Uranium Price Forecast: Top Trends That Will Affect Uranium in 2023

As the energy crisis in Europe intensifies, market participants are honing in on uranium's role in energy security. Find out what experts think is coming for the market in 2023.

Pull quotes were provided by Investing News Network clients Energy Fuels, Forum Energy Metals and Purepoint Uranium Group. This article is not paid-for content.

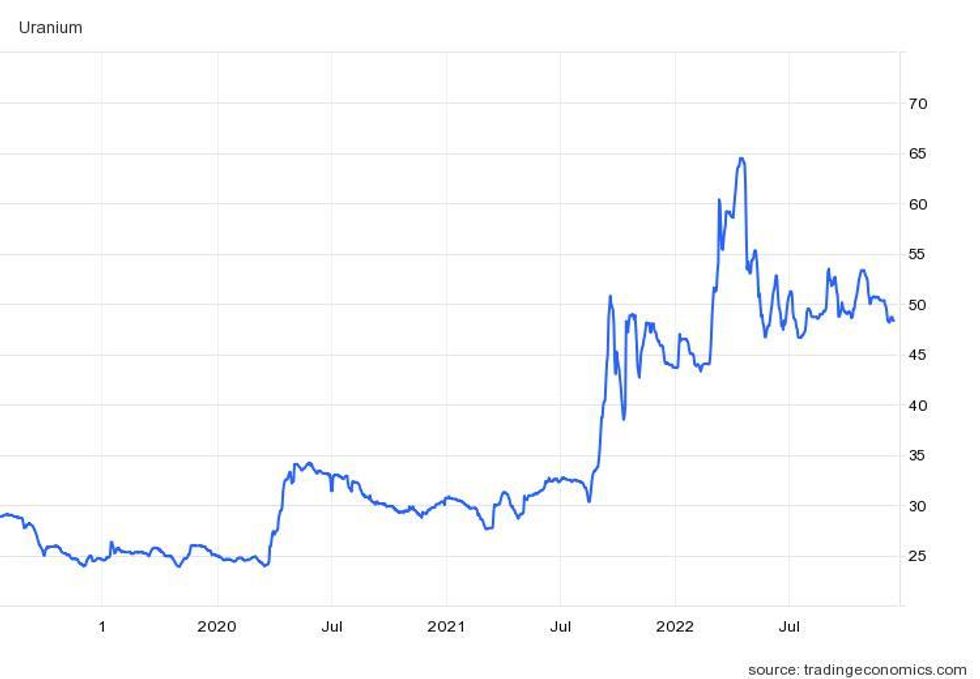

After years of price stagnation, uranium has become a breakout performer, climbing 164 percent from January 2020 to an 11 year high in April 2022 on the back of the green transition and concerns about energy security.

Those factors allowed uranium to hold firmly above US$48 per pound for the majority of 2022, but like most commodities it's still facing challenges. Sky-high inflation and steadily rising interest rates shaved off some of uranium's upside potential in 2022; however, the market has seen support from supply concerns and other factors.

With 2023 quickly approaching, the Investing News Network (INN) asked experts about their expectations for uranium in the next 12 months. Read on to learn what they had to say about the industry.

Is 2023 expected to be a bullish year for uranium?

Looking first at 2022, the market participants INN spoke to emphasized uranium's positive price action.

“Uranium — like lithium — has the most bullish fundamentals, coupled with bipartisan support globally,” said Gerardo Del Real, founder of Junior Resource Monthly and Junior Resource Trader. “Both suffered from years of underinvestment and both now enjoy surging demand that won’t be able to be brought online fast enough at current prices.”

Uranium and lithium are among the very few commodities that have posted annual gains this year, achieving upward momentum despite the economic upheaval that has weighed on markets for the majority of the calendar year.

U3O8 spot price performance, 2019 to 2022.

Chart via TradingEconomics.

For Lobo Tiggre, founder of IndependentSpeculator.com, uranium’s move was only a matter of time. “I think this was going to happen anyway, because the world’s largest producers cut back their output and BRICS countries (Brazil, Russia, India, China and South Africa) are building nuclear power plants as fast as they can — but the war has accelerated the trend,” he told INN.

Russia's late February invasion of Ukraine sent the nuclear fuel market into overdrive as all three key segments — U3O8 supply, along with conversion and enrichment services — saw price growth. “With the New Iron Curtain cutting off Russian energy, the writing is on the wall, and it’s very bullish for uranium prices,” Tiggre commented.

Ukraine houses 15 operational nuclear reactors and four power plants that generate half the country’s electricity, and Russia's takeover of the Zaporizhzhia plant created some concerns about potential damage. However, both Tiggre and Del Real emphasized that the plant's resilience is a positive sign.

“The real story is that despite the shelling of the Ukrainian power plant it has held up remarkably well and performed better than expected," Del Real said. “The uranium fundamentals are as bullish as I’ve ever seen them.”

Supply security to take center stage in uranium market

Procurement is an important element of energy security, and uranium supply is expected to stay in focus in 2023.

At the moment, nuclear power generated at the 438 reactors globally produces 10 percent of the world’s electricity, and that number is forecast to rise significantly over the next decade as about 60 new reactors come online.

