Tech 5: TSMC, ASML Post Quarterly Results; Amazon, Google Sign Nuclear Power Deals

Chip stocks were in focus this week as TSMC and ASML shared their latest quarterly results. Meanwhile, Amazon and Google are going nuclear with new power deals.

Chip stocks faced losses early this week, sparking volatility in the tech sector.

Meanwhile, Bitcoin was on the rise after US Vice President Kamala Harris said she plans to support innovation in the cryptocurrency industry. Elsewhere, Google (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) signed nuclear power deals.

Stay informed on the latest developments in the tech world with the Investing News Network's round-up.

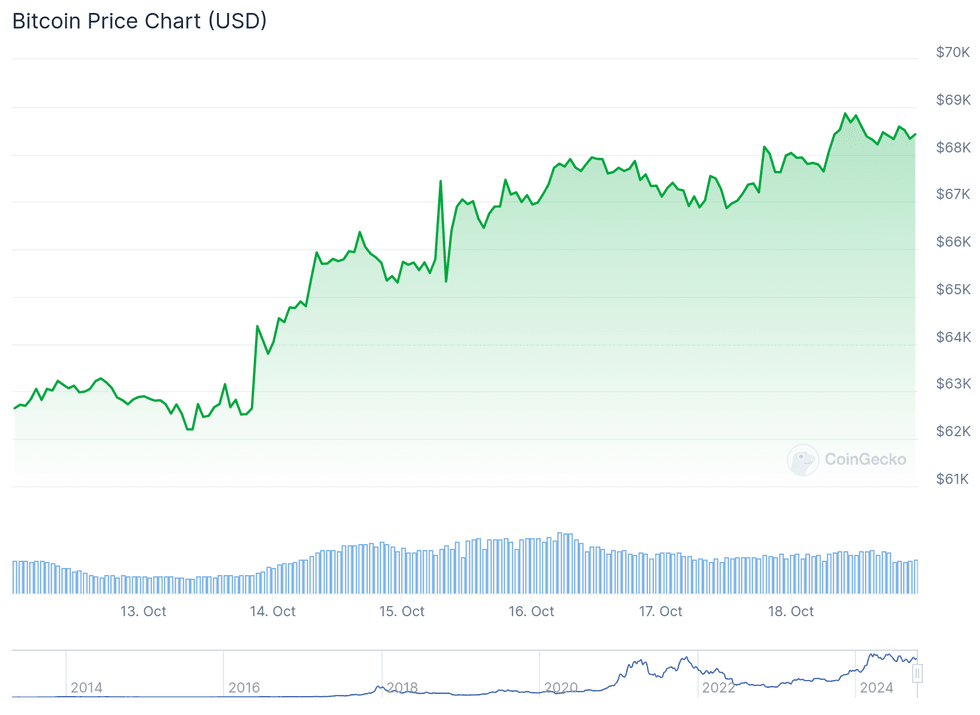

1. Bitcoin price rises to nearly US$70,000

The price of Bitcoin rose above its 200 day moving average late on Sunday (October 13) evening, reaching US$62,640 on the back of optimism over China’s recently announced stimulus plan. The popular cryptocurrency's gains extended into Monday (October 14) morning, and it eventually surpassed US$66,400 for the first time since late July.

Bitcoin performance, October 12 to 18, 2024.

Chart via CoinGecko.

Data from CoinGlass shows over US$100 million in liquidated short positions due to the sudden price jump.

Open interest in Bitcoin futures has surged to an all-time high, indicating strong institutional participation and raising expectations for a continued price rally. Bitcoin exchange-traded funds also saw record inflows of over US$250 million every day this week, further fueling bullish sentiment among sector participants.

Crypto analyst Omkar Godbole has suggested that the recent breakout could signal a significant upswing. The US$70,000 mark is now being eyed as Bitcoin's next major resistance level, while Ether's next hurdle lies at US$2,770.

Bitcoin closed the week at US$68,362, while Ether finished the period at US$2,663.

US election speculation also impacted Bitcoin this week.

On Monday evening, Harris pledged to support a regulatory framework for crypto, although the news was somewhat dampened as she didn't share a detailed plan. Even so, that didn’t stop Ripple Labs co-founder Chris Larsen from donating US$1 million worth of XRP tokens to Future Forward, a super PAC supporting Harris’ run.

