New World Disorder: Gold Smashes US$5,000 and Silver Soars Above US$100

Precious metals prices are at all-time highs. Gold has broken the US$5,000 level, while silver has overtaken US$100 and platinum is flirting with US$3,000.

Gold and silver prices are skyrocketing past key psychological levels as investors flock to safe-haven assets.

What once seemed like a fairy tale dream shared among ardent gold bugs is now a reality in today's ever-shifting new world order. Gold is now trading above US$5,000 per ounce, while silver is now into the triple digits.

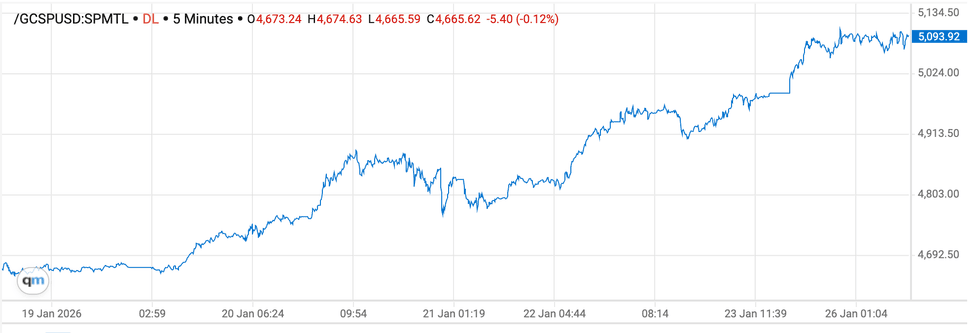

The spot price of gold broke through the US$5,000 mark on Sunday (January 25) and reached as high of US$5,110.23 in early morning trading on Monday (January 26).

Silver also reached a historic milestone, breaking through the US$100 per ounce mark and soaring as high as US$116.37 by 9:49 a.m. PST. Although it is valued as an investment metal, silver is key for technology such as solar panels.

This latest price surge in precious metals comes after US President Donald Trump's threat of 100 percent tariffs on Canadian goods in response to Prime Minister Mark Carney's latest trade deal with US rival China.

Another contributing factor is a possible US government shutdown as the Senate Democrats push back on new funding for the Department of Homeland Security. And there's the US Federal Reserve interest rate decision upcoming on Wednesday (January 28). On top of all that, investors are staring down the barrel of global economic implications of insurmountable debt levels and unresolved trade wars, which have led central banks around the world to bolster their gold reserves.

Gold price chart, January 19 to 26, 2026.

Chart via the Investing News Network.

The yellow metal's latest rise adds to an ongoing historic run.

After starting 2025 around US$2,640, gold had risen to the US$3,200 level by April. It stayed within a fairly flat range until the end of August, when it launched higher once again, breaking US$4,300 in mid-October.

The price of gold took a breather following that move, even falling briefly below US$4,000; however, its retracement was neither as steep nor as long as many market watchers expected it to be.

Gold began gaining steam again in mid-November, and took off again in earnest at the end of 2025.

In 2026, precious metals have continued to benefit from geopolitical tensions and economic uncertainty. Expectations of interest rate cuts after US Federal Reserve Chair Jerome Powell's term ends later this year have provided support too. Trump’s feud with the Fed over rates took an eyebrow-raising turn on January 9, when the US Department of Justice served the Fed with grand jury subpoenas targeting Powell with a criminal indictment.

Last week, gold climbed higher as investors moved out of global stocks after Trump said over the weekend that European nations opposing his bid to acquire Greenland could face tariffs of up to 25 percent.

The nations targeted included France, Germany, the UK, Denmark, Norway, Sweden, the Netherlands and Finland. The news prompted fears of a full-blown US-Europe trade war, a weaker US dollar, higher inflation and a worsening outlook for the global economy. There were even concerns that the conflict over Greenland could seriously weaken or dismantle the NATO alliance. Gold is traditionally used as a hedge against such risks.

Greenland's key geographic position in the Arctic has long been coveted by the US as a necessary strategic asset in its geopolitical struggle with Russia and China. “China and Russia want Greenland, and there is not a thing that Denmark can do about it,” Trump wrote on January 17 on his social media platform Truth Social. “Only the United States of America, under PRESIDENT DONALD J. TRUMP, can play in this game, and very successfully, at that!”

"Gold’s sharp response to tariff-related headlines highlights how market sentiment has shifted away from a narrow focus on growth or inflation, toward policy uncertainty as a primary driver. Tariffs do not only disrupt trade flows; they also pose spillover risks to supply chains, corporate margins, and medium-term growth expectations," Linh Tran, senior market analyst at XS.com, said in a market note shared with the Investing News Network (INN).

"As soon as the probability of escalation increases, defensive capital tends to move preemptively, rather than waiting for tangible impacts to materialize in economic data. In this context, gold functions as a portfolio risk-balancing asset."

European leaders responded with vows that they would not be blackmailed into allowing Trump to take Greenland, and said they were preparing counter measures to the president's tariffs.

"The most realistic option would be for Europe to strike back using the so-called Anti-Coercion Instrument, a legal framework that allows the EU to respond collectively when a third country uses economic pressure to influence EU or member-state policies. Concretely, this could result in retaliatory tariffs — against US Big Tech companies, for example — but also investment restrictions," Ipek Ozkardeskaya, senior analyst at Swissquote, wrote to INN. "That may explain why tech-heavy Nasdaq futures are under heavier downside pressure this morning than Dow Jones futures."

Perhaps the pressure worked, as Trump made a point of stating in his January 21 Davos speech: "I don’t have to use force. I don’t want to use force. I won’t use force."

Elsewhere in the precious metals space, platinum rose to record highs on Monday, reaching US$2,933 per ounce. Palladium is also on a tear, soaring as high as US$2,188 per ounce, although it remains well below its record US$3,440 per ounce set in March 2022.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.