Tech 5: Tech Earnings Season Kicks Off as Tesla and IBM Report Results

Meanwhile, the Bitcoin price started the week strong only to end lower, and an Apple exec teased a big announcement.

Tech investors navigated a complex landscape marked by political uncertainty and mixed economic signals.

The Bank of Canada cut interest rates by 50 basis points on Wednesday (October 23), and the US Leading Economic Index declined, signaling potential economic slowing. Meanwhile, the US Federal Reserve's Beige Book showed that economic activity was little changed since the last report, with some areas seeing modest growth and others slowing.

Yields for 10 year Treasuries initially rose, leading to a decline in crypto prices and hurting tech stocks, but Tesla's (NASDAQ:TSLA) strong earnings and declining yields later in the week boosted the sector.

Market watchers are now looking ahead to quarterly earnings reports from major tech companies. Stay informed on the latest developments in the tech world with the Investing News Network's round-up below.

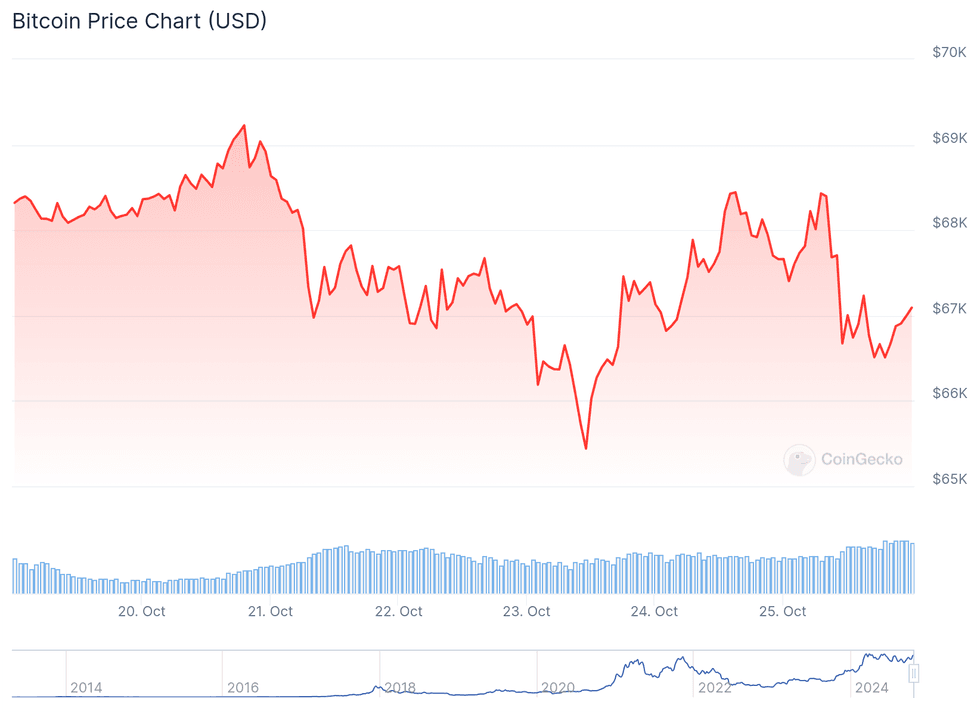

1. Bitcoin starts strong, but ends down

The CoinDesk 20 Index (INDEXNYSEGIS:CDI20) started the week up 1.17 percent in 24 hours, with Bitcoin priced at nearly US$70,000 as trading commenced in Asia. The surge corresponded with an increase in open interest for Bitcoin futures, which hit a new record high of US$40.43 billion on Monday (October 21).

Augustine Fan, head of insights at the DeFi infrastructure firm SOFA, told CoinDesk in a Telegram note that day that the current pattern points to growing bullish sentiment in the market.

Meanwhile, the estimated leverage ratio — an open interest-based ratio tracked by CryptoQuant — was showing increased leverage, indicating that traders were starting the week with an appetite for risk.

Bitcoin performance, October 19 to 25, 2024.

Chart via CoinGecko.

However, the upward trend had reversed by Tuesday (October 22), with the weekend's gains disappearing.

As mentioned, rising Treasury yields drove crypto prices down, erasing 2 percent from the sector's total market cap. According to data tracked by CoinGlass, over US$165 million in long positions were liquidated.

Bitcoin exchange-traded funds also recorded their first net outflows in two weeks.

Bitcoin’s price continued to tumble on Wednesday, dropping to US$66,444 following the release of the Fed’s Beige Book data, which shows slow growth in the employment sector and slightly high prices for necessities like food and housing. The data fueled lingering inflation concerns and supported the argument for a smaller rate cut in November.

2. Tesla leaps after quarterly results release

Elon Musk's Tesla showed off its strongest quarterly report in a year after Wednesday's close.

The company produced about 70,000 vehicles and delivered 463,000, exceeding Q2 figures. Its GAAP net income reached US$2.2 billion, surpassing the previous quarter's US$1.5 billion. While total revenue of US$25.18 million saw a slight decrease from Q2, automotive revenue showed year-on-year and quarterly growth, reaching US$20.12 million.

