Here’s an overview of the main factors that impacted the copper market in Q3 2017, and what’s ahead for the rest of the year.

The copper price rose more than 9 percent in Q3, trading near the $7,000-per-tonne mark. A strong demand outlook from China, a weaker US dollar and speculation from investors boosted prices.

That said, the red metal pulled back at the end of the period as many analysts had previously warned. At the end of September, the dollar rebounded while warehouse stocks increased, putting copper under pressure.

Read on for a more detailed overview of the main factors that impacted the copper market in the third quarter of 2017, plus a brief look at what investors should watch out for in the next few months.

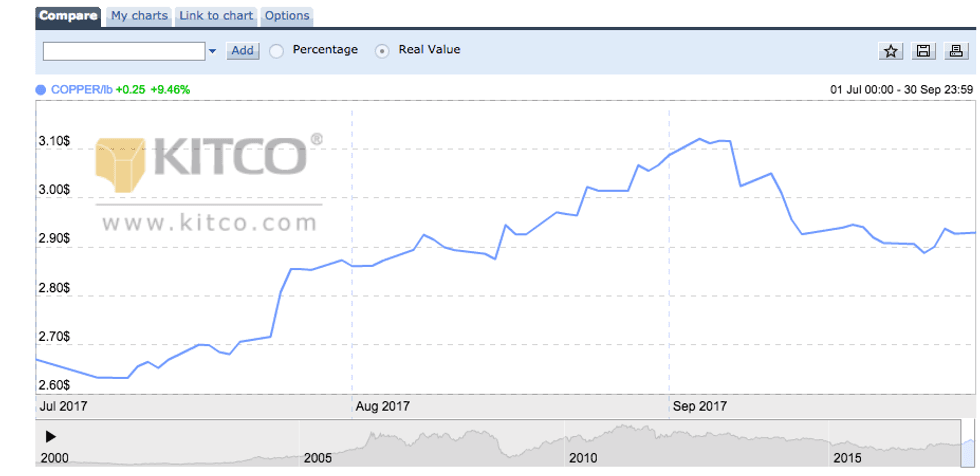

Copper price update: Q3 overview

As mentioned, copper prices trended upward in the third quarter of the year, gaining more than 9 percent to end September at $6,530. Overall, the red metal is up more than 17 percent since January.

The chart below from Kitco shows that copper reached its quarterly peak at the beginning of September, when it traded at $6,970, supported by a weaker dollar and a strong demand outlook from China.

Copper’s lowest price in Q3 came in July, when it fell to $5,780. Copper prices pulled back at the time due to a strong dollar and a surge in warehouse inventories.

Chart via Kitco.

Copper price update: Supply dynamics

In the first half of 2017, all eyes were on copper mine disruptions. Supply stoppages at the two top copper mines, BHP Billiton’s (NYSE:BHP,LSE:BLT,ASX:BHP) Escondida and Freeport-McMoRan’s (NYSE:FCX) Grasberg, are estimated to have brought global 2017 copper output down by 5 to 7 percent.

But during Q3, supply worries eased as top copper producer Chile reported higher output in July and Freeport said it would continue to export copper while negotiating a new permit with Indonesia.

It is difficult to predict whether more mine disruptions will take place this year. “The copper market is facing a 75-kilotonne deficit this year, and the potential for additional supply disruptions remains fluid,” Cormark Securities analyst Stefan Ioannou said.

Meanwhile, Karen Norton, senior analyst at Thomson Reuters GFMS, said she sees copper mine production growing this year, albeit marginally. “This, coupled with the scrap feed increase seen earlier this year, is forecast to boost refined output sufficiently to leave the market in slight surplus for 2017, with that surplus widening in 2018,” she added.

Norton also said that in the next couple of years, copper supply is seen benefiting from the startup of a number of new projects, including First Quantum Minerals’ (TSX:FM) Cobre de Panama project. Sizeable expansions at existing operations are also expected, with examples being Southern Copper’s (NYSE:SCCO) Toquepala mine and the planned restart of Glencore’s (LSE:GLEN) African operations.

But for Ioannou, many new projects will require “incentive” copper pricing above $3.25 per pound in order to be advanced. “We anticipate that medium- to longer-term copper pricing will be driven by supply fundamentals as opposed to demand considerations,” he said.

