Bitcoin: A Price History of the First Cryptocurrency

Since its inception, Bitcoin has become one of the most valuable and volatile assets in the market. Learn all about Bitcoin's price history, including its starting price, how long it took to grow to where it is now and its new all-time high set in March 2024.

Bitcoin, the most well-known cryptocurrency, paved the way for the cryptocurrency asset class.

Now the cryptocurrency of choice, its meteoric rise has been unlike any other commodity, resource or asset. Bitcoin’s price rose more than 1,200 percent from March 2020 to reach US$69,044 on November 10, 2021.

The coin showcased its famous volatility in the following year, falling as low as US$15,787 by November 2022 amid economic uncertainty and a wave of negative media coverage.

Bitcoin started 2024 just below US$45,000 and made substantial gains in remainder of the year. Following Donald Trump's victory over Vice President Kamala Harris in the US presidential election, Bitcoin soared to US$103,697 on December 4, 2024.

The first quarter of 2025 saw the price of Bitcoin decline by more than 25 percent to a low for the year of US$75,004 in early April. Since then, rising institutional demand and an emerging industry-friendly US regulatory environment have poured rocket fuel into the digital assets value.

Bitcoin reached its new all-time high price of US$126,198.07 on October 6, 2025, before closing at US$124,752.53.

However, the digital currency faced a larger than a 30 percent drop in value in November, dropping as low as US$80,659.81 per Bitcoin on November 21 as part of a larger risk-off sentiment pervading the markets.

For frequent updates on the biggest news of the crypto sector, check out our Crypto Market Recap, with updates multiple times per week.

Where did Bitcoin start, and what has spurred its price movements since its launch? Read on to find out.

In this article

What is Bitcoin and who invented it?

Created as a response to the 2008 financial crisis, the concept of Bitcoin was first introduced in a nine-page white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on October 31, 2008, on a platform called Metzdowd.

The manifesto was penned by a notoriously elusive person (or persons) who used the pseudonym Satoshi Nakamoto. The author(s) laid out a compelling argument and groundwork for a new type of cyber-currency that would revolutionize the monetary system.

Cryptographically secured, Bitcoin was designed to be transparent and resistant to censorship, using the power of blockchain technology to create an immutable ledger preventing double-spending. The true allure for Bitcoin’s early adopters was in its potential to wrestle power away from banks and financial institutes and give it to the masses.

This was especially enticing as the fallout from the 2008 financial collapse ricocheted internationally. Described as the worst financial crisis since the Great Depression, US$7.4 billion in value was erased from the US stock market in 11 months, while the global economy shrank by an estimated US$2 trillion.

On January 3, 2009, the Genesis Block was established, marking the beginning of Bitcoin’s blockchain, onto which all additional blocks have been added. The Genesis Block contained the first 50 Bitcoins ever created and a simple message: “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks.”

Many believe the message hints at Bitcoin’s mission, as it references an article in The London Times that criticized the British government’s inadequate response to the financial crisis of 2007 to 2008, particularly the government’s inability to provide effective relief and support to the struggling economy.

What was Bitcoin's starting price?

When Bitcoin started trading in 2009, its starting price was a minuscule US$0.0009.

On January 12, 2009, Nakamoto made the first Bitcoin transaction when they sent 10 Bitcoins to Hal Finney, a computer scientist and early Bitcoin enthusiast, marking a crucial milestone in the cryptocurrency’s development and adoption.

News of the cryptocurrency continued to spread around the Internet, but its value did not rise above US$0 until October 12, 2009, when a Finnish software developer sent 5,050 Bitcoins to New Liberty Standard for US$5.02 via PayPal Holdings (NASDAQ:PYPL), thereby establishing both the value of Bitcoin and New Liberty Standard as a Bitcoin exchange.

The first time Bitcoin was used to make a purchase was on May 22, 2010, when a programmer in Florida named Laszlo Hanyecz offered anyone who would bring him a pizza 10,000 Bitcoin in exchange. Someone accepted the offer and ordered Hanyecz two Papa John’s pizzas for US$25. The 10,000 Bitcoin pizza order essentially set Bitcoin’s price in 2010 at around US$0.0025.

