U3O8 Price Update: Q1 2022 in Review

The uranium spot price has gained more than 100 percent in the last year. Can its momentum continue moving forward?

Click here to read the latest U3O8 price update.

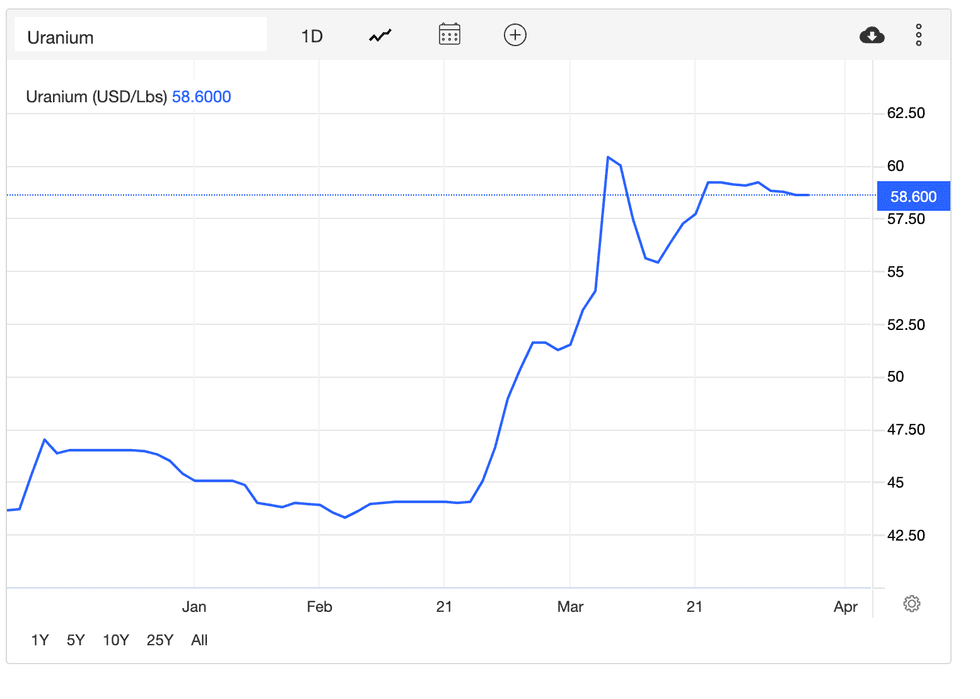

The first quarter of 2022 marked another positive performance for uranium, which saw its value rise an impressive 36 percent over the three month period.

The year started with the energy fuel holding at the US$43.62 per pound level. On January 6, U3O8 made the first of several significant price bumps during the Q1 period, climbing to US$47.17.

The move was precipitated by civil unrest in Kazakhstan — the leading country in uranium production — due to soaring gas and energy prices in the nation.

Over the course of a number of weeks, protesters took to the streets of Kazakhstan in the thousands to voice their displeasure about inflation, energy costs, low wages and other issues. Clashes between civilians with the police and military resulted in 227 deaths and thousands of arrests.

Following its early January rally to a 10 year intraday high, the U3O8 spot price began to slowly retract, ending the month back at the US$44 threshold. Prices remained rangebound for the first weeks of February, before the war in Ukraine infused more uncertainty to global supply chains and added tailwinds to commodities prices.

“After January’s rally provoked by unrest in Kazakhstan, prices petered out in February amid limited purchases by large funds,” a March report published by forecasting firm FocusEconomics reads. “That said, Russia’s invasion of Ukraine led prices to spike late in the month.”

Between February 23 and March 2, uranium prices rose from US$43.94 to US$51.84, a 17 percent increase.

U3O8 price performance, Q1 2022.

Chart via Trading Economics.

By March 10, values had rallied to US$60.59, their highest level since January 2011; prices for uranium stayed above US$55 for the remainder of the month.

U3O8 price update: Demand strong as Sprott buys and investors stay keen

Before Russia's late February invasion of Ukraine, U3O8 had been enjoying steady price growth courtesy of the push towards clean energy, growing nuclear capacity and heightened investment demand.

Investment demand was led largely by the Sprott Physical Uranium Trust (TSX:U.UN) — launched in July 2021, the vehicle quickly began amassing pounds of U3O8 on the spot market, ending 2021 with 41.3 million pounds. It had added another 6 percent, or 2.7 million pounds, to its stores by the end of January.

“After a multi-year absence, non-utility buyers have returned, buying significant quantities of physical uranium,” John Ciampaglia, CEO of Sprott Asset Management, told the Investing News Network (INN). “The Sprott Physical Uranium Trust currently holds 54 million pounds of uranium, up from 18.1 million pounds in July 2021.”

Additionally, electricity suppliers are returning to market after a long-awaited absence. “Utilities have begun to respond by signing new long-term uranium supply agreements to secure price and supply,” Ciampaglia added.

From April 2021 to April 2022, uranium jumped a whopping 106.47 percent.

“The price of uranium, along with other forms in the nuclear fuel cycle, has been materially impacted since the surprise invasion of Ukraine by Russia,” Ciampaglia explained to INN.

“Russia supplies enriched uranium to many utilities, and the threat of sanctions by western countries, self-sanctions by some utilities, along with the possibility that Russia may withhold deliveries of enriched uranium as a countermeasure, have disrupted an already vulnerable supply chain.”

Accounting for as much as 22,723 metric tonnes (MT) of annual production, disruptions to supply from Kazakhstan (19,477 MT), Russia (2,846 MT) and Ukraine (400 MT) are expected to continue adding tailwinds to the spot price.

Global X ETFs, a provider of exchange-traded funds (ETFs), has also seen heightened interest in its uranium-focused ETF, called the Global X Uranium ETF (ARCA:URA).

