America’s most prolific uranium districts: Saskatchewan’s Athabasca Basin and New Mexico’s Grants Uranium District.

Overview

North Shore Uranium (TSXV:NSU) is a North America-focused uranium exploration company advancing a dual-track strategy, targeting high-impact discoveries in two of the world’s most prolific uranium jurisdictions: the eastern Athabasca Basin region in Saskatchewan, Canada, and the Grants Uranium District in New Mexico, USA. With a lean capital structure, fully permitted drill targets in Saskatchewan, and strong insider ownership, the company is well-positioned to deliver value through cost-effective exploration and resource definition in a rising uranium price environment.

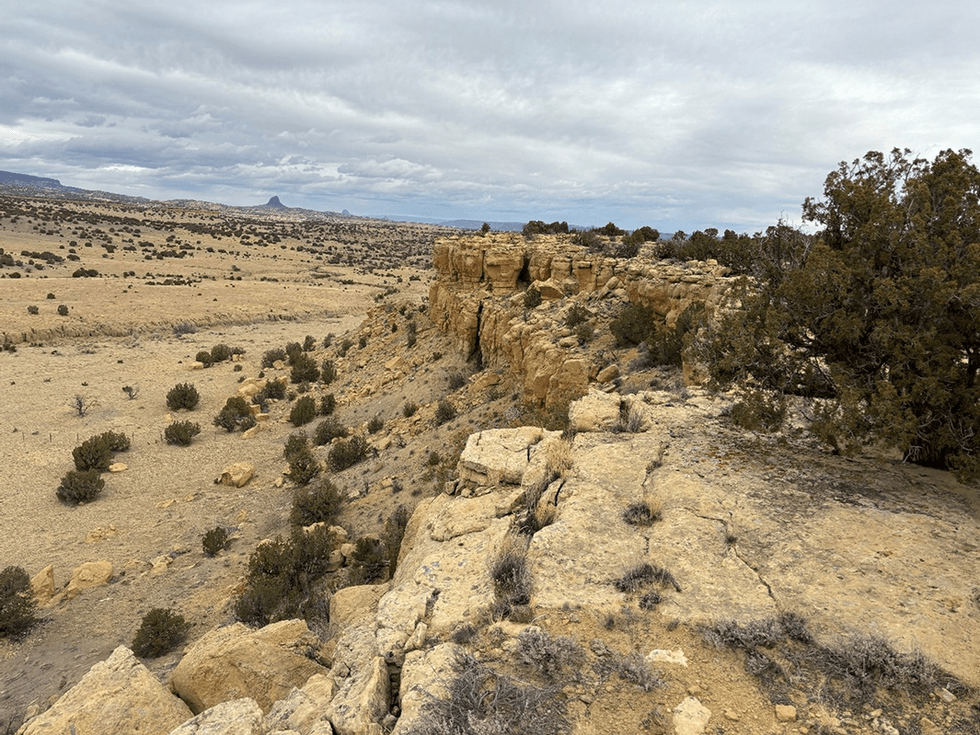

Rio Puerco project in New Mexico’s Grants District, is a historically productive uranium belt responsible for over 340 million pounds of past U3O8 production. Using data from approximately 800 historical drill holes a JORC-compliant inferred resource estimate of 11.4 million pounds U₃O₈ 1 was completed in 2009. Early evaluations suggest potential for in-situ recovery (ISR) mining – one of the lowest-cost extraction methods in the industry.

At Falcon in the Athabasca Basin, North Shore’s maiden 2024 drill program confirmed near-surface uranium mineralization in previously untested zones, highlighting the project's potential for new discoveries. The company has identified a 7-kilometre conductive corridor with high-priority drill targets named the South Priority Area, and is planning prospecting and follow-up drill programs.

Rio Puerco project area

Strategically, North Shore stands out among junior explorers by offering exposure to two of the most politically stable and uranium-endowed regions in the world.

With macro tailwinds, including spot uranium prices surpassing US$100/lb in 2024 and recent US policies aiming to triple nuclear energy capacity by 2050, the company is positioned to benefit from growing demand and supportive permitting regimes in both Canada and the United States.

Get access to more exclusive Uranium Investing Stock profiles here