Tech 5: Bitcoin Hits All-time High, Tech Stocks React to Trump Win

Elon Musk's Tesla was in the green this week, with shares reaching their highest level in 2024 on optimism about Trump's victory.

The latest US presidential election took place this week, with Donald Trump winning his second term in the White House after a tumultuous race against current Vice President Kamala Harris.

The stock market soared as the results came in, with the S&P 500 (INDEXSP:.INX), Dow Jones Industrial Average (INDEXDJX:.DJI) and Nasdaq Composite (INDEXNASDAQ:.IXIC) all setting new records.

Bitcoin also surged to a fresh all-time high, passing US$77,000. With the Senate secured by Republicans and the House within reach, the prospect of a more favorable regulatory landscape has ignited investor enthusiasm.

Stay informed on the latest developments in the tech world with the Investing News Network's round-up below.

1. Big Tech reacts to Trump's election win

Trump's election victory on Wednesday (November 6) has been perceived as a victory for CEOs, particularly those in the tech industry who have maintained close ties with policymakers. With promises to lower corporate taxes and loosen regulations, the new administration could provide a more favorable business environment.

That sentiment was reflected in the stock market this week, with some tech companies witnessing growth of well over 5 percent. After replacing Intel (NASDAQ:INTC) on the Dow on November 1, NVIDIA (NASDAQ:NVDA) surpassed Apple (NASDAQ:APPL) to become the world's most valuable company for the third time this year. It achieved a market cap of US$3.43 trillion compared to Apple's US$3.38 trillion as markets wrapped on Tuesday (November 5), and reached a historic valuation of US$3.6 trillion on Wednesday. Its share price is up 7.28 percent for the week.

In addition to NVIDIA's gains, tech giants Broadcom (NASDAQ:AVGO) and Amazon (NASDAQ:AMZN) also experienced significant share price increases of 8.29 percent and 5.87 percent, respectively. Shares of Apple, Microsoft (NASDAQ:MSFT), Meta Platforms (NASDAQ:META) and Taiwan Semiconductor Manufacturing Company (NYSE:TSM) saw more modest gains of 2.63 percent, 3.13 percent, 4.47 percent and 3.87 percent, respectively.

Adding to investor optimism is a Reuters article that suggests Trump could be planning to dial back antitrust measures enforced by the Biden administration. He reportedly also may disrupt the proposed breakup of Google (NASDAQ:GOOGL), whose share price is up 5.09 percent for the week.

2. Bitcoin sets new price record

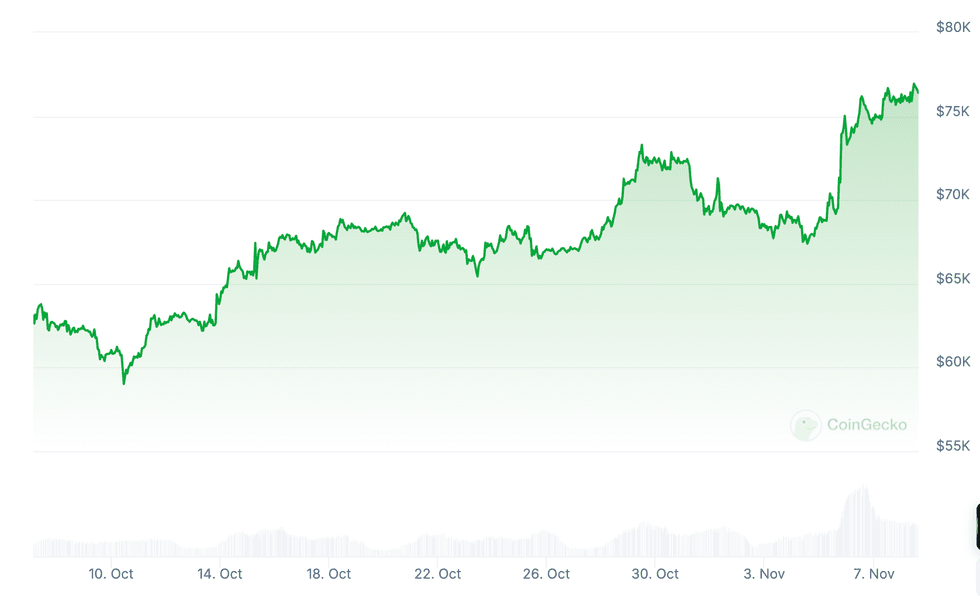

After a slump early in the week, Bitcoin reached a new all-time high after Trump's win at the polls.