Copper price update: Demand forecast

In terms of demand, all eyes are on China, the world’s top copper consumer. “Chinese demand has slightly outpaced expectations so far this year, underpinned by a strong air conditioner market and property sector,” Norton commented.

But the property sector has shown signs of cooling due to ongoing tightening measures, which could lead to even weaker demand in 2018. “[The] general consensus is that Chinese demand growth will taper in Q4, in part reflecting anticipated property market moderation over the coming months,” Ioannou said.

Similarly, Dan Smith, head of commodities research at Oxford Economics, believes Chinese copper demand will be quite weak in the months ahead. He is more positive about medium-term demand from the Asian country.

Looking at demand from countries outside of China, Smith said some markets are becoming saturated. “What we have seen in most markets [outside of China] is a bounce back from the economic recession in 2008 to 2009, which led to abnormally strong demand. We are now coming back to the previous ceiling in terms of typical production,” he explained.

Similarly, Ioannou said that he does not see copper demand rising much in other countries, aside from infrastructure rebuild requirements following the brutal hurricane season. “[That] may take months to be reflected in actual copper demand,” he added.

For Norton, US demand has been lackluster so far this year, and she sees little sign of that changing in the final quarter, with soft physical premiums and rising COMEX stocks supporting that view.

“Looking ahead to 2017, any talk of huge infrastructure spending coming through and its potential impact on the country’s copper demand is likely to be treated with far greater caution than before,” she said.

Another factor to watch will be the US dollar, according to Smith, as a strong US dollar could put pressure on copper prices. In general, a softer greenback is good news for commodities priced in dollars, as they become cheaper for investors using other currencies. “We think the dollar will continue to weaken, which is a supporting factor for commodities in the medium term,” Smith said.

Copper price update: What’s ahead?

Looking ahead, Smith said the copper price rally will run out of steam soon due to weak Chinese demand and slowing macroeconomic indicators heading into the end of the year. “We are looking to general-to-poor performance across commodities, including copper,” he noted.

Similarly, Ioannou said the copper price spike this past summer was generally regarded as “too much too soon,” and that’s why a price pullback did not come as a surprise to him.

“However, we look to the metal’s recent establishment of a firm base at $2.90 as a positive indication regarding the metal’s ‘health,'” he said. Cormark Securities expects copper prices to average $2.75 in 2017 after averaging $2.70 during the first nine months of the year.

“We expect copper will continue to test the $3 level through Q4,” Ioannou said.

Analysts polled recently by FocusEconomics estimate that the average copper price for Q4 2017 will be $5,870. The most bullish forecast for the quarter comes from ABN AMRO (AMS:ABN), which is calling for a price of $6,674; meanwhile, Euromonitor International is the most bearish with a forecast of $4,899.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

This article is updated each quarter. Please scroll the top for the most recent information.

Copper Price Update: Q2 2017 in Review

By Priscila Barrera, July 18, 2017

The copper price stalled in the second quarter, ending the period almost neutral after being hurt by worries about global demand.

Even so, the red metal is up almost 7 percent so far this year, and did enjoy some upward momentum in Q2. Supply concerns continued during the quarter, and together with a weaker dollar they helped drive the copper price. Most experts agree that further disruptions could be coming later this year, although they could be balanced out by slowing demand from China.

Encouragingly, the copper price itself is expected to stay flat or rise. Read on for a more detailed overview of the main factors that impacted the copper market in the second quarter of 2017, plus a brief look at what investors should watch out for in the next few months.

