Here’s an overview of the main factors that impacted the copper market in Q2 2018, and what’s ahead for the rest of the year.

Copper has had an interesting quarter—while looking at its start and end points for Q2, the red metal has failed to regain lost ground from the very start of 2018, but during the quarter copper reached four-year highs.

Analysts are predicting that copper will fall in value through to the third quarter of the year, saying that “trade tension flare-ups“ could make value increase while lower demand weighs on sentiment overall.

Read on for more on what copper did in Q2, with a look at big news in supply and demand and a glimpse at what the future could hold.

Copper price update: Q2 overview

Like in the first three months of the year, copper trended downward over Q2, but not as dramatically overall, with the metal falling only 1.63 percent.

Copper started the quarter at US$6.755 per tonne and ended it at US$6,645— a rather bland looking journey, but a closer look reveals the metal touched a four-year high of US$7,261.5 on June 8.

The quarterly high came amidst a week between June 6 and June 15, where the base metal stayed above US$7,000 a tonne—a situation that ended as quickly as it came about as you can see in the London Metal Exchange chart below, which shows copper’s lowest point was April 4, when it touched US$6,624.

Chart via LME

The high plateau began with news of strike fears at Escondida, the world’s largest copper mine. Over the following days Ivanhoe Mines (TSX:IVN) and CITIC (HKEX:0267) became new best friends, Vedanta declared it wanted to double copper production in Africa and a number of mines in South America came closer to fruition. At the end of the quarter, Glencore (LSE:GLEN) blew US$3 billion on making Dan Gertler go away to give it some clear air to take on all its other problems.

Since copper rapidly fell back below US$7,000, it continued a downward slide over the remainder of the quarter like its other base metals cousins, and overall for the whole of 2018 it’s lost 7.45 percent of its value after starting the year at US$7,180.5.

Copper price update: Supply dynamics

Fans of stability will be big fans of 2018. GFMS Thomson Reuters base metals analyst Karen Norton told the Investing News Network (INN) that few of the dramas of 2017 have carried into 2018.

“In comparison with last year, supply news has been relatively uneventful,” said Norton.

“Developments at the Escondida mine in Chile — operated by BHP (ASX:BHP, NYSE:BLT, LSE:BBL)— have been closely monitored, with latest reports from the two camps evidently quelling fears of a repeat of last year’s 44-day strike.

“This has played some role in the retreat in copper prices from multi-year highs, although the up and down moves were largely CTA (Commodity Trading Advisor) driven against the backdrop of global trade war fears.”

She said that there “are clear signs that the copper mine project pipeline, which had virtually ground to a halt, has gathered momentum in recent months, with the revival of mines that had been firmly on the backburner.”

In this quarter, news from Anglo American (LSE:AAL) about its Quellaveco mine, and Southern Copper’s (NYSE:SCCO) Michiquillay, have brought welcome news on the supply front.

Norton said that while supply growth will be slower in the short term, long term prospects are promising.

“Our (GFMS Thomson Reuters) ten-year supply view indicates that there will be a period of slow supply growth between 2020 and 2022, but, even discounting low and medium probability projects, momentum (bearing in mind the economic cycle) is expected to pick up again with a return to long term, or close to long term, average growth rates in the ensuing years.

“Given CITIC’s recent investment in Ivanhoe Mines we feel the large Kamoa project in the Democratic Republic of the Congo is even more likely to progress and in a timely fashion. China’s need for copper and the country’s relatively long-standing working relationship with the DRC should help the company to navigate changes to the latter country’s changes mining code.”

Analysts at FocusEconomics hold similar views on supply.

“Global supply levels should remain strong as production accelerates in the world’s top producers, especially Chile, conditional on the successful resolution of potential labor disputes,” they said in their June report.

ScotiaBank also pointed to Escondida as a potential cause for turbulence unless negotiations went smoothly.

“While last year’s disruption didn’t seem to contribute much of a boost to the already frothy copper market, physical balances are much tighter today and a similar disruption is likely to have a more pronounced effect on spot markets—copper prices briefly moved into backwardation from the protracted contango experienced by contracts since 2016, signaling just how tight spot markets are today,” ScotiaBank said in its Q3 commodities outlook report.

“Despite recent concerns, we don’t believe that we will see another significant work stoppage at Escondida this year and we anticipate that the union and management will come to an agreement through the summer.”

Norton did point to another big story this quarter, this one in India.

“The closure, supposedly permanent of Vedanta’s Sterlite smelter in India has been significant, not so much to the bottom line of copper supply as excess concentrate will be shipped to China, but more to an uptick in smelter processing charges. However, the ongoing expansion of smelter capacity in China is expected to reverse that trend later this year.”

