What happened to gold in Q3 2017? Our gold price update outlines key market developments and explores what could happen moving forward.

The gold price gained more than 3 percent in the third quarter of the year, even though September was one of its worst months of the year.

A weaker US dollar and geopolitical tensions between the US and North Korea supported gold over the quarter. Gains were offset by the US Federal Reserve’s hawkish tone — at its last meeting, the Fed pointed to another interest rate hike later this year and three more in 2018.

Despite those factors, many market watchers believe the gold price will continue to rise in 2017, supported by further geopolitical tensions and a softer dollar. Read on for an overview of the factors that impacted the gold market in Q3, plus a look at what investors should watch out for in the last few months of the year.

Gold price update: Q3 overview

In the third quarter, the gold price rose 3.08 percent, boosting its gains for the year to almost 11 percent. As the chart below from Kitco shows, the metal trended upward during the period, reaching its highest point of the year early in September.

Chart via Kitco.

Gold hit its lowest point of the quarter on July 7, when it fell to $1,212.20 per ounce. Investors awaited more signals from the Fed, while other central banks hinted at tighter monetary policy going forward.

The metal rebounded from its lowest point and broke the $1,300 mark in August, as geopolitical tensions between North Korea and the US escalated rapidly. Gold reached its quarterly peak on September 7, when it touched a one-year high of $1,348.60.

Gold price update: Factors to watch

As the last quarter of the year begins, investors interested in the gold market should pay attention to a number of factors that could have a short-term impact on the precious metal’s price.

Most analysts agree that geopolitical developments will continue to be a key driver for the gold price for the rest of the year.

“I don’t think the North Korea story is going to go away anytime soon. I think that is a very real and dangerous issue that will be resolved at some point this year,” said Gold Newsletter Editor Brien Lundin. “Any resolution that doesn’t involve China is terrible to contemplate, and will have tremendous implications not only for the markets, but for the welfare of many thousands of individuals,” he added.

Similarly, Nitesh Shah, commodities strategist at ETF Securities, said that tensions between North Korea and US will be one of the key catalysts for gold in the next few months.

Other geopolitical developments that could create uncertainty in the market include the outcome of the recent Kurdistan referendum and the possibility of further US sanctions in Venezuela and Iran. The formation of a government in Germany could also lead to uncertainty, but Shah believes that won’t have a major impact on the yellow metal.

Meanwhile, Resource Maven Gwen Preston commented that gold’s fundamentals are very strong because there is “incredible uncertainty around the world, starting with [US President] Donald Trump and going to North Korea. Then continuing with all kinds of economic arguments about the strength of the US economy and the dollar.”

The Fed was another key gold price driver during Q3. The central bank has hinted at tighter monetary policy in the future, and as mentioned, it suggested at its last meeting that it will implement one more interest rate hike later this year and another three in 2018.

According to Lundin, it’s important to be cognizant of interest rate increases, but not necessarily concerned. He pointed out that gold declined in the lead up to rate hikes that took place in December 2015 and December 2016, but then rose in the new year.

He isn’t sure if gold will decline again this year as December approaches, but noted, “gold has used [these price declines] as a sprint for a considerable rally going into the new year, which I think we may see again this year.”

Shah said that it is real interest rates that will give investors an idea of where the gold price may be heading in the last quarter. “It is important to understand how real interest rates are developing, which are the ones that really matter for gold prices,” he said. He expects increasing inflation to bring down real interest rates. That means “despite nominal interest rates increasing, the environment will not be all that negative for gold prices.”

In addition, it will be important to watch for the workings of other central banks worldwide. “The extent to which the European Central Bank, the Bank of Japan and others start or continue with their easing programs or not will also impact the demand of non-yield assets like gold,” Shah explained.

For Lundin, the future of the US dollar, which is determined by the attitude of the markets to Fed policy, is a final key issue to watch going forward. “Gold investors really need to watch monetary policy and the flow of economic data in the US,” he said.

A softer dollar could be good news for gold demand, as a weaker greenback makes commodities priced in dollars cheaper for investors using other currencies. “I think that is a long-term trend that will continue as there are doubts about the Fed’s commitment and ability to maintain its campaign of interest rate normalization,” he added

If there are any signs of a weakening dollar, that would be “extremely bullish for gold,” as it would mean the Fed will not be able to increase rates as fast as planned and will need to reverse its course.

