Copper Price Forecast: Top Trends That Will Impact Copper in 2023

What’s the copper price forecast for 2023? The Investing News Network caught up with analysts to find out.

Pull quote was provided by Investing News Network client Western Copper and Gold. This article is not paid-for content.

Copper prices traded with high volatility this past year, and even though the market's long-term fundamentals look bright, the red metal has lost more than 13 percent year-to-date.

Macroeconomic factors, including rising inflation, increasing energy costs and climbing interest rates, impacted copper in 2022; paired with subdued demand, these elements put pressure on prices.

With the year at an end, the Investing News Network (INN) asked analysts in the field for their thoughts on what’s ahead for the vital base metal. Read on for their predictions.

How did copper prices perform in 2022?

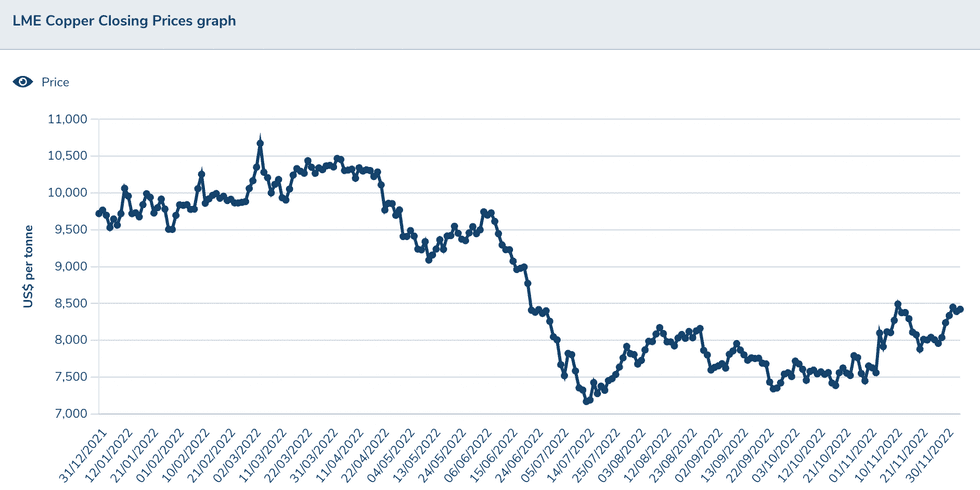

Copper prices hit an all-time high in 2022, surpassing the US$10,000 per metric ton (MT) mark for the first time ever. However, the metal was unable to sustain these gains and was volatile for most of the year.

“Prices exceeded our expectations in 2022, propelled higher in part by constrained supply growth against a backdrop of low visible inventories,” Karen Norton of Refinitiv told INN.

Copper's price performance year-to-date.

Chart via the London Metal Exchange.

Early in the year, the copper market felt the outbreak of the Russia-Ukraine war, which sent energy prices and inflation soaring. Last year, Russia produced 820,000 MT of copper, according to the US Geological Survey.

“This had the twin effect of slowing both demand and supply growth, which helped to keep the copper market relatively tight,” Dan Smith, head of research at Amalgamated Metal Trading, told INN. “We have seen some big swings in prices this year, but with so much uncertainty about the war in Ukraine and the potential for a ban on Russian metal, this was to be expected.”

Another surprise this year was that while central banks hiked interest rates, global copper demand remained resilient, helped by the green energy transition and a tight scrap market, he continued.

“Sectors such as solar and wind have been booming in China, which has more than compensated for weakness in the property market,” Smith said. “Demand is currently growing by around 4 percent, relative to a typical rate of just 2 percent.”

All in all, copper prices have declined 13.67 percent year-to-date and were sitting at US$8,391 on December 5.

Copper supply and demand dynamics in 2023

At the end of 2021, analysts were expecting a modest surplus in the market on the back of robust mine output.

“The copper market has turned out to be tighter this year than we expected at the start of the year,” Smith said.

“While demand growth has been held back by the war in Europe, supply growth has been unexpectedly weak as disruptions in key mining areas such as Chile and Peru have taken their toll," he added.

Looking at what might happen in 2023, Norton said she is expecting reasonable copper demand growth overall next year, although the early months may prove difficult. “We would anticipate higher demand from China in 2023 in particular as the negative impact of strict zero-COVID policies starts to ease off,” she said.

Similarly, Smith said copper demand in China looks likely to accelerate from what has been a poor year in 2022.

“Next year should see a green energy boost combined with a recovery in property, and the growth rate is expected to accelerate from around 2 percent in 2022 to 5 percent in 2023,” he said. “The rest of the world is likely to struggle under the weight of persistent inflation and high interest rates.”

For his part, CRU Group’s Robert Edwards expects 1.9 percent growth in Chinese refined copper consumption in 2023. For the rest of the world, that number rises to 2.4 percent.

Moving on to what might be ahead for copper supply, Norton said Refinitiv’s base case currently assumes growth in 2023 will be higher than the average over the past decade.