Bitcoin’s price finally broke through the US$1 mark in 2011, and moved as high as US$29.60 that year. However, in 2012 Bitcoin pulled back and remained relatively muted.

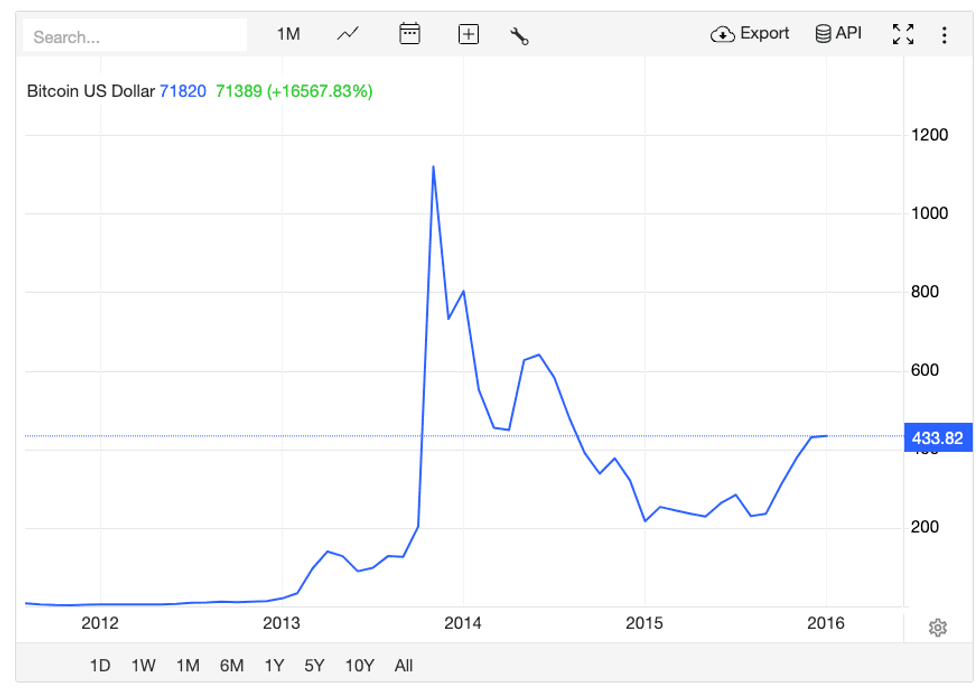

Bitcoin’s price saw its first significant growth in earnest in 2013, the year it broke through both US$100 and US$1,000. It climbed all the way to US$1,242 in December 2013.

From that peak, Bitcoin’s price began to fall, and it spent most of 2015 in the US$200 range, but it turned around in December 2015 and began to climb again, ending the year at around US$430.

When did the Bitcoin price start to grow?

January 1, 2016, marked the beginning of Bitcoin’s sustained price rise. It started the year at US$433 and ended it at US$989 — a 128 percent value increase in 12 months.

That year, several contributing factors led to Bitcoin’s rise in mainstream popularity. The stock market experienced one of its worst first weeks ever in 2016, and investors began turning to Bitcoin as a “safe-haven” stock amidst economic and geopolitical uncertainty.

2016 also saw the Brexit referendum in the UK in June and the election of Donald Trump to the White House in November, both events that coincided with a bump in Bitcoin’s price.

Bitcoin continued its ascent, while various industries continued to take an interest in blockchain technology, particularly technology and finance. In February, a group of investors that included IBM (NYSE:IBM) and Goldman Sachs (NYSE:GS) invested US$60 million in a New York firm developing blockchain technology for financial services, Dig Asset Holdings. Bitcoin was trading at US$368.12 on February 2, down a bit from January, but two months later it was US$418.

In May the price of Bitcoin experienced a significant price increase, rising by 21 percent to US$539 at the end of the month. Its price went higher into June, peaking at US$764 on June 18. After that, it fell sharply and spent the summer in the high US$600 range. It dropped to US$517 on August 1 and started its climb all over again.

