Investor Insight

Leveraging its long-history and reputation as a cable manufacturer, Energy Technologies’ (EGY) push to capitalize on the growing renewable energy sector through strategic global partnerships present a compelling investment opportunity.

Company Highlights

- Energy Technologies produces low-, medium-, and high-voltage cables, with over 90 percent of its materials sourced locally in Australia.

- The company is strategically aligned with electrification and renewable energy trends, catering to infrastructure, solar, wind and mining industries.

- Key partnerships with Gantner Instruments and Tratos Group expand its product offerings for solar farms, wind turbines and subsea transmission lines.

- The company’s partnerships position it as a comprehensive supplier for large-scale renewable energy projects, projected to grow to AU$6 billion annually by 2034.

Overview

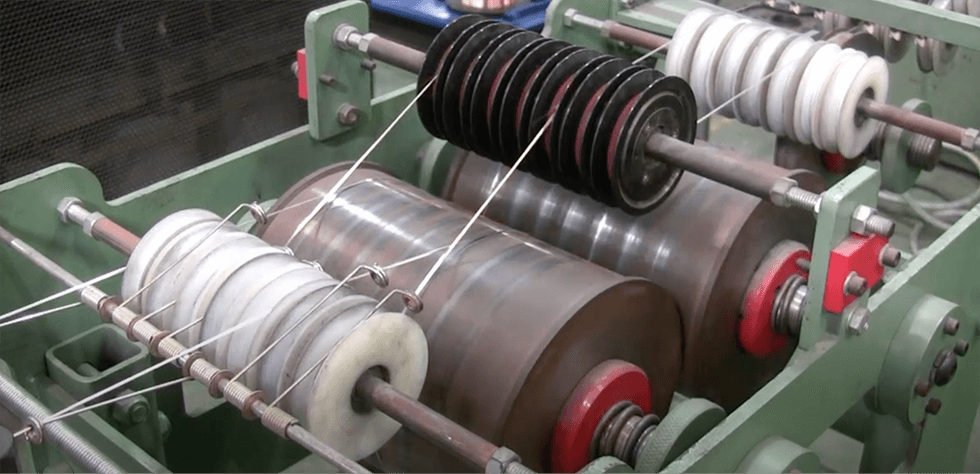

Australia-based Energy Technologies (ASX:EGY) has a strong foothold in the manufacture and distribution of copper-insulated cables through its wholly owned subsidiary, Bambach Wires and Cables. Since its acquisition by Energy Technologies, the company has served as a cornerstone of the company’s operations. Founded in 1936, the company is the oldest cable manufacturer in Australia, and its extensive history underpins a reputation for reliability and quality. With a manufacturing facility in Rosedale, Victoria, and sales offices in New South Wales, Western Australia, and Victoria, the company provides comprehensive solutions tailored to the needs of critical sectors including infrastructure, renewable energy, defense and mining. Energy Technologies’ commitment to supporting Australian industry is reflected in its products. Over 90 percent of raw materials used for its cable products, like copper and plastic, are locally sourced.

Energy Technologies employs a balanced strategy of manufacturing and purchasing cables for sale. The company focuses its factory operations on higher-margin product lines, while lower-margin cables are sourced from strategic manufacturers located around the globe, coupled with a wholesale distribution department, which capitalises on complimentary products & services in strategic market segments. This approach enhances cash flow management and operational efficiency.

The company’s Rosedale facility is a significant upgrade in its manufacturing capabilities. Situated on 122 acres, this location provides ample space for future expansion. The plant’s high level of automation supports production efficiency, processing up to 250 tonnes of copper monthly, with room for additional capacity if demand rises.

*Disclaimer: This profile is sponsored by Energy Technologies ( ASX:EGY ). This profile provides information which was sourced by the Investing News Network (INN) and approved by Energy Technologies in order to help investors learn more about the company. Energy Technologies is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Energy Technologies and seek advice from a qualified investment advisor.