Investor Insights

Aurum Resources offers a compelling value proposition through its highly prospective gold assets in Côte d'Ivoire, a fast-emerging gold region in West Africa. Its cost-effective exploration strategy of drill rig ownership also distinguishes it from its peers.

Overview

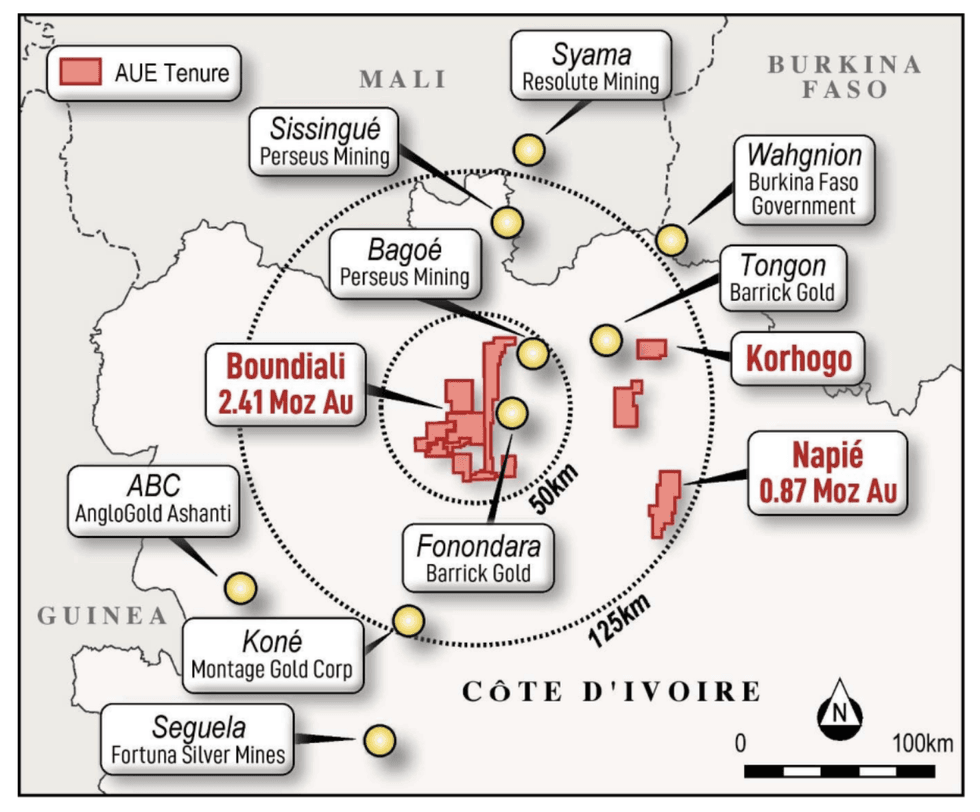

Aurum Resources (ASX:AUE) is a mineral exploration company primarily focused on gold through its Boundiali and Napié gold projects in Côte d’Ivoire, West Africa.

Côte d'Ivoire's gold mining sector is experiencing significant growth and development, with several key projects contributing to the country's economic expansion. The overall gold mining sector in Côte d'Ivoire is supported by substantial investments in infrastructure and exploration.

Geopolitically, Côte d'Ivoire outperforms most developing countries in the world in political, legal, tax and operational risk metrics. Additionally, Côte d'Ivoire continues to make notable strides in its political stability and Absence of Violence and Terrorism Index.

Boundiali Gold Project – BD Target 1 Artisanal Working

In March 2025, Aurum completed the acquisition of 100 percent of Mako Gold, bringing together its strong balance sheet and industry-leading drilling efficiencies to accelerate resource growth across northern Côte d’Ivoire. The company now holds a 90 percent interest in the highly prospective Napié Project, a 224 sq km land package with a 30 km strike near Korhogo.

Aurum has delivered a major milestone in 2025 with a +50 percent increase in the JORC Mineral Resource Estimate at its Boundiali Gold Project in Côte d’Ivoire, adding 820koz for a total of 2.41Moz. This lifts the company’s group resources to 3.28Moz, including Napié, highlighting the scale and growth potential of Aurum’s portfolio.

