What happened to silver in Q1 2019? Our silver price update outlines key market developments and explores what could happen moving forward.

The silver price took some tumbles during the first quarter of the year. While it managed to hit a high of US$16.04 per ounce on January 30, it was down close to 2 percent over Q1.

Although a softer US dollar, geopolitical issues and a slow in economic growth helped the precious metal stay above some of the lows seen last year, silver was unable to make the same gains that its sister metal gold accomplished in Q1.

However, as the white metal heads into a new quarter, many industry insiders believe that silver is well positioned to climb and may even outperform the yellow metal.

Read on for an overview of the factors that impacted the silver market in Q1, plus a look at what investors should watch out for in the months to come.

Silver price update: Q1 overview

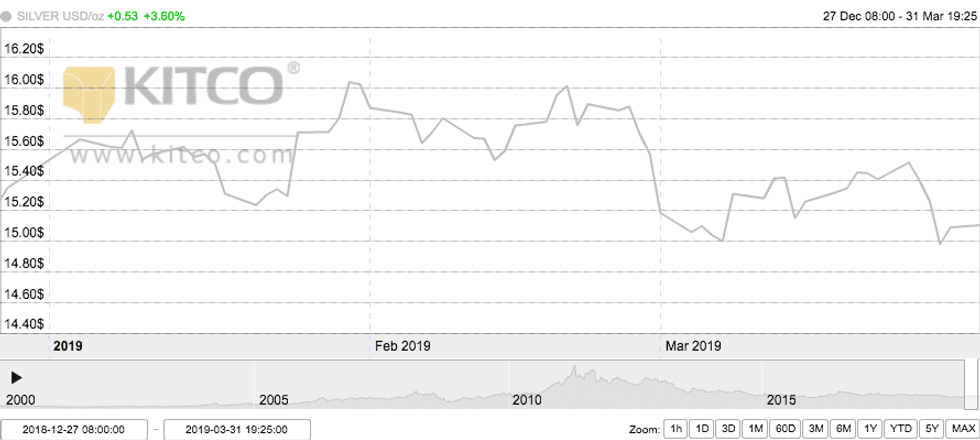

The price of silver fell by 1.82 percent in Q1. As the chart below from Kitco shows, the white metal experienced both ups and downs throughout the period, but reached its highest level at the end of January.

Chart via Kitco.com.

Silver reached its highest point of the quarter on January 30, when it traded at US$16.04. The metal finally broke through the US$16 psychological level as the US dollar retreated following the US Federal Reserve’s announcement that it would be pausing its monetary tightening cycle.

As a result, the first quarter of the year saw investor interest begin to return to precious metals.

The white metal hit its lowest point at the end of the quarter, when, on March 28, it sank thanks to a rally in the US dollar and equities.

The metal dipped to levels not seen since December when it fell to US$14.98.

Silver price update: Key drivers

As the second quarter of the year begins, investors interested in the silver market should be aware of a number of factors that could impact the white metal’s price.

Most market watchers have noted that the US dollar’s movements, the pause in interest rate hikes and the value of gold will influence the price of silver during 2019.

As a report from FocusEconomics points out, the white metal spent late February and early March being negatively affected by expectations that the US and China were approaching a final trade deal. As a result of a possible truce between the bickering countries, the US dollar moved up and placed pressure on the metal.

However, silver was able to shake off some of its loses after the Fed officially announced on March 20 a pause in interest rate hikes for the entirety of 2019.

“After the Fed’s dovish turn at its March FOMC meeting, renewed investor appetite pushed up [silver] prices modestly,” stated FocusEconomics analysts.

With the greenback’s rally seeming to lose some of its steam, silver may find more support in Q2 than in the previous quarter.

“This year, we think the US dollar is going to start its long-term downtrend,” Chantelle Schieven, research head at Murenbeeld & Co. told the Investing News Network (INN) at this year’s Prospectors & Developers Association of Canada (PDAC) convention.

However, several industry experts agree that the greenback needs to fall even further in Q2 for the white metal to reap the benefits. They note that the dollar did not face enough pressure to make a noticeable difference in silver prices during the first quarter of this year.

Adrian Day of Adrian Day Asset Management told INN at PDAC, “The biggest problem [for precious metals] right now is the [US] dollar, which remains strong.”

In addition to the direction of the greenback, many experts believe that silver won’t begin to move in any significant way until gold achieves higher gains — a feat it was unable to accomplish during the first quarter of this year.

“For now, the movement in gold hasn’t been validated by the majority of the investors,” Alain Corbani, head of commodities at Finance SA, told INN at PDAC. “I think that people are waiting for validation of the uptrend in the gold price to start buying silver.”

Corbani also added that the yellow metal will need to start trading above US$1,362 on a consistent basis before silver will have the opportunity to begin a game of catch up.

Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), shares Corbani’s sentiments, telling INN at PDAC, “silver always lags gold, but when it moves, it’ll outperform.”

Silver price update: What’s ahead?

Even though silver had a lackluster performance in 2018 and Q1 of this year, several industry insiders foresee silver rebounding to higher levels next quarter.

“Despite short-term weakness, prices are expected to rise this year and next. Headwinds in equity markets, an incipient global slowdown, and a more dovish Federal Reserve will support silver prices over the medium-term,” FocusEconomics noted.

For his part, Smallwood believes that silver will have more value than gold.

“Silver itself has gone from US$13 to US$16, and that percentage gain is much more than we have seen in gold over the last couple of months, so it always outperforms … but the negative is that it outperforms in both directions,” he said.

Smallwood added that he is more bullish on silver prices than he is on gold moving forward. His reasoning behind this is the industrial demand for silver, which he believes will increase as the year continues.

Like Smallwood, Darren Blasutti, CEO of Americas Silver (TSX:USA,NYSEAMERICAN:USAS), told INN at PDAC that the white metal tends to follow the yellow metal’s movements, but lags it by roughly three to six months. If investors go by this theory, then the second half of 2019 is most likely when they will begin to see silver shine.

“I think most people are predicting a good year for gold, which means the second half of the year or maybe early next year you’ll really start to see a move in the silver price,” he noted.

Blasutti also offered a price prediction of around US$17 to US$18 this year and close to US$20 by 2020.

Finally, Dr. Kal Kotecha, editor and founder of the Junior Gold Report, came to the same conclusions as Smallwood and Blasutti, telling INN at PDAC, “Gold is going to go up, so of course silver is going to go up.”

“[Silver] is going to go up quite a bit … to a percentage level that is going to outvalue gold,” he noted. “If you’re a bull on gold, you should be a bull squared on silver.”

Finding some balance, FocusEconomics panelists estimate that the average silver price for Q2 2019 will be US$16. The most bullish forecasts for the quarter come from both TD Securities (TSX:TD) and Julius Baer, which are calling for a price of US$17; meanwhile, Euromonitor and Commerzbank (OTC Pink:CRZBF,ETR:CBK) are the most bearish, with forecasts of US$15.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.