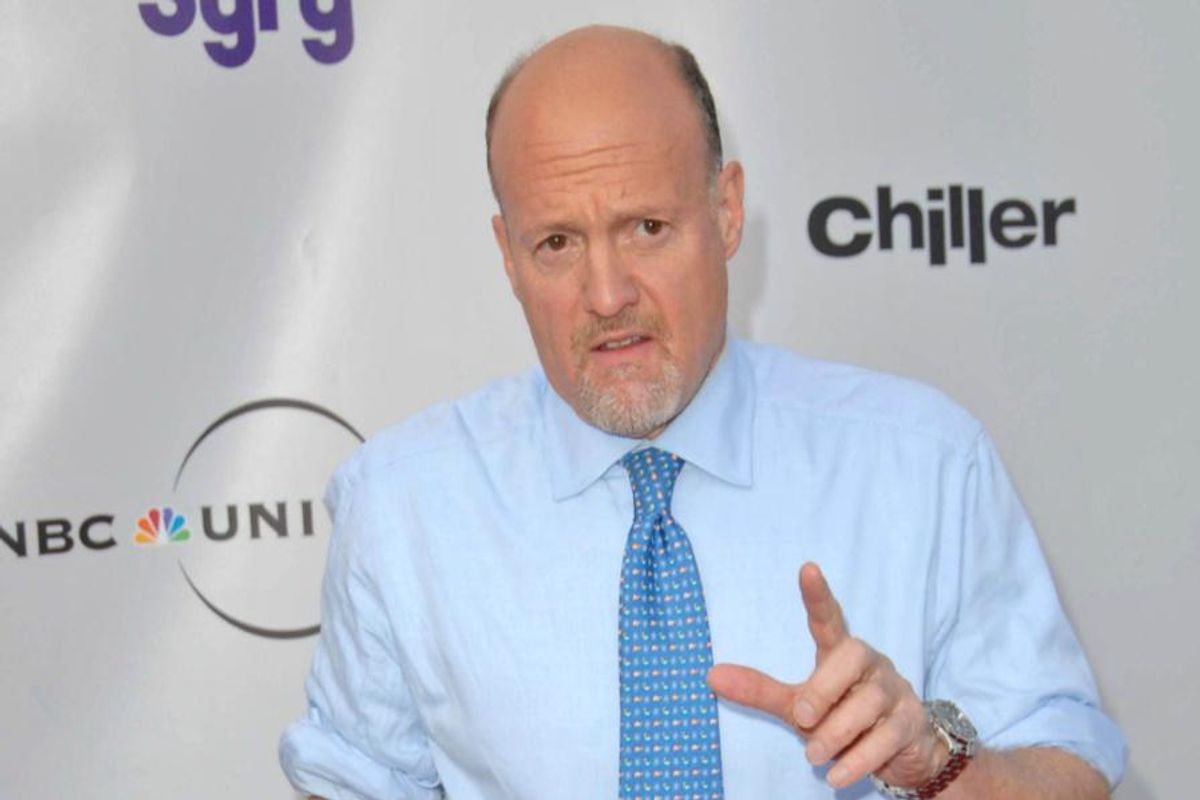

Is Gold a Buy? Jim Cramer Says Timing Looks "Perfect"

According to "Mad Money" host Jim Cramer, the charts indicate that now could be an ideal time to buy into the yellow metal.

As volatility reigns supreme across equity markets, many analysts are saying that gold’s fall below US$1,800 per ounce means it’s a good time to buy before the price goes up.

Gold's dip under that threshold began at the beginning of July, and is the first time the yellow metal has slipped below and held at that level since late 2021. The decline comes after gold breached US$2,000 in early March.

Many market participants remain resolute that it’s only a matter of time before gold regains its lost momentum, and that sentiment was echoed on Wednesday (August 3) by well-known TV personality Jim Cramer during the "Off the Charts" segment of his “Mad Money” investing show on CNBC.

Using charts developed by commodities and market historian Larry Williams, Cramer posited that gold is about to rally and investors should get on board. “The charts … suggest that the general public’s giving up on gold en masse and (Williams) thinks that that makes it the perfect entry time to do some buying,” he said.

Activity from speculators a positive indicator

Cramer explained that Williams believes too much bullishness from small speculators can indicate the top of a commodities cycle; conversely, when these same speculators take an aggressively bearish stance, that means a cycle bottom has been reached or is approaching.

This was most recently evidenced in early March of this year, when small speculators were in their biggest net long position in four years — this coincided with gold’s rally past US$2,000 that month. Currently, small speculators are in their smallest long position since May 2019, which was just before another gold price rally.

Gold could rise moving forward from its status as a hedge against inflation and a store of wealth. The precious metal could also get traction from issues like continued geopolitical uncertainty and recession concerns.

Gold price already back on the move

Gold’s July decline has already begun to reverse course. The metal began to move upward midway through the month, and got a bigger push after the US Federal Reserve’s recent interest rate hike, which brought the cost of borrowing up 0.75 percentage points to a range of 2.25 to 2.5 percent.

Click the links to read about the metal's performance in Q1 and Q2, and about the best-performing gold stocks so far this year on the TSX and TSXV.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.