Microsoft (NASDAQ:MSFT) and Bank of America Merrill Lynch partnered for a finance transacting endeavor in September. Not much price movement was observed, but Bitcoin remained on a steady upward trajectory after that. In October, Ripple partnered with 12 banks in a trial that used its native digital currency token XRP to facilitate cross-border payments. Institutional investment bolstered investor confidence, and Bitcoin went from US$629 to US$736 between October 20 and November 20.

Bitcoin’s popularity continued into 2017, and it rose from US$1,035.24 in January to US$18,940.57 in December. Futures contracts began trading on the Chicago Mercantile Exchange in December 2017, and Bitcoin began to be more widely perceived as a legitimate investment rather than a passing fad. FOMO flooded the market. What ensued was a frenzy of media coverage featuring celebrity endorsements and initial coin offerings (ICOs) that spilled into 2018.

Regulators began to take notice and issued warnings and guidelines meant to protect investors and mitigate risks associated with digital assets, which only seemed to make people want them more.

Through it all, Bitcoin remained the “gold standard” of cryptocurrencies, yet its price was subject to extreme volatility. At the beginning of 2019, it was around US$3,800, it reached nearly US$13,000 in June, but by December 2019 Bitcoin was trading at around US$7,2000.

What factors led to Bitcoin's rise in the early 2020s?

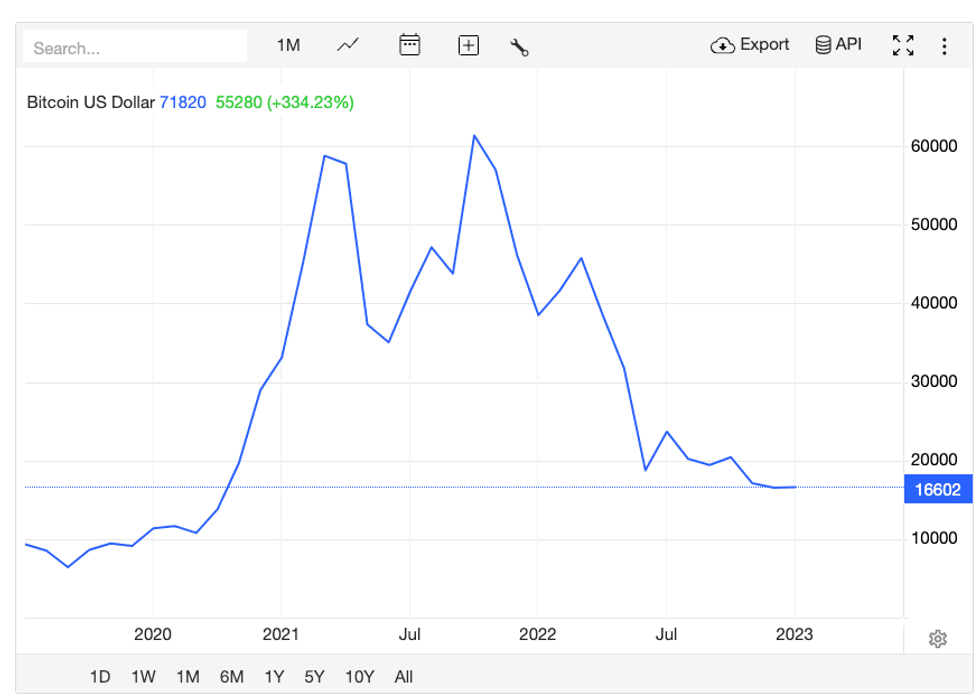

2020 proved a testing ground for the digital coin’s ability to weather financial upheaval. Starting the year at US$6,950.56, a widespread selloff in March triggered by the pandemic brought its value to US$4,841.67 — a 30 percent decline.

The low created a buying opportunity that helped Bitcoin regain its losses by May. The rally continued throughout 2020, and the digital asset ended the year at US$29,402.64, a 323 percent year-over-year increase and a 507 percent rise from its March drop.

By comparison, gold, one of the best-performing commodities of 2020, added 38 percent to its value from the low in March through December, setting what was then an all-time high of US$2,060 per ounce in August.