Gold price update: What’s ahead?

According to Francisco Blanch, head of commodities research at Bank of America Merrill Lynch, the gold price is on track to climb to a four-year high of $1,400 by early next year. Lower long-term US interest rates and a lack of progress by US President Donald Trump in delivering reforms will provide support.

Not everyone agrees with that bullish forecast, however. “I think it would be hard for gold to break the $1,400-per-ounce mark at this point [this year], as the metal has given up much of its rally since July,” Lundin said. Instead, he expects gold to end the year between $1,300 and $1,325, a base that could be used as a launching pad for more gains in 2018.

Meanwhile, Shah said ETF Securities has a more bearish forecast. The firm estimates that gold will trade around $1,260 in Q4, and is calling for the gold price to reach $1,230 by the middle of 2018.

Shah explained that this outlook is based on the absence of elevated geopolitical risk. “Our price prediction is based on the Fed interest rate hike expected later this year, the unwinding of their balance sheet, a small appreciation of the US dollar and an increase in inflation,” he said.

Similarly, FocusEconomics panelists estimate that the average gold price for Q4 2017 will be $1,250. The most bullish forecast for the quarter comes from Macquarie, which is calling for a price of $1,325; meanwhile, Emirates NBD is the most bearish with a forecast of $1,180.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

This article is updated each quarter. Please scroll the top for the most recent information.

Gold Price Update: Q2 2017 in Review

By Priscila Barrera, July 13, 2017

The gold price stalled in the second quarter of the year as concerns about geopolitical tension faded away. The US Federal Reserve’s rate hike decision in June also hurt the yellow metal, as gold is highly sensitive to increasing rates.

However, gold is still up more than 8 percent year-to-date. Concerns about US President Donald Trump, future Fed interest rate hikes as well as political uncertainty outside the US were factors that drove the precious metal’s price in the first half of the year.

Many market watchers believe the gold price will continue to rise in 2017, supported by further geopolitical tension and Trump-related instability. Read on for an overview of the factors that impacted the gold market in Q2, plus a look at what investors should watch out for in the third quarter of the year.

Gold price update: Q2 overview

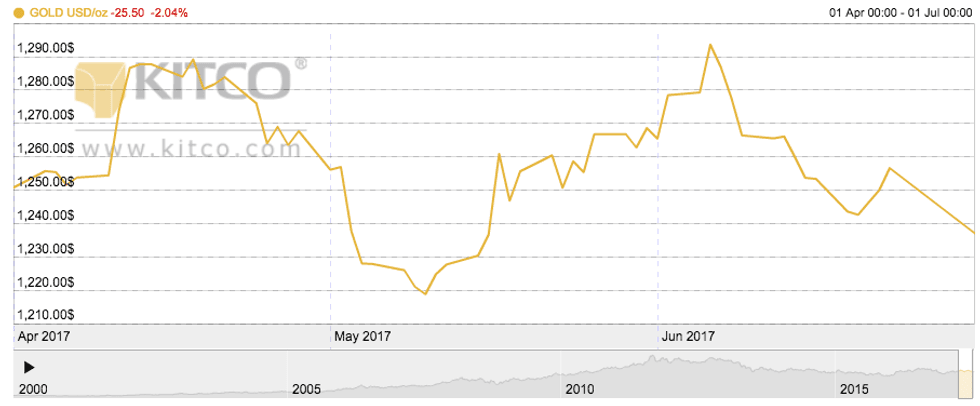

In the second quarter of the year, the gold price lost 0.4 percent; however, as mentioned, it was still up more than 8 percent for the first half of the year. As the chart below from Kitco shows, the metal put on a volatile performance in Q2, reaching its first monthly loss of the year in June.

Chart via Kitco.

Gold hit its lowest point of the quarter on May 10, when it fell to $1,218.80 per ounce after a US FOMC meeting. Investors turned to riskier assets, abandoning safe-haven metals like gold.

The metal rebounded in June, reaching a quarterly peak of $1,293.60 on June 6, its highest price in seven months. The gold price pulled back a few days after due to the Fed’s decision to hike rates, and has been on a downtrend since the end of the quarter.

Gold price update: Supply and demand

According to Thomson Reuters GFMS, physical gold demand may increase later in 2017 due to political uncertainty and tension across the globe.

