Copper Price 2023 Year-End Review

Copper started the year strong, but after a series of ups and downs looks set to end the 12 month period fairly flat. Find out what moved the metal in 2023.

2023 hasn’t been the strongest year for copper. Although it started off strong, the base metal has been influenced by supply and demand issues, and prices look set to end the year relatively flat.

Copper has a positive long-term outlook thanks to its place in the green energy transition, where it plays a role in connectivity, electric vehicle (EV) production and even wind power generation. But a weak recovery in top consumer China has dampened the red metal's near-term future, leaving investors hoping for better fundamentals in the new year.

Read on to learn how copper performed in 2023, from prices to supply and demand.

How did copper perform in 2023?

Copper price in Q1

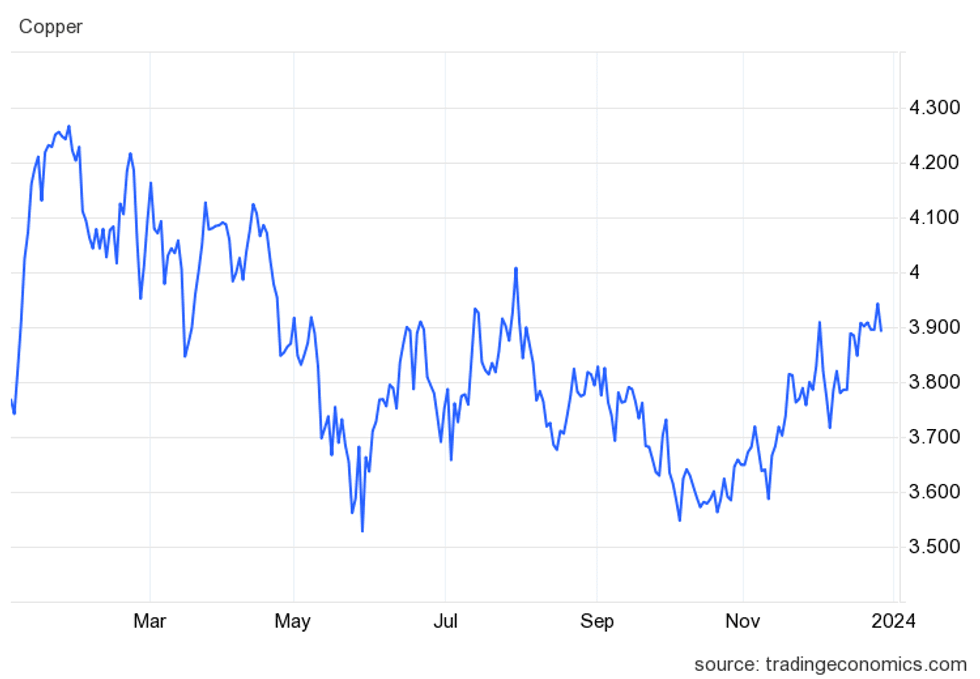

Copper ended 2022 with a slight price decline, but opened the year in a strong position. Coming in at US$8,307.01 per metric ton (MT) on January 3, copper quickly climbed to its yearly high of US$9,406.01 on January 26. The metal saw some mild volatility during the quarter, but remained largely rangebound, staying above the US$8,500 mark.

Copper price from January 3, 2023, to December 28, 2023.

Chart via Trading Economics.

Copper price in Q2

The high point for copper in the second quarter came on April 13, when it reached US$9,091.85; however, the red metal saw a precipitous decline after that point, reaching its yearly low of US$7,778.56 on May 29. This slump came on the back of lower demand for copper from the Chinese real estate sector.

After gaining through the first half of June following a retreat in the US dollar, copper closed Q2 at US$8,270.63.

Copper price in Q3

The start of Q3 saw copper fluctuate along with volatility in the dollar, and the metal reached its quarterly high of US$8,836.12 on July 31. Copper started to decline after that point as the dollar gained strength, but saw a slight rebound in the middle of August as fund managers went long on copper. Ultimately, short positions won out, and copper took a downturn at the end of the month as China continued to experience real estate sector issues.

The third quarter also brought some closure to a situation in Peru, the world's second largest copper-producing nation. Q1 was marked by a series of deadly mining protests in the country — they began in late 2022 and continued through March, leading to a 25 percent year-on-year drop in mining exports from the country in January.