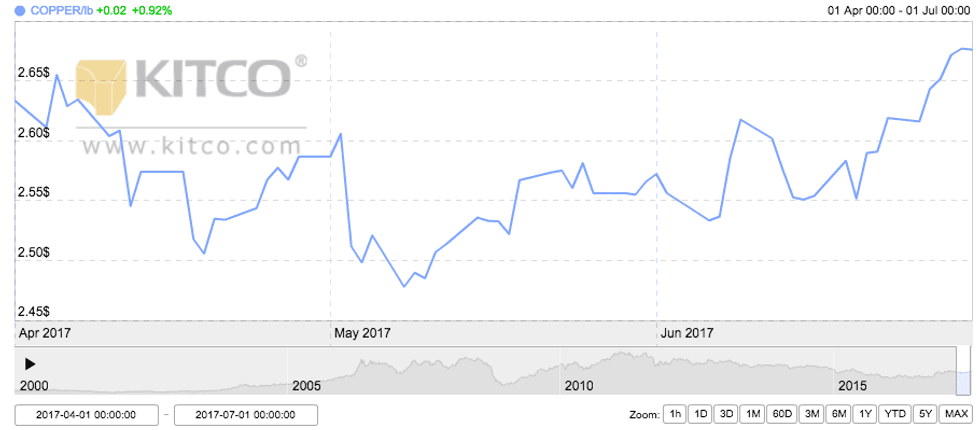

Copper price update: Q2 overview

In the second quarter of the year, the copper price performed in a choppy fashion, gaining less than 1 percent to end June at $5,908.38 per tonne.

However, as mentioned, the red metal is up almost 7 percent this year. As the chart below from Kitco shows, the copper price reached its quarterly peak at the end of June, when it traded at $5,940, supported by a weaker dollar and decreasing LME stockpiles.

Chart via Kitco.

Copper’s lowest price in Q2 came in May, when it fell below the $5,500 mark for the first time since January, trading at $5,486. The copper price was under pressure after LME copper stocks jumped by more than 30,000 tonnes and data showed a sharp drop in imports from China, the largest consumer of the metal.

Copper price update: Supply and demand

In the first three months of 2017, all eyes were on copper mine disruptions. Supply stoppages at the top two copper mines, BHP Billiton’s (NYSE:BHP,LSE:BLT,ASX:BHP) Escondida and Freeport-McMoRan’s (NYSE:FCX) Grasberg, are estimated to have brought global 2017 copper output down by 5 to 7 percent.

In May, thousands of workers at Grasberg in Indonesia decided to go on strike after Freeport laid off almost 10 percent of its workforce. In June, the union decided to extend its protests for another month.

“The strike in Indonesia cannot be ignored, but its impact appears more contained than those resulting from the disruptions seen earlier in the year,” Karen Norton, senior analyst at Thomson Reuters GFMS, said via email.

Most recently, workers at the Zaldivar copper mine in Chile voted to strike after talks with owners Antofagasta (LSE:ANTO) and Barrick Gold (TSX:ABX,NYSE:ABX) failed. Workers at Antofagasta’s Centinela mine also announced a potential strike later in the year.

FocusEconomics economist Oliver Reynolds said that the strikes at Zaldivar and Centinela mines are “small fry” compared to Escondida, since their combined output was only around 288,000 tonnes in 2016.

“The more serious implication of potential strike action in the Andean nation could be to embolden workers at other wage negotiations due to take place later this year,” Reynolds added.

Indeed, about 15 percent of annual copper production will be subject to labor negotiations in 2017, and deals will need to be made at many major mines, including Grasberg and Glencore’s (LSE:GLEN) Collahuasi.

“It would be foolhardy to rule out the possibility of further disruptions, especially with a number of major contracts up for expiry in coming months,” Norton said.

But GFMS analysts still expect global mine output to grow for the year as a whole, albeit only marginally. They also forecast that refined production will emerge “comparatively unscathed” by the earlier mine problems. “In the early months, higher prices encouraged increased scrap supply, which helped to buoy refined production despite tighter concentrate supply,” Norton explained.

In terms of demand, concerns have risen in recent weeks, spurred by surging LME inventories, which are up more than 47 percent since the end of June. But warehouse stocks have been volatile since the beginning of the year, and historical data shows that the surge in stocks could mean strong demand is coming — three similar large inflows since August were then withdrawn in the following months.

That said, some analysts are calling for weaker demand in the second half of the year, in particular from China, despite recent positive Purchasing Managers’ Index data from the country.

“After a relatively strong first half, a weakening construction industry [in China] is expected to peg back consumption growth in the second half,” Norton said. “We would expect this to weigh on prices.”

Similarly, Reynolds expects Chinese demand to ease slightly going forward as the government looks to tighten financial conditions, but is calling for it to stay “fairly robust.” He added, “the long-term picture still looks fairly healthy; the Asian giant will continue sucking in copper for infrastructure development.”