“There are few indications that physical demand from Asia is set to pick up just yet. However, as the year progresses there is a growing likelihood of safehaven flows helped by either or both US and European geopolitics,” the firm says in its GFMS Gold Survey 2017.

In fact, physical demand from India, the world’s second-largest consumer, has been surging since January. The Indian government decided to demonetize the economy last November, and in the first half of 2017 the country’s gold imports came to $22.2 billion. That’s compared to $23 billion for all of last year.

In the case of China, the world’s largest consumer of gold, the most recent data shows that local consumption was up 15 percent in the first quarter, with sales of bars for investment climbing more than 60 percent and dwarfing a 1.4-percent rise in jewelry buying, according to the China Gold Association.

“People are looking at other means to invest, a safe haven to protect their renminbi because of the depreciation, so everybody starts to look for safe haven products,” said Haywood Cheung, president of the Chinese Gold and Silver Exchange Society. “So I think we’re going to have a good year.”

That said, the market is still likely to see another surplus in 2017. “We are expecting a reduction in global mine output and a gradual demand recovery globally in 2017, resulting in a smaller surplus than in 2016 but a large one nonetheless,” GFMS notes.

Gold price update: What’s ahead?

As the third quarter of the year begins, investors interested in the gold market should pay attention to a number of factors that could have a short-term impact on the precious metal’s price.

“The Federal Reserve and shifting expectations over the future of US monetary policy will be key to watch to assess gold prices,” FocusEconomics economist Oliver Reynolds commented via email.

Similarly, CRU analysts said in a note that a combination of stronger US monetary policy and growing disappointment with Trump’s “shock therapy” for the US economy are causes for concern.

Outside the US, other geopolitical factors to watch this year include Europe’s political future. Later in 2017, Germany and Austria will face two more tests by populist politicians as they head to the polls in September and October, respectively. Brexit negotiations could also bring volatility to the markets in the medium term.

“We expect gold prices to average $1,238/oz this year, a drop of 1 percent from 2016’s average,” CRU analysts said. Looking further ahead, they expect the gold price to start heading south as soon as next year, pressured by rising US interest rates.

Panelists at FocusEconomics see gold remaining broadly stable this year, averaging $1,246 in Q3. TD Economics is more bullish with a price forecast of $1,275 for the quarter, while DZ Bank is on the bearish end of the spectrum with a call for $1,200.

“Our forecasts are remarkably similar to those we made at the outset of the year, for one simple reason: the big picture of heightened global uncertainty remains unchanged,” Reynolds added.

Many other analysts also remain optimistic about gold this year. In a recent interview, Frank Holmes, CEO and chief investment officer of US Global Investors (NASDAQ:GROW), said he is bullish on gold, explaining, “investors have to recognize that gold has a seasonal pattern to it. There is a 60- to 70-percent probability of gold rising between June and January next year.”

Peter Schiff, president and CEO of Euro Pacific Capital, said that in his opinion, “there is no limit to how high gold can go, because there’s no limit to how low the [US] dollar can go.” He added, “it’s not really that the price of gold is going up, it’s [that] the value of paper currencies is going down, and you can measure that loss of value with the price of gold.”

Similarly, John Kaiser of Kaiser Research has said that gold could likely reach $2,000 in the next three years.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

This article is updated each quarter. Please scroll the top for the most recent information.

Gold Price Update: Q1 2017 in Review

By Priscila Barrera, April 17, 2017

The gold price made its eighth Q1 gain in 10 years in the first quarter of 2017, buoyed by safe-haven demand from anxious investors.

Concerns about US President Donald Trump and anticipated rate hikes from the US Federal Reserve have caused worries, as have the Brexit process and upcoming European elections. All of those combined in the first three months of the year to drive the yellow metal’s price.

Many market watchers believe the gold price will continue to rise in 2017, supported by further geopolitical tension and Trump-related instability. Read on for an overview of the factors that impacted the gold market in Q1, plus a look at what investors should watch out for in the second quarter of the year.