Supported by a seasoned board and management team with deep gold sector expertise—and strengthened by its recent capital raising—Aurum is well-funded to expand resources and advance development plans that drive long-term shareholder value.

Company Highlights

- 3.28Moz and Growing in Côte d’Ivoire: Two cornerstone gold projects — Boundiali (2.41Moz) and Napié (0.87Moz) — positioned for rapid growth with multiple resource updates and development milestones in 2025–2026.

- Outstanding Metallurgy = Simple, Profitable Processing: Boundiali delivers free milling ore with 95 percent recoveries and a straightforward flowsheet, while Napié achieves +94 percent recoveries in tests, showcasing strong economics and low technical risk.

- Aggressive, Cost-Effective Growth Strategy: In-house drill fleet drives efficiency and scale: 100,000m at Boundiali and 30,000m at Napié planned in 2025.

- Premier Mining Jurisdiction: Located in Côte d’Ivoire’s prolific Birimian Greenstone Belt, backed by a stable, supportive government and excellent infrastructure—creating the right conditions for mine development success.

- Strategic Placement: Aurum has completed a AU$35.6 million private placement of 100 million shares at AU$0.356 per share. Key participants in the placement included:

- Lundin Family and Associates, with an AU$11.71 million cash investment, securing a 9.9 percent post-placement interest.

- Zhaojin Capital (subsidiary of Zhaojin Mining), with an AU$8.19 million cash investment, increasing its holding to 8.5 percent.

- Montage Gold with 2.9 million shares, resulting in a 9.9 percent post-placement interest.

- Leadership with a Proven Track Record: A seasoned management team with a history of value creation, supported by committed shareholders who back the company’s long-term growth vision.

Key Projects

Boundali Gold Project

The Boundiali gold project in Cote d’Ivoire is located within the Boundiali Greenstone Belt, which hosts Resolute’s Syama gold operation (11.5 Moz) and the Tabakoroni deposit (1 Moz) in Mali. Neighbouring assets also include Barrick’s Tongon mine (5 Moz) and Montage Gold’s Kone project (4.5 Moz).