There are another 96 reactors presently in the planning phase.

Securing steady supply of uranium that can be processed into nuclear fuel is especially vital to the energy transition, according to John Ciampaglia, CEO of Sprott Asset Management.

“The 434 odd reactors require about 180 million pounds of uranium each and every year for their fuel stock,” he said in November. “Primary production is about 130 million pounds, and next year it will probably go to 140 million to 145 million pounds.”

He went on to explain that the deficit can only be shored up with additional mined supply. However, with inflation driving costs up everywhere, uranium's price positivity may only be enough to restart shuttered projects — not build new mines.

“The costs have gone up significantly,” he said. “We think the cost — or the price that you would need to see in uranium to incent development of any new greenfield project — is somewhere between US$75 and US$100.”

During the last uranium bull market more than a decade ago, investors watched the spot price climb more than 1,800 percent, rising from US$7 in December 2000 to an all-time high of US$140 June 2007. This time around, the market has more fundamentals in its favor that are encouraging sustained price growth.

One of the most promising is the need for clean, uninterrupted energy. While solar and wind energy are considered green, they are susceptible to precarious weather situations, which are becoming more common.

“If you think about how reliable each of these different forms of energy is, nuclear is the highest at 92 percent,” the CEO said. “That means that 92 percent of the time, if you're running a nuclear power plant, it is generating electricity.”

On the other hand, that number drops to 42 percent when talking about hydroelectric power, and falls to 35 percent for wind and only 25 percent for solar. “Low greenhouse gas emissions are important, but reliability is equally important,” Ciampaglia said.

More uranium M&A activity could be on the horizon

Uranium experts will also be watching M&A activity in 2023 in the wake of several important 2022 deals.

One of the most memorable announcements this past year was the October news that Cameco (TSX:CCO,NYSE:CCJ) and Brookfield Renewable Partners (TSX:BEP.UN,NYSE:BEP) will acquire Westinghouse Electric Company.

The massive US$7.8 billion arrangement will see Cameco, one of the largest uranium producers globally, take a 49 percent controlling interest in “one of the world’s largest nuclear services businesses.”

Earlier in the year, Uranium Energy (NYSEAMERICAN:UEC) acquired Canada-listed UEX in a bid to “create the largest diversified North American focused uranium company.” The purchase marked the second major move from Uranium Energy in under 12 months — in December 2021, the company acquired Uranium One Americas.

“There is an emerging trend by Western utilities to secure supplies from uranium projects in politically stable and proven jurisdictions. This is a strong fit with UEC’s permitted, and production-ready US ISR projects and extensive growth pipeline in Canada,” said Amir Adnani, president and CEO of Uranium Energy.

Positive demand fundamentals, along with uranium's price stability in the face of strong headwinds, are likely to result in more sector deals, explained Junior Resource Monthly’s Del Real. “I expect more M&A as companies with better assets merge to position themselves to maximize gains from the coming uranium mania I see developing,” he said.

While these deals may be good news for the North American uranium sector, Tiggre encouraged caution.

“The consolidation gives speculators fewer companies to track — but each company that’s grown through acquisitions has become more complicated to analyze," he said. “I’m especially wary of companies that can now boast very large uranium resources in the ground, but don’t present a compelling value proposition due to the quality of the assets they bought. Buyer beware.”

As the uranium market charges ahead, he anticipates more deals down the road.

“There could easily be more consolidation among the juniors, but that doesn’t necessarily create value,” Tiggre said. “The developers that deliver profitable new mines, however, are clear takeover targets that could deliver outsized capital gains.”

How high can uranium prices go in 2023?

Just how high uranium prices will go during the current bull market remains to be seen.

As mentioned, during the last bull phase, prices went up over 1,800 percent, rising from US$7 in December 2000 to an all-time high of US$140 June 2007. The previous cycle, which ran from 1973 to 1978, saw values rise 629 percent over five years.

“I expect the uranium price to overshoot to the US$200 level before settling back to lower triple digits,” Del Real said.

Although the demand outlook is bright, Tiggre sees the price making a more staggered advance. “I expect a volatile but persistent climb higher, with smaller spikes possible along the way. Then, the market should settle at a price that incentivizes enough mine supply,” he said. “That might be around US$60 to US$70 today, but would need to be adjusted for inflation going forward.”

In terms of what the Independent Speculator will be watching for in the sector in the year ahead, he pointed to long-term contracting from utilities companies.

“Prices for these contracts are often not disclosed at signing, but we should be able to work them out, in aggregate, from producers’ financial reports in the future,” Tiggre explained. “This has already started. Unless I’m very much mistaken, 2023 should be an even better year for uranium than 2022 has been.”

More broadly, Del Real sees 2023 as a breakout year for a number of commodities.

“The lithium and uranium spaces remain the two commodities I see having the best 2023 — but don’t underestimate a rapid rerating of quality gold companies as the gold price regains its status as not just a wealth preserver, but a way to grow wealth,” he said, while also mentioning copper. “2023 should be one for the books for most commodities,” Del Real concluded.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.