Gold Price Update: Q3 2024 in Review

Oct. 16, 2024 02:00PM PST

The gold price rose to all-time highs in the third quarter. What caused the metal's record run, and what comes next?

Thichaa / Shutterstock

Gold's record-breaking price rise continued in the third quarter of the year, with the yellow metal soaring above US$2,600 per ounce for the first time in September and then moving even higher.

Critical support for the precious metal came in the form of a 50 basis point interest rate cut by the US Federal Reserve on September 18. Speaking about the much-anticipated reduction, Chair Jerome Powell cited better balance as the once-hot labor market showed signs of cooling and inflation eased closer to the central bank's 2 percent target.

Adding fuel to gold’s momentum was geopolitical uncertainty, which pushed some investors to seek out safe havens. The main contributing factor was the escalation of tensions in the conflict between Israel and Gaza.

Read on for more on gold's Q3 price drivers and what experts see coming in the months ahead.

How did the gold price perform in Q3?

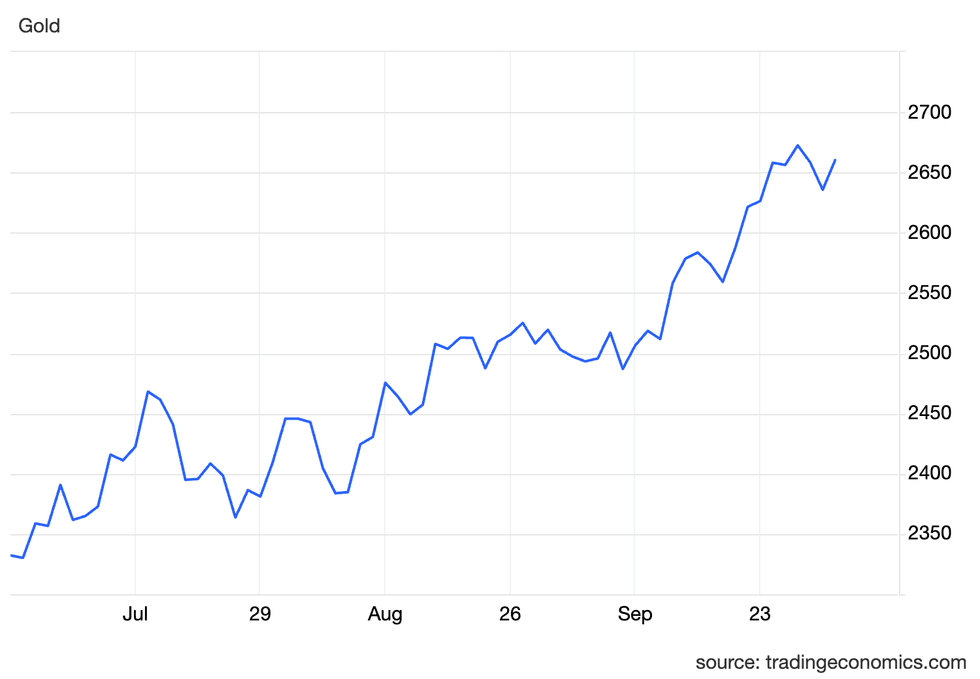

Gold started Q3 at US$2,332.30, quickly moving higher to set a new record of US$2,468.30 on July 17.

Its momentum was fueled by speculation that the Fed might cut rates at its July 30 to 31 meeting.

At the time, Fed Governor Christopher Waller suggested the time for cuts was “drawing closer,” but added that there was still uncertainty, stopping short of saying a reduction would come at the July meeting. Ultimately the Fed didn't end up cutting then, citing the need for more data indicating that inflation was sustainably moving toward 2 percent.

Gold finished the month at US$2,445.70 on July 31.

Gold price, Q3 2024.

Chart via Trading Economics.

The gold price gained at the start of August as a nonfarm payroll report out of the US boosted market watchers' expectations that the Fed's rate cut would come in September. The report indicated that the labor market was weakening faster than expected, and by August 15 gold had breached the US$2,500 mark for the first time.

Gold set yet another new price record of US$2,525.30 on August 27, not long after Powell gave his annual address at the Jackson Hole Economic Symposium, held in Wyoming from August 22 to 24.

He gave his most clear indication that a rate cut was on the way, saying, “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

With a lackluster August US jobs report released on September 6 and inflation nearing 2 percent, analysts' discussions turned to not when a rate cut would occur, but how large it would be.

The question was answered after the Fed's September 17 to 18 meeting, when officials made the decision to slash rates by 50 basis points. In the immediate aftermath, the gold price saw increased volatility; however, the precious metal stabilized and then gained momentum, pushing through the US$2,600 threshold.

Gold set a new record of US$2,672.51 on September 26 before closing the quarter at US$2,635.70. It has seen further gains at the start of Q4, trading in record territory before markets closed on October 16.

Central bank buying providing critical support

While lower rates tend to be positive for gold, the biggest story of the year is still central bank buying.

“I expect the Fed’s rate-cutting cycle to be good for gold, but central bank buying has been and remains a major factor," Lobo Tiggre, CEO of IndependentSpeculator.com, said in an email to the Investing News Network (INN).