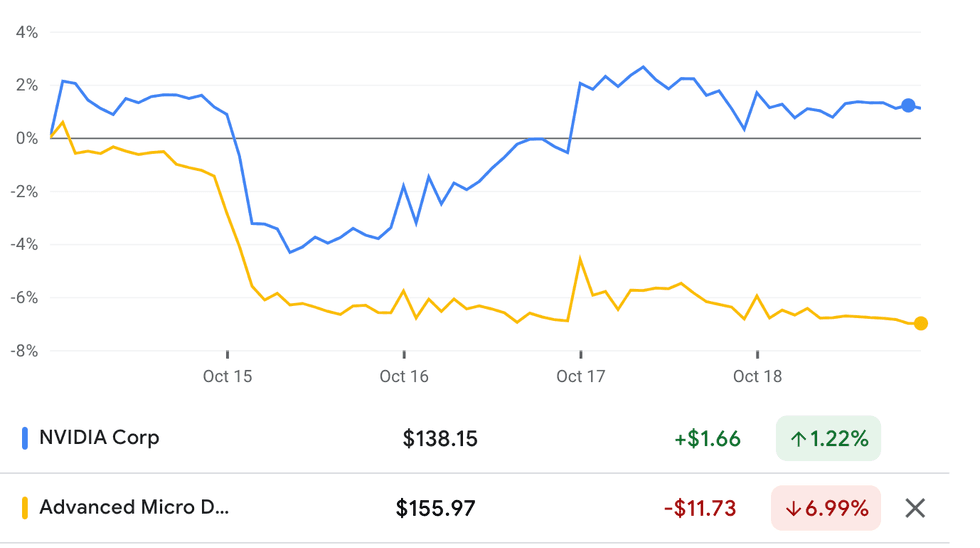

2. Chip stocks stumble on export cap reports

A Monday afternoon report from Bloomberg revealed that the US government is considering capping sales of advanced artificial intelligence (AI) chips from American companies to certain countries.

Sources familiar with the matter said the move would be made in the interest of national security, and that officials are focused on countries located in the Persian Gulf, including the United Arab Emirates and Saudi Arabia.

Both nations have invested heavily in AI, with the United Arab Emirates' Mubadala Investment Firm making significant contributions to Anthropic, and Saudi Arabia establishing a US$40 billion investment fund focused on AI.

NVIDIA and AMD performance, October 14 to 18, 2024.

Chart via Google Finance.

Shares of NVIDIA (NASDAQ:NVDA) fell by over 4 percent on Tuesday (October 15), the day after the report’s release.

Only a day earlier, the company reached its highest closing value since June, driven by positive chip industry sentiment. Shares of AMD (NASDAQ:AMD), one of NVIDIA's top rivals, also fell by over 4 percent on Tuesday morning.

According to Bloomberg, officials from the Bureau of Industry and Security, a spokesperson for the White House National Security Council and representatives from Intel (NASDAQ:INTC), AMD and NVIDIA have declined to comment.

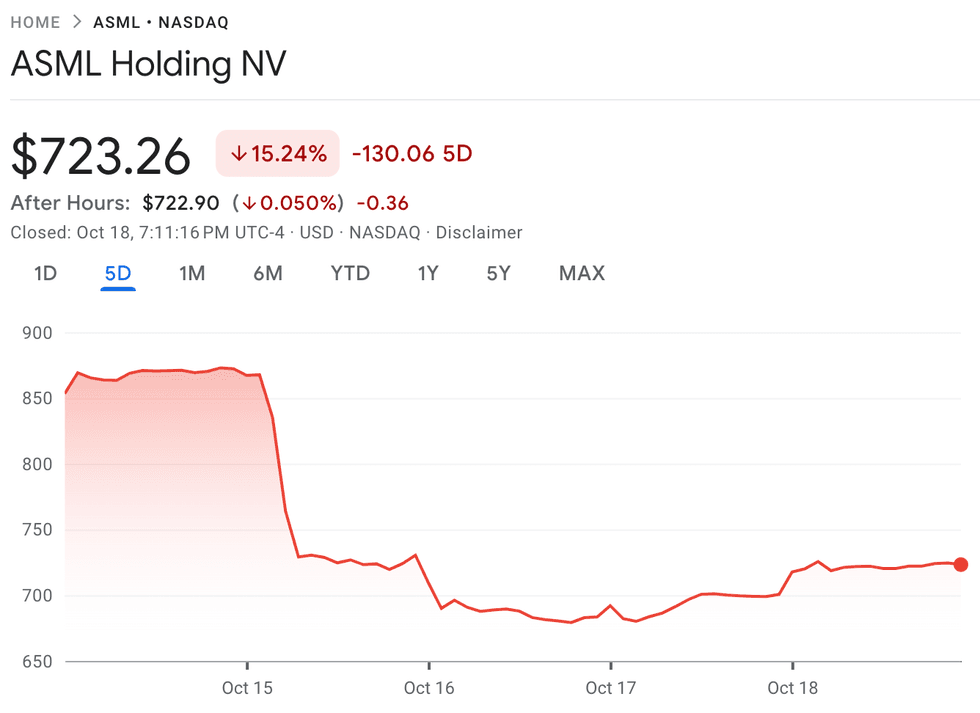

3. ASML's Q3 results fall flat

On Tuesday, ASML (NASDAQ:ASML) mistakenly released its Q3 results one day ahead of schedule, revealing that it has lowered its total net sales guidance for 2025 to 30 billion to 35 billion euros.

