Goldman Sachs Wary Despite Positive Gold Price Action

The firm still believes the gold price could fall to $1,000 per ounce in the next 12 months.

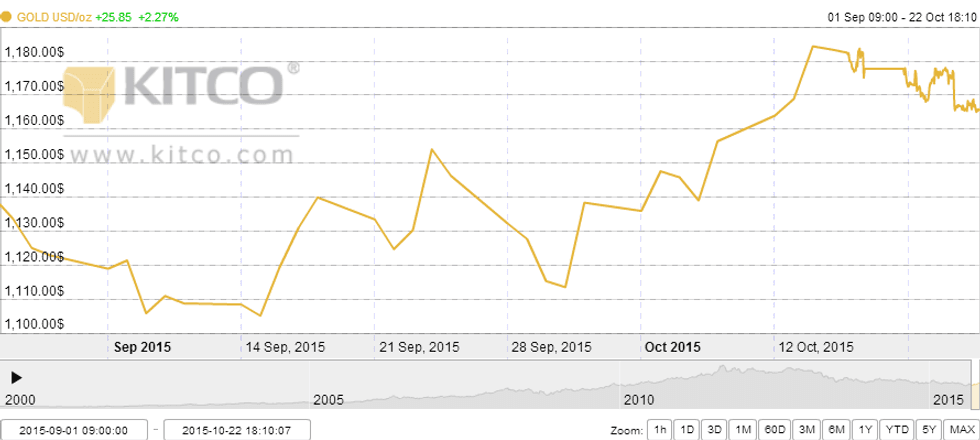

The gold price has fared well the last couple of months. At close of day Thursday, it was trading at $1,165.70 per ounce, up 2.27 percent since the start of September and up 4.68 percent since the beginning of October.

It’s the US Federal Reserve that is largely responsible for gold’s positive price action. The yellow metal’s price spiked on September 17 after the central bank announced after a two-day meeting that it would not be raising interest rates. Its good performance has continued since then — it was buoyed by a weak US jobs report on October 2, and remained strong after the release of minutes from September’s Fed meeting.

This gold price chart from Kitco illustrates those movements nicely:

Of course, savvy investors aren’t taking gold’s current positive price action for granted. As CNBC recently pointed out, while it’s now looking like the Fed won’t raise interest rates until 2016, an increase is definitely still in the cards. And when it comes, the gold price could be negatively affected.

One firm that believes that will be the case is Goldman Sachs (NYSE:GS). According to CNBC, it said in a note that while the gold price has performed well recently due to expectations that the Fed won’t hike interest rates in 2015 and higher “Chinese official sector physical gold purchases” in Q3, those factors can’t be relied upon moving forward.

“Our base case remains for higher U.S. real rates and lower gold prices, albeit with there being risks that the gold price weakness is pushed out further should the Fed surprise us and remain on hold in December,” said the firm. It sees the gold price perhaps falling to $1,000 in the next year.

Comments from one firm, even if it is Goldman Sachs, are by no means a guarantee of what will happen, but gold-focused investors might do well to keep those words in mind moving forward. Key dates to watch in the near future are October 27 and 28, when the Fed’s next two-day meeting will take place. The central bank may provide more insight on interest rates at that time.

Miners making headlines

True Gold Mining (TSXV:TGM) made headlines Tuesday with the announcement that it’s started mining at the Goulagou II deposit at its Burkina Faso-based Karma gold mine. The deposit is one of six that will be mined over a period of 11.5 years, and is expected to produce about 120,000 ounces of gold a year in its first five years of production.

Also on Tuesday, Osisko Gold Royalties (TSX:OR) said that it’s entered into an agreement to acquire a portfolio of Canadian royalties held by Teck Resources (TSX:TCK.B,NYSE:TCK) for C$28 million, plus a further C$2.5 million to be paid at a later date. The portfolio includes 31 royalties, most of which are net smelter royalties.

On Wednesday, McEwen Mining (TSX:MUX,NYSE:MUX) released a feasibility study for its Nevada-based Gold Bar project. Initial capex stands at $60 million, and average yearly gold output is pegged at 65,000 ounces at a cash cost of $728 per ounce. Gold Bar’s after-tax IRR stands at 20 percent at a gold price of $1,150, and it has a payback period of three years at that same gold price.

Juniors bring out drills

Monday saw Pilot Gold (TSX:PLG) put out results from a 21-hole diamond drill program at its Turkey-based TV Tower project. Work was focused on the Valley and Hilltop porphyry systems, and according to the company it was able to more than double the mineralized footprint at Hilltop.

Matt Lennox-King, president and CEO of Pilot Gold, said, “[t]hese results continue to show the Hilltop and Valley porphyries as potential satellites to our 40% owned Halilaga copper-gold project, 15 kilometres to the east, with the potential to grow into a stand-alone project.”

Wednesday, Serabi Gold (TSX:SBI,LSE:SRB) announced initial results from surface drilling at its Brazil-based Sao Chico gold mine. A 35-hole drill program across 5,000 meters has been taking place since April, targeting the Sao Chico Main vein, plus some infill drilling.

CEO Mike Hodgson said in this week’s release that moving forward the focus will be on more infill drilling rather than step-out drilling. “The Company has therefore taken the view that with this change in priority, the planned resource update be deferred until 2016,” he said.

Finally, on Thursday Calibre Mining (TSXV:CXB) and Centerra Gold (TSX:CG) said that they’ve started a 2015 drill program at Borosi concessions, located at the La Luz gold-silver project in Northeast Nicaragua. Centerra has the option to earn a 70-percent stake in the project by investing $7 million in exploration there by December 31, 2019.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Calibre Mining is a client of the Investing News Network. This article is not paid-for content.