That position is supported by data from the World Gold Council. It indicates that purchases from central banks reached record levels in the first half of the year, coming in at 483 metric tons.

This was despite a halt in buying by the People’s Bank of China (PBoC) at the end of Q2. While the PBoC has yet to resume purchases of the precious metal, it granted several regional banks new import quotas in August.

In an email to INN, David Barrett, CEO of the UK division of global brokerage firm EBC Financial Group, also suggested that Fed rate cuts are currently less of a factor for gold than central bank buying. “I still see the global central bank buying as the main driver — as it has been over the last 15 years. This demand removes supply from the market. They are the ultimate buy-and-hold participants and they have been buying massive amounts,” he said.

Additionally, Barrett suggested that even if China's gold buying has slowed down, Turkey, India and Kazakhstan have all continued to purchase at elevated levels, taking up some of the slack.

Both Tiggre and Barrett added that geopolitical uncertainty, especially escalating tensions in the Middle East, could be a driving force that pushes investors toward gold as they seek more security in their portfolios.

Will gold's high price drive M&A activity?

With gold continuing to hit record-high prices, Barrett expressed surprise that there hasn’t been more movement on the M&A front, but offered some potential reasons why it's taking time to kick in.

“I suspect the main reason is the massive rise in production costs and higher interest rates — making capital expenditure in a capital-intensive sector a large drag on the share prices," he explained. "Labor, energy and raw material costs have all risen significantly. Maintaining a mine requires huge upfront investment — the rise in global interest rates, from historically very low levels, means the higher returns from gold prices are still being eaten into by the running costs."

That said, M&A activity in the sector has begun to heat up to some extent. In August, South Africa-based Gold Fields (NYSE:GFI,JSE:GFI) announced plans to acquire Canada’s Osisko Mining (TSX:OSK) for C$2.16 billion. The move would consolidate the Windfall project in Quebec, Canada, which is currently a 50/50 joint venture between the two companies. The deal is expected to be finalized when Osisko shareholders meet in October.

This was followed by the September news that fellow South African gold miner AngloGold Ashanti (NYSE:AU) has entered into an agreement to purchase UK-based Centamin (TSX:CEE,LSE:CEY) for US$2.5 billion.

Tiggre sees an increase in M&A activity as inevitable. “Producers that haven’t been exploring much need to buy viable deposits or they’ll mine themselves out of existence. And historically, yes, that trickles down to exploration,” he said.

Presenters at the latest Metals Investor Forum in Vancouver, BC, said senior producers will first look to companies that already have assets in production or are close to producing, maximizing cashflow before moving on to riskier plays in exploration. However, eventually they may become more interested in junior miners.

This point was echoed by Barrett. “I suspect we will see more consolidation in the sector. The miners with the larger, better-funded balance sheets will look to take advantage of merging operational costs,” he said.

Investor takeaway

Both Tiggre and Barrett see gold continuing to rise through to the end of the year.

“It 'feels' to me that the momentum is growing stronger. Despite the nominal all-time highs this year, the market doesn’t feel 'toppy' yet. So, I expect higher (prices) this year, and probably next year, depending on whether or not gold gets ahead of itself this year,” Tiggre said in his email to INN.

He noted that conflicts in the Middle East and between Russia and Ukraine could boost gold, but also noted that the upcoming US election could provide a leg up for the metal. “Both mainstream candidates' promises are inflationary. That’s bullish for gold, whoever wins. When the election is contested — which it almost certainly will be — it depends on whether the situation boils over into major social unrest. That would likely scare people into safe-haven assets like gold. Short of that, the damage to the social fabric of the US will take longer to play out,” Tiggre explained.

Barrett noted that he sees gold being driven not by speculative interest, but by demand from buy-and-hold players. That suggests the market “has reached a point where any selling or hedging is simply swamped.”

He added that gold's current price level poses a challenge for the average trader.

“Having the confidence to continue to buy after the huge moves seen at these levels is hard. We have seen much more two-way flow since we broke US$2,400; trader confidence to buy and hold is lower,” he said.

Like Tiggre, Barrett anticipates considerable risk in the coming months. “From a market perspective, the election could affect all risk buckets in a material manner. The direction of global conflicts, particularly in the Middle East and Ukraine, seems to hinge on who is the next president. The same could be said for political relationships, especially with China, progress on trade, tariffs and economic stimulus continuing,” he explained via email.

Ultimately, Barrett sees a higher gold price coming as geopolitical and economic uncertainty leads to increased pockets of volatility and demand from central banks continues to support the market.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Affiliate Disclosure: The Investing News Network may earn commission from qualifying purchases or actions made through the links or advertisements on this page.

From Your Site Articles

- Top 5 Gold Stocks on the TSX in 2023 ›

- Top 5 Junior Gold Stocks on the TSXV in 2023 ›

- Gold Price 2023 Year-End Review ›

Related Articles Around the Web

https://twitter.com/INN_Resource

https://www.linkedin.com/in/deanbelder

dbelder@investingnews.com