Copper price update: What’s ahead?

Looking ahead, analysts across the board are predicting copper to average below US$7,000 for the remainder of 2018 before picking up into 2019.

Analysts recently polled by FocusEconomics project that copper prices will average US$6,842 per metric ton in Q4 2018 and US$7,069 per metric ton in Q4 2019. The minimum forecast for Q3 comes from Emirates NBD, which is expecting an average price of US$6,250 per tonne, while the maximum forecast comes from DZ Bank, which is projecting prices to average US$7,500.

Norton took a similar approach.

“We were already looking for prices to fall in the third quarter and so recent developments fit in with that picture. In the absence of a major supply disruption, this seasonally quieter period for demand is likely to weigh on sentiment, with trade tension flare-ups exacerbating the situation periodically.

“We are still looking for a market in surplus this year, and even though we would expect prices to recover somewhat in the final quarter, we are still forecasting an average for the year of $6,700 per tonne.”

And ScotiaBank too.

“Copper prices are expected to average US$3.10 per pound (US$6,834.26 per tonne) in 2018 before rising to US$3.25 per pound (US$7,164.95 per tonne) in 2019 on gradually widening supply-side deficits.”

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

This article is updated each quarter. Please scroll the top for the most recent information.

Copper Price Update: Q1 2018 in Review

By Priscila Barrera, April 16, 2018

Copper prices had a rocky start of the year, declining more than 6 percent in the first three months of 2018. Increasing geopolitical concerns, surging warehouse inventories and a weaker Chinese demand put pressure on prices.

Despite this, some analysts remain cautiously optimistic about the future of the red metal and expect prices to pick up in the next few months.

Read on for a more detailed overview of the main factors that impacted the copper market in the first quarter of 2018, plus a brief look at what investors should watch out for in the next few months.

Copper price update: Q1 overview

In the first quarter of the year, copper prices performed in a downtrend, declining more than 6 percent to end March at US$6,683 per tonne.

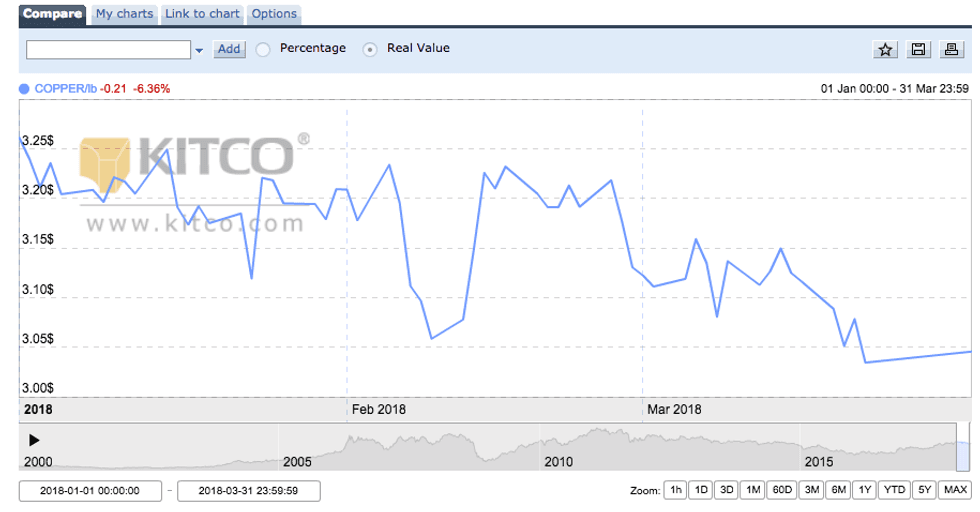

As the chart below from Kitco shows, the copper price reached its quarterly peak at the beginning of January when it traded at US$7,202 a tonne, supported by a weaker US dollar and a strong demand outlook from China.

Chart via Kitco.com

Copper’s lowest price in Q1 came in March, when it fell to US$6,499 per tonne. Copper prices pulled back as the greenback rebounded and warehouse inventories surged.

Copper price update: Supply dynamics

Last year, all eyes were on copper mine disruptions. Supply stoppages at the top two copper mines, BHP Billiton’s (NYSE:BHP,LSE:BLT,ASX:BHP) Escondida and Freeport-McMoRan’s (NYSE:FCX) Grasberg, are estimated to have brought global 2017 copper output down by 5 to 7 percent.

In 2018, there will be several labor negotiations as well but analysts believe mine supply will grow.

“Having been more or less static last year, copper mine production is seen growing by 2.5-3 percent this year, which is expected to help facilitate an increase of similar magnitude in refined output,” Karen Norton, GFMS Thomson Reuters base metals analyst, said.

