Tech 5: Meta Plans Multibillion AI Bet, Apple Reveals iOS 26 at WWDC 2025

Tech heavyweights Amazon and NVIDIA unveiled new AI deals in the US and Europe, while rumors swirled about a huge Meta investment in Scale AI.

This week saw a flurry of activity in the tech world, from Apple's (NASDAQ:AAPL) new product announcements to Amazon's (NASDAQ:AMZN) massive infrastructure investment in Pennsylvania.

Meanwhile, NVIDIA's (NASDAQ:NVDA) European expansion and its role as an artificial intelligence (AI) powerhouse were all but cemented after a series of announcements at the Paris VivaTech Conference, and Mark Zuckerberg's Meta Platforms (NASDAQ:META) made big moves in the AI startup space.

Read on to dive deeper into this week's top tech stories.

1. Meta's AI strategy takes shape with US$14.8 billion deal

Meta has a massive deal in the works with Scale AI, as per information provided by sources to multiple outlets.

On June 7, Bloomberg broke the news that Meta was in discussions for a potential investment of over US$10 billion in the AI firm. Then, on Tuesday (June 10), The Information reported Meta would acquire a 49 percent stake in Scale AI for US$14.8 billion, valuing the startup at US$28 billion, a two-fold increase from its valuation in 2024.

The news was followed by Tuesday reports from the New York Times and Bloomberg saying that Meta would be unveiling a new AI research lab focused on achieving superintelligence.

It will include Alexandr Wang, who is Scale AI's founder and CEO, among other Scale AI employees.

CEO Zuckerberg reportedly acquired additional talent for the lab by offering lucrative compensation packages to engineers from multiple other tech firms, including Google (NASDAQ:GOOGL) and OpenAI.

2. Apple's WWDC disappoints investors

Shares of Apple fell by over 2 percent on Monday (June 9) and closed 1.43 percent lower after new developments and features revealed at its annual Worldwide Developers Conference (WWDC) failed to impress investors.

Apple’s forthcoming software updates featured subtle improvements, such as a revamped operating system (OS) and AI capabilities that were noticeably toned down compared to the previous year's unveiling.

Among the new additions to Apple devices are in-app live translation, call screening, AI-driven information analysis and more sophisticated image generation capabilities thanks to its partner OpenAI.

The company also said it would provide developers with offline functionality for its on-device AI models.

The biggest development was the introduction of Liquid Glass, a new design language and graphical user interface developed to unify the visual experience across Apple’s operating systems.

Also part of the push for unification, Apple shared it is switching to an iOS naming system using a number based on calendar year after its release, meaning the next release will be iOS 26.

Apple briefly mentioned the long-awaited AI-powered upgrade to its Siri assistant that was announced at WWDC 2024. During the previous conference, executives hinted that the new Siri would be released with iOS 18, which came out last September without the upgrade.

While no release date was provided at the event, Senior Vice President of Software Engineering Craig Federighi said that the company looks forward to sharing more details “in the coming year.” The company reaffirmed that timeline in a Bloomberg report after anonymous sources told the publication Apple is aiming for a spring 2026 release.

Shares of Apple closed down 3.88 percent for the week.

3. Amazon to build nuclear-powered data centers in Pennsylvania

Amazon announced plans on Monday to invest at least US$20 billion in expanding its data center infrastructure in Pennsylvania, including the construction of two new data center campuses. One campus will be in Luzerne County, south of Scranton, alongside Talen Energy's (NASDAQ:TLN) Susquehanna nuclear power plant. The second campus will be built north of Philadelphia in Bucks County, at the site of what was once a steel mill.

“Pennsylvania is competing again — and I'm proud to announce that with Amazon's commitment of at least $20 billion to build new state-of-the-art data center campuses across our Commonwealth, we have secured the largest private sector investment in the history of Pennsylvania,” Pennsylvania Governor Josh Shapiro (D) said in a press release.

Later, on Wednesday (June 11), Talen announced the expansion of its nuclear energy partnership with Amazon. The collaboration was originally formed in 2022, and will now supply AWS data centers with up to 1,920 megawatts of electricity from its plant, double its previous commitment of 960 megawatts.

The two companies also shared plans to explore the development of small modular reactors in the state.

4. Oracle reaches new heights on earnings report

Oracle (NYSE:ORCL) reported its fiscal Q4 and full-year 2025 earnings on Wednesday, revealing total Q4 revenue of US$15.9 billion, above analyst estimates and a year-over-year increase of 11 percent.