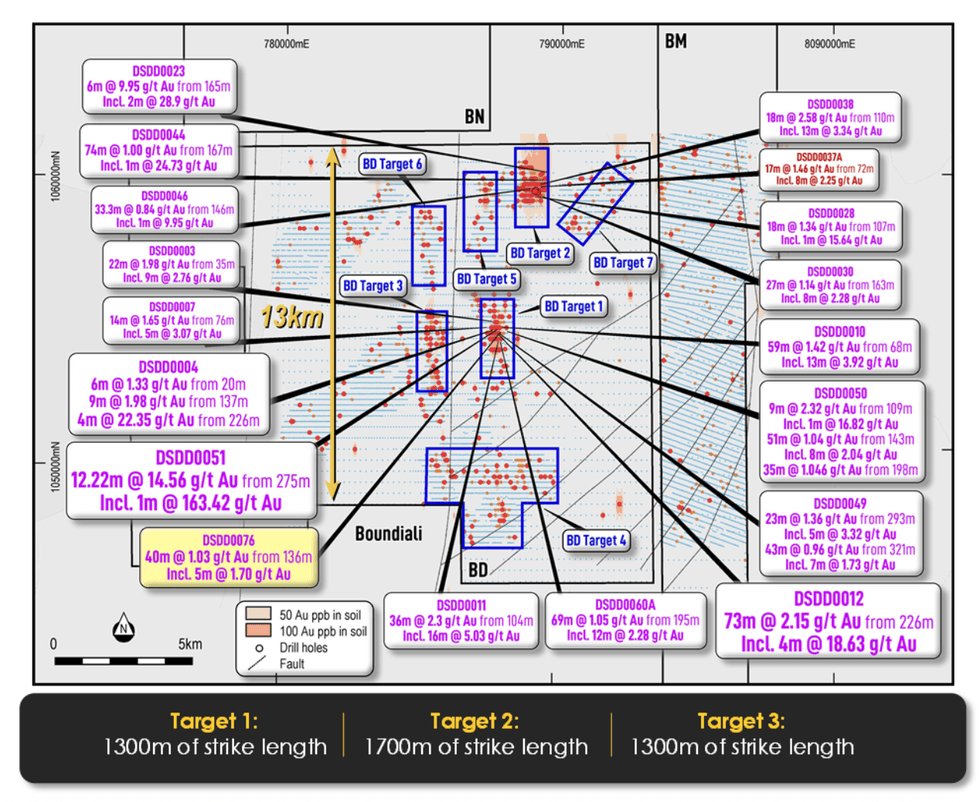

The Boundiali project area covers the underexplored southern extension of the Boundiali belt, where a highly deformed synclinal greenstone horizon traverses finer-grained basin sediments, and to the west, Tarkwaian clastic rocks lie in contact with a granitic margin. The project benefits from year-round road access and excellent infrastructure.

The first stage of drilling at Boundiali occurred from late October 2023 to end of November 2024 for both the BM and BD tenements (BM1 and BM2; BD1, BD2 and BD3 targets) and was designed to test below-gold-in-soil anomalies oriented along NE trending structures, define new gold prospects and define maiden JORC resources. With over 63,000m diamond holes drilled during this period, Maiden JORC gold resources estimate was delivered in late December 2024.

Drilling costs are estimated at US$45 per metre, as Aurum owns all of its eight drilling rigs and employs its operators, representing a significant value proposition relative to peers who use commercial drilling companies that charge upwards of $200 per meter. The company believes there is potential for multi-million ounce gold resources to be defined with hundreds thousands meters of drilling over years within the Boundiali Gold Project’s land holding areas.

The Boundiali gold project comprises four contiguous granted licenses: PR0808 (80 percent interest), PR0893 (80 percent and earning to 88 percent interest), PR414 (100 percent interest), and PR283 (earning to 70 percent interest). Historic exploration at PR0893 includes 93 AC drill holes and four RC holes. Airborne geophysical surveying, geological mapping and extensive soil sampling have also been performed at PR0893, while PR0808 has had 91 RC holes drilled for 6,229 metres along with geochemical analysis and modeling. Detailed geochemical sampling and drilling at PR414 revealed three strong gold anomalies and returned impressive high-grade results.

In May 2024, Aurum entered a strategic partnership agreement to earn up to a 70 percent interest in exploration tenement PR283, to be renamed Boundiali North (BN). Aurum, through subsidiary Plusor Global Pty Ltd, has partnered with Ivorian company Geb & Nut Resources Sarl and related party (GNRR) to explore and develop the Boundiali North (BN) tenement which covers 208.87sq km immediately north of Aurum’s BD tenement. Further to this agreement,

Aurum announced it has earned 80 percent project interest after completing more than 20,000 m of diamond core drilling.

