What happened to gold in Q2 2018? Our gold price update outlines key market developments and explores what could happen moving forward.

The price of gold fell more than 6 percent in the second quarter, dipping below the crucial US$1,300-per-ounce mark in mid-May, where it would stay for the remainder of Q2.

A strong US dollar, benchmark US Treasury yields topping a seven-year high and a second Fed hike rattled gold over the quarter. While gains were made on the back of geopolitical concerns at the beginning of the period, investors shied away from holding bullion as a safe-haven during market uncertainty throughout the second half of the quarter, causing the precious metal to be in the position of lower highs and even lower lows.

Despite gold’s reaction to these factors, many industry insiders believe that this is simply a seasonally weak period for the yellow metal and that it will return to value within the next few months, with its safe-haven nature once again appealing and therefore allowing for prices to rise in the third quarter and beyond.

Read on for an overview of the factors that impacted the gold market in Q2, plus a look at what investors should watch out for in the next few months of the year.

Gold price update: Q2 overview

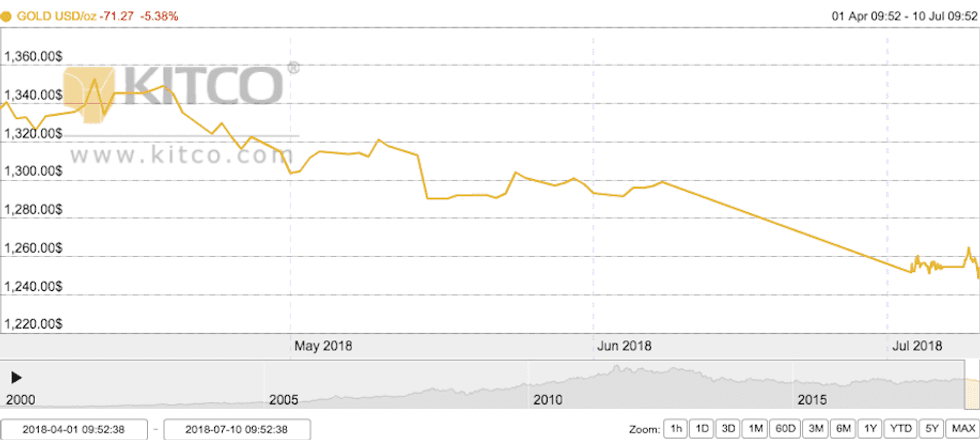

The price of gold sank 6.22 percent in the second quarter. As the chart below from Kitco shows, gold experienced mostly declines during the period, but reached its lowest point towards the end of June.

Chart via Kitco.

Gold hit its lowest point of all of 2018 on June 28, trading at US$1,247.10. The metal decreased on the back of concerns over the increasing tariff battle between the US and China. As previously noted, during this time, investors did not treat the yellow metal as a safe-haven, but rather backed away from it as they grew more concerned over the idea that if the tariff battle continued, growth would slow in both countries, and the result could be a global recession.

When compared to gold’s lowest point of US$1,302.50 in Q1 2018, the metal’s dismal quarter becomes even more apparent.

Meanwhile, the precious metal found its highest point on the morning of April 11, reaching US$1,352.80. On that day, prices edged up when the US dollar sank in response to political tensions between Syria and the US. Unfortunately, gold could not maintain the increase following the release of minutes from the Federal Open Market Committee (FOMC) meeting that same day and it tumbled from its 11-week high before the markets closed.

Gold price update: Key drivers

As the third quarter of the year begins, investors interested in the gold market should be aware of a number of factors that could impact the precious metal’s price.

Most analysts agree that the greenback’s movements, geopolitical tensions and interest hikes will continue to be key drivers for the gold price for 2018.

With the US dollar making consistent gains throughout the second quarter, bullion became too expensive for investors to hold.

“A strong dollar makes gold more expensive to buy for holders of other currencies, which weighs on demand, while rising interest rates erode the metal’s attractiveness as an investment compared to yield-bearing assets,” Angela Bouzanis, senior economist at FocusEconomics, told the Investing News Network (INN).