Bitcoin’s ascent continued in 2021, rallying to an all-time high of US$68,649.05 in November, a 98.82 percent increase from January. Much of the growth in 2021 was attributed to risk-on investor appetite.

Increased money printing in response to the pandemic also benefited Bitcoin, as investors with more capital looked to diversify their portfolios. The success of the world’s first cryptocurrency amid the market ups and downs of 2020 and 2021 led to more interest and investment in other coins and digital assets as well. For example, 2021 saw the rise of non-fungible tokens (NFTs), unique crypto assets that are stored, sold and traded digitally using blockchain technology.

Almost immediately following its record close above US$69,000 in November 2021, Bitcoin’s value began to fall once again. Market uncertainty weighed especially heavily on Bitcoin in 2022. During the second quarter of that year, values dived below US$20,000 for the first time since December 2020.

On May 7, 2022, Curve Whale Watching posted the first sign that confidence in Terra Luna, a cryptocurrency pegged to the US dollar, was waning after 85 million of its stablecoin UST exchanged for less than the 1:1 ratio it was supposed to maintain. This triggered a massive sell-off that brought Luna’s value down 99.7 percent and eventually resulted in the Terra tokens ceasing to be traded on major crypto exchanges.

Terra’s collapse had a domino effect on the industry as investors’ faith in crypto crumbled. In July, the Celsius network, a platform where users could deposit crypto into digital wallets to accrue interest, halted all transfers due to “extreme market conditions”, driving down the price of Bitcoin even further to US$19,047, a 60 percent decline from January 2022. In July, Celsius filed for Chapter 11 bankruptcy.

However, the biggest shake-up to the industry came in November when CoinDesk published findings that cryptocurrency trading firm Alameda Research led by Sam Bankman-Fried had borrowed billions of dollars of customer funds from crypto exchange and sister company FTX. Over a third of Alameda’s assets were tied up in FTT, the native cryptocurrency of FTX.

Once this news broke, investors withdrew their funds en masse, causing a liquidity crunch that collapsed FTX. Bankman-Fried was later arrested and sentenced to 25 years in federal prison on counts of money laundering, wire fraud and securities fraud.

Although Bitcoin was never implicated, the fallout of the FTX scandal led to a crisis of confidence across the sector and increased scrutiny from regulators and law enforcement. By the end of 2022, prices for Bitcoin had moved even lower to settle below US$17,000.

Bitcoin price chart from January 1, 2020, to December 31, 2022.

Chart via TradingEconomics.com.

Bitcoin's powerful performance cannot be understated as evidenced by its price performance in the later half of 2023 and so far in 2024.

Concerns with the banking system led the price of Bitcoin to rally in March 2023 to US$28,211 by March 21 after the failure of multiple US banks alarmed investors.

In Q2 2023, Bitcoin continued its ascent, stabilizing above US$25,000 even as the US Securities Exchange Commission (SEC) filed lawsuits against Coinbase Global (NASDAQ:COIN), along with Binance and its founder Changpeng Zhao.

Although it looked like bad news for the sector, Bitcoin stayed steady, holding above US$25,000. This was supported by BlackRock (NYSE:BLK), the world's largest asset manager, filing for a Bitcoin exchange-traded fund with the SEC on June 15.

Bitcoin's price jumped above US$30,000 on June 21, 2023, and on July 3, 2023, the crypto hit its highest price since May 2022 at US$31,500. It held above US$30,000 for nearly a month before dropping just below on July 16, 2023. By September 11, 2023, prices had slid further to US$25,150.

Heading into the final months of the year, the Bitcoin price benefited from increased institutional investment on the prospect of the SEC approving a bevy of spot Bitcoin exchange-traded funds by early 2024. In mid-November the price for the popular cryptocurrency was trading up at US$37,885, and by the end of the year that figure had risen further to US$42,228 per BTC.

2024 Bitcoin price performance

Bitcoin price chart from January 1, 2024, to November 6, 2024.

Chart via TradingEconomics.com.

