Copper Trends 2021: Copper Reaches All-time High, Eyes on Supply

INN takes a look back at the main copper trends of 2021 by quarter, from supply and demand dynamics to price performance.

Click here to read the previous copper trends article.

Copper prices took a hit in 2020, plummeting lower on the back of the COVID-19 pandemic, but 2021 proved to be a strong year for the red metal.

As economies reopened and demand picked up, prices hit an all-time high in May. Even though copper was unable to stay at that level throughout the year, it traded above US$9,000 per tonne for most of the 12 month period.

With 2021 rapidly drawing to a close, here the Investing News Network (INN) takes a look at what the trends for copper were in each quarter, how prices performed throughout the year and what analysts said about developments during each three month period. Read on to learn more.

Copper trends Q1: Prices hit 10 year high

Starting the year on a bright note, copper prices increased more than 11 percent during Q1, hitting their highest level since 2011. Demand expectations grew as economies recovered from COVID-19, and at the same time, interest in the metal's future in the renewable energy and electric vehicle (EV) industries picked up pace.

Copper started the year at US$7,918.50, touching its lowest level of the quarter on February 2 at US$7,755.50. Its rally started in mid-February, and it had jumped to a more than 10 year high by the end of the month.

“Copper surged in early 2021 and outperformed consensus forecasts,” Dan Smith of Commodity Market Analytics told INN in March. “The main surprise (in Q1) was the strength of Organization for Economic Co-operation and Development manufacturing, with survey data pointing to rapid expansions in Europe and the US.”

Copper’s highest point of the quarter came on February 25, when the base metal was trading for US$9,614.50. Although it wasn't able to maintain those gains, copper hovered around the US$9,000 mark for the rest of the period, ending the first three months of the year at U$8,850.50. It was, in fact, a stellar quarter compared to Q1 2020, when the metal declined over 20 percent.

Chinese copper demand continued to grow in early 2021, helped by a strong rebound in industrial production and construction activity. “However, domestic consumers are complaining about high prices, and this is resulting in a reduction in local inventory levels,” Smith explained to INN in the first quarter. “The recovery in demand in Europe still looks reasonably strong, despite rising COVID-19 cases.”

Looking over to the supply side of the story, many copper producers were seeing rising COVID-19 cases, which hampered output, particularly in Peru.

“Since the outright suspensions in Peru during the initial COVID-19 outbreak in Q2 2020, we have seen the mining industry rebound and manage production despite restrictions,” Nick Pickens of Open Mineral told INN back in Q1. “There is a consensus view that mine production will rise this year, which would be the first time since 2018. And this increase could be anywhere up to 5 percent, even after allowing for disruption.”

Copper trends Q2: Prices continue upward trend

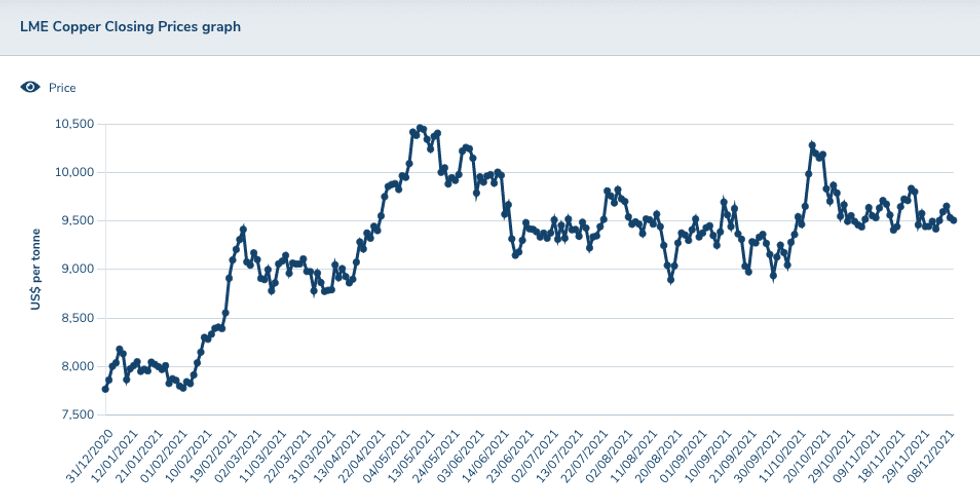

Copper's price performance, December 2020 to December 2021.

Chart via the London Metal Exchange.

Copper reached an all-time high during the second quarter of the year, trading above US$10,700 for the first time.

