Silver Price Update: Q2 2023 in Review

Silver has experienced characteristic price volatility in 2023, but experts see a path higher for the white metal.

True to its volatile nature, silver has seen price swings in 2023 as it responds to various factors.

Although it's facing pressure from interest rate hikes, strong industrial demand is seen putting the market in deficit this year.

Here the Investing News Network (INN) presents a recap of key events in the silver market during Q2.

How did the silver price perform in Q2?

Silver is known for its volatility, and Michael DiRienzo, executive director and secretary at the Silver Institute, told INN investors saw a lot of ups and downs in pricing during the first half of 2023.

“What we're hearing and what we're seeing are these sharp swings in prices,” DiRienzo said. “They really do reflect the dramatic changes in investor expectations about US monetary policy.”

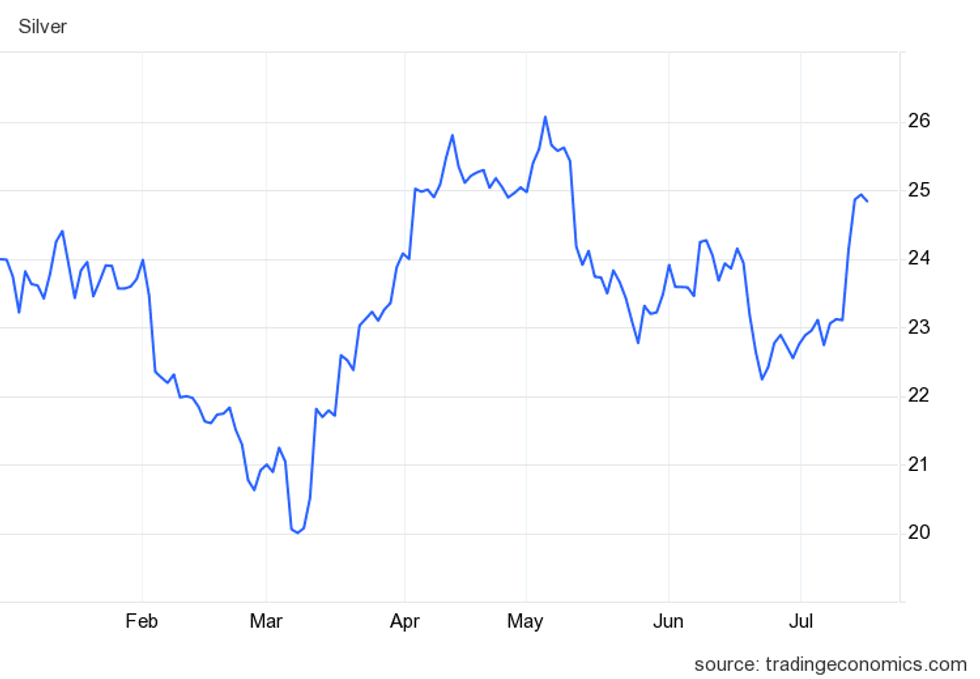

The expert charted some of the price moves seen this year, saying silver first dipped below US$20 per ounce in March, its lowest point of the year so far. Since then, the precious metal has recovered, breaking through US$26 in April and May.

Silver price chart, January 1, 2023, to July 17, 2023.

Chart via Trading Economics.

Entering the summer, "renewed selling pressure" sent silver below US$23, although by mid-July it was near US$25.

DiRienzo told INN that the decisions made this year by the US Federal Reserve have been at odds with the interests of investors, which has led to price sensitivity for silver.

While the Fed took a break from interest rate hikes at its meeting in June, Chair Jerome Powell has emphasized that more increases are likely in 2023. Many market participants are anticipating two more boosts of 25 basis points each.

“It's created heightened volatility in all financial markets, including precious metals,” DiRienzo said. “A lot of pain out there.”

Silver deficit of 142.1 million ounces expected in 2023

Looking further at silver market dynamics, DiRienzo said 2023 is set to be a record year for industrial demand.

Silver has benefited from the uptake of solar panel technology, investment in renewable energies, the rise of electric vehicles and ongoing 5G cellular service upgrades around the world, the expert said.

The white metal is benefiting in particular from demand from the solar energy industry.

“If you just go back to 2014, you look at photovoltaics, about 48 million ounces (of silver were) used then, and now we're projecting 161 million ounces in 2023,” DiRienzo told INN. “That's an over 230 percent increase.”

He added that silver also plays a key role in other major energy segments like wind and nuclear.

Overall the Silver Institute anticipates a deficit of 142.1 million ounces in 2023.

Investor takeaway

Silver’s characteristic price volatility has been at play in 2023, but experts remain optimistic about its future.

Many market watchers see the elusive US$30 level as a crucial point for silver to get through — speaking to INN in May, Don Durrett of GoldStockData.com said he thinks that would be a breakout point for the white metal.

It's also no secret that gold tends to move before silver, meaning silver may not take off before gold sees more price momentum. Although it's still historically high, the yellow metal has pulled back from the heights it saw earlier this year.

When silver does eventually move, it tends to outperform its sister metal gold.

"It's almost violent sometimes in how much it rises or falls, so if you have a rise in gold, silver's going to outperform it. We've seen this repeatedly throughout history," noted Jeff Clark of TheGoldAdvisor.com. "So if gold does rise, silver is going to follow it."

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.