Gold Outlook 2016: Analysts Calling for Sub-$1,000 Gold

The US dollar is expected to continue pressuring the gold price in 2016, and many firms are now calling for the metal to fall below $1,000.

At the end of last year, gold market watchers were feeling fairly optimistic about the metal’s prospects. While analysts were calling for a weak start to the year, the expectation was that the gold price would gain momentum later in 2015.

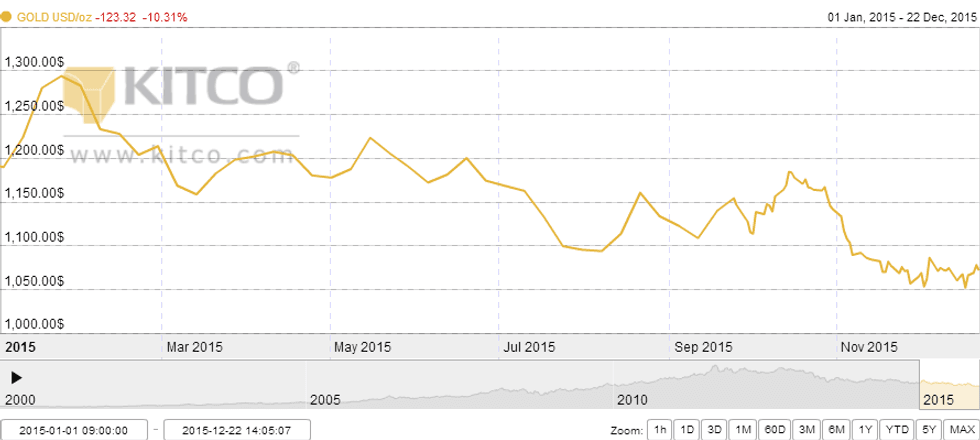

Unfortunately, that’s not exactly what happened. While gold began the year just below the $1,300-per-ounce mark, it’s taken quite a tumble since then — as of midway through December, it was down over 10 percent year-to-date, trading at about $1,065.

Take a look at the below chart from Kitco for an overview of gold’s price activity in 2015:

To find out what moved the gold price in 2015, and to get an idea of the gold outlook for 2016, the Investing News Network (INN) reached out to Martin Murenbeeld, chief economist at Dundee Economics. Here’s what he had to say.

2015 gold themes: US dollar in focus

Anyone who put even a toe into the gold space in 2015 is no doubt aware that the US dollar had a major impact on the gold price. Indeed, speaking to INN, Murenbeeld emphasized, “gold was damaged by strength in the US dollar — in fact, all commodities were to a greater or lesser degree.”

And indeed, the US dollar was undeniably strong in 2015. Bloomberg notes in a recent article that Intercontinental Exchange’s US dollar index, which tracks the currency against six of its key peers, reached its highest level since April 2003 on December 2; in the three months leading up to that date, the index gained 4.5 percent.

That strength was harmful for gold and other commodities in large part because it boosted expectations of an interest rate hike from the US Federal Reserve. The threat of an interest rate rise was particularly damaging for gold because gold earns no interest, and thus tends to fare better when interest rates are lower; conversely, when interest rates are higher, it becomes less desirable as an investment.

Ultimately, the Fed did opt to raise interest rates, though it did so much later than expected, at its last meeting of the year. Specifically, the central bank bumped the target range of the federal funds rate to 0.25 to 0.5 percent, hinting that further increases would be gradual.

The gold price didn’t initially react much to that news, but the day after its release it was struggling, with COMEX gold futures for February hitting a six-year low of $1,049.60. Since then, however, it’s bounced back a little. On the flip side, the US dollar has suffered since the rate hike took place — according to Bloomberg, as of December 21 it was down about 2 percent in December.

Aside from the US dollar, there were few events that had a major impact on the gold price in 2015. One other worth mentioning, said Murenbeeld, is China’s yuan devaluation this past August. It caused a “brief flurry in the gold price,” but nothing lasting.

Overall, Murenbeeld said that Dundee Economics sees the gold price averaging $1,165 in 2015.

Gold outlook 2016: Is the Fed for real?

Heading into 2016, Murenbeeld sees more difficulties coming for gold, largely because — despite its weakness in the wake of the rate hike — “the dollar is widely expected remain firm/rise further.” As a recent Kitco article points out, a key question for gold investors in 2016 will be “how much further will the US dollar rise?”

That said, the US dollar isn’t the only factor with the power to impact gold in 2016. Murenbeeld also noted that positive catalysts for the metal could include “further equity market setbacks, global economic deterioration, more QE abroad and no further hikes in US rates after December 2015.”

That last point seems to be one that market watchers are honing in on. As mentioned, the central bank indicated at its latest meeting that it plans to pursue a gradual increase in rates, but there has been some uncertainty about whether that will actually happen. Notably, famed economist Marc Faber recently criticized the Fed for raising interest rates, stating that “the global economy is probably already in recession now” and opining that “[w]hen the Fed realizes the economy is in recession, they will cut [interest rates] again.”

All in all, it seems that, as was the case in 2015, the US dollar and the Fed will be key factors for gold investors to watch in the new year.

In terms of specific gold price forecasts, Dundee Economics sees gold at a baseline price of $1,170 in 2016, while Morgan Stanley’s (NYSE:MS) baseline price is $1,149 (Morgan Stanley is calling for $1,382 in a bullish scenario and $976 in a bearish scenario). HSBC (NYSE:HSBC) is calling for gold to average $1,205 next year.

That said, other firms are not so optimistic. For instance, Scotiabank anticipates gold averaging $1,090 in 2016, while Citi Research said in a recent report that it sees gold averaging $1,030 in Q1, then declining gradually to an average of just $960 in Q4. Similarly, Societe Generale (EPA:GLE) sees gold at $955 in the fourth quarter of 2016, while Barnabas Gan, the most accurate gold forecaster in Q3 2015, according to Bloomberg, sees gold perhaps dropping to $950 by the end of 2016. The Bank of America Merrill Lynch anticipates a gold price of $950 early in 2016.

Other big-name firms calling for a lower gold price in 2016 include Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM), which both see the metal “fall[ing] to the psychologically important $1,000 US-per-ounce level — or lower — in 2016.”

Investor takeaway: Patience is (still) a virtue

While there may be some relief for the gold price in 2016, it’s definitely possible that the year will be equally as tough as the last few. And while investors may be getting tired of hearing it, a key point to remember in tough times like this is that the resource markets are cyclical, meaning that what goes down must (eventually) come back up. Gold bugs will no doubt be waiting to see if 2016 is the year that happens.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Related reading:

Gold Outlook 2014: Will Gold Bounce Back?

Gold Outlook 2015: Analysts Anticipate a Break from Turmoil

Gold Trends 2015: CEOs Recap the Year