Tech 5: Softbank to Invest US$2 Billion in Intel, Figure Seeks Nasdaq IPO

Elsewhere in the tech space, Google increased its stake in TeraWulf and NVIDIA faced share price turmoil amid US-China tensions.

A broad selloff in heavyweight tech stocks at the start of the week abruptly reversed after US Federal Reserve Chair Jerome Powell delivered a speech that bolstered expectations of a September interest rate cut.

Speaking at the Jackson Hole Economic Policy Symposium, Powell took a more dovish tone than investors may have been expecting, noting a slowdown in both worker supply and demand that could lead to employment risks.

He stated that the shifting balance of risks may warrant adjusting the Fed’s policy stance, stressing the need to balance both sides of the central bank's dual mandate when goals are in tension.

This is a change from the Fed's previous stance, which had been more focused on the need to keep rates high to fight inflation. Powell acknowledged the visible, though likely temporary, effects of tariffs, cautioning about the potential for persistent inflation, but signaled that the Fed is now also seriously considering downside risks to employment.

A risk-on rally ensued, impacting various markets: the S&P 500 (INDEXSP:.INX), Dow Jones Industrial Average (INDEXDJX:.DJI) and Nasdaq Composite (INDEXNASDAQ:.IXIC) all closed up by more than 1.5 percent.

Bitcoin climbed above US$116,800, the Russell 2000 Index (INDEXRUSSELL:RUT) surged by 3.9 percent and 10 year treasury yields decreased by 0.07 percentage points to 4.26 percent. Traders now have higher expectations for a September rate cut, with probabilities exceeding 83 percent, as per CME Group's (NASDAQ:CME) FedWatch tool.

Here's a look at the other drivers that shaped the tech sector this week.

1. Softbank to invest US$2 billion in Intel

Intel's (NASDAQ:INTC) share price got a boost this week after a series of major announcements, beginning with SoftBank Group’s (TSE:9984) Monday (August 18) announcement that it plans invest US$2 billion in the company.

“Semiconductors are the foundation of every industry. For more than 50 years, Intel has been a trusted leader in innovation," said Masayoshi Son, chairman and CEO of SoftBank, in a press release.

"This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” he added.

Following that news, sources confirmed last week’s reports that the US government was seeking an equity stake in Intel in exchange for Biden-era Chips Act funding. Then, on Friday (August 22), US Secretary of Commerce Howard Lutnick announced that Intel had agreed to sell an 8.9 percent stake to the federal government, a move that will convert billions of dollars in previously awarded grants into a passive ownership stake.

Intel performance, July 28 to August 18, 2025.

Chart via Google Finance.

These developments have sent Intel’s market value soaring, with its share price increasing over 28 percent from the start of the month. Shares of Intel closed up on Friday at US$24.80.

2. Figure files for Nasdaq IPO

Figure Technology filed for an initial public offering (IPO) on the Nasdaq on Monday under the ticker symbol FIGR, joining a growing list of crypto-related companies looking to access public markets following the successful debut of stablecoin issuer Circle Internet Group (NYSE:CRCL).

Figure leverages blockchain to streamline financial services. The company's filing reveals a strong financial performance, with profit reaching US$29 million in the first half of 2025, compared to a US$13 million loss in the same period last year. Its revenue for the first half of the year was US$191 million.

Goldman Sachs (NYSE:GS), Jefferies Financial Group (NYSE:JEF) and Bank of America Securities are acting as lead underwriters for the offering. The number of shares and price ranges are yet to be confirmed.

3. Google unveils new Pixel and more

Google (NASDAQ:GOOGL) made headlines this week with several new developments spanning its business lines.

The week kicked off with the tech giant announcing it has increased its stake in data center operator and Bitcoin miner TeraWulf (NASDAQ:WULF) to roughly 14 percent, worth US$3.2 billion.

The company also revealed a partnership with advanced nuclear startup Kairos Power and the Tennessee Valley Authority to power its data centers in Tennessee and Alabama using a new nuclear reactor.

On Wednesday (August 20), Google unveiled its latest Pixel smartphone, the Pixel 10, and accessories, with upgrades including a health coach powered by artificial intelligence (AI).

The week culminated with reports of a US$10 billion cloud computing agreement with Meta Platforms (NASDAQ:META) to provide the necessary servers and infrastructure for Meta's expanding AI operations. The news sent Google's share price up by over 3 percent and Meta's up by over 2 percent.

