Hydrogen Stocks: 9 Biggest Companies

Investor Insight

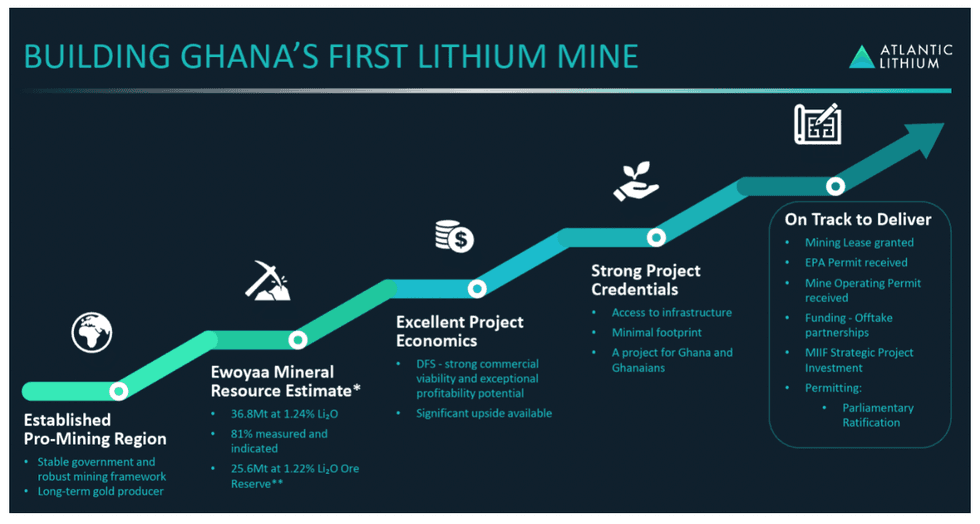

Atlantic Lithium is advancing Ghana’s first lithium mine at Ewoyaa, a fully permitted, strategically located project ready to supply global battery markets. With strong local support and a clear path to production, the company is positioned for near-term growth and long-term impact in the energy transition.

Overview

Atlantic Lithium (AIM:ALL,ASX: A11,GSE:ALLGH,OTCQX: ALLIF) is an Africa-focused lithium exploration and development company advancing its flagship Ewoyaa Lithium project through to production as Ghana’s first lithium mine.

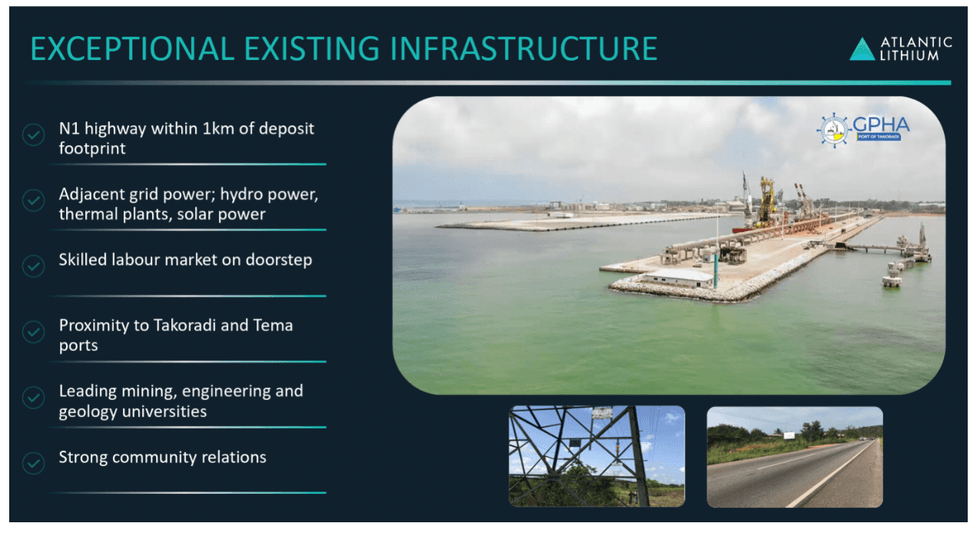

Despite its long mining history, favourable regulatory climate and stable political backdrop, Ghana remains largely overlooked as an investment jurisdiction for battery metals. Situated on the West African coast, the country boasts a strong strategic location, between Europe, the Americas and Asia, to serve the global battery metals market. Ghana is also home to an abundance of mineral wealth, with c. 180,000 tonnes of estimated lithium resources.