According to the expert, the most notable new projects this year will be First Quantum’s (TSX:FM) Cobre Panama project, which will now have a slightly larger capacity than previously planned at 350,000 tonnes per year, and Southern Copper’s (NYSE:SCCO) Toquepala expansion in Peru.

“More immediately, we have seen news of restarts of some capacity which had previously been idled in the downturn,” Norton said.

Freeport’s El Abra mine in Chile is one of the most significant examples, she added. The mine has been operating at a reduced rate since the second half of 2015, but is expected to work at full capacity this year.

“This is a year were most of the supply that is coming on is from mines that are restarting production or existing mines that are boosting their output,” ING commodities strategist Oliver Nugent said.

Aside from Glencore’s (LSE:GLEN) Zambian production, Norlisk Nickel (MCX:GMKN) in Russia and output from some mines in Australia and Africa, he expects growth from Peru and a rebound in Chile’s production.

“Although supply is expected to rise slightly on new projects and the resumption of operations in Zambia and the Democratic Republic of Congo, the market will likely remain in deficit,” FocusEconomics analysts said in their latest report.

In contrast, analysts at GFMS Thomson Reuters forecast a surplus of 100,000 tonnes this year.

“[However,] it is a busy year for labor contract negotiations and a repeat of last year’s lengthy strike at Escondida might throw a spanner in the works,” Norton said.

According to Nugent, the risk of mine disruptions is always present in the copper market. “Every year we expect 5-7 percent of mine supply to be lost, and this year we expect the same,” he said.

As a result, the analyst estimates the copper market will be fairly balanced this year.

He also mentioned inventories levels as a factor to watch, as the market has seen a lot of stockpiles move from invisible to visible. This is a trend investors need to get used to, the analyst said.

“We expect inventories to be drawn down going forward,” said Nugent, adding that it’s not unusual for stockpiles to be built in Q1.

Copper price update: Demand forecast

In terms of demand, all eyes are on China, the world’s top consumer, as the main factor driving copper prices.

According to FocusEconomics, signs of softer activity have emerged in the Asian country. In fact, the Chinese manufacturing PMI fell to an over one-year low in February.

“We expect Chinese copper demand growth to hold up reasonably well into the second quarter, but to slow somewhat in the second half, undermined primarily by the property sector,” Norton said.

Even so, the overall picture is not especially disconcerting. That’s because “the picture elsewhere is improving such that overall consumption growth, though still unspectacular, will be slightly higher than in 2017,” Norton added.

Aside from expected improvement in the United States, the world’s second biggest consumer, emerging nations such as Brazil and India will have a greater positive influence.

“After five consecutive years of decline Brazilian demand is expected to pick up again, as the economy finally recovers,” Norton said.

Meanwhile, demand in India is also expected to increase, despite being offset last year due to demonetization measures which affected construction activity.

“Growth is expected to pick up pace again as the Smart Cities Mission continues, and despite criticism that progress so far has been slower than expected,” Norton added.

Copper price update: What’s ahead?

Looking at the next months of the year, there are several factors copper-focused investors should keep an eye on.

“[Investors should pay attention to] trade war concerns that might spill over and curtail global economic growth,” Norton said.

Other geopolitical factors, such as the escalation or otherwise of hostilities between Russia, the United States and other western nations could also impact the market.

“There’s no doubt the risk of a global trade war derailing global growth is something we have to keep in the corner of our minds. We’ve got low probability on it but it has certainly been weighing on sentiment,” Nugent said.

Other factors to watch are the US dollar and US politics, China’s credit and the reform of the financial sector in the Asian country, he added.

“Looking beyond 2018, prices look set to trend upwards, on greater demand for infrastructure, electric vehicles and renewable energy,” FocusEconomics analysts said.

Market watchers polled recently by the firm gave mixed copper price predictions for the second quarter of 2018. Looking ahead to the next few months, they estimate that the average copper price for Q2 2018 will be US$6,825 per tonne.

The most bullish forecast for the quarter comes from Pezco, which is calling for a price of US$7,415; meanwhile, E2 Economia is the most bearish with a forecast of US$5,836.

For her part, Norton said the copper price performance in the first quarter of the year was in line with her expectations, as it still rose by one-fifth year-on-year on an average basis and by 2 percent sequentially.

“We are of the view that Q1 will prove to have been the strongest quarter for the market this year, with prices generally trending lower in the following six months, before picking up in the final quarter as supply growth starts to slow again on a more sustained basis,” she added.

For his part, Nugent expects a rebound in the copper price, averaging U$7,000 in Q2 and Q3.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.