March 13, 2024

Australian copper company, Cyprium Metals Limited (ASX: CYM) (Cyprium or the Company), is pleased to present an updated 2024 Mineral Resource Estimate (MRE) for its flagship asset the Nifty Copper Mine (Nifty) in Western Australia.

HIGHLIGHTS

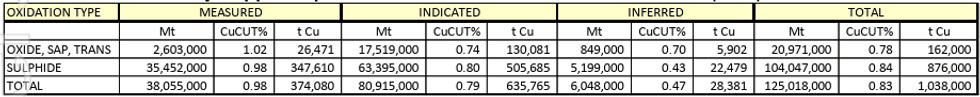

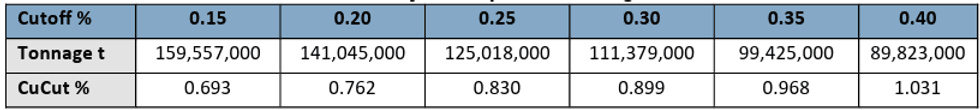

- Nifty Measured and Indicated mineral resource grows to 119mt at 0.84% pct Cu for 1 million tonnes contained copper

- Potential to further enhance mineral resource from existing mineralised heap leach inventory

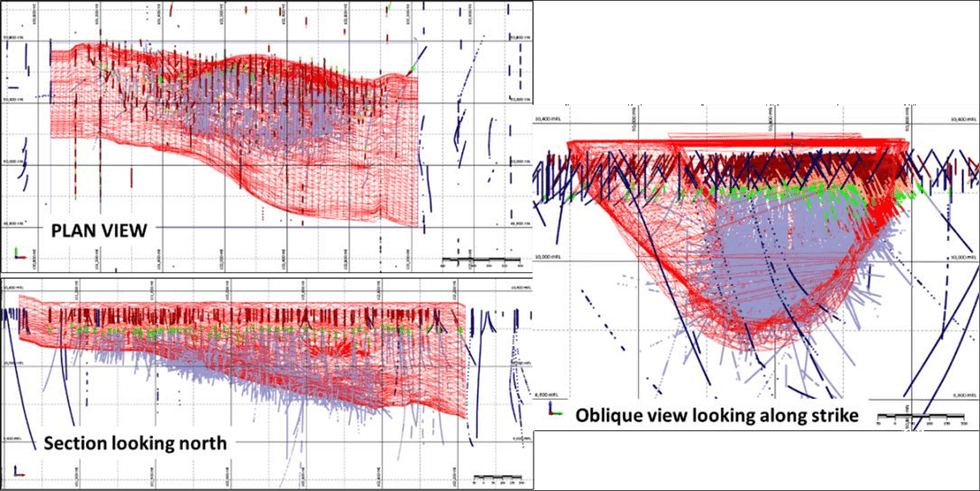

- Updated MRE incorporates past underground modelling of Nifty in detail and supports plans for a large-scale, open-cut mine

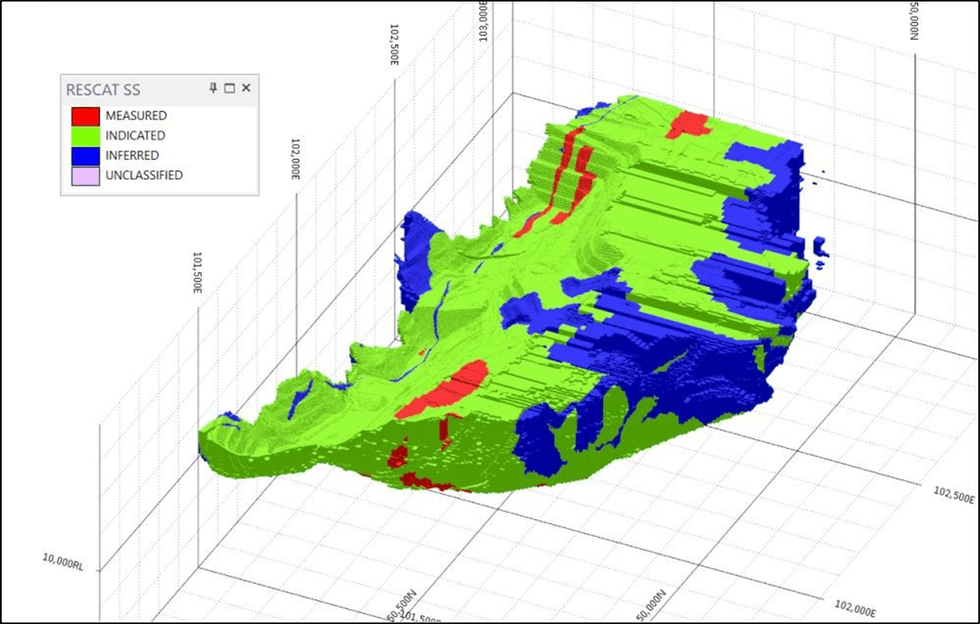

- 95% of global resource now Measured and Indicated

“We’re pleased to produce an updated Mineral Resource Estimate for Nifty,” said Executive Chair Matt Fifield. “Nifty is one of the largest non-operational copper projects in Australia, and the only brownfield project that can be reactivated in short order. This update is the result of a disciplined process run by the Cyprium team and MEC Mining. Our objective with this MRE scope was to ensure a strong foundation for our planning work, including pit optimisation and mining studies.”

Nifty’s sedimentary-hosted copper resource showcases stable mineralisation patterns, defined by comprehensive drilling and mining activities spanning more than 30 years. This robust dataset, in conjunction with geological and structural information not included in the previous estimate, has given the company a better understanding and sharper definition of the deposit and significantly upgraded the resource classifications and its economics.

“As a result of the detailed study work, the proportion of the resource categorised as Measured & Indicated has risen from 80% to 95%, bolstering the project’s feasibility and long-term economic prospects,” said Fifield.

“This MRE is the basis for our workstreams to redevelop Nifty into a significant new copper mine,” said Fifield. “With a million tonnes of contained copper, this resource should support a large scale mine. This is the long-term opportunity at Nifty.”

Click here for the full ASX Release

This article includes content from Cyprium Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CYM:AU

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

Cyprium Metals

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth Keep Reading...

23 January

Capital Raise Presentation

Cyprium Metals (CYM:AU) has announced Capital Raise PresentationDownload the PDF here. Keep Reading...

22 January

A$41M Capital Raise via Placement & Entitlement Offer

Cyprium Metals (CYM:AU) has announced A$41M Capital Raise via Placement & Entitlement OfferDownload the PDF here. Keep Reading...

19 January

Paterson Exploration Review Update

Cyprium Metals (CYM:AU) has announced Paterson Exploration Review UpdateDownload the PDF here. Keep Reading...

19 November 2025

Cathode Restart Approved by Cyprium Board

Cyprium Metals (CYM:AU) has announced Cathode Restart Approved by Cyprium BoardDownload the PDF here. Keep Reading...

13 November 2025

Senior Loan Facility Refinanced with Nebari

Cyprium Metals (CYM:AU) has announced Senior Loan Facility Refinanced with NebariDownload the PDF here. Keep Reading...

16h

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

17h

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to make gains, driven by supply and demand fundamentals and further boosted by tariff fears.The price reached a record high on January 29, and while it has since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them has... Keep Reading...

Latest News

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00