How to Invest in Manganese Stocks

Investor Insight

Jupiter Energy’s strong cash flow, substantial proven recoverable reserves, and strategic foothold in resource-rich Kazakhstan present a compelling investment opportunity. Its commitment to sustainability—reinforced by a recent strategic investment in 100 percent gas utilization infrastructure—further enhances its long-term investor appeal.

Overview

Jupiter Energy Limited (ASX:JPR) is an established oil exploration and production company that operates three oilfields in Kazakhstan. The company is currently producing approximately 600 to 700 barrels of oil per day from its licensed fields, having successfully navigated Kazakhstan’s regulatory and operational landscape since 2008. Its operations are fully compliant, with its three full commercial production licenses secured until 2045/46/46.

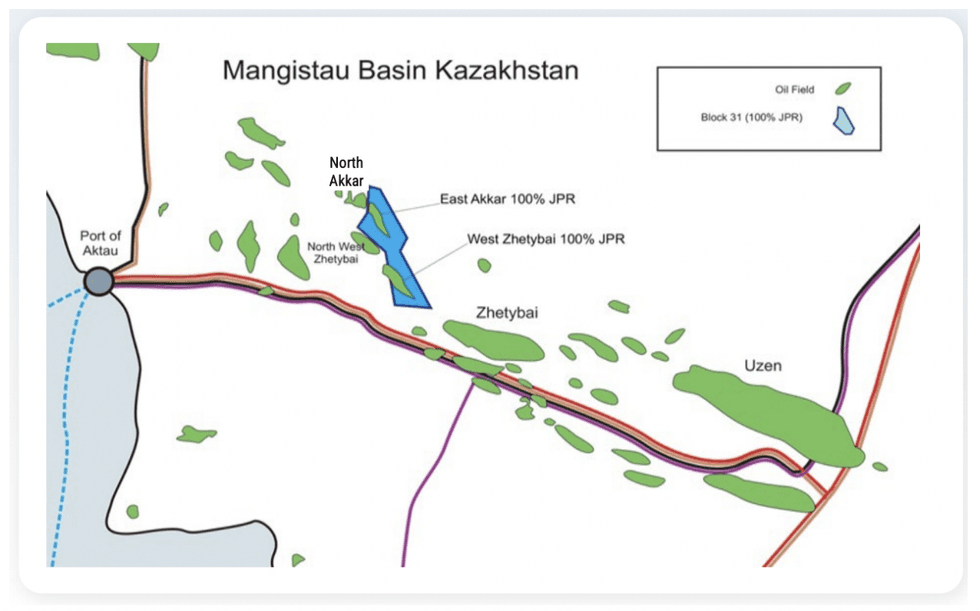

Jupiter Energy is recognized as a reliable operator in Kazakhstan, holding 100 percent ownership of its licenses, which span approximately 123 sq km in the oil-rich Mangistau region. Strategically located near the port city of Aktau, its license area benefits from proximity to established oil processing facilities and extensive oil and gas infrastructure, including key pipeline connections to the country’s major refineries (see Figure 1).

The company has successfully navigated regulatory requirements to achieve full commercial production across its three oilfields—Akkar East, Akkar North (East Block), and West Zhetybai—all operating under 25-year commercial licenses. Jupiter’s strong compliance and operational framework reinforce its commitment to long-term, sustainable production in Kazakhstan.

Jupiter Energy’s reserve base has been independently confirmed by a Sproule International competent person’s report (CPR), effective 31 December 2023, detailing significant recoverable reserves.

According to the Sproule International CPR, released in January 2024, Jupiter Energy’s recoverable reserves under the SPE/PRMS classification are as follows:

- 1P Reserves: 14.691 million barrels (mmbbls)

- 2P Reserves: 36.487 mmbbls

- 3P Reserves: 46.796 mmbbls

These figures confirm Jupiter’s substantial reserve base, and correlate with its Kazakh State Approved Reserves which are recorded at approximately 52 mmbbls recoverable (using the GOST C1 + C2 classification methodology) (see Figure 2).

Figure 1: Total reserves for the Mangistau basin are estimated to be in excess of 5 billion barrels including two large oil fields, Uzen and Zhetybai.

On November 15, 2024, Jupiter Energy announced the completion of its gas pipeline integration project, connecting the Akkar East and Akkar North (East Block) oilfields to neighboring gas utilization facilities operated by its larger neighbour, MangistauMunaiGas (MMG). This integration ensures 100 percent utilization of all its associated gas, aligning with Kazakhstan’s environmental goals and enabling the Company to drill further wells whilst continuing to comply with Kazakhstan’s strict 100% gas utilisation policy.

The company plans to connect the West Zhetybai oilfield to this infrastructure as this oilfield is further developed. This project strengthens Jupiter’s relationships with MMG and the Kazakh Ministry of Energy, facilitating long-term production under its commercial licenses and enabling it to sell its oil into both the Kazakh domestic market as well as international oil markets.