In a presidential race initially considered the closest in modern US history, the Republican candidate took an early lead by securing votes in North Carolina, Georgia and Pennsylvania, three out of seven key swing states.

At 5:34 a.m. EST on Wednesday, the Associated Press reported that Trump had won over a fourth swing state, Wisconsin, securing enough electoral college votes to be declared the winner.

As Americans cast their ballots and Trump’s prospects improved, the price of Bitcoin rose in tandem. The popular cryptocurrency went from around US$68,750 on Tuesday morning to more than US$75,000 just after 1:36 a.m. EST on Wednesday, surpassing its previous record of US$73,000 set in March of this year.

Bitcoin performance, October 10 to November 7, 2024.

Chart via CoinGecko.

On Wednesday at 5:35 a.m. EST, after Trump declared victory, Bitcoin was trading at around US$73,000. Its price continued to rise as the markets opened on Wednesday, briefly breaking past US$76,000 before retreating slightly as western markets closed. It traded in the US$74,000 range in Asia and retook US$76,000 at around 11:00 a.m. EST.

Unlike the short-lived rallies seen in recent weeks, Bitcoin has managed to maintain its gains so far.

A Trump presidency is viewed as beneficial to the cryptocurrency industry, as during his campaign he promised to loosen regulations and replace regulators like US Securities and Exchange Commission Chair Gary Gensler, who has had contentious relationships with the industry’s major players. Republicans have also secured a majority in the Senate and are on track to take the House, although votes are still being tallied. With a more crypto-friendly political landscape, industry insiders are optimistic that innovation and adoption will accelerate.

Bitcoin closed the week over 10 percent higher at US$76,739, slightly below its weekly high of US$77,239.

3. Tesla shares hit year-to-date high

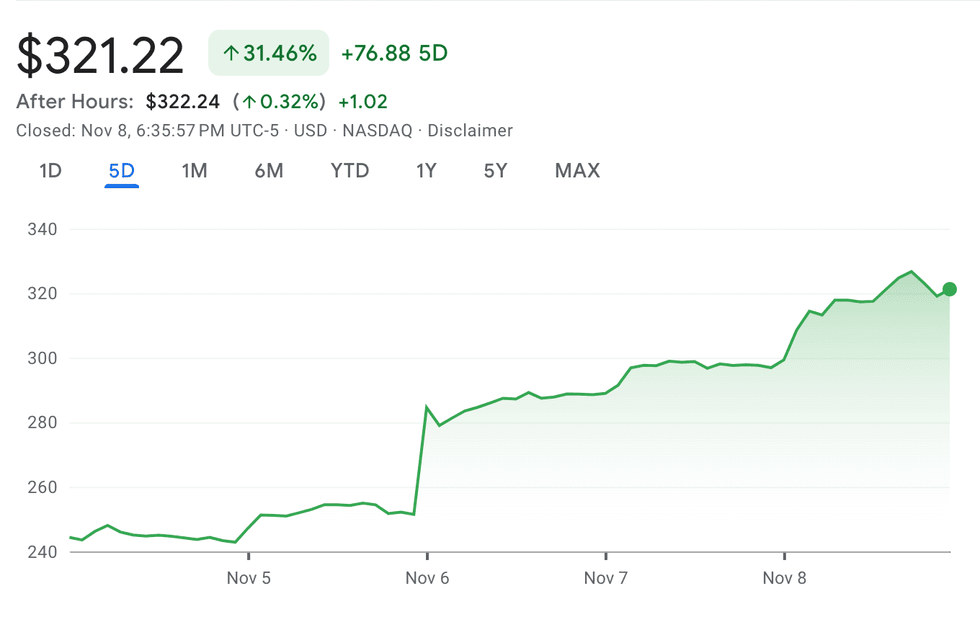

Next to Bitcoin, Tesla (NASDAQ:TSLA) is the biggest winner after Trump’s win this week.