Once the SEC’s approval of 11 spot Bitcoin ETFs hit the wires, the price per coin jumped again to US$46,620 on January 10, 2024. These investment vehicles were a major driving force behind the more than 42 percent rise in value for Bitcoin in February; it reached US$61,113 on the last day of the month.

On March 4, Bitcoin surged almost 8 percent in 24 hours to trade at US$67,758, less than 2 percent away from its previous record, and on March 11 it hit a new milestone, surpassing the US$72,000 mark. Three days later, on March 14, Bitcoin reached its highest-ever recorded price of US$73,737.94, surpassing the market cap of silver.

Bitcoin often surges leading up to the halving events, which is when Bitcoin rewards are halved for miners. The most recent came in April when the reward for completing a block was cut from 6.25 to 3.125 Bitcoin.

Several sources cited the 2024 halving as one of the forces that drove the price of Bitcoin to its newest high.

The halving occurred at around 8:10 p.m. EDT on a Friday, and Bitcoin’s price remained stable within the US$63,000 to US$65,000 range over the ensuing weekend. On April 22, the Monday following the halving, it was slightly above US$66,000.

While Bitcoin's price stayed relatively stable, the cryptocurrency's trading volume experienced significant fluctuations through that weekend, with a 45 percent increase from April 19 to April 20 followed by a 68 percent decline on April 21. Between April 30 and May 3, it fell as low as US$56,903 following the Federal Reserve’s April policy meeting, which did not produce a rate cut.

Reports that the SEC was moving to approve spot Ether ETFs in May sent the price of Bitcoin climbing again alongside that of Ether, the native token of the Ethereum blockchain, which serves as the foundation for these ETFs. Bitcoin passed US$71,000 for the second time ever at 8:00 p.m. EDT on May 20, days before the SEC approved spot Ether ETFs on May 23.

Bitcoin hovered between US$67,000 and US$69,000 for the remainder of the month and into the middle of June. It fell back below US$67,000 on June 13 and moved lower the next day when the Federal Reserve opted to delay lowering interest rates once again.

Losses picked up speed through late June and continued in July, with analysts pointing to uncertainty over post-election regulations, Germany’s sell-off of seized Bitcoin assets and concerns about the impact of the defunct trading platform Mt. Gox on the token market. Bitcoin dropped to a two-month low of US$55,880 on July 8, but quickly recovered most of its losses after Federal Reserve Chairman Jerome Powell’s congressional testimony on July 9 that signaled rate cuts may not be far off.

As crypto gains wider acceptance and accessibility, with more traditional financial institutions and products incorporating digital assets, the type of risk that Bitcoin represents has evolved. Bitcoin was primarily seen as a highly speculative alternative investment. Now, with expanding institutional interest, it is increasingly seen as a ”risk-on” asset – meaning its price movements are influenced by market sentiment, investor confidence and broader economic conditions.

A rise in Bitcoin’s price ensued after the July 13 assassination attempt of US presidential candidate Donald Trump, who has been actively endorsing the crypto industry for support. Bitcoin rose from US$57,899 to US$66,690 in the week following the incident as the odds of a Trump victory were seen to improve, highlighting the impact of regulatory uncertainty on the market. However, Bitcoin’s price didn’t experience any significant pullbacks in the week after current US President Joe Biden dropped out of the race on July 21 and current Vice President Kamala Harris took over as the new nominee.

Other significant developments affecting Bitcoin during the summer included the underwhelming performance of spot Ether ETFs, fears of a US government Bitcoin sell-off, Trump’s proposed national Bitcoin stockpile and Trump’s declining chances of winning the election as support for Harris snowballs.

Bitcoin experienced a tumultuous August, with its price plummeting alongside other digital assets and the stock market on August 5th. Several factors triggered this sell-off, including weaker-than-expected economic data on August 2 and an unexpected interest rate hike in Japan. These events sparked panic in Asian markets, leading investors to liquidate high-risk assets like Bitcoin.

Despite a brief recovery, Bitcoin continued to fluctuate throughout August, dropping to US$58,430 on the weekend of August 10 and 11, and experiencing further price swings between US$60,700 and US$56,700. While positive inflation data boosted the stock market, Bitcoin struggled to break past a US$60,000 ceiling.

