U3O8 Price Update: Q2 2022 in Review

The uranium spot price gained 17 percent during the first half of 2022. Will the second half of the year offer more price support for the energy fuel?

Click here to read the latest U3O8 price update.

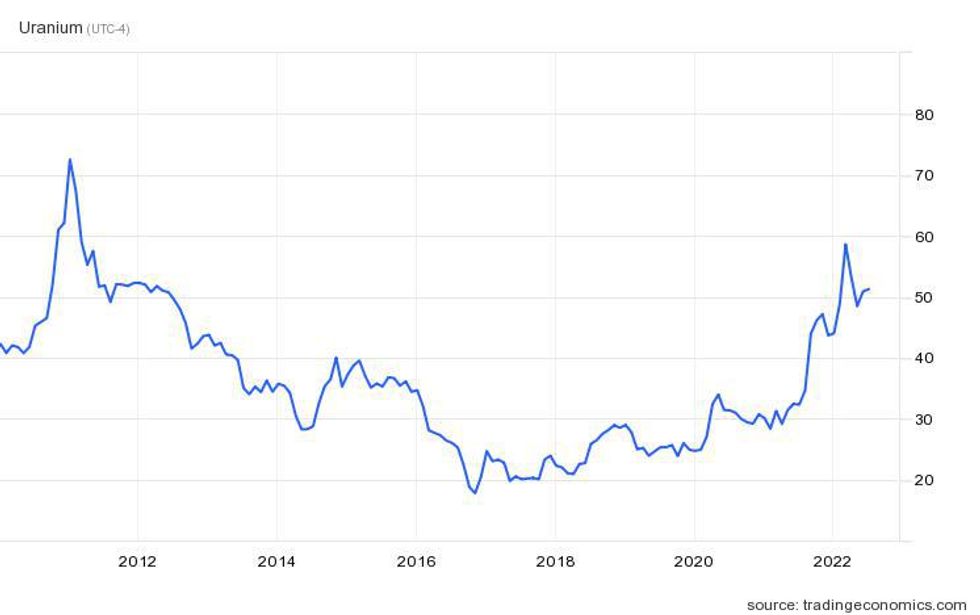

Uranium prices contracted slightly over the second quarter of 2022, shrinking 13 percent over the 90 day period, from US$58.37 per pound to US$51.05. While prices for U3O8 had slipped to the US$50 range by the end of June, the energy metal rose to an 11 year high of US$64.61 in mid-April.

After starting the year at US$43.58, uranium is one of the few commodities that has made a year-to-date gain, adding 17 percent from January through the end of June.

In fact, it's one of the top performers over the last two years, increasing its value 73 percent since January 2021.

Driving activity is the need for energy security mixed with global efforts to drastically reduce greenhouse gas emissions. While the latter has served as a long-term catalyst for value growth, the need for energy security has been key this year as prices for U3O8 spiked to a more than decade high after Russia invaded Ukraine.

“The issue is Russia is a very large portion of global capacity, not so much with uranium production, but with the services part of the fuel cycle, which is conversion and enrichment,” John Ciampaglia, CEO of Sprott Asset Management, said during his keynote address at a uranium conference held by Red Cloud.

As Ciampaglia pointed out, Russia’s function in the nuclear fuel cycle is primarily fuel services. In 2020, the nation was responsible for converting one-third of the world’s uranium ahead of enrichment.

Russia is also a key player in the enrichment sector, one of the final steps in the nuclear fuel production cycle, controlling 43 percent of global enrichment capacity.

“Essentially as the world is trying to pivot away and punish Russia for its invasion of Ukraine, western utilities are trying to figure out how to secure alternative supply, and this is causing a real pinch point,” Ciampaglia said.

Annually the US purchases roughly US$2 billion worth of uranium, with as much as 91 percent coming from outside the country. This reliance on foreign supply has led to discussions around a national stockpile and has been used to further discourse around resource nationalism.

“So this process of deglobalization in the nuclear fuel cycle, we believe, is underway, and this really puts the western utilities in a conundrum, because they obviously don't want to support Russia in terms of procuring more uranium and other services from them, but at the same time where do they source alternative suppliers?” he said.

U3O8 price update: Higher values drive fuel services expansion

Part of the reason Russia controls such a large segment of the fuel services market is the low prices the market has endured since the uranium spot price fell from US$72.77 in 2011.

11 year U3O8 price performance.

Chart via TradingEconomics.

“The reality is there's a lot of shut-in capacity, and that's been the case for a number of years because of uneconomic pricing that was in place,” Ciampaglia said.

As the CEO went on to note, this capacity can be brought back online, but it will take months or even years.