While the protests slowed in the second quarter, they flared up once again in mid-July and into August, this time coordinated by mining workers and unions who demanded the resignation of President Dina Boluarte. However, the latest round of protests was largely confined to the nation’s capital of Lima, limiting effects on the mining sector.

After months of unrest, Peruvian Prime Minister Alberto Otarola pledged at the end of September to crack down on the chaos and instability. Industry insiders have noted that the country remains weak in its effectiveness in curbing the protests, and there is uncertainty around government stability as well as industry regulations and red tape.

Despite these issues, copper production in Peru increased by around 19 percent during the first three quarters of the year compared to the same period in 2022. In an email to the Investing News Network, Federico Gay, senior mining analyst at Refinitiv, noted that these production increases were largely due to new mining operations coming online or reaching capacity in Peru in 2023, including Anglo American’s (LSE:AAL,OTCQX:AAUKF) Quellaveco.

This increased production will help Peru retain its position as a major copper producer for the time being. “We estimate Peru will remain the second largest producer for the next couple of years,” Gay explained, “but the Democratic Republic of Congo, currently the third largest producer, is threatening to take Peru’s place in the future.”

The price of copper continued to slide into the end of the quarter, reaching US$8,226.54 on September 29.

Copper price in Q4

The fourth quarter saw copper prices begin to rebound as Chinese stockpiles dropped to 13 month lows and inventories held by the London Metal Exchange declined followimg an increase in mid-July.

Copper saw further gains as major miner First Quantum Minerals (TSX:FM,OTC Pink:FQVLF) faced problems at its Panama-based Cobre Panama mine, which accounts for 1 percent of world copper supply.

On October 20, the Panamanian government granted a 20 year mining permit for the Cobre Panama mining concession, with the option for a 20 year extension. In return, the company agreed to pay the government US$375 million per year. However, news of the deal sparked widespread protests by an estimated 250,000 people who were concerned about the mine’s impact on the environment and water supply; they successfully shut operations at the mine down for weeks.

Ultimately, Panama's Supreme Court found the deal to be unconstitutional, and on November 28 Laurentino Cortizo, the country's president, ordered the mine closed. First Quantum is currently looking into legal options for its operations in Panama, but arbitration regarding Cobre Panama is likely to be protracted.

Copper prices reached a quarterly high of US$8,617.86 on December 1.

What other factors impacted copper supply and demand in 2023?

Looking at copper supply and demand in 2023, the International Copper Study Group (ICSG) provides preliminary data in a December press release. It shows that global copper mine production rose by about 1 percent year-on-year over the first 10 months of 2023; meanwhile, refined copper production increased by about 5.5 percent.

With world apparent refined copper usage up by around 4 percent year-on-year from January to October, the ICSG notes that the refined copper market was in an apparent deficit of about 51,000 MT during that time.

As mentioned, prices for copper are influenced by supply, as well as demand from various markets. The largest source of demand is the Chinese housing market, which needs copper for a variety of buildings. While demand from this category has slumped, copper's growing applications in the energy transition are providing support.

A primary contributor to this demand has been utility-scale power-generating operations like wind farms, which require between 3.5 and 9.6 MT of copper per megawatt of power generation, and photovoltaic plants, which can contain more than 5 MT of copper per megawatt. Demand from the automotive industry has also been increasing — with more nations phasing out gas engines, EVs are placing additional strain on copper supply.

That said, it's worth noting that EV makers are looking for alternatives to the red metal. Experts believe demand from the sector may not be as high as was previously forecast if new innovations reduce the amount needed per EV.

Investor takeaway

In October, the ICSG was anticipating a copper surplus of 467,000 MT in 2024 as new mines and smelters come online, but this estimate came before the closure of First Quantum’s Cobre Panama erased more than 300,000 MT of supply.

Since the mine was taken offline, firms like BMO Capital markets and Goldman Sachs (NYSE:GS) have updated their forecasts. The former is now calling for a small refined copper deficit in 2024, while the latter expects supply to fall short of demand by more than 500,000 MT. Jefferies Financial Group (NYSE:JEF) also expects a large copper deficit next year.

“Disruptions have significantly increased, and a market deficit is now increasingly likely,” BNN Bloomberg quotes Jefferies as saying. “We could be at the foothills of the next copper cycle.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.