Copper price update: What’s ahead?

As the second quarter of the year begins, investors interested in the copper market should pay attention to a number of factors that could have a short-term impact on the metal’s price.

“All eyes will inevitably be on China, in particular to see how the authorities’ efforts to tighten financial conditions impact demand for metals used for housing and infrastructure,” Reynolds said.

Investors should also watch out for any further supply disruptions later in the year, in particular how wage negotiations develop later in 2017.

“Our expectation of weaker Chinese demand would help mitigate any further supply losses, although spikes in price cannot be ruled out at least as an initial reaction to any evidence of supply problems resurfacing,” Norton said.

According to the analyst, investors should keep an eye on Freeport’s relationship with the Indonesian government as well. Another factor worth monitoring is any signs of a resurgence in scrap availability.

“We are looking for a softening of prices in the second half as it becomes clear that the market is not going to be as tight as many had envisaged, and especially with a larger surplus looming in 2018,” Norton said.

Similarly, FocusEconomics Consensus Forecast panelists expect copper to drift down slightly from its current level as the situation at Grasberg Indonesia normalizes and production at Escondida recovers to pre-strike levels.

In terms of price, panelists at FocusEconomics estimate that the average copper price for Q3 2017 will be $5,677. The most bearish forecast for the quarter comes from BBVA Research, which is calling for a price of $5,093; meanwhile, DZ Bank is the most bullish with a forecast of $6,200.

“Forecasts are now significantly higher than they were in January, largely as a result of considerable unforeseen supply disruptions so far this year,” Reynolds added.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

This article is updated each quarter. Please scroll the top for the most recent information.

Copper Price Update: Q1 2017 in Review

By Priscila Barrera, March 28, 2017

The copper price surged in the final months of 2016, and in Q1 2017 it saw a modest uptick. During the period, supply concerns, as well uncertainty about Trump’s presidency, were the metal’s main price drivers.

But what’s in store for copper in Q2 2017 and beyond? By and large experts seem to be fairly upbeat about the red metal’s prospects moving forward. Most agree that further supply disruptions could be coming, and are optimistic that demand will not flag. Encouragingly, the copper price itself is expected to stay flat or rise.

Read on for a more detailed overview of the main factors that impacted the copper market in the first quarter of 2017, and a brief look at what investors should watch out for in the next few months.

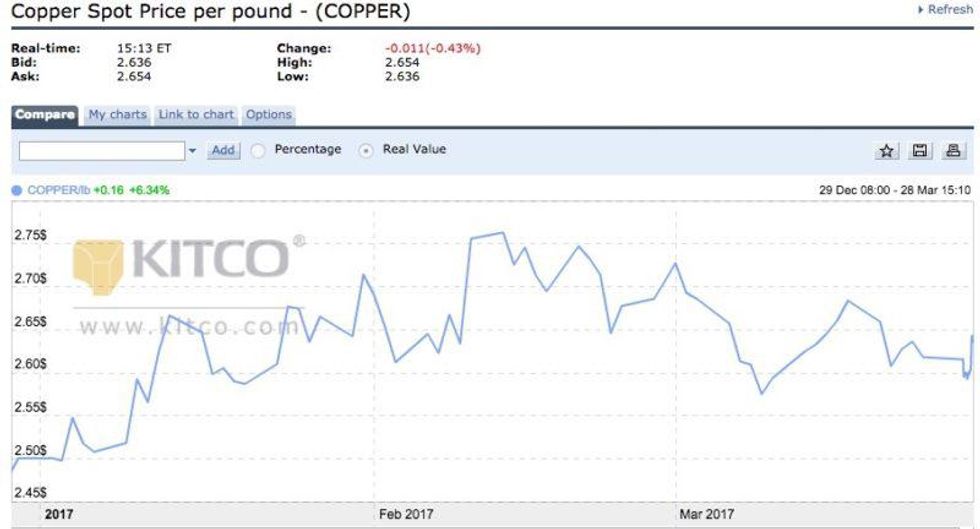

Copper price update: Q1 price overview

As mentioned, the copper price began trending upward in the second half of 2016. It has also risen in 2017, but not as strongly as some market watchers had hoped.

