Barrick Gold’s Bristow: Still Lots to Do After Mega Merger

Barrick Gold and Randgold Resources revealed plans to combine a year ago. Mark Bristow took the stage in Denver to share progress since then.

This time last year, Barrick Gold (TSX:ABX,NYSE:GOLD) and Randgold Resources shook the gold space by announcing plans to merge in a massive deal.

The move received mixed reactions from gold market participants, with some suggesting the companies could be preparing for a turnaround in the gold sector, and others expressing doubts about how well Barrick’s John Thornton and Randgold’s Mark Bristow might work together.

On Tuesday (September 17), Mark Bristow, now president and CEO of the combined company, took the stage at the Denver Gold Forum to update attendees on where the new version of Barrick is at.

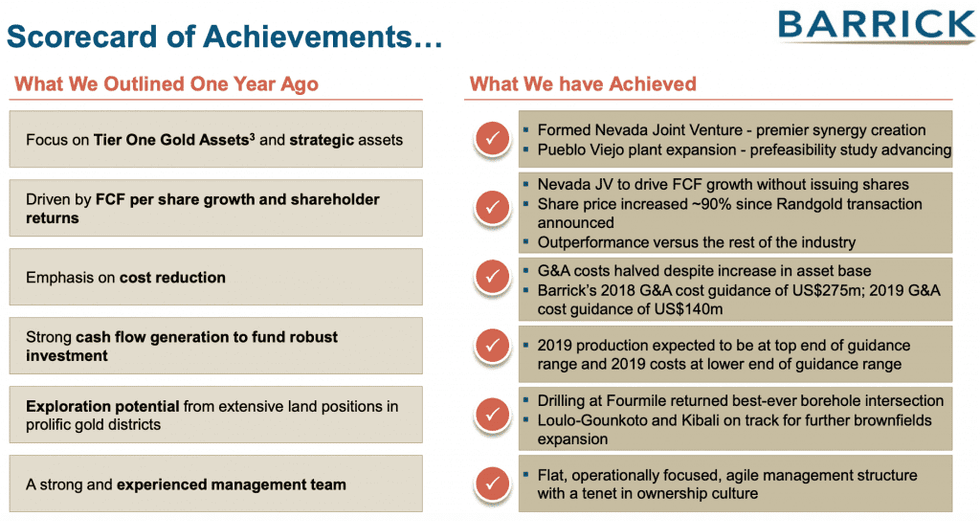

“As you can see, if you compare what we said we would do with what we’ve done, every single box has been ticked,” said Bristow as he displayed a checklist of achievements.

“All the planning that preceded the merger and a lot of hard work enabled us to sprint out of the starting box,” he added, highlighting that the company’s general and administrative (G&A) costs have been halved and production guidance for 2019 is trending toward the top end of the projected range; costs are likely to be at the low end.

Image via Barrick Gold.

Even so, the work is just beginning for Barrick, said Bristow — a claim that’s clear from this week’s two news releases from the company.

The first concerns the company’s acquisition of Acacia Mining. An agreement made between the two companies in mid-July officially went through on Tuesday, allowing Barrick to take ownership of the approximately 36 percent stake in Acacia that it did not already hold.

The US$1.2 billion deal follows a May offer of US$787 million from Barrick. It also follows considerable turmoil at Acacia, which has faced difficulties with authorities in Tanzania, where it operates.

Bristow said that while the purchase was only approved on Tuesday, Barrick has been on the ground in the country for the last few weeks with the goal of fixing the business operationally, restoring social license to operate and repairing relationships with the government and other stakeholders.

Acacia’s London office has already been closed and its Johannesburg office will close shortly, said Bristow, noting that he expects to see significant G&A savings as a result.

Barrick’s second piece of news this week was the announcement of a discovery hole about 2 kilometers from the best intercept at its Nevada-based Fourmile project. The find, which Bristow called “a very significant intersection,” is part of an orebody a kilometer north of Fourmile.

“Pierre Lassonde (of Franco-Nevada (TSX:FNV,NYSE:FNV)) said yesterday there hasn’t been a major discovery for the last two decades. Well, he’s wrong,” Bristow quipped.

Fourmile is not part of Barrick’s Nevada joint venture with Newmont Goldcorp (TSX:NGT,NYSE:NEM), which the company was quick to set up after the Randgold merger closed earlier this year. Bristow said the partnership is on track to achieve its planned US$450 million to US$500 million in synergies annually, and should see around half that amount in 2019.

Bristow told the audience to expect more exploration work now that Barrick is more secure operationally, comparing exploration to research and development in the pharmaceutical industry.

He also said that Barrick will share its five year plan when it releases its Q3 results in November. “Whilst a lot has been achieved in the last 12 months, there’s still more to do,” Bristow concluded.

Want more content from the Denver Gold Forum and Precious Metals Summit? Our full playlist can be found on YouTube.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.