“With stocks already around historical lows, we would be concerned for another year of below-trend supply growth where water shortages, lower ore grades and other disruptions hamper production in the world’s top producers,” Norton said.

For Smith, the biggest concern for copper supply is that the market is becoming increasingly reliant on countries that have been unstable and chaotic in the recent past.

“The Democratic Republic of Congo (DRC) is a particular concern as the country now accounts for 11 percent of global mine output, and there are lots of projects in the pipeline in the country that are due to come onstream in 2024 and 2025,” he said.

“The other problem is that when copper prices rise, we tend to see more disruption as miners go on strike to demand higher wages. This could be a challenge for next year.”

Disruptions in key copper countries were unsurprising in 2022; mine workers at Chile’s Escondida and Antofagasta threatened to strike over safe labor conditions, while in Peru protests disrupted work at mines, including Glencore’s (LSE:GLEN,OTC Pink:GLCNF) Antapaccay, MMG’s (HKEX:1208,OTC Pink:MMLTF) Las Bambas and Hudbay Minerals’ (TSX:HBM,NYSE:HBM) Constancia.

For CRU’s Edwards, production difficulties experienced in Chile and Peru this year will be the biggest challenge for copper supply next year. “In 2023, we expect 80 percent of mine growth globally from those two countries.”

In terms of projects to watch out for in 2023, Edwards mentioned Quebrada Blanca Phase 2, Oyu Tolgoi's underground phase, the Carrapateena block cave, Udokan and two Codelco projects — El Teniente and Rajo Inca.

Refinitv’s Norton said she will also be monitoring the ramp up of the Quebrada Blanca Phase 2 project in Chile.

“It is expected to make a sizeable contribution next year, so anything short of that will have an impact,” she said.

The Kisanfu project in the DRC will also be on her radar. “We will be keen to see whether it can follow in the footsteps of the Kamoa-Kakula mine, which has ramped up and expanded at a fast clip.”

Refinitiv is building in higher production at some of this year’s more troubled mines, such as MMG’s Las Bambas mine and major mines in Chile. Smith of Amalgamated Metal Trading expressed a similar view, saying, “There is now quite a large wave of copper mine supply coming through, suggesting that growth will be at least 4 percent in 2023."

As they do with other commodities, miners continue to face challenges to bring new supply onstream. In the case of copper, supply will play a key role in the green energy transition, with the red metal expected to experience a significant shortage by the end of the decade if the current output pace remains unchanged.

“Securing funding in a challenging economic environment may prove difficult for those with projects that are considered to be less promising prospects,” Norton said. “It seems likely that major miners will look to sweep up some of the small- to mid-sized firms that have promising projects potentially on the path to development over the medium term.”

In terms of market balance, CRU was expecting a small deficit in 2022, which has materialized.

“For 2023 we have a very small surplus of less than 150,000 MT, which is out of a total market size of around 25 million MT, so you could argue this is almost balanced,” Edwards said.

Meanwhile, Refinitv is still looking for a surplus next year, but nothing more than a relatively modest one that shouldn’t knock back prices to any great extent on an annual average basis.

What factors will move the copper market in 2023?

When asked about what other industry catalysts investors should consider as 2023 begins, Smith said that there is significant potential for an acceleration in secondary copper output.

“The scrap market has been very tight this year, but this should ease in response to high prices,” he said. “This will help reduce the pressure on mine supplies, although there is a limit on how much this will help based on existing technologies and scrap generation.” He is also following the green energy transition, which is now starting to exert a powerful impact on copper.

“It will be interesting to see whether this can be maintained in the face of strong inflation and governments in Europe being hamstrung by high debt levels,” he said.

Norton is also following the potential for growth in demand from the new energy sectors, which she expects will continue to gather momentum, regardless of the economic backdrop.

“On the other side, there is potential for more commitment to recycling projects in developed countries, which has to be a positive, even though to some extent it would stem from increasing economic insularity,” she added.

Norton said that as 2023 approaches, investors should also watch out for more resource nationalism and possible national stockpiling by some countries if the material is available.

For Edwards, investors should keep an eye out for new applications that could boost demand for copper, as well as any substitution threats, which could be negative for red metal demand.

In terms of prices, CRU is expecting copper to remain close to today’s trading levels next year.

For Norton, a move back above US$10,000 cannot be ruled out, especially if supply continues to fall short of expectations and demand from China in particular surprises to the upside on easing COVID-19 restrictions.

“Whether such a move would be sustainable for any length of time is another question,” she elaborated. “Certainly in the early months, we would expect a generally gloomy economic climate to weigh on sentiment.”

In the short term, Smith expects copper prices to fall back in response to weak demand in China. “The country is currently facing strict lockdowns in places like Chongqing, and activity has slumped despite government attempts to boost the economy,” he said.

However, Smith is bullish for next year, as China is pumping a huge amount of money into the property market and the US dollar is likely to weaken. “Given that inventory levels are very low, a surge above US$10,000 would be no surprise,” he added.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.