Tech Weekly: AI "Scare Trade" Spills into New Sectors

Explore this week’s top tech news and market movers, plus key catalysts to watch next week.

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market.

We also break down next week's catalysts to watch to help you prepare for the week ahead.

In this article:

This week's tech sector performance

The Nasdaq Composite (INDEXNASDAQ:.IXIC) ended in the green on Monday (February 9) despite a weaker open.

A rally in tech companies drove US stocks higher ahead of an economic data release, while Asian indexes also rose, led upward by Japan’s tech‑heavy Nikkei 225 (INDEXNIKKEI:NI225).

It hit new record highs after Prime Minister Sanae Takaichi’s Liberal Democratic Party secured a landslide victory in the Lower House, clearing the path for tax cuts and higher defense spending.

Tax planning and wealth management stocks fell on Tuesday (February 10) after financial software provider Altruist unveiled an artificial intelligence (AI) tool for creating tax strategies, echoing last week’s selloff in legal software stocks following the debut of a lawyer-focused AI platform.

Broader tech‑driven weakness and softer‑than‑expected retail‑sales data dragged the Nasdaq down in Tuesday’s session. The index rose again on Wednesday (February 11) after January data showed labor market stability, potentially allowing the US Federal Reserve to keep interest rates steady as it monitors inflation.

Software stocks resumed their slide, with Alphabet (NASDAQ:GOOGL) at one point down more than 2 percent, Microsoft (NASDAQ:MSFT) falling over 2.5 percent and Amazon (NASDAQ:AMZN) slipping about 1 percent.

Personal computer makers also fell after Lenovo Group (HKEX:0992,OTCPL:LNVGF) warned of shipment pressure from a memory chip shortage. HP (NYSE:HPQ) and Dell Technologies (NYSE:DELL) each lost about 4.5 percent.

After a muted close, investors turned their AI disruption fears to yet another corner of the market on Thursday (February 12). This time, it was logistics and trucking stocks, which plummeted after AI logistics firm Algorhythm Holdings (NASDAQ:RIME) said it has scaled freight volumes by 300 to 400 percent without increasing headcount.

This event showed traders that AI is now affecting sectors previously thought to be resistant to automation and AI‑driven efficiency gains, leading to selloffs that also spilled into real estate and drug distribution.

All three major indexes closed lower, with the Nasdaq hit hardest.

A softer-than-expected US consumer price index report released on Friday (February 13) morning reinforced beliefs that the Fed is likely to cut interest rates this year, while global concerns about potential AI-driven disruptions kept investors cautious. European and Asian indexes lost ground, tracking Wall Street's losses.

While the S&P 500 (INDEXSP:.INX) closed slightly ahead on the day, mega-cap tech stocks dragged on the Nasdaq, which closed the week 1.77 percent below Monday's open.

3 tech stocks moving markets this week

1. Cloudflare (NYSE:NET)

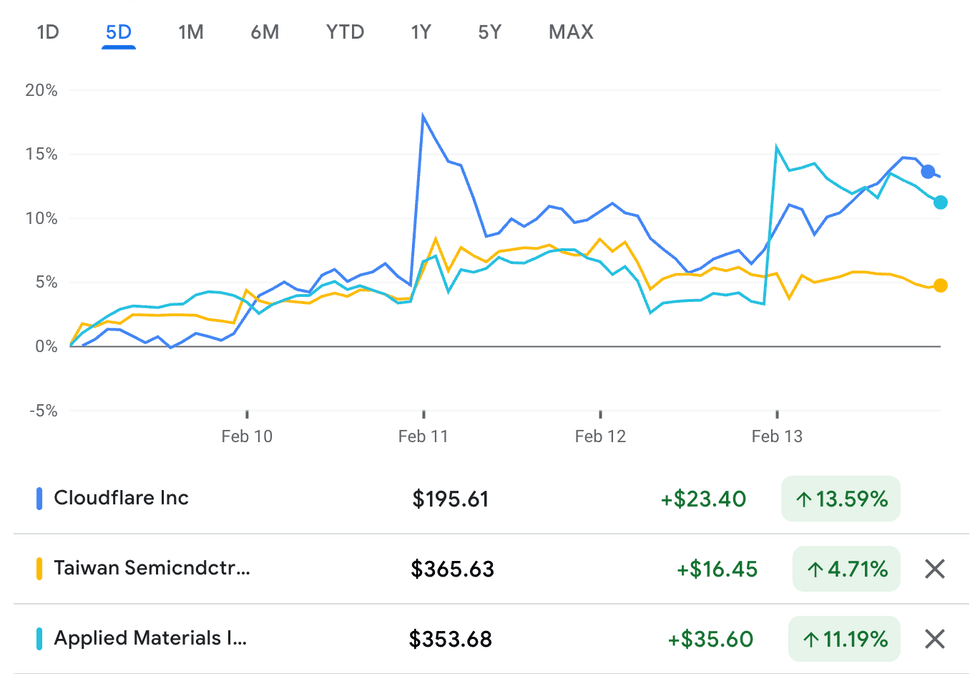

Cybersecurity firm Cloudflare saw its share price surge after its sales guidance for the current quarter exceeded expectations. Shares closed 13.07 percent higher for the week.