Similarly, Mercenary Geologist Mickey Fulp addressed the strong US dollar stating, “[t]he strong inverse correlation coefficients show that over the past 10 months, when the dollar goes up, gold goes down, and vice versa. DXY (the US dollar index) has been on quite a roll since mid-April, rising from 89.4 to 94.8 for a gain of 6.0 percent.”

“During this time, gold dropped from US$1,346 to US$1,279 for a loss of 5 percent. These numbers further illustrate the ongoing negative dollar-gold relationship,” he added.

Byron King of Agora Financial sums up the relationship between gold and the US dollar in Q2 telling INN, “[t]here’s no sugar-coating to what happened in Q2; gold prices drifted down as the dollar strengthened.”

“The dollar strengthened due to the US Fed increasing interest rates, and Fed taking heads issuing guidance to expect more rate increases at regular intervals. Plus, global markets appear to perceive strong economic growth in the US, leading to a bid-up for dollars,” he added.

Geopolitical tensions also drove the yellow metal in Q2, allowing it to make small gains throughout the quarter.

“Tailwinds for gold come in the form of a seemingly inexhaustible series of political risk triggers,” Scotiabank (TSX:BNS, NYSE:BNS) said in its recent Commodities Outlook report.

Two of the largest geopolitical concerns of Q2 have been the ongoing trade war concerns between the US and China and US president Donald Trump’s tariff spree on several countries.

“The fall in gold prices was limited somewhat by a tumultuous global political environment. US President Donald Trump’s “America First” policies and the imposition of tariffs have caused deep diplomatic riffs among traditional G7 allies and kicked off a series of tit-for-tat tariff retaliations in recent weeks,” said analysts at FocusEconomics.

However, Q2 also saw gold moving away from its safe-haven status, which caused any gains to be short-lived, and, for the most part, insignificant.

“What we are seeing is a serious lack of large investor and institutional interest in the metals and mining sector. In my opinion, the major US and Canadian markets are topping, emerging markets are falling and all markets are being whipsawed by a petulant vindictive man-child with no real plan or interest in factual data,” Brent Cook of Exploration Insights told INN.

Finally, a second Federal Reserve interest hike once again impacted gold prices towards the end of Q2.

While gold made slight gains directly after the hike was announced, it would not last long. The following day, the US dollar rebounded and the precious metal lost its gains.

Adrian Day of Adrian Day Asset Management explained to INN why this interest hike had a negative impact on the yellow metal in this quarter.

He stated, “[h]igher interest rates hurt gold only when rates move up faster than inflation.”

On a positive note, Day added, “right now it appears that inflation is beginning to show some life, both in the US and Europe.”

This is one of the factors that could support gold and its rebound going forward.

Gold price update: What’s ahead?

Many industry insiders predict that gold will remain par for the course to finish out the summer, but then it will rebound come end of September—just in time to begin Q4.

According to Bouzanis, while the yellow metal won’t skyrocket anytime soon, it should rebound before 2018 comes to a close.

“FocusEconomics panelists see gold prices regaining some lost ground in the second half of the year, averaging US$1,316 per troy ounce in the final quarter of 2018. Heightened global geopolitical risks, such as rising trade protectionism, should support safe-haven demand. Demand for gold from Asia is also seen picking up after a soft first half of the year,” she told INN.

Fulp also believes that gold will not find its footing until the fall.

He stated, “I think the current paradigm for gold is likely to continue with the seasonal low still to come within the next two months and a rising price likely to commence prior to Labor Day and continue thru mid-October.”

Fulp also suggested that now may be the perfect time to scoop up bullion, stating, “I buy gold on dips; perhaps the current price is a good place to start accumulating.”

Similarly, Brent Cook stated, “[m]y sense is that this will continue over the summer with precious metals beginning to catch a bid as uncertainty and geopolitical chaos intensifies into the fall.”

He also added that this might be the perfect time for newly developed companies to flourish. He added, “we have seen increased M&A activity in the mining space which points to the fact the the larger miners are having difficulty replacing reserves with profitable mines. This is a positive for companies in the early stages of a discovery.”

Day agrees with the previously mentioned timeline for gold to rebound, stating, “after a month or two, we see gold starting to move higher, and ending the year meaningfully higher from where it stands today.”