The red metal is up only 4 percent this year, as is outlined in the chart below from Kitco. It reached its highest point since May 2015 in February, when it traded at $6,204 per tonne. That copper price spike was supported by supply concerns caused by stoppages at major mines.

Copper’s lowest price this year came in January – during the quiet holiday period it clocked in at $5,000. Another low point this quarter was in March, before the US Federal Reserve announced an interest rate hike. At that time the metal hit a two-month low of $5,652.

Most recently, the copper price has been trading at around $5,760. Last week it took a fall after US President Donald Trump failed to push through healthcare reforms. The news fueled concerns about his ability to implement his economic policies.

“We have already started to see short-term downward corrections in copper, in line with this increased market uncertainty toward the new administration’s pro-growth policies,” Mu Li, director of base and specialty metals research at CPM Group, said via email.

“Copper prices will likely move in a choppy fashion due to mixed sentiment,” she added.

According to panelists at FocusEconomics, the average copper price forecast for Q2 2017 is $5,626. The most bearish forecast for the quarter comes from BBVA Research, which is calling for a price of $4,584; meanwhile, Standard Chartered (LSE:STAN) is the most bullish with a forecast of $6,117.

Copper price update: Supply and demand

In the first three months of 2017, all eyes were on copper mine disruption news. Chile’s Escondida, the world’s largest copper mine, faced a 43-day strike, the longest stoppage in its history, due to labor negotiations between union workers and BHP Billiton (NYSE:BHP,LSE:BLT,ASX:BHP) management.

In addition, Freeport-McMoRan’s (NYSE:FCX) Indonesia-based Grasberg mine, the second-largest copper mine in the world, stopped production for over a month due to a smelter strike and issues surrounding the renewal of the company’s mining permit.

These supply disruptions are estimated to have brought global 2017 copper output down by 5 to 7 percent. Normally such a reduction in supply would spark a price rise; however, stockpiled metal and low demand have kept the news from pushing the copper price up further.

Inventories of copper in exchange-monitored warehouses have risen more than 40 percent this year, and earlier this month hit their highest levels since 2013. Although tonnage tends to rise before Chinese demand climbs towards the middle of the year, these numbers remain high.

“We are cautious about the state of demand. Stocks of refined metal are relatively high. What’s more, we think that quarter one will represent the high point of China’s growth this year,” Caroline Bain, Capital Economics’ chief commodities economist, said via email.

Li is more optimistic about Chinese copper demand. “Rolling over to recent months … there is some healthy pickup in end-use consumption coming from China’s power infrastructure and construction sectors,” she said.

“The market looks tighter than people have previously thought, and … this improvement in fundamentals is supporting prices, if not pulling prices much higher,” she added.

Copper price update: What’s ahead?

As the second quarter of the year begins, investors interested in the copper market should pay attention to a number of factors that could have a short-term impact on the metal’s price.

Most notably, market participants should closely watch upcoming labor negotiations at copper mines around the world. About 15 percent of annual copper production will be subject to wage negotiations in 2017, and deals will need to be made at many major mines, including Grasberg and Glencore’s (LSE:GLEN) Collahuasi.

“Any additional major disruptions would send the market into a considerable deficit,” Bain said.

According to CPM Group, investors should also keep an eye on the Fed, which may hike interest rates again in June. “Running up to June the market could become very nervous and some short-term volatility in copper prices can be expected,” Li said.

Additionally, copper-focused investors will want to be aware of what Trump is doing, and in particular should watch to see whether his tax reform and infrastructure spending plans move forward. As noted, some believe that his failure to pass healthcare reforms could indicate that his other plans will face difficulties.

Trump’s defeat has “put a bit of a threat under the market in terms of all his other programs,” said David Lennox, an analyst at Fat Prophets in Sydney. As a result, “[m]arkets are fretting” over the impact on base metals demand if his plans for a spending boost on infrastructure are hampered.

Bain too noted that progress on fiscal stimulus in the US (or lack thereof) “has a powerful influence on investor sentiment.” That said, she does not believe it will make a significant difference for copper demand this year.

Lastly, investors should be aware of economic data from China, the world’s largest consumer of the base metal. According to Capital Economics, China’s economy could slow over the course of 2017, supported by a lack of additional stimulus from its government.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.