The price rally picked up pace during the first few weeks of the period, leading to copper's all-time high, but the red metal could not hold on to that level throughout the quarter, finishing around the US$9,350 mark.

As expectations of higher demand increased due to the lifting of COVID-19 lockdown restrictions around the world, so did prices for copper, which gained 7 percent in Q2.

For Karen Norton of Refinitiv, copper prices pre-empted, as they had in the past, a medium- to long-term change in the market’s fundamentals. “From the time they breached U$9,000 in February, a test of the previous record high looked to be a near certainty,” she said. “In this regard, without evidence of a major change to the tight supply picture, consolidation in this range has not been a major surprise.”

Expectations of demand for copper in EVs continued to drive prices in 2021. “The copper bulls have the bit between their teeth in terms of green energy and demand prospects,” Norton said back in the second quarter.

“There is no question that copper has a big role to play in a decarbonized world, but ultimately we feel that vastly inflated copper prices will leave consumers searching for cheaper alternatives such as aluminum, and that demand growth will not fulfil the dizzy heights currently bandied around.”

Furthermore, the expert said scrap is likely to become an increasingly significant feature in the supply picture, helping to reduce the reliance on new mines.

Looking over to copper supply, the picture for output in 2021 was getting brighter — treatment charges were increasing, which was a sign of recovery.

“It is becoming increasingly clear that the tightness in copper mine supply is starting to ease, and treatment charges are rising as a result,” Smith said in Q2. “The second half of this year will see key projects such as Grasberg in Indonesia and Kamoa in the Democratic Republic of Congo ramping up, adding to other projects which are already in the pipeline.”

This strength in supply fits Refinitiv’s view that mine production is picking up and on course to grow in the region of 2.5 percent this year, with growth accelerating into 2022.

“It is only in 2025 that we see below-trend growth again, although this does coincide with expectations of demand growth getting a leg up from the green energy narrative,” Norton said.

Copper trends Q3: Chinese demand slows down

After reaching an all-time high of US$10,700 during the second quarter of the year, copper traded around the US$9,300 mark for most of Q3.

Prices performed with volatility throughout the period as labor negotiations shared center stage with the Evergrande (HKEX:3333,OTC Pink:EGRNF) crisis in China.

After the highs seen in the second quarter, Smith said he was expecting prices to retreat. “We were looking for a 4 percent drop in copper prices in Q3, and the market pulled back by 4.5 percent as expected,” he said.

The red metal saw its highest level in Q3 on July 27, when it hit US$9,781. Copper then saw its biggest drop in the period three weeks later on August 19, when it was trading at US$8,775.50.

Developments in copper supply and demand dynamics took an interesting turn in the third quarter. In China, the world’s top copper consumer, there was growing evidence of slowing demand.

“Additionally, the Evergrande debt crisis, which raised concerns of contagion in the country’s property sector, and the power squeeze, with worries that demand would be worse hit than supply, were some of the key factors to dominate,” Norton explained to INN at the time.

For Smith, there were two main factors weighing on copper prices in Q3. Firstly, mine supply growth started to accelerate, and this resulted in a significant jump in treatment charges.

“These were up by 66 percent in Q3, a significant recovery from a very low level in Q2,” he said. “Secondly, Chinese copper demand has started to slow, with electricity shortages and bottlenecks hampering output, and high energy costs squeezing manufacturing margins.”

Copper trends Q4: Uncertainty hits prices

Copper started the last quarter of the year at US$9,128 and traded above the US$9,000 point for the entire period. It tested US$10,000 again in mid-October, spending a week above it, but pulled back before the end of the month.

“(Prices fell) somewhat in recent weeks, largely due to depleting stocks, which sparked supply fears among investors,” FocusEconomics analysts said in their latest report.

“Against this backdrop, top copper producer Chile recorded falling output in September, exerting additional upward pressure,” they said. “On top of this, the Fed’s updated forward guidance following its November meeting reduced the risk of an earlier-than-expected rate hike, providing an additional boost to prices.”

Looking forward, some analysts believe copper’s fate in 2022 might not be as bright as 2021.

“Copper prices have soared since mid-2020 as demand raced ahead of supply,” Capital Economics analysts said in a November report. “However, a strong supply response is now underway which, in tandem with cooling copper demand, will weigh on prices into 2022.”

The cash copper contract on the London Metal Exchange is expected to average US$9,000 a tonne in 2022, a median forecast of 29 analysts in a Reuters poll showed at the end of October.

"Bearish macro drivers will dominate the copper market next year ― a slowdown in Chinese growth and rising mine supply," UK independent analyst Robin Bhar told the news outlet.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.