While King does not provide a timeline for when gold prices will takeoff, he does suggest that it will be due to reasons other than geopolitical concerns.

King stated, “[t]he trigger? Likely, it’ll be some global event—collapse of a bank that’s otherwise, “too big to fail” (until it fails). Twenty years ago, the disaster with long term capital management broke the back of Wall Street. Ten years ago, the crash of 2008 almost broke the Fed.”

He added, “[t]he next big disaster will require a global response, leading to a reordering of international currency systems—starting with the dollar. One key way to preserve wealth across the event will be with precious metals.”

Finally, some insiders still believe that the yellow metal could push significantly above the US$1,300 mark.

Gary Christenson, writer at Miles Franklin, told INN, “[g]old prices increase as debt and total currency in circulation rise. Inflationary expectations, lack of confidence in central banks and political instability also support prices. Those forces plus seasonal strength indicate that support should hold. Gold prices are likely to rally into year-end.”

“First resistance is around US$1,375. A trend line back to 2008 suggests prices could bounce off current lows and rise into the US$1,400s. Political or financial instabilities could push prices over US$1,500,” he added.

Finding some balance, FocusEconomics panelists estimate that the average gold price for Q3 2018 will be US$1,325 per ounce. The most bullish forecast for the quarter comes from JP Morgan (NYSE:JPM), which is calling for a price of US$1,390.00. Meanwhile, DZ Bank is the most bearish with a forecast of US$1,200.00.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

This article is updated each quarter. Please scroll the top for the most recent information.

Gold Price Update: Q1 2018 in Review

By Nicole Rashotte, March 28, 2017

The gold price gained more than 3 percent in Q1 2018 despite a volatile February, when the yellow metal experienced its first monthly loss of the year.

A weaker US dollar and inflation supported gold over the period. While gains were initially offset by expectations over a US Federal Reserve interest rate increase, gold trended upward after the hike became official.

Given those factors, many industry insiders believe that gold is prime for a price increase, with its safe-haven nature allowing it to stand against a chaotic market.

Read on for an overview of the factors that impacted the gold market in Q1, plus a look at what investors should watch out for in the next few months of the year.

Gold price update: Q1 overview

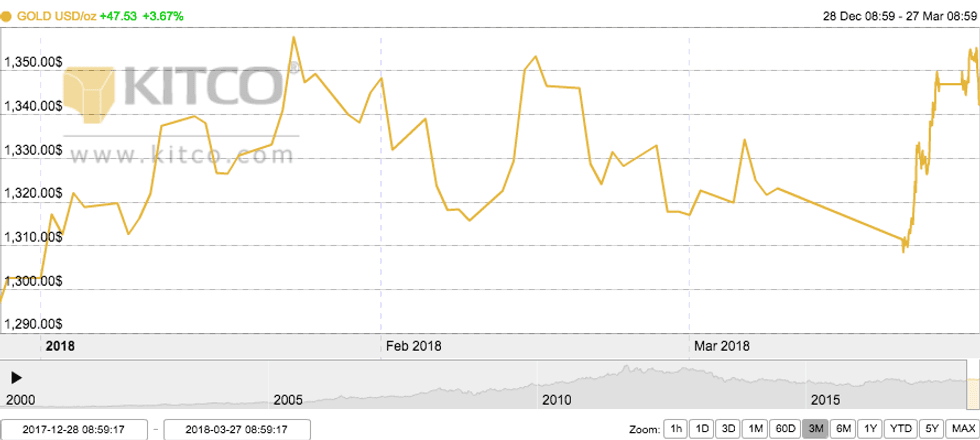

As mentioned, gold rose 3.61 percent in Q1. As the chart below from Kitco shows, gold experienced several ups and downs during the period, but reached its highest point toward the end of January.

Chart via Kitco.

The yellow metal found its highest level on January 24, reaching US$1,357.70 per ounce. On that day, the price edged up to its highest since August 2016 as the US dollar hit three-year lows.

Meanwhile, gold hit its lowest point of the quarter on January 1, trading at US$1,302.50. The metal hit another low point on March 20, when it fell to US$1,308.40. The precious metal decreased as the US dollar strengthened ahead of the Fed’s first rate hike of the year.