Atlantic Lithium intends to produce spodumene concentrate capable of conversion to lithium chemicals for use in electric vehicle batteries and energy storage, aiming to support global decarbonisation.

A definitive feasibility study (DFS) released in June 2023 shows that Ewoyaa has demonstrable economic viability, low capital intensity and excellent profitability.

Through simple open-pit mining, three-stage crushing and conventional Dense Medium Separation (DMS) processing, the DFS outlines the production of 3.6 Mt of spodumene concentrate over a 12-year mine life, which will make it one of the largest spodumene mines by production capacity globally.

The Ewoyaa Lithium Project was awarded a Mining Lease in October 2023, an EPA Permit in September 2024, and a Mine Operating Permit in October 2024.

Having secured all of the permits required to begin construction, Atlantic Lithium currently awaits parliamentary ratification of the Ewoyaa Mining Lease, which was issued by the Ministry of Lands and Natural Resources in October 2023.

The JORC mineral resource estimate at Ewoyaa now stands at 36.8 million tons (Mt) at 1.24 percent lithium oxide, 81 of which is now in the higher confidence measured and indicated categories (3.7 Mt at 1.37 percent lithium oxide in the measured category, 26.1 Mt at 1.24 percent lithium oxide in the indicated category, and 7 Mt at 1.15 percent lithium oxide in the Inferred category).

The residents of the project-affected communities in Ghana’s Central Region have voiced their strong support from the advancement of the project towards production.

Atlantic Lithium’s Ewoyaa Lithium Project site

Project Funding

The development of the project is co-funded under an agreement with NASDAQ and ASX-listed Piedmont Lithium (ASX: PLL), under which Piedmont is required to contribute the first US$70m of Development Costs, as defined in the agreement, as sole funding to complete its earn-in to 50% of Atlantic Lithium's ownership of the project, with all Development Costs and other project expenditure equally shared by both Atlantic Lithium and Piedmont thereafter.

In accordance with the agreement, which is intended to result in the construction of the project and the achievement of initial spodumene production, Piedmont will earn the rights to 50 percent of all spodumene concentrate produced at Ewoyaa at market rates, providing a route to consumers through several major battery manufacturers, including Tesla.

The Minerals Income Investment Fund (MIIF), Ghana’s minerals sovereign wealth fund, has also agreed to invest US$27.9 million at project-level to acquire a 6% contributing interest in the project and Atlantic Lithium’s Ghana Portfolio. The project-level investment represents Stage 2 of its Strategic Investment in the company.

This follows Stage 1 of its Strategic Investment, comprising MIIF’s Subscription for US$5 million Atlantic Lithium shares, which was completed in January 2024, resulting in MIIF becoming a major strategic shareholder in the company.

MIIF’s Strategic Investment is intended to expedite the development of the project towards production.

In addition, noting that Ewoyaa is one of the most advanced undeveloped hard rock lithium projects globally, Atlantic Lithium continues to engage with parties across the battery metals supply chain who express inbound interest in lithium products from Ewoyaa.

In doing so, Atlantic Lithium aims to expedite and de-risk the development of the Project, realise attractive terms for any offtake contracted and secure well-credentialled partners that will support the company's and Ghana's objectives of supplying lithium into the global market.

Ghana

Ghana is a well-established mining region with access to reliable, existing infrastructure and a significant mining workforce. There are currently 16 operating mines in the country.

Already the largest taxpayer and employer in Ghana’s Central Region, Atlantic Lithium is expected to provide direct employment to over 900 personnel at Ewoyaa and, through its community development fund, whereby 1 percent of revenues will be allocated to local initiatives, will deliver long-lasting benefits to the region and Ghana.

Through its proven lithium discovery, exploration and evaluation methodologies, Atlantic Lithium has the potential to capitalise on its extensive exploration portfolio and deliver upon its objectives of becoming a leading producer of lithium in West Africa.

Get access to more exclusive Lithium Investing Stock profiles here