Operating cashflow increased substantially, reaching US$6.3 billion compared to Q2's US$3.6 billion. GAAP earnings per share for Q3 were US$0.62, significantly higher than last quarter and the previous year.

Tesla’s share price has experienced significant swings this year as the company has adjusted timelines for several of its key products, including Full Self-Driving, new vehicle models, its robotaxi program and its humanoid robot Optimus. The National Highway Traffic Safety Administration has also launched several probes into the company’s self-driving technology following a series of traffic accidents involving Teslas.

Tesla performance, October 21 to 25, 2024.

Chart via Google Finance.

Shares ended Wednesday at US$213.65 ahead of the report’s release, down 2.45 percent from the week's start.

However, Tesla jumped by 12 percent in after-hours trading, boosted by the significant difference in cashflow and Musk’s confident forecast of a rise in vehicle deliveries by year's end. The company also confirmed that its timeline for new, affordable models remains on track, with production set to begin in the first half of 2025.

The report sparked a rebound in tech stocks after troubling Beige Book data and a rise in 10 year Treasury yields. For its part, Tesla finished the week up more than 22 percent.

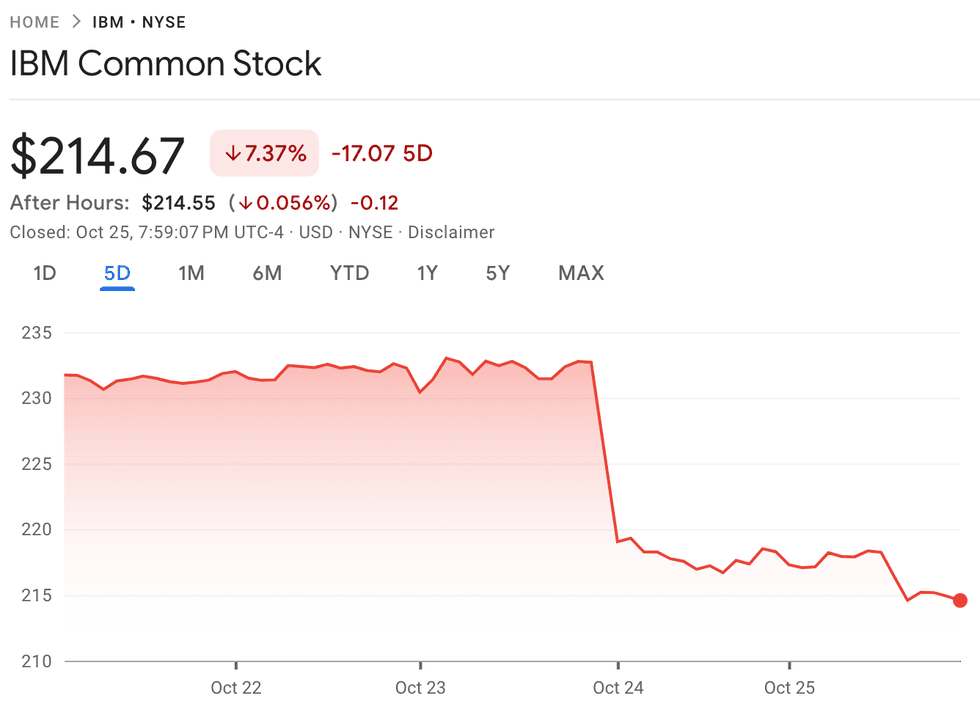

3. IBM's quarterly results fail to impress

Also on Wednesday, IBM (NYSE:IBM) released its Q3 earnings report.

Its performance was driven by a 9.7 percent year-on-year increase in software revenues, with a notable 14 percent contribution coming from Red Hat, a subsidiary acquired by IBM in 2019.

Overall, the tech giant's Q3 revenue saw a modest 1 percent increase year-on-year, reaching US$15 billion, slightly below projected estimates of US$15.07 billion. Adjusted earnings per share showed stronger year-on-year growth of 5 percent, reaching US$2.30. IBM also highlighted its generative artificial intelligence (AI) segment.

"Our generative AI book of business now stands at more than $3 billion, up more than $1 billion quarter to quarter," said Arvind Krishna, the company's chairman, president and CEO.

"Heading into the final quarter of 2024, we expect fourth-quarter constant currency revenue growth to be consistent with the third quarter, with continued strength in Software. We are confident in our ability to deliver more than US$12 billion in free cash flow for the year, driven by continued expansion of our operating margins," he added.

IBM performance, October 21 to 25, 2024.

Chart via Google Finance.

Shares of IBM fell 5.87 percent to US$219.05 at the opening bell on Thursday. The company finished the week 7.77 percent below its peak price of US$233.01, which came on Wednesday.