Gold price update: Factors to watch

As the second quarter of the year begins, investors interested in the gold market should be aware of a number of factors that could impact the precious metal’s price.

Most analysts agree that political uncertainty, increased interest rates and the state of the US dollar will continue to be key drivers for the gold price in 2018.

According to analysts at FocusEconomics, “[f]ears of a potential trade war followed US President Donald Trump’s decision to place import tariffs on steel and aluminum, supporting demand for gold, as it both increased the precious metal’s appeal as a hedge against uncertainty compared to US bonds and equities, and put downward pressure on the US dollar.”

Similarly, Brien Lundin, editor at Gold Newsletter, addressed the tariffs, stating, “I think they’re terrible. They’re a terrible idea. I think it creates uncertainty, which creates volatility in the market. There is a scenario in which gold can benefit from that, but I don’t look at it as a long-term driver of gold prices. I think it’s a long-term driver from uncertain in the economy.”

Similarly, an analyst for UBS (NYSE:UBS) said, “[a]s choppier markets seem likely, gold will remain a good hedge against unexpected spikes in equity market volatility and geopolitical tensions, in our view.”

Other political concerns stem from frequent changes within the Trump administration. Earlier this month, departures of two key officials, former Secretary of State Rex Tillerson and top economic advisor Gary Cohn, left investors worried. This political shakeup resulted in a weakened dollar, which made bullion cheaper for holders of other currencies.

Another factor driving the gold price during the first quarter was an anticipated rise in interest rates. “There’s a battle going on right now. Interest rates going up in the US and the dollar strengthening, but the government down there wants it lower,” said Rob McEwen, chairman and chief owner at McEwen Mining (TSX:MUX,NYSE:MUX).

He added, “and so it’s going back and forth, and investors are saying, ‘well if interest rates go up, gold’s going to go down because the dollar’s going to go up.’ And gold is quoted in dollar terms. But often you’ve seen periods where both interest rates and gold are going up at the same time.”

The Fed and its rate hikes took on a major role for gold toward the end of Q1. Three increases are forecast for 2018, the first of which took place on March 21. Gold faced a decline prior to the hike’s implementation, but then experienced gains on the back of an announcement making the raise official.

According to Bilal Hafeez, strategist at Nomura, the US dollar’s movements aren’t being driven by actual rate increases, but rather expectations of what may happen in the future. Hafeez believes that markets “are all about expectations,” and that it is likely that the expectation of the first hike of 2018 is what was “helping the dollar.”

“The actual hike, then, would naturally reset those expectations and would lead to a ‘buy the rumour, sell the fact’ dynamic in the dollar. Indeed, the dollar has followed a pattern of trading relatively well into Fed hikes, but selling off after,” he noted.

Investors should keep an eye out to see what will happen to gold if the Fed keeps its forecast and raises interest rates again later this year.

Gold price update: What’s ahead?

Many market watchers predict that gold will not only have a bullish Q2, but will also experience a bull market for the majority of 2018.

According to John Kaiser of Kaiser Research, gold could trade between US$1,600 and US$2,000 this year. “There’s a growing demand for gold that could push up the real price as opposed to inflation or the US dollar declining,” Kaiser said. “A real price increase is critical. A move into the US$1,600 to US$2,000 range is very plausible without it being inflation driven. I think this is going to happen this year.”

Other experts also see a bullish forecast for gold — in fact, their predictions for the yellow metal reach much higher levels than Kaiser’s. McEwen, who is well known for his call for US$5,000 gold, uses historical figures to predict a high price for gold.

Meanwhile, Goldman Sachs (NYSE:GS) analysts believe that “the dislocation between [gold] and US rates is here to stay,” and expect the yellow metal to “outperform” in the coming months.

Finding some balance, FocusEconomics panelists estimate that the average gold price for Q2 2018 will be US$1,302. The most bullish forecast comes from JPMorgan (NYSE:JPM), which is calling for a price of US$1,380; Société Générale (EPA:GLE) is the most bearish with a forecast of US$1,200.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.