“Uranium has seen the highest amount of inflows so far this year within our commodity suite of ETFs,” Jon Maier, Global X’s chief investment officer, told INN via email. He went on to explain that if Russian supply — which accounts for 17 percent of the market — is banned, the discrepancy will need to be replaced from somewhere.

“If that supply is cut off, then the gap will need to be filled by other producers, though the ramp up cannot be immediate,” Maier said. “Most of the price increase has been because of potential disruption concerns, and for market participants to lock in the current rate instead of potentially paying a premium in the future.”

U3O8 price update: Geopolitical instability highlighting supply chain issues

With immediate supply from Eastern Europe and Central Asia under threat, and demand forecast to grow, uranium values could return to levels unseen since 2007’s all-time high of US$140.25.

These disruptions are being compounded by the fact that annual production has been on the decline since reaching a peak of 63,207 MT in 2016.

“There are approximately 440 nuclear power plants globally, and they require 180 million pounds of uranium annually to operate,” Ciampaglia commented. “Primary production is only at 130 million pounds, so there is a supply deficit. Secondary supplies are quickly dwindling.”

This supply conundrum will be further compounded by the rollout of new nuclear fleets.

“China alone is planning to build 150 new nuclear power plants over the next 10 to 15 years, while heavily coal-dependent countries like Poland are considering nuclear power for the first time,” he said.

Supplying as much as 20 percent of electricity in Organization for Economic Co-operation and Development countries, nuclear energy is touted by the United Nations Economic Commission for Europe (UNECE) as an indispensable tool for achieving the global sustainable development agenda.

“It has a crucial role in decarbonizing the energy sector, as well as eliminating poverty, achieving zero hunger, providing clean water, affordable energy, economic growth, and industry innovation,” a 2021 UNECE nuclear energy report reads. “Improved government policy and public perception along with ongoing innovation will enable nuclear energy to overcome traditional barriers to deployment and expand into new markets.”

This is already being proven by the over 50 nuclear reactors now under construction in 19 countries globally.

However, as more reactors come online each year, production from favorable jurisdictions like Canada and Australia, which accounted for 10,058 MT in 2020, won’t be near enough to meet demand.

Beyond that, civil unrest, geopolitical instability and pandemic closures have highlighted the fragility of the nuclear fuel supply chain, a factor countries must take into account as nuclear power becomes more key for electricity.

In 2019, Donald Trump, then US president, proposed building a domestic uranium stockpile with US$150 million of annual purchases from US miners. The idea was to earmark the stash for the national energy grid and military, a move that could be copied by other nations dependent on nuclear energy to supply their electricity.

The proposal came after a Section 232 investigation, which examined national security around uranium imports.

“The US has the largest fleet of nuclear reactors in the world, yet domestic production of uranium is essentially zero,” Ciampaglia said. The country imports US$2 billion worth of uranium annually to supply its nuclear fleet.

“The US government has realized that they need to support and incentivize local uranium production, so they are not completely dependent on foreign sources,” he added in conversation with INN. “This will take time as new mine development and mine restarts can take many years.”

While there are several companies capable of producing uranium in the US, previously depressed prices have kept American projects curtailed. Additionally, building and opening new uranium mines is a complex, multi-leveled process in addition to regular mining regulations.

“The strategic uranium reserve being created in the US is a good first step, but its initial funding is only US$75 million, which is immaterial relative to their annual uranium needs,” Ciampaglia said.

U3O8 price update: Energy security dependant on nuclear power

Prices for oil surpassed the US$100 per barrel level earlier this year, placing new emphasis on the importance of energy security. A key aspect of the clean energy transition is the importance of unimpeded, steady energy production, and diverse experts believe nuclear will be pivotal to making this move.

“The inclusion of nuclear energy in a broad energy mix will enhance a nation’s energy security,” the UNECE report reads. “As a baseload power source, nuclear energy complements intermittent energy sources and reduces a nation’s exposure to disruptions in the availability of, or acceptability of utilizing, baseload fossil fuels.”

A robust domestic nuclear fuel cycle can also aid in reducing reliance on imported power, and can present opportunities to export excess power for profit.

“While Europe has shifted to renewable energy over the past 20 years, their intermittency (sun, wind and rain) requires a reliable baseload power source (natural gas, coal or nuclear),” Ciampaglia said regarding the role nuclear plays in Europe’s energy market. “The war in Ukraine has heightened concerns about energy security – Germany’s decision to phase out its nuclear power plants has made it highly dependent on Russia for its energy.”

By April 13, positive fundamentals across the sector had buoyed U3O8, with prices at US$64.83.

Despite the steady upward trend prices have displayed since August 2021, when they clocked in at only US$30.27, FocusEconomics has a relatively conservative stance in terms of the rest of the year.

"Our Consensus Forecast expects uranium prices to fall by year-end from March’s average prices,” its latest energy outlook states. “However, they will remain comfortably above next year’s prices amid robust demand stemming from green transition plans and Western efforts to wean themselves off Russian energy.”

The economic analysis firm goes on to note that there is an increased amount of uncertainty in the broader commodities market that could also affect the price trajectory for U3O8.

“Much depends on politics, supplier discipline, and potential nuclear accidents,” its March overview reads. “Our panelists forecast prices to average US$45.80 per pound in Q4 2022 and US$45.50 per pound in Q4 2023.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Uranium Outlook 2022: Prices Have Broken Out, How High Will ... ›

- Top Uranium Stocks on the TSX and TSXV | INN ›

- When Will Uranium Prices Go Up? | INN ›

- Investors Eyeing Uranium on Back of New Products, Conflict and More | INN ›

- Uranium Stockpiling: The Rise of Nationalism or an Energy Security Effort? | INN ›