A brief rally on August 23rd, prompted by the Federal Reserve's signal to begin lowering interest rates, was quickly followed by another price drop. This pattern of rallies and subsequent declines persisted for the remainder of August and most of September. Bitcoin ended the month at just above US$64,540.

During the lead up to the 2024 US presidential election had a notable affect on Bitcoin's price movements, with the Republican party generally seen as more "crypto-friendly" than the Democrats. On October 28, PolyMarket, bettors favored Trump with a 66.1 percent probability of winning compared to Harris’ 33.8 percent. This translated into a 7 percent gain in a little over 24 hours on October 29 to flirt with the previous all-time high, coming in at US$73,295.

A few days later on November 3, Trump’s lead would seemingly narrow with the gap closing to 55 percent for Trump and 44.3 percent for Harris. The Bitcoin price responded by dropping to US$67,874 on November 4.

Bitcoin set a then high price on November 6, 2024, when it reached US$76,243 per BTC at 4:00 p.m. EST. This price came after the 45th US President Donald Trump made a stunning political comeback to become the 47th US President. His retaking of the presidency was heralded as hugely positive for the cryptocurrency market.

“We have a #Bitcoin President,” Michael Saylor, founder of Bitcoin development company Strategy (NASDAQ:MSTR), posted on X.

Bitcoin crossed the US$100,000 threshold for the first time on December 4, 2024, rising as high as US$103,697.

What was the highest price for Bitcoin?

Bitcoin set a new all-time high price on October 6, 2025, when it reached US$126,198.07 per BTC.

Investor's Business Daily reported that the spike came as the US government shutdown in a gridlock on the budget. Analysts also noted that October is typically a stellar month for double digit gains in the cryptocurrency.

You can learn more about the biggest news driving Bitcoin in the October 6 Crypto Market Update.

What is the Bitcoin price today?

As of December 1, 2025, Bitcoin is trading around the US$87,000 level after spending much of November on a steady decline.

Earlier in 2025, Bitcoin demonstrated its volatile nature when the price of the cryptocurrency fell to as low as US$75,000 per coin by April 7. This represented a key buying opportunity as crypto buffs were anticipating further strength in the market under Trump.

Soon after, the price of Bitcoin was once again on a steady upward path and breached the US$100,000 level on May 8, and reached its new high above US$126,000 in October.

FAQs for investing in Bitcoin

What is a blockchain?

A blockchain is a digitized and decentralized public ledger of all cryptocurrency transactions.

Blockchains are constantly growing as completed blocks are recorded and added in chronological order. The mechanism by which digital currencies are mined, blockchain has become a popular investment space as the technology is increasingly being implemented in business processes across a variety of industries. These include banking, cybersecurity, networking, supply chain management, the Internet of Things, online music, healthcare and insurance.

Is Peter Todd Satoshi Nakamoto?

Canadian software developer Peter Todd has denied he is Satoshi Nakamoto, a claim made by the documentary "Money Electric: The Bitcoin Mystery," which aired on October 8, based on circumstantial evidence such as posts on an early Bitcoin forum and correspondence between Todd and Hal Finney, who received the first Bitcoin from Satoshi.

Aired on HBO, the film by Cullen Hoback features interviews with people involved in Bitcoin's creation and suggests that Todd could be the elusive Satoshi Nakamoto who wrote the 2008 white paper that led to Bitcoin's launch. Reddit posts dating back to 2015 have also suggested that Todd could be Satoshi.

Todd has continuously denied the claim, most recently to multiple media outlets, including CoinDesk and Bloomberg.

How to buy Bitcoin?

Bitcoin can be purchased through a variety of crypto exchange platforms and peer-to-peer crypto trading apps, and then held in a digital wallet. These include Coinbase Global, CoinSmart Financial (OTC Pink:CONMF,NEO:SMRT), BlockFi, Binance and Gemini.

What is the Bitcoin halving?