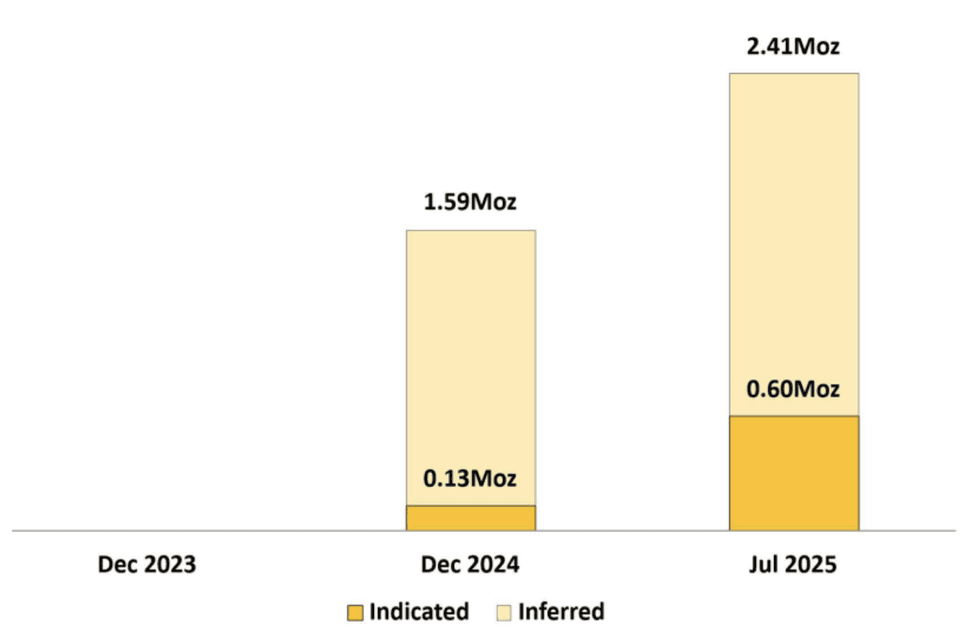

Boundiali Project JORC Mineral Resource Estimate

Aurum has announced a maiden independent JORC mineral resource estimate of 1.59 Moz gold for its 1,037 sq. km. The Boundiali Gold Project comprises the BST, BDT1 & BDT2, BMT1 and BMT3 deposits. Drilling is ongoing on these deposits, and Aurum has identified other prospects at Boundiali which have yet to be drilled. Since October 2023, the company has completed an extensive 63,927-metre diamond drilling program. This aggressive exploration campaign has rapidly defined a significant gold resource of 50.9 Mt @ 1.0 g/t gold for 1.6 million ounces.

In August 2025, Aurum announced a 50 percent increase in the JORC Mineral Resource Estimate (MRE). The update adds 820koz, lifting Boundiali’s resource to 2.41Moz and boosting total group resources to 3.28Moz, including Napié. The 2025 MRE covers six deposits, including BST1, BDT1, BDT2, BDT3, BMT1, and BMT3, with drilling ongoing and additional untested targets offering strong growth potential.

Aurum is working towards completing an open pit PFS for the Boundiali Gold Project by the end of 2025. This will provide an evaluation of the project's economics and technical feasibility.

