Is Now a Good Time to Invest in Oil Stocks?

Top 5 Canadian Cobalt Stocks (Updated January 2026)

Top 9 Global Lithium Stocks (Updated January 2026)

Top 5 Canadian Lithium Stocks (Updated January 2026)

Top 5 Canadian Nickel Stocks

5 Best-performing Canadian Cleantech Stocks

Overview

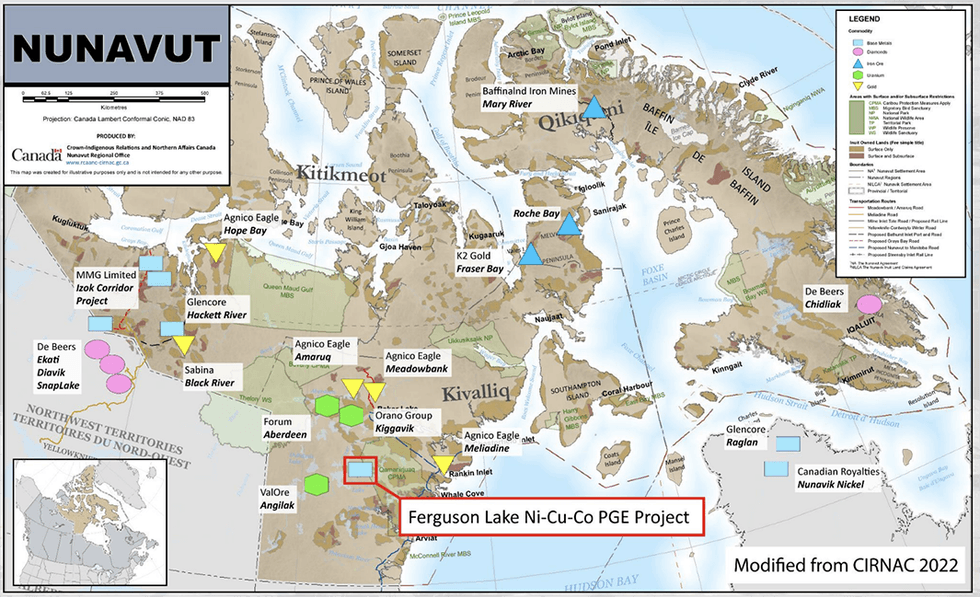

Canadian North Resources (TSXV:CNRI,FSE:EO0) is a mineral exploration and development company advancing a critical minerals project in Nunavut, Canada. The Ferguson Lake property has, through the years, gone through more than 200,000 meters of exploratory drilling and has proven critical mineral deposits. Canadian North Resources is a relatively new market player with a tight shareholder structure and 65 percent insider ownership.

Nunavut is an emerging major mining district in Canada that has received minimal attention in the past. Miners have historically focused more on Ontario, Quebec and BC, but Nunavut is now gaining more attention as new discoveries are made. The global transition to clean energy is driving demand for critical minerals and creating the need to secure domestic supply chains in stable jurisdictions. Nunavut is emerging as a new frontier for exploration and mining of these critical minerals.

Ferguson Lake is a historical asset dating back to 1952, with C$160 million already invested in the project since its inception. These investments include infrastructure, metallurgy, drilling and exploration. The asset contains known deposits of critical minerals, including copper, nickel, cobalt, platinum and palladium.

Canadian North Resources updated Ferguson Lake’s historical 43-101 resource estimate in June 2022. The company successfully surpassed its 20,000-meter drill program, completing 21,126-meters in 2023.

With data from the last three years of drilling campaign, Canadian North Resources plans to further update the 43-101 and take the inferred resources to the indicated category, all while moving toward a pre-feasibility study (PFS).

A seasoned management team with expertise throughout the natural resources industry leads the company, with experience in geology, metallurgy and international business administration.

Company Highlights

- Canadian North Resources is an exploration and development company with a prolific critical minerals asset in Nunavut, Canada.

- The company has a tight shareholder structure with 65 percent insider ownership.

- Canadian North’s Ferguson Lake asset has undergone more than 200,000 meters of drilling since its discovery in the 1950s.

- Nunavut is an emerging mining district due to its critical mineral deposits that are rapidly growing in demand as the world transitions to clean energy.

- Canadian North Resources updated the historical 43-101 resource estimate in 2022 with an indicated 24.3 million tonnes and inferred 47.2 million tonnes of ore.

- The company has commissioned SRK to conduct a new mineral resource estimation following National Instrument 43-101 Standards of Disclosure for Mineral Projects for its Ferguson Lake nickel, copper, cobalt, palladium and platinum project to incorporate the results of 39,270 meters of new diamond drilling in 145 holes completed by the company.

- Canadian North Resources plans to proceed with a PFS as it moves toward development.

- The Ferguson Lake project contains known deposits of several high-demand critical minerals, such as cobalt, platinum, copper, nickel and palladium.

- An experienced management team with a track record of success leads the company.

Get access to more exclusive Nickel Investing Stock profiles here