Earnings per share were US$1.70, which also exceeded expectations of US$1.64.

The software maker’s cloud infrastructure business grew by 50 percent year-over-year in fiscal year 2025, and Oracle projected a further increase of 70 percent in cloud infrastructure sales over the next year.

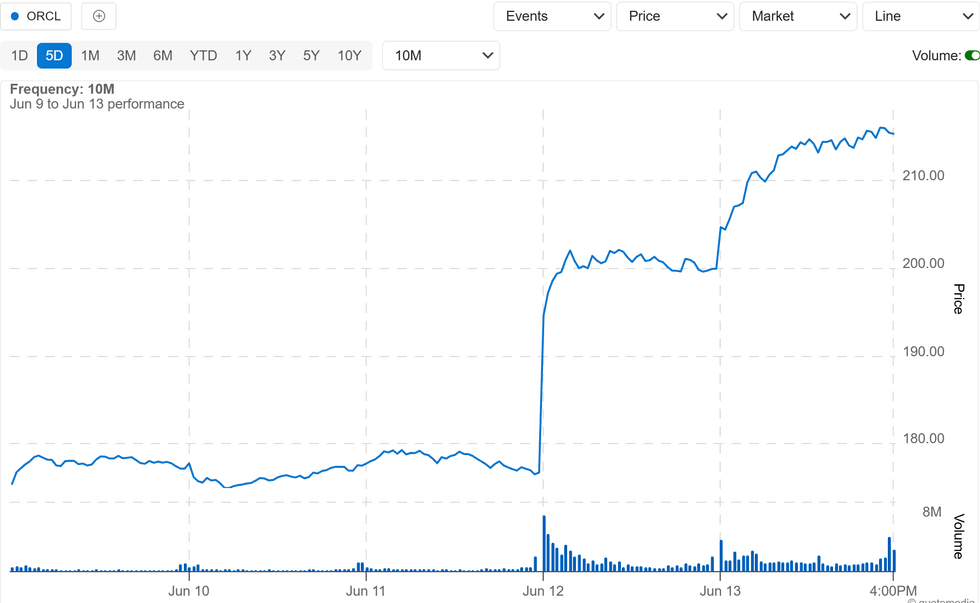

Oracle performance, June 9 to 13, 2025.

Chart via the Investing News Network.

CEO Safra Catz's news during the earnings call that the Stargate joint venture is “not yet formed” had little bearing on the company’s share price. The positive report sent shares to a new high of US$202.44, and they continued climbing to close Friday up 23 percent since the start of the week.

5. NVIDIA CEO highlights AI job creation, European AI deals at VivaTech

In a week of announcements that coincided with the VivaTech 2025 conference in Paris, NVIDIA CEO Jensen Huang showcased his company’s role as a full-stack AI infrastructure provider.

His message during his keynote presentation on Wednesday was a stark contrast to Anthropic CEO Dario Amodei’s warning earlier this week that AI could lead to widespread job displacement.

On the contrary, Huang said that AI will create new industries and demand for jobs. He also noted that quantum computing technology is at an inflection point, with the potential to solve problems that currently demand years of processing by classical computers. His comments came just one day after IBM (NYSE:IBM) unveiled its newest roadmap, which includes plans for a new quantum data center and the IBM Quantum Starling, which the company says will be the world's first large-scale, fault-tolerant quantum computer.

Cementing NVIDIA's role as a global infrastructure leader, Huang shared plans to develop European sovereign AI models through a newly announced partnership with US-based, AI-powered search engine Perplexity and French sovereign AI start-up H Company. Developers will be able to access and fine-tune Perplexity’s models through Hugging Face, a platform for model sharing and collaboration.

DGX Cloud Lepton, NVIDIA's sovereign-ready AI cloud platform, will host the models on European infrastructure to comply with local data privacy and localization requirements. Huang said that, with over 20 active AI factory initiatives in the region, he anticipates a tenfold increase in Europe's AI computing capacity within two years.

Also on Wednesday, insiders for Bloomberg reported that NVIDIA and Samsung Electronics (KRX:005930) will make minority investments in robotics software developer Skild AI as part of the company’s Series B funding round.

The round is led by a US$100 million investment from SoftBank (TSE:9434) and will result in a US$4.5 billion valuation, according to the report. Sources with insider knowledge said that NVIDIA will invest US$10 million and Samsung will put in US$25 million in a strategic move aimed at boosting the companies' influence in the consumer robotics sector.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.