Napié Gold Project

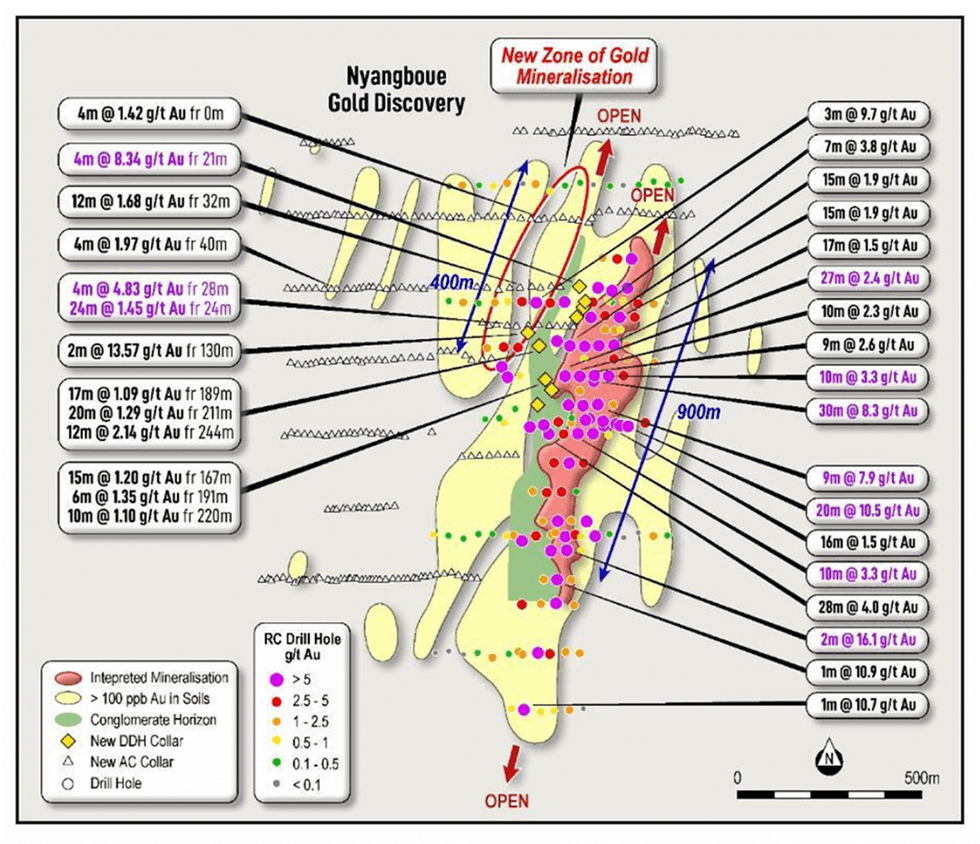

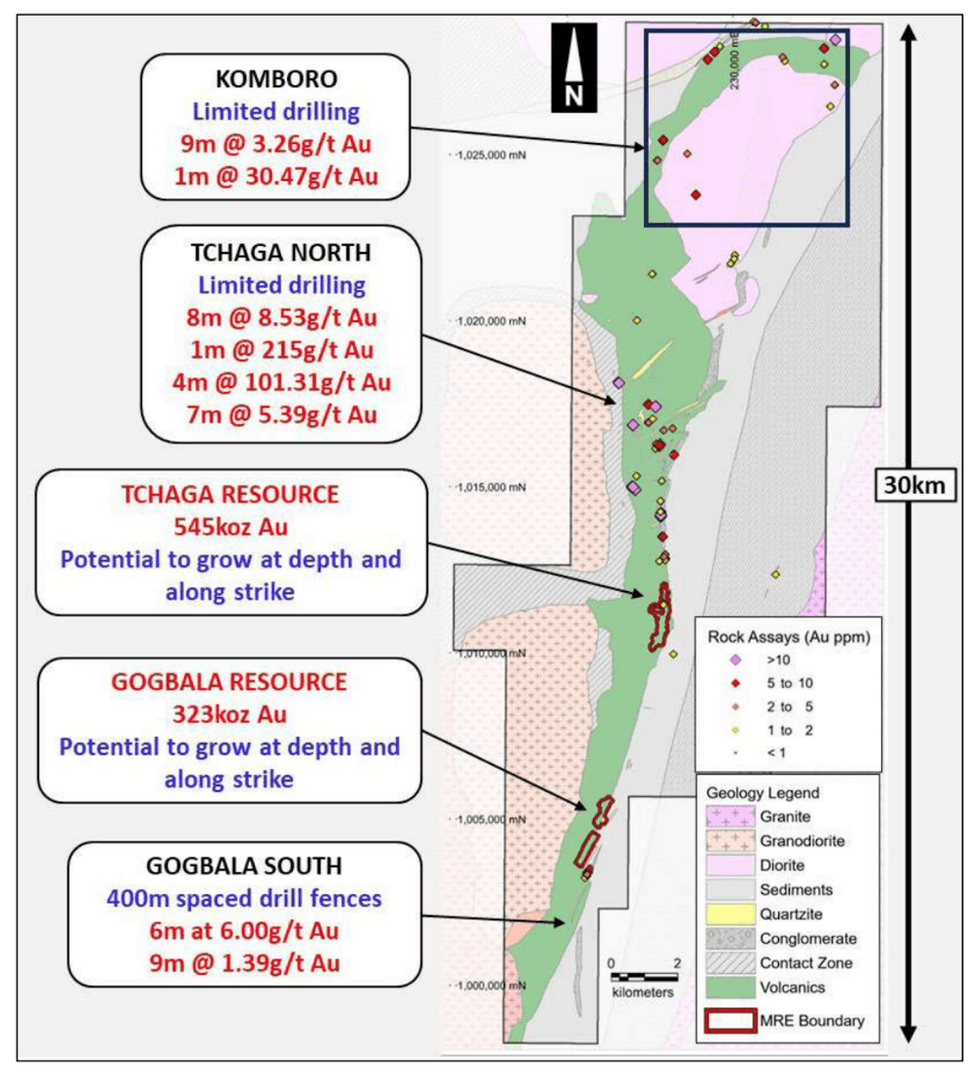

Aurum holds a 90 percent interest in the Napié Project in north-central Côte d’Ivoire, acquired through its takeover of Mako Gold. Located approximately 30 km southeast of Korhogo, the project covers a 224 sq km land package with a 30 km strike length along the highly prospective Napié Shear Zone.

