Tesla Puts Nickel in Focus at Battery Day, but Details Still Needed

After Battery Day, INN caught up with analysts to get more insight on Tesla’s plans involving nickel. Read on to learn what they had to say.

Nickel has been making headlines since Tesla (NASDAQ:TSLA) CEO Elon Musk called for more mining of the metal over the summer, and the company’s Battery Day has reinforced interest.

Musk said at the recent event that the automaker is looking to process nickel in a more efficient way, eliminating steps and addressing the waste of water. He also reiterated his request for more nickel mining, and said the company is developing cathodes that will contain higher nickel and no cobalt.

At Battery Day, all plans unveiled by Tesla point to a reduction in battery costs, in line with the company’s goal of producing an affordable US$25,000 electric vehicle (EV) in the next three years. Tesla is also looking to ramp up battery production capacity to 100 GWh by 2022 and to 3 TWh by 2030.

“The move to high-nickel cathodes has been widely accepted, and Tesla confirmed that it was in the same boat,” Sean Mulshaw of Wood Mackenzie told the Investing News Network (INN). “(But) more nickel comes at the expense of cobalt, and this means lower stability of the cathode.”

There are several reasons why Tesla would want to increase nickel and reduce cobalt, including reducing exposure to the cobalt market and its associated reputational risks, decreasing the cost of raw materials and increasing cell energy density.

However, the presence of cobalt plays a critical role by improving the life cycle for batteries; the metal stabilizes the structure of the cathode and helps to manage the cell’s thermal stability, Gregory Miller of Benchmark Mineral Intelligence told INN.

“Taking these technical challenges into consideration, we believe there is still significant development work needed before Tesla and other battery makers, such as China’s SVOLT, can successfully overcome these safety issues and commercialize ‘cobalt-free’ batteries on a wide scale,” he added.

Meanwhile, research firm Roskill has noted that a number of companies are looking into developing other methods to reduce high-nickel cathode thermal runaway risks besides cobalt, including doping, cathode coating, electrolyte additives and battery management systems.

“Cathode chemistries like lithium–iron–phosphate (LFP) remove this problem and provide cost reduction,” Jack Anderson of Roskill told INN.

Processing nickel for batteries

During Battery Day, Musk also said the California-based automaker has found a simplified way to process nickel that suggests it will eliminate the Class 1 nickel dissolution process.

Watch Tesla’s Battery Day presentation above.

Miller said the new processing route of nickel to cathodes is promising, and is an area in which further advances can be made to both lower costs and reduce the environmental footprint of the supply chain.

“However, further clarification is needed before assessing the viability of this new processing route.”

For Woodmac’s Mulshaw, while the details from Tesla are vague, this is already widely happening.

“Mixed sulfides and mixed hydroxide precipitates are already being directly converted into suitable sulfates for cathode production – so not really a new development,” he said.

Currently, demand for nickel sulfate is based on present-day commercialized nickel raw material to cathode production routes, with Tesla now announcing its intention to utilize 100 percent nickel powder direct to cathode, Anderson said.

“However, the difficulties of such with regards to process refinement, yield optimization and expanding to commercial scale should not be understated,” he added. “New developments in technology from first inception through to commercialization can span eight to 10 years; an industry track record indicating a minimum of five years longer is likelier than that of Tesla’s proposed three year plan.”

Should Tesla succeed in its battery cathode manufacturing ambitions, Roskill believes there is a greater supply shortage risk for suitable metal powder than there is for nickel sulfate.

“In addition to the availability of specific nickel products, there are growing concerns surrounding sustainability of the nickel supply chain. This is particularly important for the EV supply chain, where consumers are inherently aware of the environmental footprint of their purchase,” Anderson said.

Sourcing nickel in North America

As mentioned, earlier this year, Musk called for miners to mine more nickel, promising a “giant” contract to miners that produce the metal in an “environmentally sensitive way.”

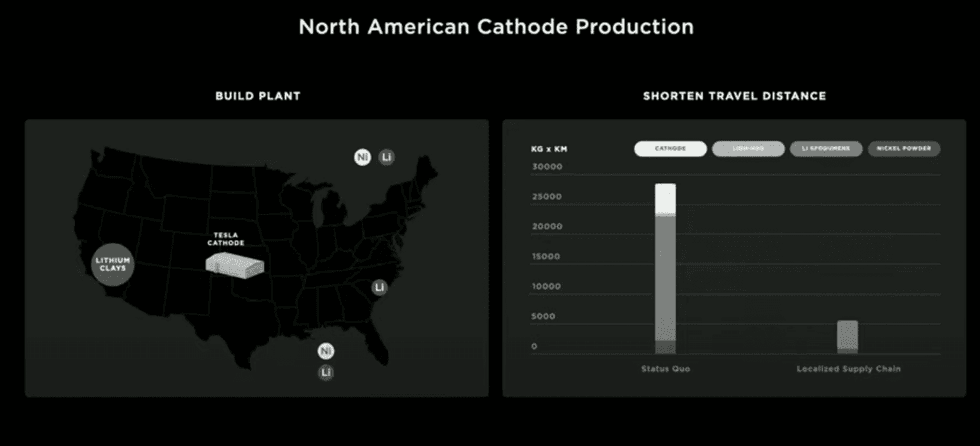

At Battery Day, Musk also said Tesla plans to source raw materials from North America for its US cell production plans, which include a cathode production facility and a lithium hydroxide plant in Texas.