The company also missed revenue expectations for the quarter by more than half, prompting a nearly 16 percent decline in its share price for the week and erasing roughly US50 billion from its market cap.

"While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness,” said ASML CEO Christophe Fouquet in a press release.

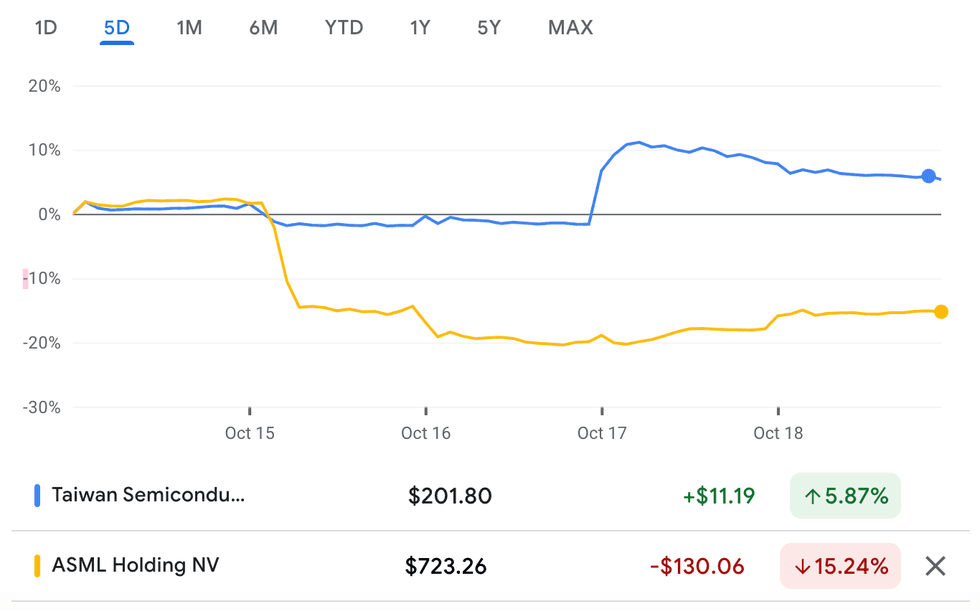

ASML performance, October 14 to 18, 2024.

Chart via Google Finance.

The impact of ASML's results sent shockwaves through the semiconductor industry, as ASML is a key supplier to many of the world's largest chipmakers. Shares of ASML's major customer, Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE:TSM), also fell about 3.3 percent in early trading on Tuesday. Intel, which has already seen its market share dwindle this year, and Samsung (KRX:005930) also saw their share prices fall by over 2 percent each.

Analysts have attributed ASML's lowered expectations to several factors, including slower-than-expected demand for logic and memory chips and potential export controls in China. “Logic foundries are ramping up new nodes at a slower pace than expected, and ASML is seeing little capacity additions in memory so far,” Morningstar's Javier Correonero wrote on Wednesday (October 16), cutting his fair value estimate for ASML shares from 900 euros to 850 euros.

4. TSMC raises revenue growth target

TSMC posted better-than-expected Q3 results on Thursday (October 17), raising its revenue target for the fourth quarter of the year to the US$26.1 billion to US$26.9 billion range.

Its Q3 earnings increased by 39 percent year-on-year to roughly US$23.5 billion, representing growth of nearly 13 percent compared to the previous quarter. Net income also increased by an impressive 31.2 percent. Investors sent the company’s share price above US$200 for the first time this year on Thursday morning ahead of the release.

TSMC and ASML performance, October 14 to 18, 2024.

Chart via Google Finance.

“Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies,” said Wendell Huang, senior vice president and CFO of TSMC. “Moving into fourth quarter 2024, we expect our business to continue to be supported by strong demand for our leading-edge process technologies."

Shares of TSMC's two biggest customers, NVIDIA and Apple (NASDAQ:AAPL), also received a boost following the release of the report. Apple’s share price opened 1.75 percent higher when the markets opened on Friday (October 18), rising 2.66 percent for the week. NVIDIA, which suffered a setback at the start of the week, opened 2.63 percent higher ahead of the report’s release on Thursday morning. NVIDIA's share price is up 1.11 percent for the week.

5. Google, Amazon sign nuclear power deals

Last month, Microsoft (NASDAQ:MSFT) announced plans to source energy for its data centers from nuclear power, signing a multi-year purchase agreement with Constellation Energy (NASDAQ:CEG). Now, Google and Amazon are the latest Big Tech companies to look to nuclear power to meet their growing energy needs.

On Monday, Google signed an agreement to purchase nuclear energy from several small modular reactors (SMRs) that will be developed by Kairos Power. The deal is part of Google’s efforts to reach its ambitious net-zero goals.

The first SMR is set to come online by 2030, with additional deployments scheduled through 2035.

Amazon made a similar announcement on Wednesday, signing three agreements with Energy Northwest, Dominion Energy (NYSE:D) and X-Energy to support the buildout of SMRs in Virginia and Washington.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.