Crypto Market Update: SEC, CFTC Open Door to Spot Crypto Trading on Registered Exchanges

Elsewhere in the crypto space, a Bitcoin treasury company backed by Cameron and Tyler Winklevoss is set to go public in Amsterdam.

Here's a quick recap of the crypto landscape for Wednesday (September 3) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

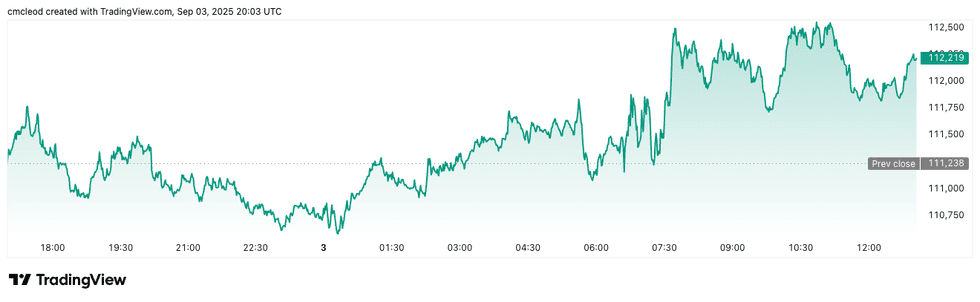

Bitcoin (BTC) was priced at US$112,188, a 1.4 percent increase in 24 hours. Its lowest valuation of the day was US$111,203, and its highest was US$112,502.

Bitcoin price performance, September 3, 2025.

Chart via TradingView.

Crypto sentiment has rebounded after Bitcoin's dip below US$110,000 last week.

According to trader CrypNuevo, the coin's retreat was a "false move." A potential interest rate cut from the US Federal Reserve on September 17 could act as a bullish catalyst for risk assets.

Ether (ETH) was priced at US$4,476.03, up by 4.8 percent over the past 24 hours. Its lowest valuation on Wednesday was US$4,377.97 and its highest was US$4,486.12.

Altcoin price update

- Solana (SOL) was priced at US$210.18, up by 2.4 percent over 24 hours. Its lowest valuation on Wednesday was US$209.09, and its highest level was US$212.41.

- XRP was trading for US$2.86, up by 1.5 percent in the past 24 hours. Its lowest valuation of the day was US$2.85, and its highest price was US$2.88.

- SUI (Sui) was trading for US$3.40, up by 2.6 percent in the past 24 hours, its highest valuation of the day. Its lowest for the day was US$3.3.35.

- Cardano (ADA) was priced at US$0.8405, up by 2.6 percent. Its lowest valuation for Wednesday was US$0.8328, and its highest point was US$0.8417.

Today's crypto news to know

US regulators clear path for spot crypto products

The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) will allow registered exchanges to offer certain spot crypto products, a move that could reshape US digital asset trading.

In a joint statement on Tuesday (September 2), the agencies said exchanges under their oversight will be permitted to facilitate transactions tied to leverage, margin and financed spot retail commodity products.

While no specific coins were named, the message signals a coordinated approach to expanding investor access.

The statement builds on an earlier call for regulatory clarity in digital finance from the president's Working Group on Digital Asset Markets. It also comes as the Trump administration continues rolling back lawsuits and enforcement actions that dogged the cryptocurrency sector under previous leadership.

In a statement posted on X, CFTC Acting Chair Caroline Pham called the decision “another win on regulatory clarity.”

Winklevoss-backed Bitcoin firm to go public in Amsterdam

A Bitcoin treasury company supported by Cameron and Tyler Winklevoss is heading for the public markets in the Netherlands, Reuters reported. It will list via a reverse takeover of Dutch investment vehicle MKB Nedsense.

The firm, called Treasury, will be backed by Winklevoss Capital and Nakamoto Holdings. Treasury has already raised 126 million euros and built a stash of more than 1,000 BTC.

The deal values Treasury at a hefty premium, with plans to consolidate shares at 2.10 euros apiece. Bitcoin-only treasury firms have grown in appeal as the world’s largest cryptocurrency keeps smashing record highs.

While Europe has rolled out several Bitcoin-linked exchange-traded products, investor uptake has lagged behind the US spot exchange-traded fund (ETF) boom. Treasury’s listing places a bold bet that Amsterdam can become a hub for institutional Bitcoin holdings, with trading set to start under the ticker TRSR.

CFTC grants Polymarket regulatory clarity for US relaunch

In a Wednesday notice, the CFTC said it has issued a no-action letter to QCX and QC Clearing.

The two entities were recently acquired by prediction market platform Polymarket so that the company could gain the legal and regulatory licenses it needed to operate in the US. This new development essentially gives Polymarket temporary relief from reporting and record-keeping rules for its event contracts.

The letter also provides Polymarket with the regulatory clarity to officially relaunch its platform for users in the US. “This process has been accomplished in record timing,” said CEO Shayne Coplan in an X post. “Stay tuned.”

Bancorp to relaunch digital asset custody services

US Bancorp (NYSE:USB), a prominent financial institution, is restarting its digital asset custody services, specifically targeting institutional investment managers. This strategic move comes as the Trump administration continues its efforts to foster a more crypto-friendly regulatory environment. Previous SEC regulations compelled banks to allocate substantial capital on their balance sheets for cryptocurrency-related activities.

US Bancorp will initially offer Bitcoin custody services, targeting registered investment funds and existing Bitcoin ETF providers. Crypto firm NYDIG will act as the sub-custodian. The bank may broaden its custody offerings to include other cryptocurrencies, provided they meet its stringent internal risk and compliance standards.

Trust Wallet integrates tokenized US stocks and ETFs

Binance co-founder Changpeng CZ Zhao’s Trust Wallet has integrated tokenized US stocks and ETFs through partnerships with Ondo Finance and 1inch. The integration became official on Wednesday following an announcement in June to introduce real-world asset (RWAs), tokens that represent traditional financial assets.

Ondo Finance will provide the tokenized RWA assets, while 1Inch is enhancing the swap functionality to ensure smooth and efficient transactions. The platform supplying the assets launched on the Ethereum blockchain with over 100 tokenized stocks and ETFs, with plans to offer 1,000 by the end of the year.

The company also plans to support BNB Chain and Solana in the near future.

Ethereum Foundation to sell US$43 million in ETH for ecosystem funding

The Ethereum Foundation has announced plans to offload another 10,000 ETH, valued at roughly US$43 million, to finance research, ecosystem grants and philanthropic work. The organization said the tokens will be sold gradually through centralized exchanges rather than in a single transaction, aiming to avoid market disruption.

Just weeks ago, the foundation sold a similar tranche to SharpLink Gaming (NASDAQ:SBET), making that firm the first public company to directly acquire ETH from the network’s core steward. In June, the foundation unveiled a new treasury framework that caps annual spending at 15 percent and builds a long-term reserve buffer.

Ether saw a recent surge in price as it touched a record high of US$4,866 in late August.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.