Gold price update: Q1 overview

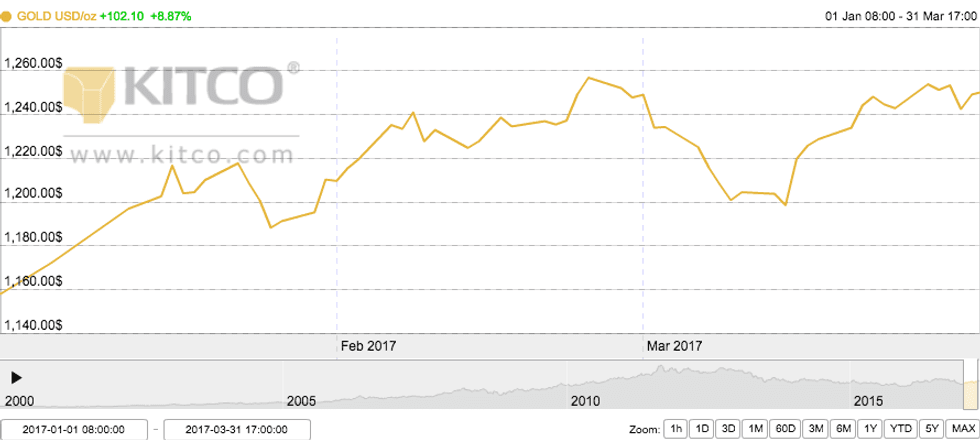

At the end of Q1, the gold price was up 8.87 percent year-to-date, its best quarterly gain in a year. As the chart below from Kitco shows, the metal has been trading in a choppy fashion since January, but climbed in the last few weeks of the quarter to reach a five-month high.

“The fear trade has driven the market so far this year,” David Govett of Marex Spectron told Reuters.

Chart via Kitco.

Gold hit its lowest point on January 26, when it sank to $1,184.62 per ounce due to US dollar strength. The metal rebounded in February, reaching a quarterly peak of $1,257.64 on February 23 prior to a Fed rate hike announcement.

The gold price slipped again in the first half of March, but has been surging since then, supported by increased geopolitical tension. At the end of Q1, the gold price was trading at $1,249.30.

Gold price update: Supply and demand

According to Thomson Reuters GFMS, world gold mine production remained almost neutral in 2016, posting an increase of only 0.4 percent. The organization is calling for a decline in 2017.

“The [2016] rise … was modest and in our view these record breaking habits are close to an end,” the firm says in its GFMS Gold Survey 2017. “The growth rate has roughly halved every year for the last three years, partly as output from new mines has slowed and we expect production to contract in 2017.”

In terms of demand, total global physical gold demand slumped 18 percent last year to reach its lowest level since 2009. The fall was mainly due to a 21-percent decline in jewelry fabrication, and it led the gold market to its biggest physical surplus of the century — 1,176 tonnes compared to just 220 tonnes in 2015.

GFMS sees physical gold demand potentially increasing later in 2017 due to political uncertainty and tension across the globe. “There are few indications that physical demand from Asia is set to pick up just yet. However, as the year progresses there is a growing likelihood of safehaven flows helped by either or both US and European geopolitics,” the report says.

That said, the market is still likely to see another surplus in 2017. “We are expecting a reduction in global mine output and a gradual demand recovery globally in 2017, resulting in a smaller surplus than in 2016 but a large one nonetheless,” GFMS notes.

Gold price update: What’s ahead?

As the second quarter of the year begins, investors interested in the gold market should pay attention to a number of factors that could have a short-term impact on the precious metal’s price.

“While the European elections, Brexit negotiations and Trump’s foreign policies could reignite safe-haven interest, gold is not without hurdles,” Standard Chartered (LSE:STAN) recently said in a note. “We believe the fragile physical market and Fed rate hikes will create a softer footing for gold prices. We maintain our view that Q2 and Q3-2017 are likely to mark the strongest quarters for gold prices this year.”

Paul Christopher, head global market strategist for Wells Fargo Investment Institute in St. Louis, also emphasized that gold may face difficulties as the year continues. He suggested that investors should “[g]et accustomed to uncertainty because of US foreign policy questions and trade questions,” as well as uncertainty over tax reform in the US.

“The market will see good days and bad days and end the year roughly where it is,” he added.

Panelists at FocusEconomics see gold remaining broadly stable this year, averaging $1,208 in Q2. RBC Capital Markets is more bullish with a price forecast of $1,300 for the quarter, while DZ Bank is on the bearish end of the spectrum with a call for $1,100. GFMS sees the metal averaging $1,259 in 2017, up slightly from $1,248 last year.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.