Its share price gained over 13 percent on Wednesday morning and is up over 31 percent for the week, trading at US$321.22, its highest level year-to-date.

Tesla performance, November 4 to 8, 2024.

Chart via Google Finance.

CEO Elon Musk actively supported Trump in the weeks leading up to the election, contributing roughly US$130 million to his campaign efforts despite Trump's criticism of electric vehicles.

In September, Trump indicated his intention to offer Musk a role in the White House, saying he would ask him to focus on streamlining government operations and cutting federal spending.

Musk has boldly predicted that he could eliminate at least US$2 trillion of federal spending. While he hasn't specified exactly where these cuts would come from, reports suggest that Musk and Trump may target agencies responsible for regulating industries in which Musk's companies operate. These agencies could include the Federal Aviation Administration (FAA), the Federal Communications Commission and environmental agencies.

Musk may have a vested interest in reducing the FAA's regulatory oversight of SpaceX, as diminishing the agency's funding could potentially clear a path for expanded commercial space exploration.

Issues between the FAA and SpaceX — such as a US$633,009 fine imposed by the FAA in September for procedural violations related to Falcon 9 launches, as well as its decision to delay the test launch of SpaceX’s Starship mega rocket — have created tension between Musk and the government agency.

4. Super Micro shares audit update, reports preliminary earnings

Super Micro Computer (NASDAQ:SMCI) announced preliminary results for its first fiscal quarter of 2025 on Tuesday, providing a net sales forecast of US$5.9 billion to US$6 billion, missing analysts’ expectations of US$6.79 billion. The projection is also slightly below the company's previous guidance of US$6 billion to US$7 billion.

For its second fiscal quarter of 2025, Super Micro said it is expecting net sales of US$5.5 billion to US$6.1 billion. This outlook led to a share price drop of over 24 percent on Wednesday morning.

In Tuesday's release, the company also shared an update from an independent special committee formed to investigate concerns initially raised by EY about Super Micro's accounting records. The committee said it found no evidence of fraud or misconduct by management or the firm's board, and recommended that Super Micro conduct “a series of remedial measures … to strengthen its internal governance and oversight function."

A full report on the committee's findings is expected next week.

Meanwhile, Super Micro is working to file its delayed Form 10-K and regain compliance with Nasdaq listing requirements. After being issued a notice of noncompliance, companies have 60 days to either file a Form 10-K or submit a plan to regain compliance. If Super Micro fails to do either and is delisted from the Nasdaq, it faces potential early repayment on up to US$1.725 billion of its March 2029 convertible notes.

5. Arm stumbles on Q2 revenue growth

Arm Holdings (NASDAQ:ARM) released its latest quarterly results on Wednesday, showing that its revenue growth slowed to 5 percent in the September quarter, down from 39 percent in the previous period.

The slowdown in revenue growth was primarily attributed to a decline in licensing revenue, the fees that Arm receives from companies that use its intellectual property (IP) to develop their own chips.

License and other revenue came to US$330 million during Arm's second fiscal of 2025, compared to US$472 million in previous quarter, which amounts to a difference of 43 percent.

Arm Holdings performance, November 4 to 8, 2024.

Chart via Google Finance.

The decline was partially offset by royalty revenue, which increased by 23 percent year-on-year to US$514 million. Royalty revenue refers to fees Arm receives from companies that use its IP in products sold to end consumers.

While Arm's share price initially dipped following the report, it rebounded strongly, and was up nearly 10 percent by midday on Thursday (November 7). This positive shift may reflect investor confidence in Arm's strong position within the tech industry. The company collaborates with major tech players like Apple, Samsung Electronics (KRX:005930) and NVIDIA, and its chips are essential components in a wide range of consumer and industrial electronics.

The company's share price ended the week up 5.16 percent.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.