Image courtesy of Tesla.

According to Mulshaw, there are a few options open to Tesla to achieve this goal. It could buy nickel metal from Vale’s (NYSE:VALE) Canadian operations and dissolve it, or invest in a project.

“Giga Metals’ (TSXV:GIGA) Turnagain project and Waterton’s Dumont have both been pushing their suitability to supply into the battery sector, but there are other projects out in Canada too,” he said. “However, it seems unlikely they will achieve much in three years,” which is the timeframe Musk set to achieve the improvements announced to the audience on Battery Day.

North America currently accounts for 5 percent of global refined nickel supply. However, nearly all of the growth in new supply is set to come from laterite ores in Indonesia, and there are no significant new projects under development in the region.

That’s why Benchmark Mineral Intelligence is forecasting that the continent’s share of global supply will decrease to 3.5 percent by the end of the decade, Miller explained.

“Tesla may be able to source a significant proportion of its supply from North America to match its initial 100 GWh production capacity,” he said. “(But) the company will quickly become supply constrained as it ramps up production of nickel-rich battery cells, and will undoubtedly be forced to look towards alternative supply sources to match the scale of its ambitions.”

Roskill’s Anderson agreed, saying sourcing only from North America will be very challenging.

“We know that on average it takes a long time to go from discovery of a deposit to an operating mine, with all the feasibility studies that have to be performed and permits and approvals that have to be received. Given the volumes of nickel that are required and the timeframe Tesla is working on, it is hard to see Tesla not receiving its battery-grade nickel requirements from existing operations elsewhere.”

Tesla is reportedly having discussions with both top nickel producers Vale and BHP (ASX:BHP,NYSE:BHP,LSE:BHP). At the same time, Indonesia’s government has also said that it is in early discussions with the EV maker about a potential investment in the Southeast Asian country.

Where will nickel supply come from?

Benchmark Mineral Intelligence estimates suggest that Tesla’s nickel-based battery cells could account for 1,350 GWh of the 3 TWh figure the carmaker announced by 2030.

This is an initial and conservative figure, after factoring in several assumptions related to the split between output for different applications, Miller said. He explained that if Tesla were to achieve this level of output, Benchmark forecasts that Tesla would need to consume just under 50 percent of total nickel supply in today’s market.

“Even with global nickel supply forecasted to reach 4.5 million tonnes by 2030, Tesla would face stiff competition for supply from other cell producers ramping up their own nickel-rich battery capacity and the stainless steel industry,” Miller said.

Looking ahead in terms of securing supply of nickel for the EV industry, Mulshaw said currently with the massive surpluses forecast in the nickel market, one would think there could be nickel to spare.

“Except that all the growth in supply is nickel pig iron (NPI) for the Chinese stainless steel industry.”

In fact, the nickel supply chain is becoming increasingly integrated, and offtake agreements have been agreed upon over recent years and months.

“Because of the large volumes of nickel forecast to be required by the battery industry in the near term, battery-grade nickel will have to be procured from operations currently in existence and, over the next few years, based on laterite ore from Indonesia,” Anderson said. “There is already a lot of competition from downstream in the supply chain, and this is expected to intensify in the next few years.”

For now, Tesla’s announcements have not changed Roskill’s forecast for nickel in the coming years.

“At Roskill, we remain fundamentally bullish on the demand for nickel in batteries, with our forecasts for lithium-ion battery cathode chemistries pointing towards the prevalence of ultra-high-nickel chemistries, including LNO, NCM 811 and NCA+ by the end of the decade,” Anderson said.

Nickel junior miners challenges ahead

For Mulshaw, the biggest challenge junior miners face ahead is understanding what they need to do.

“Understanding their orebody, choosing a process route, high CAPEX, raising the money, building the plant and making it work to produce a NiSO4 that meets the very high specification of potential offtakers,” he said.

Aside from securing sufficient investment to develop a new asset, Miller of Benchmark Mineral Intelligence said another hurdle for juniors will be producing a consistent material that can be qualified by battery producers and OEMs.

For Anderson, the biggest obstacle facing nickel junior miners is the relatively low nickel price. Despite having a better performance in recent months, Roskill believes that the continued rapid ramp up of low-cost NPI capacity from Indonesia will act as a headwind to the nickel price in the near term.

“Secondly, alongside the time taken to develop a deposit, it also has to be in a convenient location in terms of infrastructure and conform to potentially tight environmental and tailings regulations in the region,” he said. “Nickel sourced in an environmentally sustainable way is one of the major sourcing requirements for Elon Musk and Tesla.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.