2. Applied Materials (NASDAQ:AMAT)

Applied Materials, a provider of materials engineering solutions for the semiconductor sector, saw its share price rise sharply after reporting better-than-forecast quarterly financial results. Shares advanced 10.05 percent.

3. Taiwan Semiconductor Manufacturing Company (NYSE:TSM)

Taiwan Semiconductor Manufacturing Company rose after D.A. Davidson analyst Gil Luria gave it a "buy" rating with a US$450 price target and called it a top AI foundry name. Shares advanced 5.02 percent.

Cloudflare, TSMC and Applied Materials performance, February 9 to 13, 2026.

Chart via Google Finance.

Top tech news of the week

- South Korea's Yonhap news agency reported that Samsung Electronics (KRX:005930) could begin large-scale production of its next-generation, high-bandwidth memory chips as early as this month. Micron Technology (NASDAQ:MU) lost ground on the news.

- TotalEnergies (NYSE:TTE) unveiled new power purchase deals to supply 1 gigawatt of solar capacity to Google data centers in Texas. It follows previous deals between Google and Clearway Energy (NYSE:CWEN), which is partially owned by TotalEnergies.

- Alphabet completed two bond sales this week, raising a combined total of nearly US$52 billion. On Monday, the company sold US$20 billion in US dollars, followed by a nearly US$32 billion multi‑currency bond sale in British pounds and Swiss francs completed within 24 hours on Tuesday.

- Meta Platforms (NASDAQ:META) said it will spend more than US$10 billion on a new data center in Lebanon, Indiana, which is expected to be operational at the end of 2027 or in early 2028.

- Anthropic raised US$30 billion, reaching a US$380 billion valuation.

- The Information reported on Friday that publicly traded investment firm Blue Owl Capital (NYSE:OWL) is planning more than US$100 billion in fresh capital for US AI data center projects.

- Morgan Stanley (NYSE:MS) analyst Stephen Byrd’s latest note highlights a list of “stocks mispriced in the AI disruption unwind,” including Shopify (NYSE:SHOP) and Descartes Systems (TSX:DSG). In his view, they present possible opportunities for investors.

- A trial alleging that the Meta and YouTube platforms addict young users began on Monday. The trial will likely feature testimony from Meta CEO Mark Zuckerberg, Instagram head Adam Mosseri and YouTube CEO Neal Mohan. Legal experts are comparing the case to 1990s tobacco litigation.

- Amazon is reportedly planning to launch a marketplace where publishers would be able sell content to AI companies, licensing it on their own terms instead of dealing with unclear usage.

- BlackBerry (TSX:BB,NYSE:BB) co-founder Michael Lazaridis invested in Vancouver-based Railtown AI Technologies, a company that builds AI tools that help software developers detect, analyze and fix errors. Lazaridis also joined the firm's board of advisors.

- AI-powered humanoid robot startup Apptronik secured about US$520 million in a new funding round, bringing the company’s valuation to more than US$5.5 billion.

- Apple (NASDAQ:AAPL) is reportedly planning a major “product blitz” in early 2026, featuring the iPhone 17e, a major Siri overhaul, refreshed entry‑level iPad and iPad Air models and new MacBook Pro laptops with M5‑series chips, according to Bloomberg and other outlets. In other news, the company suffered its biggest daily loss since April 2025 on Thursday after the US Federal Trade Commission chair called on it to review possible political bias in Apple News. Additionally, Counterpoint Research data reveals that the iPhone 17 series was the only smartphone line to register growth in China sales in January.

- Cisco Systems (NASDAQ:CSCO) posted a quarterly gross margin below estimates, alongside current-quarter guidance that disappointed investors. Its share price closed 9.29 percent lower for the week.

- Lattice Semiconductor (NASDAQ:LSCC) reported better‑than‑expected results for its 2025 fiscal year, highlighting strong demand for its low‑power programmable logic devices.

- Shopify reported strong Q4 2025 revenue growth and announced a US$2 billion share buyback, but the company's margins and guidance disappointed some investors.

- Rivian Automotive (NASDAQ:RIVN) reported better‑than‑expected Q4 2025 results and raised its 2026 delivery forecast to 62,000 to 67,000 vehicles, up 47 to 59 percent year‑on‑year.

- Micron surged this week after Morgan Stanley reaffirmed its "overweight" rating and Deutsche Bank (NYSE:DB) raised its price target for the stock to US$500 from US$300.

Tech ETF performance

Tech exchange-traded funds (ETFs) track baskets of major tech stocks, meaning their performance helps investors gauge the overall performance of the niches they cover.

This week, the iShares Semiconductor ETF (NASDAQ:SOXX) advanced by 2.56 percent, while the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) advanced by 1.89 percent.

The VanEck Semiconductor ETF (NASDAQ:SMH) also increased by 2.19 percent.

Tech news to watch next week

Tech stocks face a quieter earnings backdrop next week, with no mega‑cap AI giants reporting; instead, the sector will be trading on macro cues and any guidance hints from mid‑tier semis and software names.

Key US data includes jobs‑related releases and consumer confidence surveys.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.