As of June 2022, Napié hosts a JORC 2012 Mineral Resource Estimate of 868,000 ounces of gold (22.5 Mt at 1.20 g/t Au), based on the Tchaga and Gogbala deposits—two of four known prospects along the shear. To date, only 13 percent of the Napié Shear has been explored, leaving substantial potential for further discoveries.

Napié Project – Previous results with detailed mapping area on Komboro Prospect shown in black rectangle

Project Highlights:

- Gold Resource: Shallow open pit 0.87Moz JORC Resource at 1.20g/t Au, with mineralisation open along strike and at depth. Maximum resource depth between 160 m – 195m across the two deposits

- Exploration Upside: Less than 13 percent of the 30 km Napié Shear has been explored, offering significant potential for resource growth.

- Drilling Commenced in June 2025: 30,000 m of diamond drilling has commenced to expand the project's resource.

- Preliminary Recovery Test Work: Returned more than 94 percent average gold recoveries.

- Resource Growth Target: First MRE update planned end of 2025, to significantly expand the resource base.

- Infrastructure: Excellent access to hydroelectricity, roads, and water, supporting future development.

Management Team

Troy Flannery – Non-executive Chairman

Troy Flannery has more than 25 years’ experience in the mining industry, including nine years in corporate and 17 years in senior mining engineering and project development roles. He has a degree in mining engineering, masters in finance, and first-class mine managers certificate of competency. Flannery has performed non-executive director roles with numerous ASX listed companies and was the CEO of Abra Mining until October 2021. He has worked at numerous mining companies, mining consultancy and contractors, including BHP, Newcrest, Xstrata, St Barbara Mines and AMC Consultants.

Dr. Caigen Wang – Managing Director

Dr. Caigen Wang founded Tietto Minerals (ASX:TIE), where he led the company as managing director for 13 years through private exploration, ASX listing, gold resource definition, project study and mine building to become one of Africa’s newest gold producers at its Abujar gold mine in Côte d’Ivoire. He holds a bachelor, masters and PhD in mining engineering. He is a fellow of AusIMM and a chartered professional engineer of Institution of Engineer, Australia. Wang has 13 years of mining academic experience in China University of Mining and Technology, Western Australia School of Mine and University of Alberta, and over 20 years of practical experience in mining engineering and mineral exploration in Australia, China and Africa. Other professional experience includes senior technical and management roles in mining houses, including St. Barbara, Sons of Gwalia, BHP Billiton, China Goldmines PLC and others.

Mark Strizek – Executive Director

Mark Strizek has nearly 30 years’ experience in the resource industry, having worked as a geologist on various gold, base metal and technology metal projects. He brings invaluable geological, technical and development expertise to Aurum, most recently as an executive director at Tietto Minerals’, which progressed from an IPO to gold production at the Abujar gold project in West Africa. Strizek has worked as an executive with management and board responsibilities in exploration, feasibility, finance, and development-ready assets across Australia, West Africa, Asia, and Europe.

Steve Zaninovich - Non-Executive Director

Ateve Zaninovich is a qualified engineer with over 25 years of experience in mining project development, business development, maintenance, and operational readiness, with a focus on gold, base metals, and lithium. He is currently director of operations at Kodal Minerals, where he is responsible for advancing the Bougouni Lithium Project. His previous roles include project director at Lycopodium Minerals for the Akyem Gold Project in Ghana and chief operating officer at Gryphon Minerals. Following Gryphon’s acquisition by Teranga Gold Corporation, he became vice-president of major projects and a member of Teranga’s executive management team.