Unlike traditional currencies that can increase circulation through printing, the number of Bitcoins is finite. This limit is a core function of Bitcoin's algorithm and was designed to offset inflation by maintaining scarcity. There are 21 million in existence, of which 19,952,398 are in circulation as of November 24. This means there are 1,047,602 still unmined.

A new Bitcoin is created when a Bitcoin miner uses highly specialized software to complete a block of transaction verifications on the Bitcoin blockchain. Roughly 900 Bitcoins are currently mined per day; however, after 210,000 blocks are completed, a Bitcoin protocol called a halving automatically reduces the number of new coins issued by half. Halving not only counteracts inflation but also supports the cryptocurrency’s value by ensuring that its price will increase if demand remains the same.

Halvings have occurred every four years since 2012, with the most recent happening on April 19, 2024. The next halving is expected to occur in 2028.

Bitcoin’s halving has significant implications for the cryptocurrency’s mining activity and supply because of how Bitcoin mining works. Currently, miners are paid 3.125 Bitcoin for every block they complete. After the next halving, the pay rate will lower to 1.5625 Bitcoin for every completed block for the next four years.What is Coinbase?

Coinbase Global is a secure online cryptocurrency exchange that makes it easy for investors to buy, sell, transfer and store cryptocurrencies such as Bitcoin.

How does crypto affect the banking industry?

Cryptocurrencies are an alternative to traditional banking, and tend to attract people interested in assets that are outside mainstream systems. According to data from Statista, 53 percent of crypto owners are between the ages of 18 and 34, showing that the industry is drawing younger generations who may be interested in decentralized digital options.

Privacy is a key draw for cryptocurrency owners, as is the fact that they are separated from third parties such as central banks. Additionally, crypto transactions, including purchases, sales and transfers, are often quick and have fewer associated fees than transactions going through the banking system in the typical manner.

That said, banks are starting to notice how popular cryptocurrencies are. As Bitcoin and its compatriots become increasingly mainstream, many banks have begun to invest in cryptocurrencies and blockchain companies themselves.

Is Bitcoin a good investment anymore?

While Bitcoin has reached new heights in 2025, one of its well-known features is its volatility. Investors who are more accepting of risk could look to the cryptocurrency space as there historically has been money to be made, and Bitcoin is regaining value after plummeting in 2022. However, there is also historically money to be lost, and investors who prefer to take smaller risks should look towards other avenues.

For more information on investing in Bitcoin right now, check out our article Is Now a Good Time to Buy Bitcoin?

Who has the most invested in Bitcoin?

Satoshi Nakomoto, the mysterious founder of Bitcoin, is believed to also be the biggest holder of the coin. Analysis into early Bitcoin wallets has revealed that Nakamoto likely owns over 1 million of the nearly 19.5 million Bitcoins in existence.

Does Elon Musk own Bitcoin?

Tesla and Twitter CEO Elon Musk’s association with both Bitcoin and the meme coin Dogecoin is well known, and both his tweets and Tesla’s actions have influenced the cryptocurrencies’ trajectories over the years.

While it is unknown just how much he owns, Musk has disclosed that he personally has holdings of Bitcoin and Dogecoin, as well as Ether. It was revealed in September 2023 that Musk may be funding Dogecoin on the quiet, according to Forbes.

As for Tesla, the company purchased US$1.5 billion of Bitcoin in 2021, but sold 75 percent of that the next year. As of November 2025, the EV maker's Bitcoin holdings were estimated at 11,509 Bitcoin, the twelfth-largest bitcoin holdings for a publicly traded company. In a January 2024 post on his social media platform X, Musk said “I still own a bunch of Dogecoin, and SpaceX owns a bunch of Bitcoin."

This is an updated version of an article first published by the Investing News Network in 2021.

Don’t forget to follow us @INN_Technology for real-time updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

- Larry Lepard: Gold Stocks, Silver, Bitcoin — Prices to Double in 2026? ›

- 2025 Crypto Market: Q3 Review and Forecast ›

- SEC Approves First Spot Bitcoin ETFs; Grayscale, BlackRock Set to Launch Products ›

- Is Now a Good Time to Buy Bitcoin? ›

- 11 Canadian Cryptocurrency ETFs ›