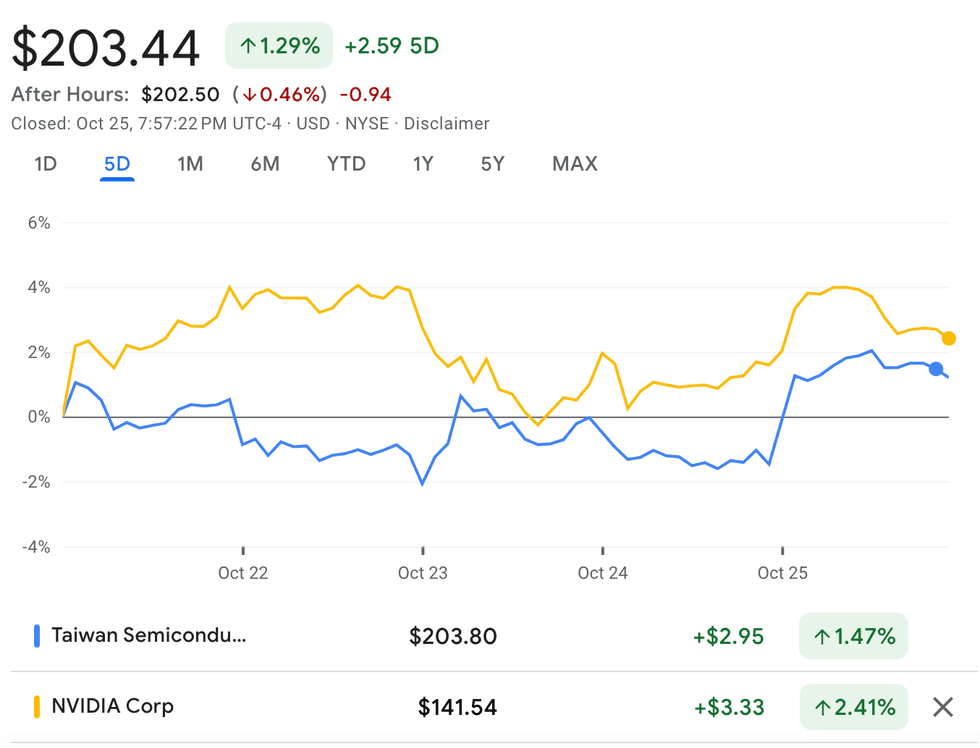

4. NVIDIA and TSMC resolve chip design issue

On Wednesday, NVIDIA (NASDAQ:NVDA) announced the resolution of a design problem that delayed the production of its newest Blackwell chips, which were revealed in March and expected to be released sometime in Q2.

CEO Jensen Huang said the flaw was “100 percent NVIDIA's fault” and credited its collaborative partner, Taiwan Semiconductor Manufacturing Corporation (TSMC) (NYSE:TSM), for its assistance resolving the issue.

"What TSMC did, was to help us recover from that yield difficulty and resume the manufacturing of Blackwell at an incredible pace," Huang told an audience in Denmark, where he was launching a new supercomputer built by NVIDIA in collaboration with the Novo Nordisk Foundation and Denmark’s Export and Investment Fund.

The market responded by sending the company’s share price up over 2 percent in the final hours of trading on Wednesday. Shares of NVIDIA are up 2.66 percent for the week, and the company even briefly dethroned Apple (NASDAQ:APPL) as the world’s most valuable company on Friday (October 25) afternoon.

Analysts at Morgan Stanley (NYSE:MS) have projected that NVIDIA could produce up to 450,000 Blackwell GPUs in the fourth quarter. TSMC is NVIDIA's primary chip manufacturer, and its advanced manufacturing technology is crucial when it comes to meeting demand from NVIDIA's long list of customers, which includes tech mega corporations Alphabet (NASDAQ:GOOGL), Meta (NASDAQ:META) and Amazon (NASDAQ:AMZN).

TSMC and NVIDIA performance, October 21 to 25, 2024.

Chart via Google Finance.

TSMC’s strong Q3 results, released last week, were largely driven by demand for its manufacturing process, which uses EUV lithography to fabricate chips with higher precision. During a recent presentation for the Potomac Institute for Policy Studies, Rick Cassidy, president of TSMC’s California-based US division, reportedly told listeners that chip yield at an Arizona plant has exceeded that of similar factories in Taiwan by 4 percent.

TSMC is in line to receive US$11.5 billion in US government grants and loans, and it qualifies for a 25 percent tax credit under the CHIPS Act, which will better position it to capitalize on the growing demand for advanced AI chips.

5. Apple exec teases announcement next week

Apple is preparing to drop major news next week, according to Greg Joswiak, the company’s senior vice president of worldwide marketing, who teased a “week of announcement” on X, formerly Twitter, on Thursday morning.

Although no details have been released, Bloomberg reported that the company will likely roll out a line of new AI Macbooks and a newly redesigned Mac mini powered by Apple’s newest M4 chip.

Also next week, Apple is set to update its iOS system with Apple Intelligence, the company's homegrown AI platform. The update will be available for: all Macs with Apple silicon M1 and M2 chips; iPad Pro and iPad Air models with M1 chips or later; and the iPhone 15 Pro, iPhone 15 Pro Max and newly released iPhone 16 series.

The market gave a muted response to the news, which came a day after tech stocks declined on the back of rising 10 year Treasury yields. Some of Apple’s product rollouts earlier this year failed to generate significant consumer enthusiasm, and Apple is lagging behind its competitors in on-device AI capabilities.

By the end of the trading week, Apple's share price had decreased by 1.38 percent, closing at US$231.41.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.