Ely Gold Royalties Options North Carlin Project to Fremont Gold

Ely Gold Royalties Inc. (TSXV: ELY) (OTC Pink: ELYGF) (“Ely Gold” or the “Company”) through its wholly owned subsidiary, Nevada Select Royalty, Inc (“Nevada Select”) is pleased to announce that it has entered into a definitive option agreement with Intermont Exploration LLC., (“Intermont”) a Nevada limited liability company and a wholly owned subsidiary of Fremont Gold Ltd, a British Columbia corporation (TSXV: FRE) (“Fremont”) whereby Fremont has the option to acquire a 100% interest in the North Carlin Project, located in Elko County, Nevada (the “Option” or “Option Agreement”).

Ely Gold Royalties Inc. (TSXV:ELY) (OTC Pink:ELYGF) (“Ely Gold” or the “Company”) through its wholly owned subsidiary, Nevada Select Royalty, Inc (“Nevada Select”) is pleased to announce that it has entered into a definitive option agreement with Intermont Exploration LLC., (“Intermont”) a Nevada limited liability company and a wholly owned subsidiary of Fremont Gold Ltd, a British Columbia corporation (TSXV: FRE) (“Fremont”) whereby Fremont has the option to acquire a 100% interest in the North Carlin Project, located in Elko County, Nevada (the “Option” or “Option Agreement”). The total Option consideration (if exercised by Fremont) is US$267,500 and Nevada Select will retain a net smelter returns royalty (“NSR”). Fremont will also issue 200,000 Fremont Shares to Ely Gold, subject to TSXV approval.

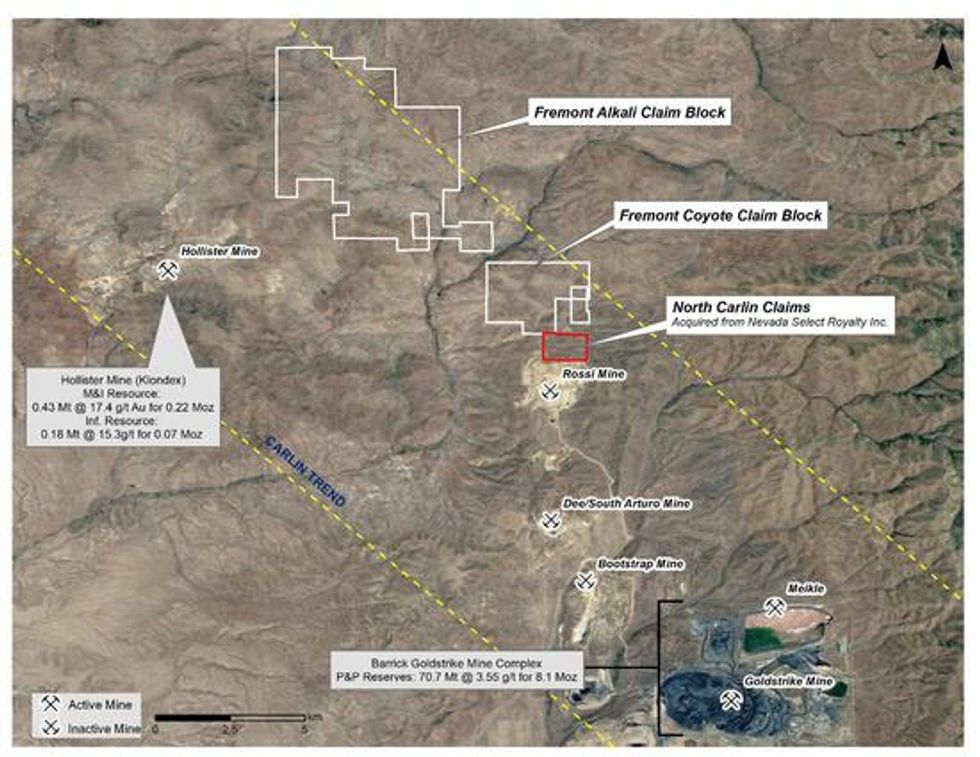

The North Carlin project consists of twelve (12) unpatented mining claims (the “North Carlin Claims”) which are adjacent to a larger claim package staked by Fremont. With this additional property, Fremont now essentially controls the northern end of the Carlin Trend. Nevada Select acquired the North Carlin Claims through staking in 2017.

Jerry Baughman, President of Nevada Select commented on the Option Agreement, “This is the fourth high-quality project we have optioned to Fremont. They are excellent exploration partners and we are excited to see them test the high-quality targets identified at North Carlin.”

The Option

Under the terms of the Option Agreement, Fremont can acquire a 100% interest in the Property by making an initial payment of US$5,000 and 200,000 Fremont Shares, followed by:

- $12,500 six months after the Effective Date

- $25,000 one year after the Effective Date

- $37,500 two years after the Effective Date

- $37,500 three years after the Effective Date

- $50,000 four years after the Effective Date

- $100,000 five years after the Effective Date (the “Final Option Payment”)

Fremont may terminate the Option Agreement at any time without further liability for future Option payments.

In addition to the payments, Fremont must pay advance royalty payments as follows:

- $25,000 on the first, second and third anniversary of the Final Option Payment; and

- $35,000 on the fourth anniversary of the Final Option Payment and on each anniversary thereafter.

There are no work commitments or additional expenditures required other than Fremont’s obligation to maintain the claim maintenance fees. If the Option is exercised by Fremont, Nevada Select will retain a 2% NSR on the North Carlin Claims. There is no area of interest associated with the NSR. Fremont will have the right to buy-down 1% of the NSR for an aggregate purchase price of $3,000,000.

Location map showing the North Carlin Claims in relation to Fremont’s Alkali and Coyote claim blocks

To view an enhanced version of the Location Map, please visit:

https://orders.newsfilecorp.com/files/4181/32937_a1519145818413_37.jpg

Trey Wasser, President and CEO of Ely Gold stated, “This transaction provides another excellent example of our royalty business model. The Carlin Trend is the second richest gold province in the world, with total historic production of greater than 50 million ounces and 3 million ounces of production in 2017. Finalizing this Option adds another exciting exploration property to our Nevada asset portfolio.”

Stephen Kenwood, P. Geo, is director of the Company and a Qualified Person as defined by NI 43-101. Mr. Kenwood has reviewed and approved the technical information in this press release.

About Ely Gold Royalties Inc.

Ely Gold Royalties is an emerging royalty company with development assets focused in Nevada and the Western US. The Company is actively purchasing existing third-party royalties for its portfolio and all the Company’s Option Properties will produce royalties, if exercised. Most of the royalties and option properties have active exploration programs and are being developed by partners comprised of majors, mid-tier gold producing companies and well-funded junior explorers. In 2018, Ely Gold estimates it will generate positive cash flow from its current portfolio. Ely Gold maintains a strong cash position and a gold stock equity portfolio. Ely Gold is well positioned with its current portfolio of available properties to generate additional operating revenue through option and sale transactions. The Company has a proven track record of maximizing the value of its properties through claim consolidation and advancement using its extensive, proprietary data base.

On Behalf of the Board of Directors

Signed “Trey Wasser”

Trey Wasser, President & CEO

For further information, please contact:

Trey Wasser, President & CEO

trey@elygoldinc.com

972-803-3087

Joanne Jobin, Investor Relations Officer

jjobin@elygoldinc.com

604-488-1104

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Click here to connect with Ely Gold Royalties (TSXV:ELY,OTC:ELYGF) for an Investor Presentation.

Source: www.newsfilecorp.com