A look back at the main copper trends of 2018, from supply and demand dynamics to price performance over each quarter of the year.

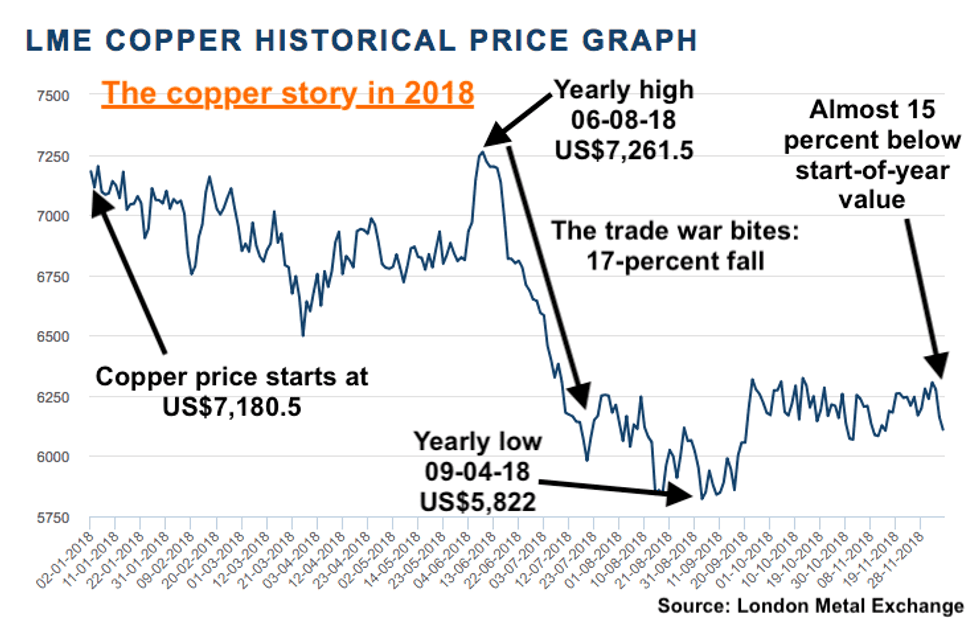

For copper, 2018 was a year clearly split into two halves: before the US-China trade war and after, with investor sentiment markedly different before and after.

In the first half of the year, copper bumbled along without much in the way of drama before its value spiked at the end of Q2. But then the trade war locked in and the copper price dropped by over 17 percent between June and July.

With 2018 rapidly drawing to a close, here the Investing News Network (INN) takes a look at what the trends for copper were in each quarter, how prices performed throughout the year and what analysts said about developments quarter by quarter.

Copper trends Q1: Relative calm before the storm

Between January and March, copper prices declined by almost 7 percent, having started well up at US$7,180.50 per tonne and rounding out the quarter down at US$6,683.

At the end of the quarter, analysts noted that the supply disruptions of 2017 didn’t appear to be carrying into the new year. Meanwhile, warehouse inventories were up and weaker Chinese demand meant that copper was lower — and combined with an expected uptick in production, it was due to stay that way.

“Having been more or less static last year, copper mine production is seen growing by 2.5 to 3 percent this year, which is expected to help facilitate an increase of similar magnitude in refined output,” Karen Norton, base metals analyst at GFMS Thomson Reuters, said at the time.

Norton noted that the big projects of the year would be First Quantum Minerals’ (TSX:FM) Cobre Panama project, and Southern Copper’s (NYSE:SCCO) Toquepala expansion in Peru.

Copper trends Q2: Big news and rumblings

In the second quarter of the year, copper hit a four-year high as the supply disruptions of 2017 returned to haunt the markets, forcing prices upwards as the prospect of BHP’s (ASX:BHP,NYSE:BLT,LSE:BBL) Escondida grinding to a halt became slightly too real.

Price wise, the downward trend from Q1 continued through Q2, with copper starting the quarter at US$6,755 and ending it at US$6,645 — though a downward pitch would continue through to Q3 as the trade war hammered all commodities.

Despite the beginnings of the trade war downturn, analysts were optimistic about developments in copper in Q2, with the supply side looking rosy thanks to big deals by CITIC (HKEX:0267), adept problem solving by Glencore (LSE:GLEN), Southern Copper (NYSE:SCCO) announcing a production start date for Michiquillay and Anglo American (LSE:AAL) finding a partner for its Quellaveco project in Peru.

Analysts said that a fall in prices was expected over the quarter — though the trade war would end up hitting much harder than expected.

Copper trends Q3: Rock-bottom prices

It was during Q3 that copper hit bedrock, falling all the way to US$5,822 in September. At the time, analysts interviewed by INN doubted copper’s value could go any lower anytime soon.

Copper slowly inched its way back up from those lows through Q3 and into Q4, increasing above US$6,000 before the end of the third quarter, but still below its Q3 starting point of US$6,594.50, which was also its quarterly high.

The Escondida drama concluded in a happy ending for BHP, with workers agreeing to a new contract, and supply disruptions disappearing from a long list of investor concerns.

Despite the languishing of base metals values, there were still plenty of transactions going through.

China’s Zijin Mining (HKEX:2899) made two big purchases in Serbia: it entered into a partnership with Belgrade over the RTB Bor copper complex, and made a friendly takeover bid for Canada’s Nevsun Resources (TSX:NSU), the owner of the sought-after Timok copper project nearby.

Copper trends Q4: More deals, slow recovery

In Q4, the copper price made a slow recovery back upwards. The red metal has stayed above US$6,000 for the entire quarter so far — it started at US$6,170 and as of December 4 was trading at US$6,277, representing a 1.7-percent increase.

During Q4, companies indicated that the trade war was hurting them — and if it wasn’t hurting, it certainly wasn’t helping. Canada’s Teck Resources (TSX:TECK.A,TSX:TECK.B,NYSE:TECK) revealed that low commodities prices were chewing into its bottom line, while for operators in Chile guidances were being trimmed due to grades and jobs cut due to “restructuring.”

The copper price is clearly good enough for new projects in the US though, with Excelsior Mining (TSX:MIN) announcing it would go ahead with its Gunnison project in Arizona in October, while over in Nevada, Nevada Copper (TSX:NCU) is making progress on its Pumpkin Hollow project, which it gave the green light to in Q3.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Nevada Copper is a client of the Investing News Network. This article is not paid-for content.