4. NVIDIA tumbles amid China tension and chip sales

NVIDIA (NASDAQ:NVDA) experienced a volatile week, with its share price slipping in early trading on Monday following reports of renewed tensions with China. The downturn was triggered by news that Beijing will move to restrict sales of the H20 AI chip, the company’s most advanced product approved for the Chinese market.

China’s internet and telecom regulator, as well as the state planning agency, issued informal guidance to major tech companies, instructing them to halt new orders of the H20 chips, citing security concerns.

According to unnamed officials who spoke to the Financial Times, the decision was also influenced by “insulting” remarks from US Secretary of Commerce Howard Lutnick.

In response to the Chinese directive, NVIDIA has reportedly instructed its component suppliers, including Foxconn Technology (TPE:2354), Samsung Electronics (KRX:005930) and Amkor Technology (NASDAQ:AMKR), to suspend production of the H20 chip; the company also said it is working on a new AI chip for China.

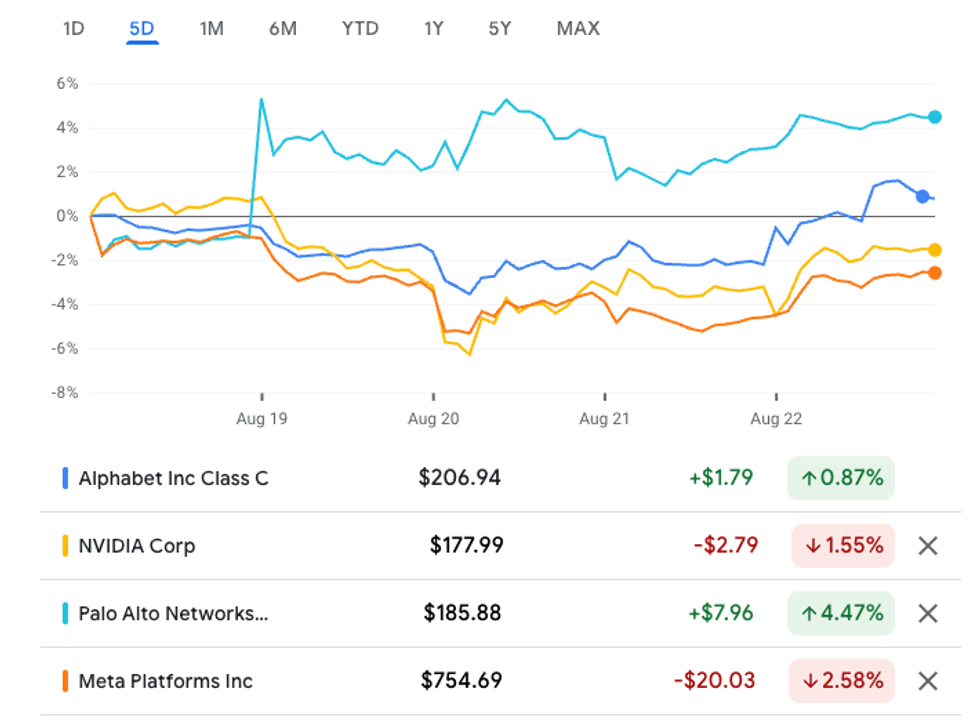

Alphabet, NVIDIA, Palo Alto Networks and Meta Platforms performance, August 19 to 22, 2025.

Chart via Google Finance.

NVIDIA saw the greatest losses midweek, falling over 4 percent between Tuesday and Thursday. The company recovered some of its losses during Friday’s rally, but finished the week over one percent lower.

5. Palo Alto Networks rises on strong forecast

Palo Alto Networks (NASDAQ:PANW) surged over 7 percent on Tuesday after the cybersecurity company forecast that revenue and profit for its 2026 financial year will come in above estimates.

The company gave a strong performance in its 2025 fiscal year, with total revenue increasing 15 percent year-on-year to US$9.2 billion, fueled by an increase in revenue from newer, cloud-based security products. This growth occurred alongside a 24 percent rise in its future contracted business to US$15.8 billion.

The company also surpassed a US$10 billion revenue run rate while maintaining its “Rule-of-50” status — a measure of the balance between growth and profitability — for the fifth consecutive year.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.