“More importantly, these facilities have signaled very clearly that they will not make new investments and ramp up their facilities unless they have the right incentive pricing, which I think the market is starting to adjust to,” he added. “But more importantly, they won't ramp up capacity without long-term contracts in place, and I would say that that process is just starting.”

U3O8 price update: Energy transition a major tailwind

Before energy security was the dominant topic in the nuclear fuel sector, growing demand from the global energy transition was the main focus, and it remains a profoundly important topic.

This area was highlighted by David Doerksen from Cameco (TSX:CCO,NYSE:CCJ) during his presentation at the Prospectors and Developers Association of Canada conference. “We see nuclear regaining its place in the policy toolbox, driven by global focus on decarbonization (and) the push for global clean energy,” he said.

The vice president of marketing at one of the sector’s leading producers explained that the underlying price driver for uranium is robust demand for nuclear power. “We hear the urgency in the conversation, and I think you do too,” he said. “Climate change, global warming, climate catastrophe, decarbonizing the grid, the race to net zero … means the window for action is narrowing. Urgency is increasing.”

In order to ensure that the global move toward electrification is powered by clean energy, the world is going to need an abundance of new nuclear-generation capacity.

Nicolas Piquard of Horizons ETFS believes that as countries set targets to transition from internal combustion engine transport to electric vehicles, the best and most suitable energy source is nuclear.

“This is the backdrop for a multi-year bull market,” he said during his keynote at the Red Cloud webinar.

“Not only is there not enough uranium produced today to satisfy existing demand — with demand only being satisfied by secondary inventories — but demand is being revised higher every year going forward as the life expectancy of the existing nuclear fleet is being prolonged by decades as governments struggle with electricity grids and plants are getting lifetime extensions," he noted.

Additionally, China plans to spend US$450 billion on 150 new reactors, which would grow the current global fleet of 440 by 33 percent. Other countries are also planning, examining or in the building stage currently.

Aside from generating clean electricity, Piquard also sees a mega trend developing in terms of land use.

“Land prices are only getting more expensive, (and) people don't want to put more wind turbines in their backyard,” he said. “Nuclear really represents the smallest land use and the highest power density going forward as we need more and more electricity. Nuclear makes more and more sense to be part of that mix.”

He also highlighted the potential opportunity this presents for small modular reactors, whose scalable technology requires much less space and uranium than traditional nuclear power plants.

“There's a potentially bright future ahead for next-generation technology as well with small modular reactors and a lot of the leading countries (in that space) — the US, Canada, France and the UK,” Piquard said.

U3O8 price update: Heightened investor interest helping positivity

All three uranium market executives also mentioned the increasing attention uranium is receiving from investors.

For Sprott, this has boosted interest in both its uranium trust and its new ETF. It launched its Physical Uranium Trust (TSX:U.UN) in July 2021 and acquired the Northshore Uranium ETF (ARCA:URNM) in April of this year.

“(Uranium stocks) tend to have a lot of beta in up markets,” Ciampaglia said at the Red Cloud event. “If you're bullish on uranium longer term, look at the previous cycles; you'll see that the stocks generally outperform on a historical basis against the spot commodity price.”

He continued, “Uranium stocks, despite a very positive commodity story, are stocks, and when you have these big market macro selloffs, the correlation of stocks — whether they're gold stocks or whatever — they tend to decouple from the underlying commodity prices and they tend to act more like stocks."

Piquard of Horizon ETFs said he sees the success of his company’s Global Uranium Index ETF (TSX:HURA) as evidence that alternative energy ETFs are gaining popularity.

Moving forward, the vice president, portfolio manager and options strategist expects the energy transition, as well as inflationary conditions and supply/demand imbalances, to be catalysts for a long-lasting uptick.

“If you go back and look at the big commodity bull markets of the '70s or 2000 to 2010, they were driven by inflation and by strong commodity demand by China,” Piquard commented. “Where are we today? It seems we're back in the inflation of the 1970s.”

Wrapping up his presentation, Cameco's Doerksen noted that Cameco, which mines the vast majority of its uranium in Canada, sees rising demand, the need for more production and the global shift in the nuclear fuel cycle as drivers that investors, market watchers and participants should watch for.

“These are exciting times in the market,” he said. "Nuclear power has just unprecedented opportunity. Uranium demand is growing. We need more production and (with) the geopolitical shifts that we've seen, (we) hopefully double down on needing more western production."

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top Uranium Stocks on the TSX and TSXV | INN ›

- When Will Uranium Prices Go Up? | INN ›

- Investors Eyeing Uranium on Back of New Products, Conflict and More | INN ›

- Uranium Stockpiling: The Rise of Nationalism or an Energy Security Effort? | INN ›

- Uranium Outlook 2022: Prices Have Broken Out, How High Will They Go? ›